Spotify at present launched Concerning the Tune, a beta characteristic that delivers contextual storytelling instantly inside the cellular listening expertise, marking the streaming platform’s newest effort to deepen listener engagement past passive consumption. The characteristic integrates brief, swipeable story playing cards into the Now Taking part in View, presenting particulars about track meanings, artistic processes, and behind-the-scenes moments sourced from third-party publications.

The rollout targets Premium subscribers throughout the USA, United Kingdom, Canada, Eire, New Zealand, and Australia by iOS and Android cellular purposes. In accordance with Spotify’s announcement, the characteristic addresses a elementary listener conduct: the need to right away perceive what impressed a track that captures consideration. “We consider that understanding the craft and context behind a track can deepen your connection to the music you’re keen on,” the corporate acknowledged.

Technical implementation and consumer interface design

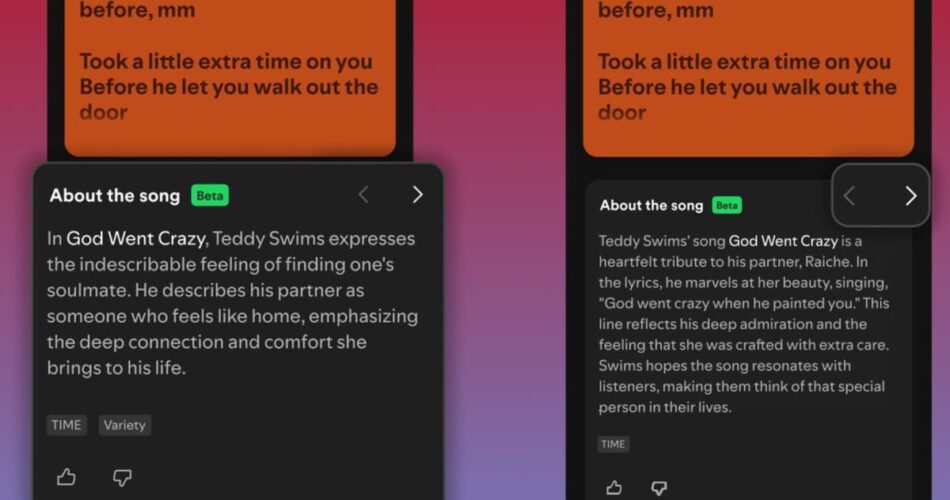

The characteristic manifests by an “Concerning the Tune” card positioned beneath the Now Taking part in View controls. Customers scroll all the way down to entry the cardboard on supported tracks, then swipe horizontally by a number of story fragments. Every card presents summarized data extracted from third-party sources together with TIME and Selection, with attribution displayed beneath the content material. The interface features a “Credit” hyperlink that presumably connects to Spotify’s expanded Song Credits system, which the corporate enhanced by its November 19, 2025 acquisition of WhoSampled.

The announcement specifies that tales are “summarized from third-party sources to floor fascinating particulars and behind-the-scenes moments.” This strategy suggests content material curation reasonably than authentic editorial manufacturing, distinguishing the characteristic from artist-generated content material or platform-produced documentaries. The summarization course of raises questions on content material choice methodology, supply licensing preparations, and editorial requirements for figuring out which songs obtain story playing cards.

Beta contributors can submit suggestions instantly by the cardboard interface, enabling Spotify to refine each content material accuracy and have usability earlier than broader deployment. The corporate offered no timeline for basic availability past the present beta designation.

Strategic context inside Spotify’s product ecosystem

Concerning the Tune represents the third part of Spotify’s expanded music attribution infrastructure announced November 19, 2025. The corporate concurrently launched SongDNA, an interactive visualization mapping connections between songs by collaborators, samples, and covers, powered by WhoSampled’s database monitoring 622,026 samples throughout 1.2 million songs. The corporate additionally expanded Tune Credit past efficiency, songwriting, and manufacturing to incorporate engineers, featured artists, and different contributors.

These initiatives replicate a broader business sample of streaming platforms enhancing discovery and engagement by contextual data reasonably than relying completely on algorithmic advice. Amazon Music launched Fan Groups on November 11, 2025, creating devoted communities the place listeners uncover and focus on music suggestions with out leaving the applying. Amazon subsequently launched 2025 Delivered on December 2, positioning itself as a direct competitor to Spotify Wrapped by remodeling streaming historical past into customized insights.

The aggressive dynamics lengthen to synthetic intelligence purposes in content material discovery. Whereas Spotify emphasizes human-curated editorial content material summarized from established publications, different platforms experiment with AI-generated explanations and conversational search capabilities. The excellence suggests Spotify prioritizes perceived authenticity and supply credibility over automated content material era for options designed to elucidate inventive intent.

