Apple introduced further promoting positions all through App Retailer search outcomes beginning in 2026, based on documentation printed by the corporate. The enlargement introduces a number of advert placements past the present top-of-search-results place, routinely enrolling current campaigns with out requiring advertiser modifications.

The announcement, shared through Apple’s promoting assist documentation and confirmed via business sources on December 18, 2025, marks the platform’s most important stock enlargement because the firm rebranded its advertising business from Search Ads to Apple Ads in April 2025. Based on the documentation, advertisers can not choose or bid for particular placements. As an alternative, adverts will seem both on the current prime place or additional down in search outcomes primarily based on Apple’s automated placement algorithms.

Subscribe PPC Land publication ✉️ for related tales like this one

Almost 65 % of App Retailer downloads occur straight after a search, based on Apple’s information from 2022. This statistic underscores why search outcomes symbolize the platform’s Most worthy promoting stock. The corporate’s present search promoting system, launched in October 2016 with a single top-of-search placement, has expanded regularly to incorporate the Search tab, At the moment tab, and “You May Additionally Like” sections on product pages. The 2026 additions symbolize the primary enhance in search outcomes advert density because the platform’s preliminary launch.

Conversion charges and placement mechanics

Search outcomes adverts on the prime place ship greater than a 60 % common conversion fee, based on Apple’s information spanning November 2024 via October 2025. The corporate defines this conversion fee as tap-through set up charges throughout all obtainable Apple Adverts nations and areas. This efficiency metric considerably exceeds typical cell promoting benchmarks, the place global e-commerce apps achieved 2.28 installs per thousand impressions in 2024.

The advert format stays constant throughout all positions. Advertisers can use both default product pages generated from App Retailer metadata or customized product pages created in App Retailer Join. Custom product pages integrate with Apple Search Ads to create advert variations aligned with particular audiences and key phrase themes. Deep hyperlinks directing customers to particular in-app locations can be found for search outcomes placements on gadgets working iOS or iPadOS 18 and later.

Apple’s public sale system determines which adverts seem primarily based on relevance and bid quantities. The corporate explicitly states that apps missing relevance to look queries won’t show “no matter how a lot you might be prepared to pay.” This relevance requirement distinguishes Apple’s strategy from conventional keyword-triggered promoting techniques that prioritize bid quantities over contextual matching. Apple considers each elements however excludes apps from auctions completely in the event that they fail inside relevance thresholds.

Automated marketing campaign integration

Advertisers working energetic search outcomes campaigns will routinely qualify for all obtainable positions with out marketing campaign modifications. The corporate specifies that billing continues primarily based on current pricing fashions: value per faucet or value per set up. This automated enrollment strategy differs from typical platform expansions that require advertisers to choose into new stock sources or alter marketing campaign settings manually.

The enlargement arrives as Apple’s promoting enterprise faces elevated scrutiny from regulators and opponents. French antitrust authorities fined Apple €150 million in early 2025 over App Monitoring Transparency implementation, arguing the consent framework created benefits favoring Apple Adverts over third-party networks. The expansion of Apple’s advertising inventory raises questions on whether or not elevated advert density impacts person expertise or App Retailer economics for builders who select to not promote.

Market context and aggressive dynamics

Apple’s promoting enterprise operates inside its broader providers division, which reached new income highs within the first quarter of 2025. The corporate has steadily elevated its promoting footprint since launching Search Adverts in 2016. The platform expanded to 21 new countries across Europe, Asia, and Africa in October 2024, together with Türkiye, Cyprus, Morocco, and 18 different numerous markets spanning totally different financial and technological landscapes.

The timing of the 2026 enlargement coincides with broader shifts in cell promoting infrastructure. Apple carried out App Monitoring Transparency in April 2021, requiring apps to acquire person permission earlier than accessing the Identifier for Advertisers. This framework basically altered iOS promoting measurement, with SKAdNetwork (rebranded as AdAttributionKit in 2025) now overlaying 77 % of all referral-based conversions to the App Retailer based on business evaluation. The challenges created by privacy restrictions have pushed advertisers towards Apple’s first-party promoting merchandise, which preserve deterministic attribution throughout the firm’s ecosystem.

