The Reuters Institute for the Research of Journalism released its annual know-how traits survey on January 12, displaying that media leaders anticipate dropping almost half their remaining visitors over the following three years as synthetic intelligence continues reworking how audiences devour information. The analysis, primarily based on responses from 280 trade executives throughout 51 nations, paperwork an acceleration of challenges which have already decimated writer revenues all through 2024 and 2025.

News publishers have lost half their Google Search traffic in two years, with Internet Search declining from 51% to 27% of referrals between 2023 and the fourth quarter of 2025. The Reuters survey confirms this trajectory exhibits no indicators of reversing. Publishers count on an extra 43% decline in search visitors over the following three years, based on the manager responses compiled by Nic Newman.

Chartbeat information monitoring greater than 2,500 web sites revealed world Google Search visitors declined 33% year-over-year evaluating November 2024 to November 2025. United States publishers skilled even sharper drops at 38%. Since Might 2023, world Google Search referrals have fallen 21%, with US visitors down 22% throughout the identical interval.

Google Uncover visitors collapsed 21% globally and 29% in america year-over-year. The December core update destroyed Discover traffic for news sites, with some publishers reporting full elimination of impressions inside 24 hours. One operator managing 4 information web sites described receiving over 100,000 clicks every day from Uncover earlier than December 12, then watching visitors fall to zero.

The survey outcomes show elementary shifts in writer technique as conventional distribution channels fail. Publishers are deprioritizing actions that drove success for twenty years whereas embracing solely new approaches to content material creation and platform relationships.

YouTube turns into high platform precedence

YouTube emerged as publishers’ highest-priority platform for 2026, recording a internet rating of +74 when measuring the steadiness between executives planning to take a position extra versus much less effort. This represents a considerable improve from +52 within the 2025 survey, reflecting recognition that video distribution gives higher resistance to AI disruption than text-based content material.

The platform paid $70 billion to creators, media companies, and music partners over the previous three years by its Associate Program, which now consists of 3 million monetized channels. Publishers try to faucet into this income stream as conventional search visitors evaporates.

CNN introduced plans to launch CNN Creators in 2026 with a purpose-built studio in Doha, Qatar. ABC Information is getting ready to launch ABC Information Loop in Australia as a “made-for-social” explainer journalism model. The Washington Publish’s Dave Jorgenson left the group after eight years, demonstrating the pull that impartial creator economics exert on expertise. After his departure, the Washington Publish Universe YouTube channel’s views collapsed whereas his new impartial enterprise overtook the institutional model’s efficiency.

DMG New Media, which operates the Every day Mail, has employed roughly 60 younger creators to construct vertical channels. The Unbiased signed YouTuber Adam Clery as artistic director. These organizational adjustments mirror writer acceptance that creator-style content material manufacturing could supply higher financial outcomes than conventional editorial fashions.

The survey discovered 76% of publishers plan to encourage journalists to behave extra like creators. Precisely half plan to companion with creators for distribution, whereas 31% intend to rent creators instantly and 28% are creating joint ventures or creator studios.

Seventy p.c of executives expressed concern that creators are taking time and a spotlight from conventional journalism. Thirty-nine p.c fearful about dropping expertise to the creator ecosystem. These issues seem well-founded given the compensation disparities. YouTube Shorts achieved revenue per watch hour parity with traditional video in america in the course of the third quarter of 2025, validating short-form content material as commercially viable promoting stock.

AI platforms achieve precedence regardless of minimal visitors

Publishers ranked AI platforms together with ChatGPT, Gemini, and Perplexity at +61 on the web precedence scale, making them the second-highest funding space after YouTube. This prioritization creates rigidity as a result of present AI platform visitors stays negligible whereas potential licensing income stays unsure.

ChatGPT accounts for 0.02% of whole writer visitors based on Chartbeat information, rising from primarily zero in July 2024. Perplexity contributes simply 0.002% of referrals. Regardless of these minuscule visitors shares, publishers view licensing agreements with AI firms as crucial income diversification.

Sixty-nine p.c of executives count on not less than some income from AI licensing inside three years. Twenty p.c anticipate important revenue, whereas 49% count on minor contributions. Twenty p.c count on no AI licensing income, and 11% do not know what to anticipate.

