Greater than three-quarters of UK advertising professionals count on enterprise revenues to develop in 2026, whereas synthetic intelligence continues reshaping operations with out changing artistic groups, in accordance with analysis from performance marketing agency Impression launched December 10, 2025. The survey of 1,000 advertising professionals spanning center administration by means of C-level executives reveals persistent optimism tempered by vital operational challenges round competitors, prices, and cross-channel integration.

The analysis coated professionals throughout 19 business sectors at corporations producing revenues from beneath £1 million to exceeding £500 million, carried out throughout October 2025. The findings illuminate how UK entrepreneurs navigate financial uncertainty whereas maintaining budget commitments and embracing synthetic intelligence with out basic workforce restructuring.

Subscribe PPC Land publication ✉️ for comparable tales like this one

Competitors and prices dominate considerations

Elevated competitors emerged as the first enterprise problem dealing with entrepreneurs throughout 2025, notably acute amongst bigger organizations. Companies producing over £500 million in annual income reported competitors as their most important concern, with 24% figuring out it as their largest problem. Rising prices ranked second throughout a number of dimensions: promoting prices, price of residing, inflation pressures, and operational bills collectively affected entrepreneurs, with smaller companies beneath £1 million income experiencing probably the most extreme influence from these financial pressures.

On-line knowledge safety surfaced as a selected concern for corporations within the £100 million to £500 million income bracket, highlighting how knowledge breaches have an effect on model belief and organizational status at scale. These findings align with broader advertising cost pressures documented all through 2025, the place show retargeting prices surged 11% year-over-year in the course of the vacation interval.

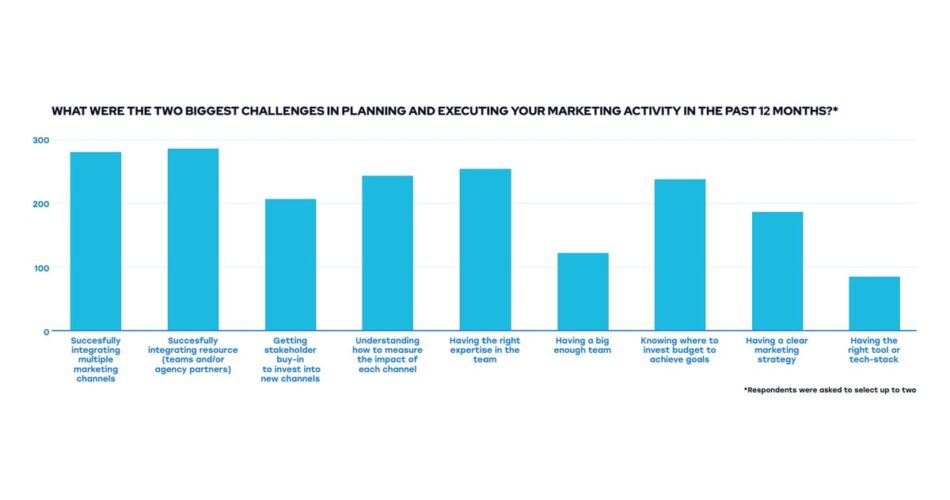

Integration challenges dominated operational execution difficulties. Efficiently integrating a number of advertising channels ranked as the highest planning and execution problem, adopted intently by integrating sources together with groups and company companions. Smaller companies particularly struggled with price range allocation choices and creating clear advertising methods, whereas organizations throughout all sizes grappled with measurement challenges and assembling groups with acceptable experience.

“Integration issues are often about possession,” acknowledged Claire Elsworth, Technique Director at Impression. Elsworth emphasised that constructing multi-channel plans proves simpler than aligning groups, companions, and platforms behind shared imaginative and prescient, aims, and timelines. This integration deficit displays measurement challenges the place 86% of in-house entrepreneurs battle to find out every channel’s influence regardless of unprecedented analytics entry.

Income development expectations decline modestly

Income development forecasts present 77% of entrepreneurs anticipating growth in 2026, representing an 8-percentage-point lower from 2025 ranges when 85% predicted development. Amongst these anticipating will increase, 63% challenge slight development between 1% and 25%, whereas solely 13% foresee vital growth exceeding 26%. This reasonable decline in confidence happens in opposition to unsure financial situations and shifting shopper behaviors documented throughout a number of industry forecasts for 2026.

Advertising budgets reveal stronger momentum. Sixty-nine p.c of respondents count on price range will increase within the subsequent 12 months, up 8 share factors versus 2025. This price range growth accompanies funding development in artistic property, with 56% planning to extend artistic spending—a 3-percentage-point rise in comparison with the earlier 12 months. Workforce development plans equally present growth, with 54% anticipating bigger advertising groups, up 5 share factors year-over-year.