Aykut Karaalioglu, founding father of MobileAction, commented on the announcement through LinkedIn that “extra placements = extra floor space, but additionally extra competitors.” He instructed that “inventive, relevance, and key phrase technique are about to matter greater than bids alone.” Hitanshu Ghelani, a advertising marketing consultant, characterised the event as “a giant shift” the place “extra placements = extra floor space, but additionally extra competitors.”

The enlargement creates potential benefits for bigger advertisers with refined key phrase methods and artistic testing capabilities. Smaller builders and impartial publishers could face elevated competitors for visibility in search outcomes, although Apple’s relevance necessities may defend towards purely bid-driven displacement. The automated enrollment strategy ensures that current advertisers preserve entry to new stock with out technical boundaries, although aggressive dynamics throughout the expanded public sale surroundings stay unsure.

Purchase adverts on PPC Land. PPC Land has commonplace and native advert codecs through main DSPs and advert platforms like Google Adverts. Through an public sale CPM, you possibly can attain business professionals.

Technical implementation and key phrase matching

Apple’s clever know-how matches person search phrases with marketed apps utilizing both advertiser-selected key phrases or Apple-suggested key phrases. The system’s 60 % common conversion fee suggests comparatively refined matching algorithms that prioritize contextual relevance over broad key phrase matching. Advertisers can select their very own key phrases or settle for Apple’s ideas primarily based on app metadata, class, and aggressive positioning.

The platform’s keyword-based strategy differs from discovery-focused promoting placements within the At the moment tab or product web page sections. Search promoting captures customers with express intent, as evidenced by the 65 % of downloads occurring straight after searches. This intent sign produces increased conversion charges in comparison with discovery promoting, the place customers browse with out particular app classes or options in thoughts.

Deep linking performance provides one other layer of conversion optimization. Apps utilizing this characteristic can direct customers to particular content material, options, or promotional presents moderately than generic app touchdown screens. The restriction to iOS 18+ gadgets limits deep linking availability however displays Apple’s strategy of linking superior promoting options to current working system variations. This requirement doubtlessly creates fragmented person experiences the place some advert clicks result in deep-linked locations whereas others default to plain app launches.

Pricing mannequin continuity

Apple maintains current pricing fashions regardless of the stock enlargement. Advertisers pay both value per faucet (CPT) or value per set up (CPI) relying on marketing campaign goals and platform configurations. The corporate doesn’t specify whether or not totally different placements carry totally different value buildings, suggesting uniform pricing throughout all search outcomes positions. This strategy contrasts with show promoting platforms that usually cost premium charges for above-the-fold positions.

Cost per install serves as a primary metric for measuring app promoting effectiveness, representing the overall value incurred for every app set up generated via paid campaigns. The metric permits advertisers to gauge marketing campaign efficiency, evaluate promoting platforms, and set life like acquisition targets. CPI varies considerably by app class, geographic market, and aggressive depth, with extra aggressive classes usually commanding increased charges.

The preserved pricing mannequin suggests Apple prioritizes public sale effectivity and advertiser continuity over differential pricing methods. Nevertheless, placement efficiency variations may successfully create value variations via conversion fee disparities. High-of-search-results adverts attaining 60 % conversion charges ship decrease efficient CPI than decrease placements with decreased visibility and conversion efficiency, even when the nominal CPT or CPI pricing stays constant.

Business implications and promoting economics

The enlargement impacts a number of stakeholder teams inside Apple’s app ecosystem. Builders acquire further promoting alternatives to succeed in customers throughout high-intent search moments. Nevertheless, elevated advert density all through search outcomes may have an effect on natural discovery, significantly for apps rating instantly beneath paid placements. The addition of a number of advert positions means extra search end result pages will characteristic promoting, doubtlessly pushing natural listings additional down the display screen.