Promoting implications and platform monetization

The characteristic arrives as Spotify’s advertising business faces persistent execution challenges. The corporate reported on July 29, 2025, that ad-supported income fell 1% year-over-year to €453 million in Q2, regardless of ad-supported month-to-month lively customers rising 10% to 433 million. CEO Daniel Ek characterised these challenges as “execution” points reasonably than strategic issues throughout the earnings name.

Engagement-enhancing options like Concerning the Tune serve twin functions inside Spotify’s enterprise mannequin. For Premium subscribers who generate 89% of complete income by subscriptions, deeper content material engagement helps retention metrics that cut back churn. Larger engagement and listening period create elevated promoting stock alternatives for the ad-supported tier whereas bettering marketing campaign efficiency by higher viewers consideration.

The platform has pursued aggressive advertising technology modernization throughout 2025. Spotify launched its programmatic Spotify Advert Trade (SAX) on April 3, enabling real-time auction-based shopping for of audio and video advert stock. The corporate subsequently expanded automated podcast buying to 170 million listeners across 12 markets on July 11. These infrastructure investments purpose to seize proportional promoting funding as digital audio commanded 20% of all time spent with digital media whereas representing solely 2.9% of complete digital promoting income.

Content material attribution infrastructure and creator relationships

The Concerning the Tune characteristic exists inside complicated relationships between streaming platforms, artists, labels, and music publishers concerning correct attribution and compensation. In accordance with producer Mike Dean’s assertion in Spotify’s November 19 announcement, “Again within the report and CD period, folks learn liner notes and it was an enormous factor to do when you listened. We used to pay attention, learn, and dream of being listed at some point. Later in my life, when my profession began, folks found me by the credit lengthy earlier than the web was common.”

This nostalgic framing positions expanded attribution options as restoring historic practices disrupted by digital streaming’s transition from bodily media. Nonetheless, the financial implications differ considerably. Bodily album liner notes represented mounted prices absorbed throughout manufacturing, whereas streaming platform attribution options require ongoing content material licensing, summarization assets, and interface upkeep throughout tens of millions of tracks.

Combine engineer Manny Marroquin emphasised recognition’s skilled worth: “So many unimaginable creatives contribute to a monitor, and recognizing them publicly will be life-changing. Correct credit open doorways, whether or not it is new work, new relationships, or just being seen.” This attitude highlights how attribution options lengthen past listener curiosity to have an effect on creator profession trajectories {and professional} networking alternatives.

Jacqueline Ankner, Spotify’s Head of Songwriter & Writer Partnerships, acknowledged: “Each track is a collaboration, and each contributor ought to be seen. With expanded Tune Credit, SongDNA, and Concerning the track, we’re giving followers a deeper have a look at the folks and artistic threads behind the music they love and giving creators the popularity they deserve.”

Information integration and third-party supply relationships

The announcement offers minimal technical element about supply choice methodology, licensing preparations, or content material refresh schedules. The summarization strategy raises a number of operational questions: how Spotify determines which publications present supply materials, whether or not licensing agreements compensate publishers for content material use, how steadily tales replace to replicate new interviews or revelations, and whether or not artists or labels can affect or dispute introduced data.

The reliance on third-party sources like TIME and Selection suggests Spotify prioritizes established media credibility over platform-generated content material or unverified fan contributions. This editorial strategy contrasts with WhoSampled’s neighborhood contribution mannequin, the place contributors earn factors for authorized submissions of samples, covers, remixes, details, and tales about musical connections.

The mixing with Tune Credit, which labels and artist distributors present, creates potential synchronization challenges. Credit information flows by distribution agreements and metadata requirements, whereas Concerning the Tune content material derives from journalistic publications with unbiased editorial processes. Guaranteeing accuracy and consistency throughout these parallel data streams requires ongoing content material administration assets.

Consumer expertise design and discovery friction

The location inside the Now Taking part in View addresses a selected consumer conduct sample: lively listening moments when curiosity a couple of monitor peaks. Nonetheless, the scroll-and-swipe interplay mannequin introduces friction in comparison with algorithmic suggestions that floor mechanically. Customers should acknowledge the characteristic’s presence, scroll to entry it, and actively interact reasonably than passively receiving data.

This design selection aligns with Spotify’s broader interface philosophy emphasizing user-initiated discovery over algorithmic imposition. The corporate adjusted shuffle algorithms in November 2025 to cut back track repetition by contemplating current listening historical past, demonstrating consideration to perceived randomness in automated playback. Concerning the Tune extends this sample by offering contextual data upon request reasonably than interrupting listening move.

