Apple as we speak introduced transformative video podcast capabilities coming to Apple Podcasts this spring, introducing HTTP Stay Streaming know-how that guarantees to reshape how creators monetize content material and the way advertisers entry podcast audiences. The announcement positions Apple to compete immediately with platforms like YouTube and Spotify within the quickly increasing video podcast market, the place advertising spending surged 32% year-over-year through the fourth quarter of 2025.

The corporate revealed the replace in a February 16, 2026 press launch, marking what Eddy Cue, Apple’s senior vice chairman of Providers, characterised as “a defining milestone” 20 years after Apple added podcasts to iTunes. The shift arrives as video podcast consumption continues reshaping the industry, with video content material commanding increased advertiser charges attributable to elevated engagement alternatives and expanded artistic prospects.

HLS infrastructure allows dynamic promoting

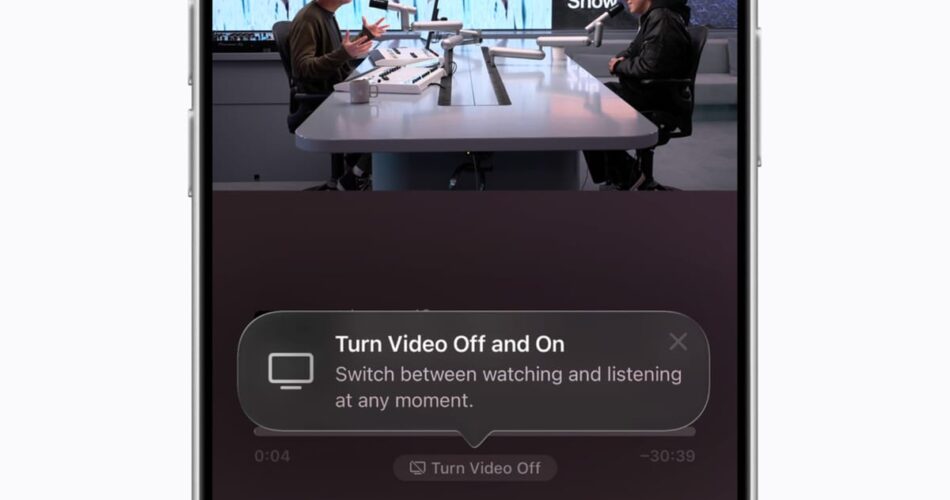

The technical implementation facilities on Apple’s HTTP Stay Streaming protocol, which helps adaptive bitrate streaming throughout various community situations. Customers will have the ability to swap seamlessly between watching and listening to exhibits throughout the Apple Podcasts app, transfer to horizontal full show, and obtain movies for offline viewing. Automated high quality adjustment powered by HLS know-how ensures clean playback whether or not listeners are on Wi-Fi or mobile connections.

The HLS structure differs essentially from conventional video internet hosting approaches. As a substitute of serving static video information, the system delivers content material in small segments, permitting real-time high quality changes based mostly on accessible bandwidth. This technical design proves significantly essential for cell podcast consumption, the place community situations fluctuate ceaselessly as customers transfer between places.

For creators, probably the most vital technical development entails dynamic video advert insertion capabilities. The system allows automated promoting placement inside video episodes, together with host-read spots, sustaining the authenticity that podcast audiences value while delivering programmatic efficiency. Analysis signifies 46% of U.S. podcast listeners by no means skip episodes of their favourite exhibits, creating favorable situations for advertiser messaging.

Internet hosting supplier ecosystem determines market penetration

Apple confirmed 4 internet hosting suppliers supporting HLS video at launch: Acast; ART19, an Amazon firm; Triton’s Omny Studio; and SiriusXM, inclusive of SiriusXM Media, AdsWizz, and Simplecast. Further suppliers will be a part of sooner or later, in keeping with the announcement. The preliminary roster represents substantial market protection, given these platforms energy lots of of main podcast networks.

Acast CEO Greg Glenday characterised the event as “a defining second – increasing what’s doable for creators, advertisers, and the medium as a complete.” The corporate recently integrated episode-level targeting capabilities with Barometer to supply model security verification, positioning itself to capitalize on elevated video stock.

ART19 CEO Geoff Mattei emphasised creator empowerment: “Video deserves that very same expertise” as audio distribution, referring to ART19’s concentrate on versatile monetization options. Amazon acquired ART19 in June 2021, subsequently integrating the Podcast Audience Network into Amazon DSP to supply advertisers with entry to premium podcast stock via unified marketing campaign administration.