Google partnered with The Associated Press on January 15 to combine real-time information content material into its Gemini utility. Neither group disclosed monetary phrases. The New York Instances has filed lawsuits in opposition to OpenAI concerning unauthorized content material use, demonstrating the cut up between litigation and partnership methods.

Dotdash Meredith reported during first quarter 2025 earnings that licensing income elevated 30% year-over-year, pushed primarily by its OpenAI partnership starting in Might 2024. The corporate skilled a 3% year-over-year decline in core consumer periods partly attributed to AI Overviews showing on roughly one-third of search outcomes associated to its content material.

The Monetary Instances, The Guardian, Der Spiegel, El País, and different main publishers have secured particular person offers with Google and OpenAI. Smaller publishers without resources to negotiate individual licensing agreements face visitors declines with out compensation mechanisms.

Social platforms present divergent trajectories

TikTok ranked third in writer priorities at +56, adopted by Instagram at +41 and LinkedIn at +40. These platforms signify alternatives for viewers growth that do not rely on Google’s algorithmic selections.

Fb visitors has fallen 43% since Might 2023, although the platform confirmed a 9% year-over-year restoration in the latest information. X (previously Twitter) visitors declined 46% since Might 2023, with a 15% year-over-year world improve masking a 22% decline in Europe.

Publishers assigned X a internet precedence rating of -52, indicating widespread plans to scale back funding within the platform. This represents one of many sharpest damaging scores within the survey. Fb obtained -23, suggesting publishers view Meta’s flagship social community as a declining asset regardless of its restoration from 2024 lows.

BlueSky scored -11 on the precedence scale. The damaging score for a platform that launched just lately signifies skepticism about whether or not various social networks can obtain ample scale to justify funding.

Conventional search optimization loses relevance

Conventional Google web optimization scored -25 on the writer precedence index, marking a dramatic reversal for methods that dominated digital publishing technique for twenty years. The deprioritization stems from recognition that rating effectively in search outcomes not ensures visitors when AI Overviews and different options reply queries with out requiring clicks.

Analysis from Ahrefs analyzing 300,000 key phrases discovered that AI Overviews scale back natural clicks by 34.5% to 54.6% when current in search outcomes. The research in contrast click-through charges for high positions with and with out AI Overviews throughout similar time intervals from March 2024 to March 2025.

Google’s December 2025 core update finally wrapped after 18 days, creating rating volatility that Glenn Gabe, a distinguished algorithm analyst, characterised as touchdown “in an enormous means” for hundreds of beforehand impacted websites. The Spectator recorded a 64% visibility decline, dropping from 2.4 to 0.9 in SISTRIX monitoring. The Telegraph fell 30%, whereas Reuters decreased 31%.

Google Community promoting income, encompassing AdSense, AdMob, and Google Advert Supervisor, declined 1% to $7.4 billion during the second quarter of 2025. This marked the primary year-over-year decline in years, suggesting lowered monetization alternatives as AI options maintain customers inside Google’s interface relatively than directing them to writer web sites.