The beta suggestions mechanism embedded inside playing cards represents customary product growth follow for pre-release options. Each artists and listeners can share suggestions instantly by the interface, enabling Spotify to assemble qualitative insights about content material relevance, interface usability, and have worth earlier than committing growth assets to basic availability.

Aggressive positioning inside streaming platforms

Music streaming platforms more and more differentiate by options that stretch past catalog comprehensiveness and audio high quality. Amazon Music’s Fan Groups allow direct neighborhood dialogue and music sharing inside the utility. Apple Music emphasizes artist interviews, unique content material, and spatial audio capabilities. YouTube Music leverages video content material integration and user-generated uploads unavailable on licensed streaming providers.

Spotify’s strategy by Concerning the Tune emphasizes editorial curation and third-party journalism reasonably than social options or technical audio enhancements. The technique aligns with the platform’s historic emphasis on playlist curation, Spotify Wrapped personalization, and artist-facing instruments like Spotify for Artists analytics.

The WhoSampled acquisition value, disclosed as undisclosed sum within the November 19 announcement, suggests Spotify assigned strategic worth to music connection information that extends past what collaborative filtering algorithms present. SongDNA’s capacity to map concrete, verifiable connections between songs based mostly on musical relationships reasonably than listening patterns differentiates the characteristic from algorithmic playlist era.

Privateness and information assortment concerns

The announcement comprises no details about information assortment practices related to Concerning the Tune utilization. Normal analytics would monitor which songs customers view story playing cards for, how lengthy they interact with content material, whether or not they swipe by a number of playing cards, and correlation between story card engagement and subsequent listening conduct.

This engagement information probably informs each content material creation choices and promoting focusing on capabilities. Larger engagement charges on particular story varieties may information future editorial choice. Listening patterns following story card interplay may point out whether or not contextual data influences music discovery or repeat listening.

The characteristic operates inside Spotify’s present privateness framework, which permits deterministic consumer identification by logged-in accounts reasonably than probabilistic cookie-based monitoring. This authentication benefit, shared by different logged-in platforms like Amazon and Meta, offers extra correct attribution and frequency administration in comparison with open online advertising environments.

Market timing and business developments

The February 6, 2026 announcement arrives throughout a interval of serious transformation in digital audio and streaming media. Spotify’s advertising revenue grew 8% in Q1 2025 pushed by automated shopping for instruments, with over 10,000 advertisers using new automation options. The corporate distributed greater than $100 million to podcast publishers and podcasters globally in Q1 by its Associate Program for video podcast creators.

Related tv and audio streaming proceed gaining promoting funding as conventional linear tv viewership declines. Business evaluation signifies CTV’s share of media budgets projected to double from 14% in 2023 to 28% in 2025, underscoring significance of unified measurement capabilities throughout tv and streaming platforms.

These market dynamics create strain on streaming platforms to display engagement metrics that justify promoting charges and help subscription retention arguments. Options enhancing time spent with content material instantly have an effect on each enterprise mannequin elements: longer listening periods create extra promoting stock alternatives whereas demonstrating subscription worth that reduces churn chance.

Technical scalability and content material operations

Extending Concerning the Tune past English-language markets in six international locations presents substantial operational challenges. Content material summarization requires language-specific experience, cultural context understanding, and entry to native music journalism sources. The present limitation to Premium customers in English-speaking markets suggests both licensing constraints, content material availability points, or strategic prioritization of high-value subscriber segments.

Scaling to Spotify’s full catalog of tens of tens of millions of tracks would require both substantial content material staff growth or automated summarization applied sciences. The announcement’s emphasis on “third-party sources” reasonably than inner editorial manufacturing suggests outsourced content material operations or licensing preparations with present publishers reasonably than constructing complete in-house music journalism capabilities.

The WhoSampled integration by SongDNA demonstrates one scalability strategy: buying present databases with neighborhood contribution fashions reasonably than creating content material from scratch. WhoSampled’s platform paperwork samples from motion pictures and tv reveals past music-only samples, offering infrastructure for attributing cultural references and audio snippets utilized in music manufacturing.

Business reactions and creator views

The announcement included views from producers, engineers, and Spotify executives emphasizing creator recognition and listener engagement. These curated statements body the options as benefiting each audiences in search of deeper understanding and creators deserving correct attribution.

Nonetheless, the announcement contained no unbiased artist reactions, label views, or music writer feedback. This selective sourcing sample is customary for firm bulletins however leaves questions on stakeholder alignment concerning implementation particulars, income implications, and editorial management.