SiriusXM’s chief promoting income officer Scott Walker highlighted the technical innovation: “This innovation from Apple helps to maintain the integrity of what makes the medium so particular, whereas enhancing video and audio with new capabilities as the 2 codecs proceed to converge.” The corporate reported podcast advertising revenue climbing nearly 50% year-over-year within the third quarter of 2025.

Sharon Taylor, Triton Digital’s chief income officer, emphasised the significance of an open strategy: “An open strategy that allows publishers to retain management over their audiences, promoting, and measurement – whereas increasing entry to content material throughout codecs – helps long-term progress and higher selection for listeners.” Triton announced support for video podcast creation via Omny Studio in December 2025.

Income mannequin preserves creator economics whereas taxing advert networks

Apple’s enterprise mannequin maintains its long-standing coverage of not charging internet hosting suppliers or creators to distribute podcasts, whether or not by way of conventional RSS/MP3 or HLS video. The corporate will as a substitute cost taking part advert networks an impression-based price for delivering dynamic adverts in HLS video on Apple Podcasts beginning later this 12 months. The announcement didn’t specify price constructions or charges.

This income strategy differs considerably from Apple’s strategy to different providers. The App Retailer prices builders 15-30% commissions on digital purchases. Apple Podcasts Subscriptions, launched in 2021, takes a 30% fee within the first 12 months and 15% thereafter on subscriber income. The choice to cost advert networks slightly than creators or internet hosting suppliers suggests strategic positioning to speed up adoption whereas capturing income from the promoting worth chain.

The impression-based price mannequin aligns with how programmatic podcast advertising has advanced throughout the business. AdsWizz processes 16 billion month-to-month dynamically inserted audio advert impressions, whereas platforms more and more undertake impression-based pricing to align with digital promoting requirements established in show and video channels.

For the primary time, creators can dynamically insert video adverts – together with host-read spots – unlocking entry to the broader video promoting market whereas sustaining full artistic management. Video integrates seamlessly into current exhibits with out disrupting followers or downloads. Creators can monetize via sponsorships and dynamic promoting, sustaining full management of their content material and monetization methods via taking part internet hosting suppliers and advert networks.

Video podcast economics show premium pricing potential

Trade knowledge suggests substantial monetization alternatives for video podcast content material. Audioboom reported income per mille figures of $40.74 for video content material in June 2025, representing premium pricing in comparison with conventional audio-only podcast promoting. Nonetheless, more moderen knowledge signifies video monetization rates have declined, with Audioboom CEO Stuart Final stating in January 2026 that the corporate’s audio-only content material generates round $71 income per thousand downloads on common whereas video generates lower than half that determine.

The pricing volatility displays incomplete infrastructure for video podcast promoting. Platforms have developed refined dynamic ad insertion capabilities for audio content material over years of technical refinement. Video podcast promoting requires parallel infrastructure growth, together with video-specific artistic codecs, high quality verification methods, and measurement requirements.

Podcast advertising spending increased 26% year-over-year within the third quarter of 2025, with 1,689 manufacturers promoting on podcasts for the primary time. New manufacturers spent a mean of $33,900 through the quarter, usually operating 49-second ads. The inflow demonstrates podcasting’s evolution from experimental channel to strategic promoting platform.

Reveals simulcast on YouTube demonstrated distinct traits in comparison with podcasts distributed solely by way of RSS feeds throughout This fall 2025. Simulcast exhibits confirmed 45% host-read commercial share versus 34% for RSS-only podcasts. Advert load reached 8.34% for simulcasts in comparison with 7.77% for RSS podcasts. Direct response model share hit 33% for simulcasts versus 24% for RSS podcasts, whereas renewal charges amongst direct response manufacturers reached 43% for simulcasts in comparison with 34% for conventional podcasts.

The elevated host-read share for video-enabled codecs suggests advertisers worth visible integration and genuine endorsement. Host-read ads in video contexts enable viewers to watch host interactions with services or products, probably enhancing credibility and persuasiveness in comparison with audio-only shows.

Platform competitors intensifies for video podcast dominance

Apple’s entry into video podcasting arrives amid substantial platform competitors. Edison Research began incorporating data from people whose sole podcast consumption occurred via video platforms in 2025, affecting exhibits with substantial video parts. No Jumper climbed 11 spots in rankings, whereas The Pat McAfee Present rose 26 positions after the video integration.