Content material technique shifts towards investigation and context

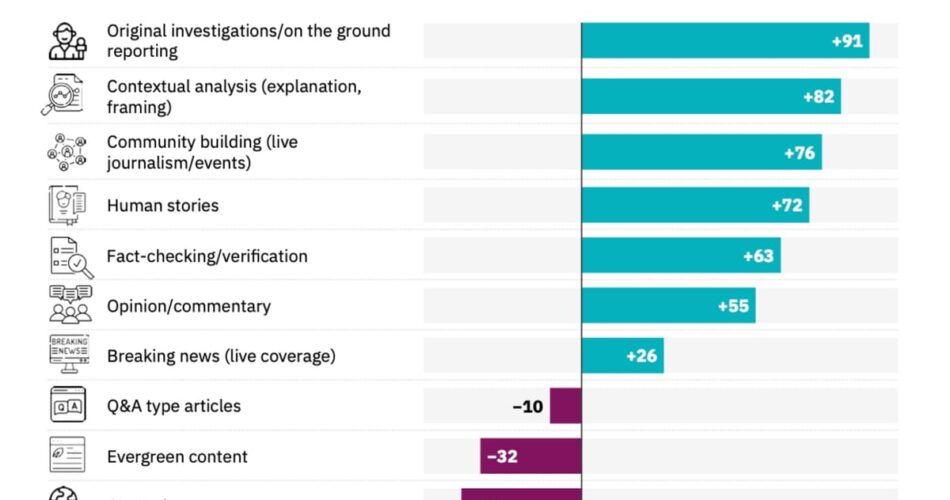

Publishers are making substantial adjustments to content material priorities in response to those distribution challenges. Unique investigations and on-ground reporting obtained the very best internet rating at +91 when executives rated their significance. Contextual evaluation and rationalization scored +82, whereas neighborhood constructing and stay occasions rated +76.

Human tales scored +72, and fact-checking plus verification actions rated +63. These classes share traits that make them tough for AI methods to duplicate: unique reporting requiring bodily presence, nuanced evaluation drawing on institutional information, neighborhood relationships constructed over time, and verification experience.

Service journalism scored -42 on the precedence scale, marking it because the content material sort publishers most aggressively plan to desert. Evergreen content material rated -32, whereas normal information scored -38. These classes face direct competitors from AI methods that may reply service questions and supply normal information summaries with out requiring visits to writer web sites.

The strategic shift displays acceptance that competing with AI for informational queries represents a dropping proposition. Publishers are as an alternative specializing in content material varieties the place human judgment, supply entry, and institutional authority create differentiation that AI can’t simply replicate.

Format priorities show comparable adaptation. Seventy-nine p.c of executives mentioned video would change into extra vital, with 41% score it “far more vital.” Audio obtained comparable remedy at 71% saying extra vital. Solely 20% of executives rated textual content as changing into extra vital, suggesting widespread perception that written journalism faces the harshest AI competitors.

AI implementation exhibits blended outcomes

Publishers are deploying synthetic intelligence internally regardless of issues about exterior AI platforms destroying their enterprise fashions. Sixty-four p.c of executives rated back-end automation together with transcription, tagging, and copyediting as “essential” for his or her AI methods.

Coding and product growth utilizing AI instruments scored 44% essential, representing a 16 proportion level improve from the 2025 survey. Industrial functions together with propensity fashions reached 33% essential. Newsgathering makes use of comparable to story identification and information interrogation scored 29% essential, as did content material creation with oversight.

When requested about outcomes from their AI initiatives, 44% of executives characterised them as “promising,” whereas 42% mentioned “restricted.” Solely 13% described outcomes as “transformational,” suggesting most implementations have not but delivered breakthrough enhancements.

Job impression from AI deployment has been minimal to this point. Sixty-seven p.c of publishers reported slicing no jobs because of AI, whereas 16% reduce a small quantity. 9 p.c added jobs associated to AI implementation, and simply 1% reduce a major variety of positions.

The New York Instances carried out AI to sift by podcasts and movies for investigations. A case involving Charlie Kirk required two weeks as an alternative of what would have been greater than a 12 months manually. Helsingin Sanomat deployed HS Watchdog bots to watch Russian Telegram channels. Reuters launched FactGenie, a software that halves the time required for non-corporate alerts utilized by 150 journalists globally.

Norway’s iTromsø created Djinn, a software that sifts by authorities paperwork. The implementation delivered six cowl tales in a single week. India’s Scroll added a slider bar permitting readers to regulate the depth of explainer content material. Norway’s VG carried out AI-generated “what’s new since final go to” messages customized to particular person readers.

Seventy-five p.c of executives count on “massive” or “very massive” impression from agentic AI over the following three years. These methods embody AI browsers comparable to Atlas and Comet, plus agentic functions like Huxe and Pulse that may autonomously full duties relatively than merely responding to queries.

Business confidence collapses

Confidence in journalism general has fallen dramatically. Sixty p.c of executives expressed confidence in 2022. That determine dropped to 38% within the present survey, representing a 22 proportion level decline in 4 years. Eighteen p.c now report being not assured in journalism’s future, up from 10% beforehand.

Executives cited a number of causes for declining confidence: uncertainty about AI adoption paths, lack of visibility in search and social platforms, conventional media dropping contact with youthful audiences, and political assaults on journalism undermining public belief.

