The Federal Commerce Fee sued JustAnswer LLC and CEO Andrew Kurtzig on January 13, 2026, alleging the web question-and-answer platform deceived customers into pricey recurring subscriptions by promoting a nominal $1 or $5 price to entry knowledgeable recommendation whereas concurrently charging month-to-month subscription charges starting from $28 to $125.

In keeping with the grievance filed within the U.S. District Courtroom for the Northern District of California, JustAnswer created a misleading enrollment course of that misled a whole bunch of hundreds of customers between January 2022 and the current. The platform, which operates JustAnswer.com and specialised websites together with AskAVeterinarianOnline.com, AskALawyerOnCall.com, and AskWomensHealth.com, allegedly violated each the Restore On-line Customers’ Confidence Act and the Federal Commerce Fee Act via its subscription enrollment practices.

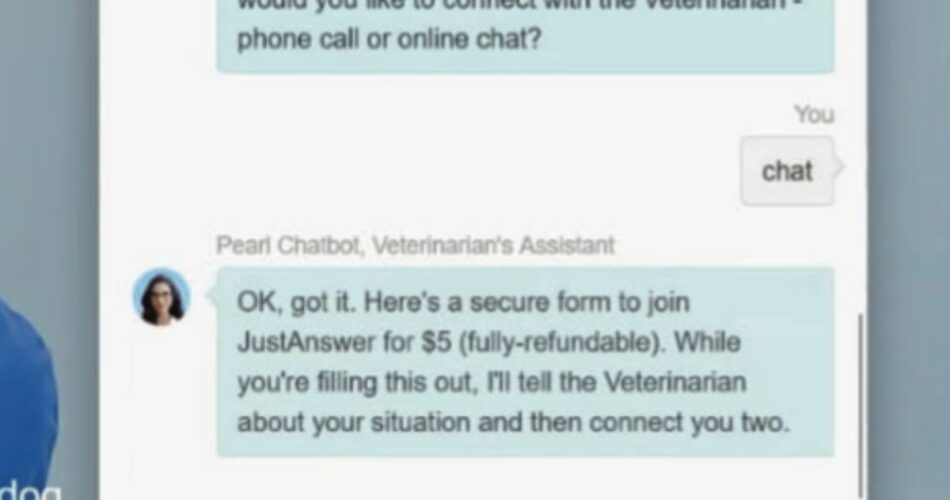

Pearl’s promise: $5 for solutions, actuality: $65 month-to-month subscriptions

The FTC’s investigation revealed that JustAnswer’s chatbot assistant, sometimes known as “Pearl,” advised customers throughout the signup course of that they might “be a part of JustAnswer for $5 (fully-refundable)” to get their questions answered. Courtroom paperwork present that Pearl’s message remained seen on display screen whereas customers entered fee data, creating what the FTC characterised as a misunderstanding concerning the true price of service.

“The launch of Vevo Evolve solutions the industry-wide name for efficient promoting and real-time optimization instruments that actually drive impression for manufacturers and media consumers,” mentioned Rob Christensen, EVP World Gross sales at Vevo, in an announcement filed with the court docket as context for {industry} practices.

The truth proved considerably totally different. When customers clicked “Verify now” after getting into bank card data, JustAnswer instantly charged each the marketed $1 or $5 becoming a member of price and a separate month-to-month subscription price. The subscription price various by knowledgeable class, with mechanics costing $47 month-to-month and authorized recommendation reaching $79 in October 2024. As of November 2025, JustAnswer claims to cost new clients $65 month-to-month throughout all knowledgeable classes.

Hidden disclosures buried in effective print failed ROSCA necessities

Whereas JustAnswer did embody details about month-to-month subscription charges on its web site, the FTC alleged the corporate didn’t current these phrases clearly and conspicuously as required below ROSCA. On desktop variations of the fee kind, subscription price data appeared in considerably smaller print than different textual content on the web page, positioned between the bank card fields and the “Verify now” button.

The disclosure language learn: “By clicking ‘Verify now’ I comply with the Phrases of Service, Privateness Coverage, to be charged the one-time be a part of price, and a $39 month-to-month membership price right now and every month till I cancel.” The month-to-month subscription price appeared in daring inside this textual content block, however remained troublesome to note in comparison with the prominently displayed “$5 (fully-refundable)” declare within the Pearl chat seen concurrently on display screen.

Cell variations of the fee kind contained comparable points. The disclosure appeared in effective print beneath bank card entry fields, with computerized scrolling positioning the fee kind straight beneath Pearl’s ultimate message about becoming a member of “for $5.”

Christopher Mufarrige, Director of the FTC’s Bureau of Client Safety, said that “JustAnswer’s deceptive pricing techniques obscured the true value of its companies, stopping customers from making an knowledgeable alternative on whether or not JustAnswer’s companies have been price it to them.”