Price range allocation between brand-building and efficiency advertising reveals strategic priorities. Most entrepreneurs reported splits between 60:40 and 70:30 favoring brand-building actions, aligning with analysis popularized by Les Binet and Peter Area concerning balanced long-term model funding and short-term gross sales activation. Smaller companies demonstrated heavier emphasis on efficiency advertising in comparison with bigger organizations that maintained extra balanced approaches.

Funding priorities for 2026 consider electronic mail/SMS/app push advertising, content material advertising, and generative engine optimization concentrating on AI-powered search platforms. Twenty-six p.c plan to extend electronic mail channel funding, 23% will develop content material advertising budgets, and an equal 23% intend to put money into AI-powered search optimization—reflecting how AI platforms are emerging as vital promoting locations.

Purchase advertisements on PPC Land. PPC Land has customary and native advert codecs through main DSPs and advert platforms like Google Advertisements. By way of an public sale CPM, you possibly can attain business professionals.

Natural channels dominate income technology

SEO and content material advertising emerged as high income drivers in the course of the previous 12 months. These natural channels outperformed social media promoting, which skilled substantial decline in effectiveness rankings in comparison with earlier years. E-mail, SMS, and app push communications ranked intently behind search engine optimization and content material, whereas social media promoting fell considerably regardless of sustaining relevance for buyer engagement functions.

The shift towards natural channel efficiency coincides with rising paid promoting prices and increasing alternatives for natural site visitors acquisition. Companies prioritize constructing sustainable visibility foundations relatively than relying completely on paid acquisition, notably as platform prices enhance and attribution turns into extra advanced. This strategic rebalancing displays how rising acquisition prices drive manufacturers to prioritize organic foundations.

Social media platforms stay dominant for viewers engagement regardless of promoting effectiveness considerations. Instagram and Fb mixed seize 45.5% of platform exercise the place audiences actively interact with manufacturers. YouTube and TikTok symbolize the biggest non-Meta platforms, with TikTok’s video-first strategy influencing Meta properties to undertake comparable options together with Instagram Reels and Fb video codecs.

Twenty-six p.c of surveyed entrepreneurs recognized search engine optimization as their anticipated largest income driver for 2026, whereas 25% chosen AI-powered search platforms, 28% selected electronic mail/SMS/app push, 27% picked content material advertising, 28% named influencer advertising, and 23% specified social media promoting. This distribution demonstrates fragmentation throughout a number of channels relatively than focus round single dominant platforms.

AI adoption accelerates with out changing artistic roles

Synthetic intelligence and automation ranked because the second most necessary success issue for 2026 behind clear advertising technique. Thirty-six p.c of respondents recognized AI and automation as essential to attaining objectives, whereas 44% emphasised having a transparent advertising plan. Regardless of AI’s prominence in strategic significance, solely 12% of entrepreneurs plan to make use of AI for content material creation, indicating desire for human-generated artistic work.

Advertising crew development plans contradict predictions of AI-driven workforce reductions. Fifty-four p.c plan to develop inside advertising groups in the course of the subsequent 12 months, whereas simply 6.7% anticipate crew dimension decreases. This development happens alongside AI adoption, suggesting know-how augments relatively than replaces advertising professionals—no less than throughout 2026.

AI utility focuses on knowledge evaluation and insights, the first use case for 18.9% of respondents. Personalization and buyer segmentation ranked second at 13.2%, adopted by advertising marketing campaign optimization at 11.5%. Content material creation purposes, regardless of media consideration, attracted solely 12.1% adoption, whereas customer support chatbots garnered 11.5% implementation.

“The anticipated development in advertising groups exhibits that AI job scaremongering may nonetheless be a bit untimely,” acknowledged Mikey Emery, Industrial Director at Impression. Emery characterised AI as elevating roles by means of execution job automation relatively than wholesale substitute, with future success relying on recruiting hybrid expertise able to leveraging AI to scale back supply prices whereas preserving human creativity and problem-solving capabilities.

Know-how funding priorities replicate this AI integration sample. Buyer knowledge platforms lead deliberate investments at 29%, adopted by AI/machine studying instruments at 27%, advertising automation platforms at 26%, and improved CRM programs at 25%. These applied sciences allow personalization and effectivity relatively than eliminating advertising workforce necessities, notably as 92% of entrepreneurs report AI transforms customer engagement whereas precision-focused practitioners waste 27% much less price range.

Measurement challenges persist regardless of knowledge abundance

Buyer lifetime worth evaluation and advertising combine modeling emerged as most well-liked strategies for measuring marketing campaign effectiveness, every utilized by over 40% of respondents. Multi-touch attribution, incrementality testing, and A/B testing adopted, whereas 10% reported no formal measurement practices. This measurement precedence displays ongoing struggles the place 54.1% of professionals report unchanged confidence in measurement accuracy year-over-year regardless of enhancing instruments and increasing knowledge entry.