Confidence in respondents’ personal companies remained increased at 53%, much like 2025 ranges. This hole between confidence within the general trade versus particular person organizations suggests executives imagine their particular firms can navigate challenges even because the broader journalism ecosystem struggles.

Fifty-two p.c of executives imagine AI-generated content material and misinformation will strengthen information media’s aggressive place, up from 41% in 2025. Twenty-seven p.c imagine it’ll weaken their place. The reasoning facilities on trusted information manufacturers doubtlessly gaining worth as audiences wrestle to differentiate dependable data from AI-generated content material of unsure high quality.

TikTok has generated greater than 1 billion AI movies. Practically one in 10 of the fastest-growing YouTube channels present solely AI-generated content material. France documented greater than 4,000 faux information websites powered by generative AI. NewsGuard analysis exhibits zombie native information websites in america now outnumber actual native information shops.

Publishers hope this deluge of low-quality AI content material will drive audiences towards established manufacturers with verification processes and editorial requirements. Whether or not this dynamic will offset visitors losses from AI options in search platforms stays unsure.

Income fashions beneath stress

Industrial publishers excluding public broadcasters ranked subscription and membership as their high income precedence at 76%. Show promoting scored 68%, down from 81% in 2020. Native promoting reached 64%, representing a 5 proportion level improve pushed primarily by short-form video alternatives.

Occasions, each bodily and on-line, scored 54%, up 6 proportion factors as publishers search in-person income streams proof against digital disruption. Platform funding together with AI licensing scored 37%, representing a 17 proportion level improve over two years.

Philanthropy and basis funding rated 18%, down 2 proportion factors as United States-based funding sources contract. This decline significantly impacts nonprofit information organizations that expanded in the course of the earlier decade primarily based on expectations of sustained philanthropic assist.

The IAB’s 2026 Annual Leadership Meeting features zero sessions addressing publisher revenue challenges, based on criticism from Andy Batkin, CEO of Length Media. The group, which initially launched solely to serve publishers, now dedicates programming to advertiser issues whereas publishers face existential threats.

Digital promoting income focus among the many high 10 know-how firms reached 80.8%, with firms ranked 11 by 20 capturing simply 5.9% of whole spending. This focus demonstrates platform energy that makes writer negotiations more and more uneven.

The IAB Europe released technical standards in September 2025 requiring AI platforms to compensate publishers for content material ingestion. The framework establishes three mechanisms: content material entry controls, discovery protocols, and monetization APIs. Implementation stays unsure as main AI firms haven’t dedicated to adopting these requirements.

Cloudflare information confirmed pages crawled to guests referred ratios deteriorating from 2:1 to 18:1 in June 2025. OpenAI’s ratio reached 250:1 after which 1,250:1, indicating the corporate crawls content material at charges vastly exceeding the visitors it sends again to publishers. Unauthorized scraping elevated 40% between the third and fourth quarters of 2024.

More than 80 media executives met in New York on July 30, 2025, beneath the IAB Tech Lab banner to debate collective responses. Google and Meta despatched representatives. OpenAI, Anthropic, and Perplexity notably didn’t attend, suggesting these AI-native firms see restricted profit in trade coordination which may constrain their entry to coaching information.

Visitors distribution basically altered

Present visitors distribution exhibits dramatic shifts from historic patterns. Google Uncover now accounts for 13% of whole referrals to information publishers. Google Search contributes 7.3%, Fb gives 3.3%, and X delivers 0.3%. ChatGPT and Perplexity mixed signify lower than 0.03% of visitors.

This distribution creates issues past the apparent visitors declines. Google Uncover operates by advice algorithms that publishers can’t predict or optimize for systematically. Content material that receives Uncover distribution achieves large attain, whereas content material excluded receives minimal visibility. Publishers haven’t any dependable technique for understanding which articles will obtain distribution.

One publisher described this as asymmetric dependency, the place content material creators should produce materials suited to Uncover’s algorithms whereas having minimal affect over distribution selections. This contrasts with conventional search, the place optimization practices may enhance rankings by established methods.

The European Fee launched a proper antitrust investigation on December 9, 2025, analyzing whether or not Google violated EU competitors guidelines by utilizing writer content material for AI functions with out acceptable compensation or viable opt-out mechanisms. Brussels regulators assessed whether or not Google imposed unfair phrases on publishers whereas granting itself privileged entry to coaching information that rivals can’t acquire.