Apple’s strategy of automated marketing campaign enrollment with out placement choice contrasts with platforms providing granular stock management. Google Adverts, for comparability, permits advertisers to specify community concentrating on, placement exclusions, and bid changes by place. Apple’s unified strategy simplifies marketing campaign administration however reduces advertiser management over the place adverts seem and the way a lot they pay for particular placements.

The relevance-first public sale design displays Apple’s positioning as a premium promoting platform prioritizing person expertise over pure monetization. The corporate’s acknowledged unwillingness to show irrelevant apps “no matter how a lot you might be prepared to pay” creates theoretical safety towards low-quality promoting. Nevertheless, the definition and measurement of relevance stay proprietary to Apple, with restricted transparency about how the corporate evaluates app-query matching high quality.

Cell promoting measurement agency Alter reported that e-commerce app installs declined 14 % in 2025 regardless of session development, suggesting broader challenges in app acquisition economics. Global e-commerce app CPI reached $0.99in Q1 2025, with important regional variations starting from $0.90 in Asia-Pacific to $2.70 in North America. These metrics point out substantial value variations throughout markets, seemingly influencing how the 2026 stock enlargement impacts totally different geographic areas.

Promoting format specs

Adverts make the most of both default product pages or customized product pages configured in App Retailer Join. Default adverts pull metadata straight from app listings, together with title, subtitle, icon, screenshots, and rankings. Customized product pages enable advertisers to create tailor-made displays emphasizing particular options, use circumstances, or promotional messages aligned with key phrase themes or viewers segments.

Advert variations allow refined concentrating on approaches the place totally different inventive messages match particular search contexts. An app with a number of use circumstances may create variations highlighting health options for fitness-related searches and productiveness options for work-related queries. This customization functionality turned obtainable when Apple integrated custom product pages with Apple Search Ads in January 2022.

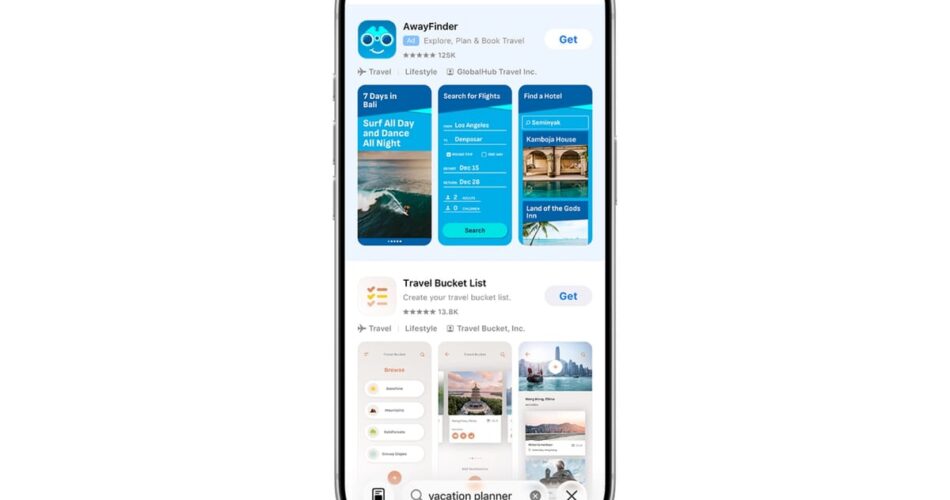

The visible format mirrors natural app listings to keep up consistency inside search outcomes. Adverts show the identical data hierarchy as non-paid listings, with clear “Advert” labels distinguishing promotional content material from natural outcomes. This design strategy prioritizes person expertise over promoting differentiation, although critics argue it creates confusion about which ends up symbolize algorithmic rankings versus paid placements.