Smaller companies demonstrated decrease measurement sophistication, with corporations producing beneath £1 million income extra prone to lack formal effectiveness measurement in comparison with bigger organizations implementing complete attribution programs. The measurement hole creates price range allocation challenges, as 60.2% of entrepreneurs face stakeholder questions on metric validity no less than sometimes.

Personalization methods consider viewers segmentation relatively than one-to-one customization. Most entrepreneurs make use of segmented personalization for key viewers teams relatively than individual-level personalization, balancing useful resource constraints in opposition to personalization advantages. Bigger companies reveal larger charges of one-to-one personalization in comparison with smaller organizations prioritizing segment-based approaches.

Platform adoption patterns reveal robust desire for in-house advertising execution, with 59.3% of respondents planning to ship exercise internally. Mixed approaches utilizing businesses and in-house groups account for 20.6%, whereas agency-only fashions symbolize 16.1% and freelancer-only approaches represent simply 4% of deliberate execution. This in-house focus marks shift from earlier years when company reliance dominated, although bigger income companies preserve stronger company relationships in comparison with smaller organizations.

Strategic priorities emphasize planning and integration

Clear advertising technique emerged as the only most necessary success issue for 2026, recognized by 44% of respondents. This planning emphasis outweighed all different components together with AI and automation at 36%, new instruments and know-how at 32%, correct measurement at 30%, and bigger budgets at 29%. The discovering underscores persistent execution gaps the place strategic planning stays disconnected from operational supply.

“It is a helpful reminder that readability nonetheless beats complexity,” Elsworth famous. She emphasised that AI and automation rank extremely however require clear plans to keep away from changing into distractions, with technique defining each what entrepreneurs will do and equally necessary, what they won’t pursue. The fundamentals matter: stable foundations, fit-for-purpose instruments, and groups understanding how parts join to maximise funding worth.

Outsourcing plans consider electronic mail/SMS/app push at 26%, content material advertising at 23%, and AI-powered search optimization at 23%. SEO, natural social media, and public relations comply with intently, indicating entrepreneurs complement inside capabilities with exterior experience throughout a number of specialised domains relatively than wholesale company delegation.

Model funding priorities align with revenue-driving channel efficiency. Companies plan largest will increase in electronic mail advertising, content material advertising, and influencer advertising—all areas demonstrating robust natural efficiency throughout 2025. Conventional media faces declining funding, with solely restricted deliberate spending on out-of-home promoting, linear tv, and outbound exercise in comparison with digital channel growth.

Subscribe PPC Land publication ✉️ for comparable tales like this one

Timeline

Subscribe PPC Land publication ✉️ for comparable tales like this one

Abstract

Who: Impression, a efficiency advertising company with over 120 workers and places of work in Nottingham, London, Manchester, and New York, surveyed 1,000 UK advertising professionals from center administration by means of C-level positions throughout 19 business sectors at corporations producing revenues starting from beneath £1 million to exceeding £500 million yearly. Survey was carried out throughout October 2025.

What: Analysis revealed 77% of UK entrepreneurs forecast income development in 2026 (down 8 share factors from 2025), 69% count on advertising price range will increase (up 8 share factors), 56% plan elevated artistic asset funding (up 3 share factors), and 54% anticipate crew development (up 5 share factors). Key challenges embrace elevated competitors notably for £500 million-plus companies, rising prices affecting smaller organizations, and integration difficulties throughout channels and groups. AI adoption accelerates for knowledge evaluation and automation however not artistic position substitute, with solely 12% planning AI content material creation whereas 54% develop human groups.

When: Survey knowledge collected October 2025, outcomes launched December 10, 2025. Findings cowl previous 12-month efficiency throughout 2025 and future 12-month plans for 2026.

The place: Analysis targeted on United Kingdom advertising professionals working throughout automotive, FMCG, style, skilled providers, and 15 extra business sectors. Findings replicate UK market situations together with financial uncertainty, aggressive pressures, and know-how adoption patterns particular to British advertising panorama.

Why: Analysis addresses how UK entrepreneurs navigate competing priorities of financial uncertainty, aggressive depth, rising prices, know-how adoption, and operational integration challenges whereas sustaining development expectations and funding commitments. The 8-percentage-point decline in income development confidence from 85% to 77% year-over-year displays cautious optimism amid persistent challenges, whereas price range and crew growth plans reveal continued dedication to advertising funding regardless of headwinds. Integration challenges dominate execution difficulties as a result of strategic planning stays disconnected from operational supply throughout channels, groups, and company partnerships.

Source link