YouTube’s place because the dominant podcast platform represents a basic problem that Apple should deal with. Analysis from Edison Analysis and SXM Media exhibits 70% of Gen Z listeners discover podcasts via YouTube suggestions, whereas 75% uncover new exhibits via temporary podcast clips on social media. YouTube’s suggestion algorithms take into account viewing historical past, engagement metrics, and content material similarity throughout the platform’s total ecosystem, creating viewers growth alternatives that conventional podcast platforms battle to duplicate.

Spotify has pursued aggressive video podcast enlargement all through 2025. The corporate launched its Partner Program on January 2, 2025, introducing twin income streams combining audience-driven payouts with promoting monetization. Spotify diminished Companion Program eligibility thresholds by 80% in January 2026, decreasing the barrier from 2,000 listeners to 1,000 engaged viewers members. The platform launched a Distribution API enabling creators to publish and monetize video content material from internet hosting platforms together with Acast, Audioboom, Libsyn, Omny, and Podigee with out switching providers.

The aggressive panorama displays broader structural modifications in audio consumption. Regardless of digital audio commanding 20% of client media time, audio funding represents solely 2.9% of complete digital promoting income, in keeping with business measurements. This 22% gap between consumer engagement and advertiser investment creates progress potential for platforms that may successfully monetize podcast audiences via each audio and video codecs.

Measurement and attribution challenges persist

Video podcast promoting inherits measurement complexities which have challenged audio podcast monetization for years. In contrast to digital show promoting the place impression verification and conversion monitoring comply with established technical protocols, podcast consumption happens throughout a number of platforms and units. Customers would possibly uncover content material on one platform, obtain episodes on one other, and hear via third-party functions, fragmenting the attribution chain.

Apple’s strategy maintains the open RSS ecosystem that has characterised podcasting since its inception. Creators distribute via taking part internet hosting suppliers, sustaining portability throughout platforms. This open structure differs from YouTube and Spotify’s walled backyard approaches, the place content material uploaded to these platforms stays beneath their technical management.

The HLS implementation offers Apple with technical capabilities for impression verification that conventional MP3 distribution lacks. Streaming supply via Apple’s infrastructure allows real-time monitoring of video views, completion charges, and engagement metrics. These measurement capabilities change into more and more essential as programmatic podcast advertising expands, with advertisers demanding accountability requirements corresponding to different digital channels.

Nonetheless, the multi-platform distribution mannequin creates attribution gaps. A listener would possibly watch video episodes on Apple Podcasts whereas consuming audio variations via Spotify or different functions. Cross-platform habits monitoring proves technically difficult with out unified consumer identifiers, limiting advertisers’ capability to measure true attain and frequency throughout consumption patterns.

Trade responses to measurement challenges have included IAB Tech Lab certification programs offering standardized methodologies that allow comparability throughout totally different publishers and platforms. Triton Digital’s Podcast Metrics offers IAB-certified measurement capabilities, addressing purchaser considerations about knowledge reliability. Nonetheless, certification addresses methodology consistency slightly than cross-platform attribution capabilities.

Technical necessities demand creator workflow adaptation

The shift to HLS video requires creators to adapt manufacturing and distribution workflows considerably. Conventional podcast manufacturing entails recording audio, modifying episodes, and importing MP3 information to internet hosting platforms. Video podcast manufacturing calls for lighting, digicam gear, video modifying software program, and considerably bigger file storage and bandwidth capability.

Apple emphasised its dedication to supporting creators via this transition. The corporate directed podcast internet hosting suppliers and creators to podcasters.apple.com for details about enabling HLS video on Apple Podcasts and utilizing Apple merchandise and instruments to seize, produce, and share video podcast episodes. The sources web page presumably consists of technical specs, encoding pointers, and manufacturing suggestions, although the announcement didn’t element particular necessities.

The manufacturing burden varies considerably based mostly on content material sort and creator sources. Established media corporations with current video manufacturing infrastructure can deploy video podcasts comparatively effectively. Impartial creators working with restricted budgets face extra substantial adaptation necessities, probably creating aggressive benefits for well-funded operations.

Some creators might undertake intermediate approaches, utilizing static pictures or minimal video parts slightly than totally produced video content material. The technical flexibility of HLS supply accommodates various manufacturing high quality ranges, although whether or not audiences and advertisers will settle for lower-quality video implementations stays unsure.