Regulatory surroundings and platform energy

Apple’s promoting enlargement happens towards a backdrop of regulatory scrutiny concerning platform market energy and aggressive practices. The corporate faces antitrust investigations in a number of jurisdictions inspecting whether or not its management over iOS distribution creates unfair benefits for Apple’s personal providers, together with promoting merchandise. The French advantageous associated to App Monitoring Transparency particularly addressed issues that privateness controls favored Apple Adverts over opponents.

The recent tightening of App Store age controls and data sharing disclosure necessities in November 2025 demonstrates Apple’s ongoing platform governance function. These insurance policies have an effect on how apps gather information, acquire person consent, and implement age verification techniques. Critics argue that Apple’s twin function as platform operator and promoting supplier creates inherent conflicts of curiosity, significantly when platform insurance policies have an effect on aggressive dynamics in promoting markets.

The promoting enlargement advantages Apple’s providers income, which reached report ranges in early 2025. Nevertheless, the corporate maintains that promoting stays a small part of general providers income in comparison with subscriptions, App Retailer commissions, and fee processing charges. Apple executives have persistently emphasised that promoting development won’t compromise person privateness or expertise, although the addition of a number of search outcomes adverts exams this dedication.

Developer concerns and strategic implications

Builders should consider whether or not the expanded stock justifies elevated promoting funding. The automated marketing campaign enrollment means current advertisers will compete throughout extra placements with out express motion, however finances allocations and bid methods could require adjustment as aggressive dynamics evolve. Advertisers can not particularly goal or exclude the brand new placements, limiting strategic flexibility in comparison with platforms providing position-level bidding controls.

The relevance-based public sale system theoretically protects high quality apps with robust metadata and person rankings from being outbid by much less related opponents with bigger budgets. Nevertheless, the enlargement doubtlessly will increase general promoting prices as extra stock attracts extra advertisers and intensifies public sale competitors. Builders should stability promoting funding towards different person acquisition channels, together with natural optimization, social media, influencer partnerships, and cross-promotion networks.

Small and impartial builders face explicit challenges in expanded promoting environments. Bigger publishers with devoted person acquisition groups, refined key phrase analysis instruments, and substantial promoting budgets can optimize throughout a number of placements extra successfully than resource-constrained independents. The automated enrollment supplies technical accessibility however doesn’t deal with basic useful resource disparities affecting aggressive positioning.

The emphasis on key phrase technique and artistic optimization means that profitable advertisers will put money into complete key phrase analysis, advert variation testing, and customized product web page growth. These actions require time, experience, and doubtlessly specialised instruments or company help. Builders treating Apple Search Adverts as a easy extension of App Retailer optimization could discover themselves deprived because the promoting surroundings turns into extra refined and aggressive.

Timeline and preparation necessities

Apple states the enlargement will happen “in 2026” with out specifying precise launch dates or phased rollout plans. This timeframe supplies restricted steering for advertisers planning 2026 budgets and techniques. The corporate could implement the adjustments regularly throughout markets or launch concurrently in all energetic Apple Adverts territories. Earlier Apple Adverts expansions have usually adopted world rollouts with out prolonged testing intervals.

Advertisers needn’t modify current campaigns to entry the brand new placements. Nevertheless, strategic preparation may embody key phrase enlargement, customized product web page growth, bid technique refinement, and finances reallocation planning. The shortage of placement-specific controls means advertisers can not put together focused campaigns for particular positions however can optimize for general search promoting efficiency enhancements.

The announcement arrives in the course of the important vacation purchasing season, when cell app promoting usually experiences peak demand and pricing. E-commerce app installs traditionally surge during Q4, with 44 % of customers beginning vacation purchasing in October or earlier based on business analysis. The 2026 timing suggests the expanded stock will probably be obtainable for the next vacation season, doubtlessly affecting year-over-year planning cycles for seasonal advertisers.

Comparability with aggressive platforms

Google’s app promoting system operates throughout YouTube, Google Search, Google Play, and the Show Community, providing advertisers granular channel choice and placement controls. Google introduced modeled conversions for iOS app campaigns to handle measurement challenges created by App Monitoring Transparency, although these conversions stay unavailable in third-party measurement instruments. The multi-channel strategy contrasts with Apple’s App Retailer-focused promoting ecosystem.