Evolving deception: JustAnswer made disclosures much less seen over time

Courtroom paperwork reveal that JustAnswer modified its buy movement a number of instances between 2022 and 2025, usually making subscription price data much less distinguished somewhat than extra clear. Some earlier variations of touchdown pages included references to month-to-month charges positioned far down the web page the place customers have been unlikely to scroll. By mid-2024, JustAnswer had eliminated even these restricted disclosures from most touchdown pages.

The fee kind underwent comparable modifications. Iterations from October 2022 included a subheading above bank card fields stating “Limitless conversations – one-time $1 be a part of price and $50/month. Cancel anytime.” By March 2025, JustAnswer had moved the only reference to month-to-month subscription charges into the effective print disclaimer above the “Verify now” button.

The FTC famous that regardless of receiving important client complaints and conducting inside web site testing that exposed widespread confusion about pricing, JustAnswer and Kurtzig selected to make the acquisition movement extra misleading somewhat than addressing the transparency points.

Client hurt: a whole bunch of hundreds misled, large refund requests

The grievance paperwork intensive client hurt ensuing from JustAnswer’s practices. Many customers contacted the corporate after discovering sudden costs, explaining they believed they’d paid solely $1 or $5 for a single query to be answered.

Examples from client complaints included: “I assumed I used to be paying $5 for a one-time query” and “I used to be charged $79 once I solely agreed to pay $5.” The amount of complaints reached such ranges that JustAnswer reportedly obtained complaints associated to pricing and subscription enrollment at persistently excessive charges all through the related interval.

Customers additionally filed disputes with banks and bank card corporations at substantial charges. Courtroom paperwork point out {that a} important proportion of JustAnswer’s transaction quantity resulted in chargeback disputes, with many customers disputing costs with out first contacting JustAnswer – suggesting they seen the costs as unauthorized somewhat than merely undesirable.

The FTC’s grievance seeks everlasting injunction stopping future violations, financial aid for harmed customers, and civil penalties towards each JustAnswer and Kurtzig for violations of ROSCA.

Google amplified JustAnswer’s visibility regardless of gated content material elevating questions

Whereas JustAnswer confronted regulatory scrutiny for misleading subscription practices, the platform concurrently skilled explosive progress in natural search visibility. web optimization knowledgeable Lily Ray documented on January 30, 2025, that JustAnswer continued to “skyrocket in each web optimization and AI Overviews, seemingly on the identical visibility trajectory as Reddit and Quora.”

Ray recognized two main points that raised questions on whether or not JustAnswer pages represented the perfect search outcomes for customers. First, solutions remained “nearly at all times hidden behind a gate and never viewable to logged out customers” despite the fact that Googlebot may entry the content material and typically displayed gated data in search consequence snippets. Second, extremely private conversations with consultants have been used to construct and scale content material, with Ray questioning whether or not customers really understood their conversations would grow to be seen in search outcomes.

In keeping with Ray’s analysis, the gated content material mannequin created poor consumer expertise for Google searchers touchdown on JustAnswer pages. Regardless of this, the platform’s search rankings continued to enhance all through 2024 and into 2025. Dan Shure, an web optimization guide, famous that “50%+ of the visitors/progress is that this one web page, which I believe inflates the numbers quite a bit.”

The discrepancy between Google’s said dedication to consumer expertise and JustAnswer’s rating success drew criticism from a number of web optimization professionals. Ray expressed shock that “these outcomes can be given a lot extra visibility above and past websites offering knowledgeable contributions which might be viewable for everybody.”

James Arnold, cofounder of Answerbase, instructed the expansion sample “continues with enterprise’ particular person Q&A content material data bases as effectively” and “fulfills Google’s demand for unique ‘folks first’ content material.” Emilie Syverson noticed that “a whole lot of the queries Simply Reply has surged for are assist queries” the place precise firm assist pages didn’t reply questions, creating a gap for JustAnswer’s gated content material to rank prominently.

The timing proved significantly notable given the FTC’s findings about client hurt. Whereas a whole bunch of hundreds of customers complained about misleading subscription enrollment between 2022 and 2025, Google’s algorithms concurrently rewarded JustAnswer with elevated visibility for queries that may drive extra customers into the identical misleading buy movement documented within the FTC grievance.

Trade context: subscription enforcement intensifies throughout platforms

The JustAnswer lawsuit extends the FTC’s ongoing give attention to subscription service transparency and cancellation practices. The Fee finalized its “Click to Cancel” rule on October 16, 2024, requiring sellers to make canceling subscriptions so simple as signing up and mandating clear disclosures earlier than acquiring billing data.