World distribution extends past U.S. market

Apple confirmed HLS video performance will attain iPhone, iPad, and Apple Imaginative and prescient Professional customers, in addition to by way of Apple Podcasts on the internet this spring. The announcement specified availability in beta variations of iOS 26.4, iPadOS 26.4, and visionOS 26.4 beginning February 16, 2026. Apple’s podcast catalog operates throughout iPhone, iPad, Mac, Apple Watch, CarPlay, Imaginative and prescient Professional, and the online at podcasts.apple.com.

The multi-device technique displays consumption sample variety. Edison Analysis knowledge exhibits podcast listeners eat content material throughout various contexts – commuting by way of CarPlay, exercising with Apple Watch, enjoyable with iPad or Imaginative and prescient Professional, and dealing on Mac. Video podcast consumption patterns differ from audio consumption, with video viewing usually occurring throughout leisure time with devoted consideration slightly than background listening throughout different actions.

Apple Podcasts operates in additional than 170 international locations and areas, offering world distribution infrastructure that extends past U.S.-focused platforms. The announcement didn’t specify regional rollout schedules for HLS video capabilities, although the spring timeframe suggests broad availability throughout main markets.

Worldwide enlargement turns into significantly essential given global podcast advertising growth patterns. The US captured 86.6% of worldwide podcast promoting spend whereas representing 80.3% of listeners, demonstrating increased monetization effectivity than different markets. Video podcast capabilities might assist worldwide markets shut this monetization hole by offering premium stock codecs that command increased charges.

Characteristic integration maintains current consumer expertise

Video episodes will combine with current options Apple Podcasts customers already make the most of, together with customized suggestions and editorial curation on the New tab and in Class pages. The seamless integration strategy suggests Apple goals to keep away from fragmenting the consumer expertise between audio and video content material.

Apple Podcasts already provides options together with Improve Dialogue mode, playback speeds from 0.5x to 3x, mechanically created chapters, timed hyperlinks, and transcripts throughout over 125 million episodes in 13 languages. Listeners can immediately help creators via premium subscriptions with advantages like unique content material and ad-free listening.

The preservation of current function parity between audio and video content material addresses potential consumer expertise friction. If video episodes lacked options customers anticipate from audio podcasts – similar to variable playback speeds or chapter navigation – adoption would possibly endure. The technical implementation apparently maintains function consistency throughout content material codecs.

Premium subscription capabilities change into significantly related for video content material. Creators providing unique video content material via Apple Podcasts Subscriptions can probably command increased subscription costs than audio-only choices, given video manufacturing prices and perceived worth variations. The subscription mannequin offers an alternate monetization path past promoting for creators constructing devoted viewers communities.

Promoting infrastructure determines adoption velocity

The success of Apple’s video podcast initiative relies upon considerably on promoting infrastructure growth by taking part advert networks. Dynamic advert insertion for video requires technical capabilities together with video artistic administration methods, high quality verification processes, concentrating on infrastructure, and measurement reporting that many podcast advert networks haven’t but deployed at scale.

SiriusXM Media, AdsWizz, and Simplecast convey substantial technical capabilities to the initiative. AdsWizz processes 16 billion monthly dynamically inserted audio ad impressions and facilitates 4 billion month-to-month audio impressions bought by way of third-party DSPs. The corporate transcribes 40 million podcast episodes for model security and contextual viewers help, demonstrating refined content material evaluation capabilities relevant to video content material.

The technical infrastructure supporting video podcast promoting has superior significantly throughout taking part platforms. Triton Digital’s Omny Studio introduced help for video podcast creation, distribution, and monetization on December 4, 2025, alongside current audio content material capabilities. The enlargement acknowledges that video has change into important infrastructure slightly than an experimental format throughout the podcast ecosystem.

Nonetheless, video promoting at scale requires artistic asset administration methods dealing with a number of video codecs, side ratios, and high quality ranges. Advertisers should produce video artistic belongings particularly for podcast placements slightly than repurposing tv commercials or social media video adverts. The artistic manufacturing burden might gradual advertiser adoption initially.

Market implications prolong past podcasting

Apple’s video podcast announcement carries implications extending past the podcasting business into broader digital promoting markets. Video podcast stock competes immediately with YouTube for advertiser budgets, significantly for direct response entrepreneurs looking for performance-driven placements.

The emphasis on creator management and open distribution contrasts with platform-exclusive approaches pursued by opponents. Creators sustaining distribution throughout a number of platforms can probably command increased promoting charges by demonstrating attain throughout various audiences slightly than platform-specific concentrations.