Meta’s app promoting merchandise focus on Fb and Instagram placements, leveraging social context and detailed concentrating on capabilities unavailable in search environments. TikTok has invested closely in iOS promoting measurement enhancements, with real-time conversion tracking through Kochava partnership addressing SKAdNetwork limitations. These platforms compete with Apple Search Adverts for app promoting budgets however serve totally different discovery contexts and person intent states.

Apple’s closed ecosystem strategy supplies measurement benefits inside iOS however limits multi-platform marketing campaign coordination. Advertisers working campaigns throughout iOS and Android should handle separate attribution techniques, with Apple’s deterministic first-party attribution contrasting sharply with modeled approaches required on platforms missing direct iOS integration. The enlargement of Apple’s promoting stock doubtlessly will increase finances allocation towards the corporate’s first-party merchandise on the expense of cross-platform options.

Market measurement and development trajectory

The worldwide app financial system is projected to surpass $626 billion by 2030, representing a compound annual development fee of 14.3 % from 2024 based on business evaluation. Cell promoting maintains a dominant place, with U.S. cell advert spend anticipated to succeed in $228.11 billion in 2025, constituting 66.4 % of complete digital advert spending. Apple’s promoting enterprise represents a small however rising portion of this market.

Apple Search Adverts advantages from the corporate’s premium person base and high-spending app customers. The platform’s 60 % conversion fee considerably exceeds business benchmarks, suggesting that App Retailer search promoting delivers superior efficiency regardless of doubtlessly increased prices. This efficiency benefit derives from the mix of excessive person intent throughout searches, high quality person base traits, and efficient relevance matching algorithms.

The addition of a number of search placements will increase addressable stock with out increasing complete App Retailer search quantity. This implies the identical pool of searches will characteristic extra promoting, doubtlessly affecting person expertise and natural discovery patterns. The financial impression will depend on whether or not elevated advert density displaces natural listings, reduces natural click-through charges, or distributes person consideration throughout extra paid and unpaid outcomes with out considerably altering general conduct patterns.

Attribution and measurement concerns

Apple’s promoting platform maintains deterministic attribution throughout the firm’s ecosystem, avoiding the modeling and estimation required by third-party platforms working on iOS. Advertisers can observe installs and in-app conversions with excessive confidence, although cross-device monitoring and offline conversion measurement stay restricted. The SKAdNetwork framework (AdAttributionKit) supplies privacy-preserving attribution for all iOS promoting, with Apple’s first-party merchandise benefiting from tighter integration and quicker reporting.

The enlargement to a number of placements raises questions on attribution transparency and placement-level efficiency reporting. If Apple doesn’t present placement-specific metrics, advertisers can not decide whether or not top-of-search or decrease placements ship higher efficiency. This limitation would forestall optimization methods primarily based on placement effectiveness, requiring advertisers to just accept Apple’s unified public sale strategy with out granular efficiency insights.

Third-party measurement platforms face ongoing challenges attributing iOS conversions, with modeled approaches partially compensating for deterministic attribution limitations. Apple’s first-party promoting merchandise keep away from these measurement issues, creating potential benefits over opponents requiring probabilistic attribution methodologies. Nevertheless, advertisers searching for unified measurement throughout platforms could discover Apple’s ecosystem strategy complicates cross-platform efficiency comparability and finances optimization.

Inventive technique and optimization

The constant advert format throughout all placements simplifies inventive growth however limits strategic differentiation by placement. Advertisers can not create customized messages particularly for top-of-search versus decrease positions, as an alternative growing common inventive approaches efficient throughout a number of contexts. This constraint differs from show promoting environments the place advertisers tailor inventive to particular placements, codecs, and viewers segments.