Pew Analysis discovered that simply 1% of customers click on hyperlinks when AI Overviews seem in search outcomes. This engagement price makes AI options functionally equal to no-click seek for publishers, offering no visitors regardless of that includes their content material.

Marfeel’s monitoring research published December 18, 2025, discovered 51% of Google Uncover feed positions in check markets now encompass AI Summaries. Seventy-seven p.c of AI Abstract exits default to inline YouTube performs relatively than writer hyperlinks. Publishers obtain model visibility by multi-icon shows however minimal visitors as main consumer actions path to Google-owned properties.

Various platform experiments

Some publishers are exploring revenue-sharing preparations with platforms. Vox Media secured revenue-share offers with creators for podcasts together with Pivot and Hacks on Faucet. The Washington Publish launched Ripple, providing revenue-share partnerships with impartial Substack writers.

Perplexity launched a revenue-sharing subscription mannequin the place the corporate distributes 80% of consumer charges to collaborating publishers primarily based on engagement metrics. This mannequin addresses the zero-click downside by offering compensation with out requiring visitors, although adoption stays restricted.

Actually Easy Licensing (RSL) Collective has organized greater than 50 publishers together with Penske Media, Ziff Davis, Yahoo, BuzzFeed, USA Immediately, and Vox Media to barter collectively with AI platforms. The collective licensing method mirrors music rights societies however faces challenges establishing utilization measurements and allocation formulation.

WordPress.com partnered with Perplexity AI for content material discovery. Google expanded Preferred Sources globally on December 10, 2025, whereas piloting AI-powered article overviews with main publishers together with The Guardian. These partnerships try to keep up writer relationships whereas deploying AI options that scale back conventional click-through patterns.

The industrial partnerships Google introduced included The Guardian, Der Spiegel, El País, Folha de S. Paulo, Infobae, Kompas, The Instances of India, The Washington Examiner, and The Washington Publish. Google has not disclosed cost quantities. These selective preparations create two-tier methods the place main publishers safe particular person offers whereas impartial shops face visitors declines with out compensation mechanisms.

Regional variations

Visitors patterns range considerably by geography. UK website traffic growth collapsed 86% since Google’s AI search rollout, based on Tank analysis monitoring 800 firms throughout 16 sectors. Common month-to-month natural visitors development fell from 26.3% to three.7%. Hospitality skilled the worst efficiency at -6.7% development. Rating pages declined 11.1%, down from constructive 14.1% development the earlier 12 months.

India news sites plummeted during the December update, with SISTRIX monitoring displaying Hindustantimes.com visibility dropping from above 6 factors to beneath 2 factors in the course of the 18-day rollout between December 11 and December 29.

The Reuters survey coated 51 nations, guaranteeing geographic range in responses. Sixty-four editors-in-chief participated alongside 64 CEOs and 51 heads of digital or innovation. This executive-level perspective differs from practitioner surveys, specializing in strategic selections relatively than tactical implementation.

Implications for advertising professionals

The Reuters findings carry important implications for digital advertising. Visitors sources that supported programmatic promoting for many years are failing. Publishers implementing paywalls and decreasing free content material will lower obtainable promoting stock. Video and audio codecs gaining precedence have completely different promoting traits than text-based content material.

Creator partnerships supply manufacturers entry to audiences however require completely different relationship fashions than conventional media shopping for. YouTube’s Associate Program gives standardized creator monetization, doubtlessly simplifying model collaborations. Nevertheless, creator content material high quality and model security range greater than conventional writer stock.

The shift towards neighborhood constructing and occasions creates alternatives for experiential advertising however reduces scalable digital promoting placements. Subscription development limits addressable audiences for advertising-supported campaigns.

AI platform promoting stays nascent. OpenAI explored sponsored content in ChatGPT responses in December, although implementation particulars remained undisclosed. Google launched promoting in AI Overviews throughout Might 2025, competing instantly with writer stock for queries the place AI options seem.

Publishers pivoting away from service journalism and evergreen content material will scale back promoting stock for industrial intent queries. Manufacturers beforehand focusing on these content material varieties by contextual promoting should determine various placements.