For promoting know-how suppliers, Apple’s entry validates the video podcast class and should speed up infrastructure funding. Demand-side platforms might want to combine Apple Podcasts video stock alongside current YouTube, Spotify, and standalone podcast connections. Provide-side platforms should develop relationships with taking part advert networks to entry Apple’s impression-based stock.

The broader development towards omnichannel audio advertising suggests platforms will more and more compete by providing unified entry to a number of codecs. iHeartMedia and Magnite launched an omnichannel audio promoting market in January 2024, bringing collectively broadcast radio, streaming radio, and podcast belongings for inclusion in programmatic media buys. Video podcast stock represents one other format requiring integration into unified shopping for platforms.

Timeline

- June 21, 2020: SiriusXM acquires Simplecast podcast administration platform

- August 18, 2023: AdsWizz integrates PodScribe’s contextual-targeting solution for podcast promoting

- August 4, 2024: SiriusXM launches premium podcast subscription on Apple Podcasts

- March 31, 2025: Frequency launches Premium Publisher Network for podcast promoting monetization

- April 16, 2025: The Athletic signs exclusive global podcast deal with Acast

- July 17, 2025: Audioboom acquires UK podcast leader Adelicious

- August 2, 2025: Edison Research podcast rankings reveal video integration challenges

- August 9, 2025: Audioboom video strategy delivers positive results

- August 20, 2025: Triton Digital launches advanced podcast audience targeting with Q2 knowledge

- October 16, 2025: Audioboom reports record Q3 revenue with 18% growth from video expansion

- November 1, 2025: SiriusXM reports third quarter revenue of $2.16 billion with podcast progress

- November 4, 2025: Podcast advertising spending surges 26% as Gaming business leads progress

- November 14, 2025: Washington Post partners with Triton Digital for podcast monetization technique

- December 4, 2025: Triton Digital’s Omny Studio publicizes help for video podcast creation, distribution, and monetization

- December 7, 2025: Programmatic audio shifts to curation, identity, and video in 2026

- December 20, 2025: Global study reveals podcast advertisers missing affluent 55+ audiences

- January 7, 2026: Spotify cuts Partner Program barriers as Audioboom stakes video declare

- January 15, 2026: Audioboom hits $5.1M profit as Spotify partnership targets video monetization gap

- January 21, 2026: Acast and Barometer debut episode-level podcast targeting before bids

- January 26, 2026: Amazon DSP unlocks podcast ads with ART19’s audience intelligence

- February 10, 2026: Podcast ad spending hits 32% growth as 1,482 new advertisers check channel

- February 16, 2026: Apple publicizes HLS video podcast capabilities coming to Apple Podcasts this spring

Abstract

Who: Apple introduced the replace, with participation from internet hosting suppliers Acast (CEO Greg Glenday), ART19 (CEO Geoff Mattei), Triton’s Omny Studio (CRO Sharon Taylor), and SiriusXM (chief promoting income officer Scott Walker). Eddy Cue, Apple’s senior vice chairman of Providers, supplied the strategic context.

What: Apple launched HTTP Stay Streaming video podcast capabilities enabling creators to distribute video content material via taking part internet hosting suppliers whereas sustaining full management over monetization. The system helps dynamic video advert insertion together with host-read ads, seamless switching between video and audio consumption, offline viewing, and computerized high quality adjustment. Apple will cost taking part advert networks an impression-based price for delivering dynamic adverts in HLS video beginning later this 12 months, whereas not charging internet hosting suppliers or creators for distribution.

When: The announcement occurred on February 16, 2026, with performance accessible for testing in beta variations of iOS 26.4, iPadOS 26.4, and visionOS 26.4 beginning the identical day. Basic availability will arrive this spring for iPhone, iPad, Apple Imaginative and prescient Professional, and internet customers.

The place: The performance will launch globally throughout greater than 170 international locations and areas the place Apple Podcasts operates, accessible via iPhone, iPad, Mac, Apple Watch, CarPlay, Imaginative and prescient Professional, and internet at podcasts.apple.com.

Why: The initiative addresses creator demand for video podcast monetization capabilities whereas sustaining content material management and distribution flexibility. It positions Apple to compete with YouTube and Spotify within the quickly increasing video podcast market the place promoting spending surged 32% year-over-year throughout This fall 2025. The transfer allows creators to entry the broader video promoting market via dynamic advert insertion whereas preserving the open RSS ecosystem that has characterised podcasting. For Apple, the implementation offers new promoting income alternatives via impression-based charges charged to advert networks, with out undermining creator economics or internet hosting supplier relationships.

Share this text