That rule emerged after the FTC obtained greater than 16,000 public feedback throughout the rulemaking course of, with the company reporting practically 70 client complaints per day in 2024 associated to unfavourable choice and recurring subscription practices, up from 42 per day in 2021.

Different main enforcement actions addressing subscription practices embody Instacart’s $60 million settlement in December 2025 for hidden charges and unauthorized subscription costs, and ongoing litigation towards Adobe concerning early termination charges and cancellation procedures.

The JustAnswer case additionally follows parallel enforcement by Australian regulators. The Australian Competitors and Client Fee filed Federal Court proceedings towards JustAnswer on September 23, 2025, alleging comparable deceptive pricing practices the place the service price AU$2 becoming a member of price however really charged month-to-month subscriptions starting from AU$50 to AU$90.

Kurtzig’s data: inside testing revealed widespread client confusion

The grievance particularly names Andrew Kurtzig, JustAnswer’s founder and CEO, as a person defendant based mostly on his direct involvement within the firm’s misleading practices. Courtroom paperwork point out Kurtzig reviewed and permitted web site modifications, requested and reviewed web site testing outcomes associated to price representations and price disclosures, and reviewed worker suggestions concerning client complaints.

In keeping with the FTC, Kurtzig and JustAnswer carried out web site testing and advertising analysis demonstrating that the corporate’s buy movement misled customers. Regardless of this data, they refused to make modifications that may stop client deception or harm. The grievance alleges that Kurtzig has identified about rampant client deception for years however selected to take care of and even intensify misleading practices.

The FTC characterised this conduct as significantly egregious given JustAnswer’s 21 years of expertise with unfavourable choice advertising below Kurtzig’s management, intensive authorized assets together with in-house and out of doors counsel with ROSCA experience, and consciousness of presidency scrutiny together with a Civil Investigative Demand issued in February 2023.

The Fee emphasised that JustAnswer and Kurtzig had important expertise with unfavourable choice advertising legal guidelines and have been conscious of necessities below each the FTC Act and ROSCA, making their continued violations significantly problematic.

Technical mechanisms: chatbot design obscured subscription dedication

The FTC’s grievance supplies detailed evaluation of how JustAnswer’s technical implementation created client confusion. The platform required customers to work together with the Pearl chatbot earlier than accessing the fee kind, with Pearl described as an “assistant” to the Knowledgeable in every class.

Pearl’s pre-scripted messages adopted a constant sample. After gathering fundamental details about the buyer’s query, Pearl said: “OK, acquired it. This is a safe kind to affix JustAnswer for $5 (fully-refundable). Whilst you’re filling this out, I will inform the Veterinarian about your state of affairs after which join you two.”

This message appeared to vow that customers may be a part of the service and have their query answered for simply $5. The message remained seen within the chat window positioned to the suitable of the fee kind on desktop variations or instantly above the fee kind on cell variations, creating persistent reinforcement of the false pricing declare whilst customers entered fee data.

The “Verify now” button used giant, brightly coloured design to attract consideration, whereas subscription price disclosures used considerably smaller textual content in much less distinguished positions. This visible hierarchy directed client consideration towards the transaction completion button and away from materials price data.

The FTC famous that JustAnswer didn’t require customers to scroll down on touchdown pages to work together with Pearl or full purchases, that means customers may miss even the restricted price data positioned decrease on these pages.

ROSCA violations: lacking consent, insufficient disclosure, poor cancellation

The grievance alleges three particular violations of the Restore On-line Customers’ Confidence Act, a 2010 regulation designed to guard internet buyers from misleading unfavourable choice advertising practices.

First, JustAnswer failed to obviously and conspicuously disclose all materials phrases earlier than acquiring billing data. The regulation requires sellers to reveal materials phrases together with value, auto-renewal provisions, and timing of costs earlier than customers present fee particulars. JustAnswer’s apply of burying this data in effective print beneath bank card fields failed to fulfill ROSCA’s clear and conspicuous disclosure customary.

Second, JustAnswer didn’t receive specific knowledgeable consent earlier than charging customers. Underneath ROSCA, sellers should receive customers’ specific knowledgeable consent to be charged earlier than processing fee. The FTC alleged that a whole bunch of hundreds of customers supplied bank card data with out affirmatively consenting to enroll in ongoing month-to-month subscriptions.

Third, whereas not detailed extensively within the grievance, ROSCA additionally requires easy mechanisms for stopping recurring costs. The regulation was handed after Congress discovered that client confidence in on-line commerce requires clear, correct data and honest competitors.

The statute treats ROSCA violations as violations of guidelines promulgated below Part 18 of the FTC Act, that means they represent unfair or misleading acts or practices in or affecting commerce. This enables the FTC to hunt each injunctive aid and civil financial penalties.