The focus of promoting income amongst high know-how platforms reached 80.8%, limiting writer negotiating energy. Manufacturers looking for various media combine choices face shrinking impartial writer stock as consolidation accelerates.

Timeline

- Might 2023: Chartbeat monitoring begins displaying decline in Google Search visitors that ultimately reaches 21% globally

- September 2023: Google Useful Content material Replace begins sustained visitors declines for impartial publishers

- Late October 2024: Inflection level happens when conventional Google Search visitors drops from roughly 16% to 10% of whole referrals, coinciding with AI Overviews rollout to 100+ nations

- Might 2024: Dotdash Meredith partners with OpenAI, starting licensing income development of 30% year-over-year

- July 23, 2025: Google Network advertising revenue declines 1% to $7.4 billion in Q2 2025

- July 30, 2025: More than 80 media executives meet under IAB Tech Lab to debate AI scraping responses

- August 2025: Research reveals Discover accounts for two-thirds of Google referrals to information websites

- September 2025: IAB Europe releases framework proposing publisher compensation mechanisms for AI content material utilization

- November 2024-November 2025: World Google Search visitors to publishers declines 33% year-over-year; US visitors falls 38%

- December 9, 2025: European Commission launches antitrust investigation into Google’s AI content material practices

- December 10, 2025: Google announces commercial partnerships with select publishers for AI options; Most well-liked Sources launches globally

- December 11, 2025: Google’s December core update destroys Discover traffic with publishers reporting full elimination

- December 18, 2025: Marfeel publishes Discover Monitoring research displaying 51% of feed consists of AI Summaries in check markets

- December 23, 2025: NewzDash evaluation of 400+ publishers confirms Internet Search decline from 51% to 27% between 2023-This fall 2025

- December 29, 2025: December 2025 core update completes after 18 days

- January 12, 2026: Reuters Institute publishes 2026 Journalism and Know-how Tendencies survey displaying publishers count on extra 43% visitors decline over subsequent three years

- January 15, 2026: Google announces partnership with Associated Press for real-time information in Gemini

Abstract

Who: The Reuters Institute for the Research of Journalism surveyed 280 media leaders together with 64 editors-in-chief, 64 CEOs, and 51 heads of digital or innovation throughout 51 nations throughout November and December 2025. Chartbeat offered visitors information from greater than 2,500 web sites. NewzDash analyzed 400+ information publishers worldwide.

What: Publishers skilled 33% world Google Search visitors decline year-over-year (38% in US), with Internet Search falling from 51% to 27% of Google referrals between 2023 and This fall 2025 whereas Uncover climbed to 68%. Executives count on an extra 43% visitors decline over the following three years. Publishers are shifting priorities towards YouTube (+74 internet rating), AI platforms (+61), and TikTok (+56) whereas deprioritizing conventional Google web optimization (-25), X (-52), and Fb (-23). Content material technique emphasizes unique investigations (+91), contextual evaluation (+82), and video (79% saying extra vital) whereas abandoning service journalism (-42) and evergreen content material (-32).

When: The Reuters survey occurred November-December 2025 with publication January 12, 2026. Visitors declines started accelerating from the inflection level in late October 2024 when AI Overviews rolled out to 100+ nations. The December 2025 core replace between December 11-29 destroyed remaining Uncover visitors for a lot of publishers.

The place: Visitors declines have an effect on publishers globally however present regional variations: US publishers skilled 38% year-over-year Search visitors decline versus 33% globally; UK natural visitors development collapsed 86%; India information websites plummeted throughout December replace. Google Uncover now accounts for 13% of whole writer referrals, Google Search 7.3%, Fb 3.3%, and X 0.3%.

Why: The transformation issues for the advertising neighborhood as a result of it represents elementary shifts in content material distribution, with publishers pivoting from search optimization to video, creator partnerships, and AI platform licensing whereas conventional promoting stock shrinks. Google Community income declined 1% to $7.4 billion in Q2 2025 as AI options maintain customers inside Google’s interface. Sixty-nine p.c of publishers count on AI licensing income inside three years, although 52% imagine AI-generated content material will strengthen relatively than weaken information media’s aggressive place as audiences wrestle to differentiate dependable data from low-quality AI content material.

Share this text