The timing coincides with ongoing business discussions about streaming economics, honest compensation, and creator visibility. Spotify raised premium subscription costs throughout a number of markets in August 2025, growing month-to-month prices from €10.99 to €11.99. The corporate reached 276 million Premium subscribers as of Q2 2025 whereas working with 650 million customers globally throughout free and paid tiers.

Measurement and success metrics

Spotify offered no particular metrics defining Concerning the Tune’s success standards throughout the beta interval. Normal measurement approaches would consider engagement charges (share of listeners accessing story playing cards), session period modifications correlated with characteristic utilization, and qualitative suggestions sentiment evaluation.

The characteristic’s impression on music discovery stays unsure. Whether or not story playing cards affect subsequent listening conduct – resembling exploring artists’ again catalogs, discovering sampled tracks by SongDNA connections, or investigating collaborators talked about in credit – represents a key query for evaluating strategic worth past engagement time.

For advertisers, enhancements in listener retention and engagement period probably have an effect on marketing campaign efficiency metrics together with viewability, completion charges, and model recall. The integration of advertising platforms like Smartly with Spotify Ads Manager demonstrates ecosystem growth enabling cross-platform marketing campaign administration and unified measurement.

Future growth instructions

The beta designation suggests Spotify anticipates refinement earlier than broader deployment. Potential growth vectors embrace further language help, geographic market growth, integration with podcast content material past music tracks, and enhanced interactivity resembling linking story card mentions to associated artists or tracks.

The WhoSampled acquisition creates alternatives for deeper integration between Concerning the Tune content material and SongDNA visualizations. Tales mentioning samples may hyperlink on to pattern supply tracks, whereas cowl model discussions may set off SongDNA’s interactive relationship mapping.

The characteristic may evolve towards AI-generated summaries reasonably than curated third-party content material, although such a shift would characterize important strategic repositioning given present emphasis on established publication sources. Spotify’s November 16, 2025 launch of AI-powered audiobook summaries demonstrates the corporate’s consolation with automated content material era in particular contexts.

Timeline

- April 3, 2025: Spotify launches programmatic Spotify Ad Exchange and AI-powered creative tools

- April 29, 2025: Spotify’s ad revenue climbs 8% as automation tools transform platform

- July 11, 2025: Spotify expands automated podcast buying to 170 million listeners across 12 markets

- July 29, 2025: Spotify advertising revenue drops 1% year-over-year in Q2

- August 2025: Spotify raises premium subscription costs throughout a number of markets from €10.99 to €11.99

- September 3, 2025: Smartly integrates Spotify Ads Manager for cross-channel campaigns

- October 16, 2024: DoubleVerify expands video ad measurement to Spotify Ads Manager

- November 13, 2025: Spotify begins rolling out shuffle algorithm enhancements to cut back track repetition

- November 16, 2025: Spotify launches AI-powered audiobook summaries to reduce listening friction

- November 16, 2025: Spotify brings monetization program to Nordic creators

- November 19, 2025: Spotify acquires WhoSampled music database and announces SongDNA, expanded Song Credits, and About the Song

- February 6, 2026: Spotify launches Concerning the Tune characteristic in beta for Premium customers

Abstract

Who: Spotify launched Concerning the Tune characteristic developed in collaboration with third-party publication companions together with TIME and Selection. The characteristic targets Premium subscribers in the USA, United Kingdom, Canada, Eire, New Zealand, and Australia utilizing iOS and Android cellular units.

What: Concerning the Tune presents swipeable story playing cards inside the Now Taking part in View that designate track meanings, artistic processes, and behind-the-scenes moments. Content material is summarized from third-party journalistic sources reasonably than generated by Spotify or contributed by artists. The characteristic enhances SongDNA’s interactive connection mapping and expanded Tune Credit displaying all contributors from producers and engineers to songwriters and featured artists.

When: Spotify introduced the beta launch on February 6, 2026, with no specified timeline for basic availability past the present testing part. The characteristic follows the November 19, 2025 announcement of SongDNA and expanded Tune Credit, making a coordinated music attribution infrastructure.

The place: The characteristic operates completely inside Spotify’s cellular purposes on iOS and Android platforms, accessible by the Now Taking part in View by scrolling down to seek out the Concerning the Tune card on supported tracks. Present availability restricts entry to Premium subscribers in six English-speaking markets.

Why: Spotify goals to deepen listener connections to music by offering fast entry to contextual details about songs that seize consideration. The corporate believes understanding craft and context enhances engagement with music, supporting each Premium subscriber retention and ad-supported consumer session period. The characteristic addresses competitors from platforms like Amazon Music whereas differentiating Spotify by editorial curation reasonably than social options or technical audio enhancements. For creators, the expanded attribution infrastructure offers skilled recognition and profession growth alternatives by public visibility of their contributions.

Share this text