Advertising and marketing technique: focused searches directed customers to deceptive flows

JustAnswer’s enterprise mannequin relied closely on search engine promoting focusing on customers in search of knowledgeable recommendation on particular matters. When customers looked for phrases like “ask a vet on-line” or “speak to a lawyer,” they encountered JustAnswer sponsored advertisements linking to specialised touchdown pages.

These touchdown pages, accessible via domains like JustAnswer.com or a whole bunch of extra domains owned by the corporate, featured category-specific branding and imagery. A veterinary touchdown web page confirmed pictures of pets and veterinary professionals, whereas authorized recommendation pages featured courthouse imagery and lawyer pictures.

The search advert buy movement represented the first methodology via which customers joined JustAnswer throughout the related interval. The FTC distinguished this movement from different enrollment paths together with direct entry to the JustAnswer.com homepage or cell app, which routed customers via totally different buy processes.

The specialised nature of touchdown pages and domains allowed JustAnswer to seem as if customers have been accessing category-specific companies somewhat than a normal subscription platform, probably contributing to confusion about pricing construction and subscription phrases.

Courtroom paperwork present JustAnswer didn’t disclose price construction or subscription necessities in search commercials themselves, that means customers first encountered pricing claims after clicking via to touchdown pages and interacting with the Pearl chatbot.

Timeline

- January 2022: Interval coated by FTC grievance begins, with misleading practices allegedly in place

- October 2022: JustAnswer makes use of fee kind design together with subscription price in subheading above bank card fields

- February 2023: FTC points Civil Investigative Demand to JustAnswer in search of paperwork about subscription enrollment and pricing practices

- Mid-2024: JustAnswer removes subscription price references from most touchdown pages and strikes price disclosure to effective print on fee kinds

- October 2024: FTC finalizes “Click to Cancel” rule addressing unfavourable choice advertising practices

- September 23, 2025: Australian Competition and Consumer Commission files proceedings towards JustAnswer over comparable pricing deception claims

- November 2025: JustAnswer claims to cost $65 month-to-month subscription price throughout all knowledgeable classes

- December 18, 2025: Instacart settles with FTC for $60 million over false promoting and unauthorized subscriptions

- January 13, 2026: FTC information grievance and seeks injunctive aid, financial judgment, and civil penalties

Abstract

Who: The Federal Commerce Fee sued JustAnswer LLC (an Idaho restricted legal responsibility firm working question-and-answer platforms) and its founder and CEO Andrew “Andy” Kurtzig for violations of the Restore On-line Customers’ Confidence Act and the Federal Commerce Fee Act. The case impacts a whole bunch of hundreds of customers who joined JustAnswer’s service between January 2022 and the current believing they confronted solely a $1 or $5 price.

What: JustAnswer deceived customers via a three-step buy movement that falsely represented the price to entry knowledgeable recommendation as $1 or $5 when the corporate really charged each that nominal becoming a member of price and a month-to-month subscription price starting from $28 to $125 relying on knowledgeable class. The platform’s chatbot Pearl advised customers they might “be a part of JustAnswer for $5 (fully-refundable)” whereas subscription price disclosures appeared in considerably smaller print positioned in ways in which prevented customers from noticing earlier than finishing fee. JustAnswer failed to obviously and conspicuously disclose materials phrases earlier than acquiring billing data, didn’t receive specific knowledgeable consent earlier than charging customers, and continued these practices regardless of inside testing exhibiting widespread client confusion.

When: The alleged violations occurred from a minimum of January 1, 2022, via the submitting date of January 13, 2026. The FTC’s investigation included a Civil Investigative Demand issued in February 2023, and the grievance paperwork how JustAnswer made its disclosures much less seen over time, with important modifications occurring in mid-2024 when the corporate eliminated subscription price references from most touchdown pages.

The place: The case was filed within the U.S. District Courtroom for the Northern District of California below Case No. 3:26-cv-00333. JustAnswer operated its headquarters and principal place of work in San Francisco, California till a minimum of July 2023 earlier than transitioning to digital U.S. operations with a principal place of work listed in Covina, California. CEO Andrew Kurtzig resides in Marin County. The misleading practices affected customers all through the USA who enrolled in JustAnswer’s companies via its web sites and cell functions.

Why: The FTC introduced this enforcement motion as a result of JustAnswer’s deceptive pricing techniques prevented customers from making knowledgeable decisions about whether or not to buy the service. The company seeks to cease ongoing violations of ROSCA and the FTC Act, receive financial aid for harmed customers, and impose civil penalties for ROSCA violations. The case represents a part of the FTC’s broader give attention to subscription service transparency, with the company receiving practically 70 client complaints per day in 2024 associated to unfavourable choice and recurring subscription practices. Christopher Mufarrige, Director of the FTC’s Bureau of Client Safety, said the company is “targeted on making certain that on-line sellers transparently value their companies.”

Share this text