Customized product pages present the first inventive optimization mechanism. Advertisers can develop a number of variations emphasizing totally different options, advantages, or use circumstances matched to key phrase themes. Testing these variations towards key phrase efficiency permits data-driven inventive optimization, although Apple doesn’t disclose testing finest practices or present automated inventive testing instruments similar to platforms providing dynamic inventive optimization.

Screenshots, app preview movies, and promotional textual content represent the first inventive components inside App Retailer listings. Apple restricts sure promotional approaches, together with claims about rankings, aggressive comparisons, and price-focused messaging. These limitations have an effect on promoting inventive growth, requiring advertisers to emphasise options, advantages, and person worth propositions moderately than promotional techniques frequent in different promoting environments.

Future platform trajectory

The 2026 enlargement represents continued development in Apple’s promoting enterprise, following the 2025 rebrand from Search Adverts to Apple Adverts and hypothesis about potential enlargement into Apple Maps, Apple Information, and different first-party properties. The generic “Apple Adverts” naming helps theories that the corporate plans promoting past the App Retailer, although no official bulletins have confirmed these instructions.

Business observers anticipate that Apple will proceed increasing promoting stock fastidiously to stability income development with person expertise safety and privateness commitments. The corporate’s strategy contrasts with ad-supported platforms that prioritize promoting income, as an alternative treating promoting as a supplementary providers income stream inside a hardware-focused enterprise mannequin. This positioning doubtlessly supplies flexibility to keep up stricter high quality requirements and person expertise necessities than opponents depending on promoting as major income sources.

The enlargement happens as synthetic intelligence transforms digital promoting via automated marketing campaign administration, inventive optimization, and predictive concentrating on. Apple has examined AI-powered advert placement optimization, based on 2024 experiences, suggesting the corporate could leverage machine studying to maximise promoting effectiveness throughout the expanded stock construction. Nevertheless, Apple’s privacy-focused strategy limits information assortment in comparison with opponents, doubtlessly constraining AI mannequin growth relative to platforms with extra intensive person monitoring capabilities.

Subscribe PPC Land publication ✉️ for related tales like this one

Timeline

Subscribe PPC Land publication ✉️ for related tales like this one

Abstract

Who: Apple introduced adjustments affecting advertisers, app builders, and App Retailer customers throughout all markets the place Apple Adverts operates. The corporate’s promoting platform crew printed up to date documentation detailing the enlargement, with business professionals together with Aykut Karaalioglu of MobileAction and advertising consultants commenting on aggressive implications.

What: Apple will introduce further promoting positions all through App Retailer search outcomes past the present top-of-search placement. Present campaigns will routinely qualify for all obtainable positions with out modifications. Adverts will seem both on the prime of search outcomes or additional down, with advertisers unable to pick out or bid for particular placements. The advert format stays constant throughout positions, utilizing default or customized product pages with optionally available deep hyperlinks. Billing continues primarily based on current pricing fashions: value per faucet or value per set up.

When: The enlargement launches in 2026 based on Apple’s announcement on December 18, 2025, although the corporate didn’t specify precise implementation dates or phased rollout plans. The adjustments will apply routinely to all energetic search outcomes campaigns when carried out.

The place: The extra placements will seem all through App Retailer search outcomes throughout all nations and areas the place Apple Adverts presently operates. The corporate expanded to 21 new markets in October 2024 and operates in dozens of nations spanning North America, Europe, Asia-Pacific, Latin America, the Center East, and Africa. The enlargement impacts iOS and iPadOS customers trying to find apps throughout the App Retailer software.

Why: Apple cites search as the first app discovery methodology, with almost 65 % of downloads taking place straight after searches. The enlargement supplies advertisers “extra alternatives to drive downloads from search outcomes” by growing obtainable promoting stock. The adjustments happen as Apple grows its promoting enterprise, which stays a small part of providers income however has expanded considerably because the 2016 Search Adverts launch. The enlargement follows the April 2025 rebrand to “Apple Adverts” and hypothesis about potential promoting enlargement past the App Retailer into different Apple properties.

Source link