Generative AI adoption is basically reshaping how customers seek for info on-line. Cellular gaming stands to profit considerably from these behavioral shifts, based on new analysis launched December 11, 2025.

LoopMe surveyed 66,819 customers throughout Australia, the UK, and the USA between September 4 and September 8, 2025, to gauge generative AI utilization and habits patterns. The analysis reveals that buyers are twice as possible to make use of GenAI for search within the US (2x) and UK (2.2x), whereas the chance almost triples in Australia (2.7x). These findings carry important implications for model visibility and promoting methods as AI instruments scale back conventional search engine utilization and net looking time.

The analysis comes as Google integrates generative AI capabilities across its search platform and publishers navigate declining traffic from AI-powered search features. Whereas AI adoption results in declining clicks and related web site visitors, cell gaming emerges as a progress channel providing scale throughout demographics alongside engaged and receptive audiences.

Subscribe PPC Land e-newsletter ✉️ for related tales like this one

Adoption stays early however engagement runs deep

Simply 19% of US customers at present use generative AI instruments, leaving greater than four-fifths but to undertake. The UK exhibits 21% adoption whereas Australia reaches 20%, based on LoopMe information. Youthful adults lead utilization patterns, with 24% of Individuals aged 18-24 utilizing AI instruments, 34% of UK residents in that age bracket, and 31% of Australians. Early adoption throughout older demographic teams demonstrates broad potential for progress past present youth-dominated utilization.

Amongst adopters, engagement depth proves substantial. The information exhibits 56% of US adopters qualify as frequent customers—30% utilizing AI instruments each day and 26% greater than weekly. UK adopters present related patterns at 54% frequent utilization (29% each day, 25% greater than weekly). Australia leads barely with 57% frequent customers (27% each day, 30% greater than weekly).

Older teams interact closely as soon as they undertake the expertise. Amongst US adopters aged 45 and above, 45-53% use AI continuously. UK and Australian patterns mirror this development, with 48% of UK adopters 45+ utilizing AI continuously and Australian customers aged 45-54 displaying comparable engagement ranges, based on the survey outcomes.

These utilization frequencies point out behavior formation throughout age demographics fairly than experimental or sporadic engagement. Each day and weekly customers develop common patterns incorporating AI instruments into info discovery workflows, changing or supplementing conventional search behaviors.

Net looking declines as AI searches improve

Practically one-fifth of GenAI customers throughout all three markets report spending much less time looking the online due to AI instruments. The US exhibits 19% decreasing net looking time, the UK reaches 20%, and Australia leads at 22%. These reductions happen towards solely 15%, 13%, and 11% respectively reporting elevated net looking time, creating substantial internet declines in conventional net navigation.

The shift extends past simply frequent AI customers. Even amongst rare GenAI customers, conventional search patterns present motion away from typical looking. Net looking falls by 19-50% throughout the markets amongst informal AI software customers, demonstrating that even restricted AI publicity adjustments information-seeking behaviors.

Older demographics lead the discount in looking time. US customers over 65 are 2.5 occasions extra more likely to scale back looking than improve it. UK customers aged 35-54 present much more pronounced patterns, being 70-80% extra more likely to scale back looking than improve it. Australian customers aged 45-54 lead by being 3 occasions extra more likely to scale back looking than improve it, based on the information.

Customers cite velocity as the first profit. Practically one-third of customers (28% within the US, 30% in Australia and the UK) throughout all three international locations determine “getting solutions quicker” because the primary advantage of GenAI. This emphasis on velocity explains diminished looking time—customers get hold of info instantly from AI instruments with out navigating by means of a number of net pages or sifting by means of search outcomes.

Extra advantages embody leisure or enjoyable (20% in US and UK, 14% in Australia), producing content material (14% in US, 13% in UK, 17% in Australia), and decreasing time spent looking or looking (13% in US, 12% in UK, 14% in Australia), based on the survey responses. The twin framing of AI as each productiveness enhancer and leisure software bridges utility and leisure functions.

Purchase adverts on PPC Land. PPC Land has commonplace and native advert codecs through main DSPs and advert platforms like Google Advertisements. Through an public sale CPM, you possibly can attain {industry} professionals.

Cellular gaming positive factors as looking time decreases

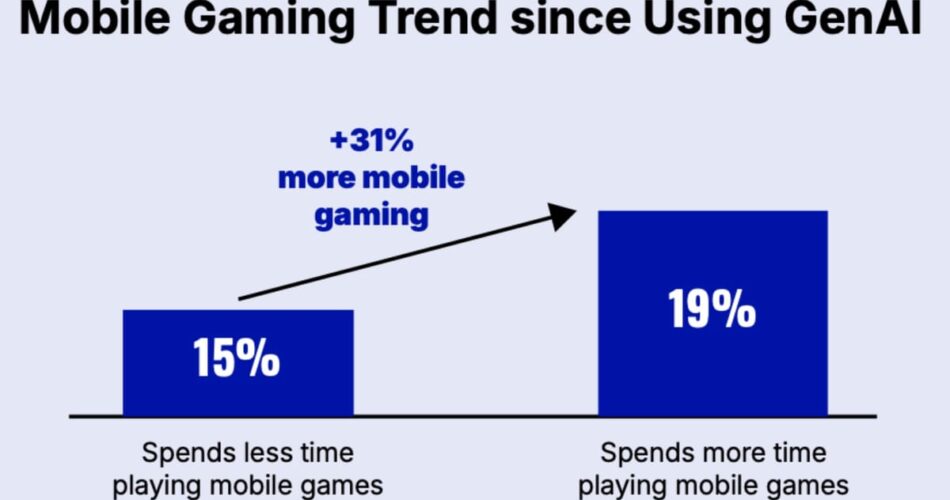

The discount in looking time creates area for different pursuits. Cellular gaming emerges as a major beneficiary throughout all three surveyed markets. In Australia, 18% report spending extra time on cell gaming. The US reaches 19% whereas the UK leads at 21%, creating internet will increase of 31%, 37%, and 54% respectively after accounting for customers reporting decreased gaming time.

Development patterns span all age teams and markets. The UK exhibits the best shift amongst 18-24-year-olds, with 62% spending extra time on cell gaming fairly than much less. US customers aged 25-34 lead American progress at 40%. Australian customers aged 35-44 present the strongest home progress at 58%. Development extends throughout all age bands, with robust cell gaming will increase even amongst 55-64-year-olds in all three international locations.

These positive factors prolong to rare GenAI customers. Within the US, a 40% internet distinction exists between informal GenAI customers who spend extra time gaming and those that spend much less. Australia exhibits 55% internet progress whereas the UK reaches 71% amongst rare AI adopters. The broad progress throughout utilization frequencies suggests cell gaming advantages from a number of AI-related behavioral adjustments fairly than remoted patterns amongst heavy AI customers.

Streaming exhibits modest internet positive factors by comparability. The information reveals 18% internet streaming will increase throughout all three markets, with progress concentrated at age extremes. Youthful and older demographics drive streaming positive factors whereas middle-aged teams (35-54) present declines, creating uneven progress patterns in contrast to cell gaming’s constant cross-demographic enlargement.

The desire for streaming varies by age. Youthful customers aged 18-24 and 25-34 characterize the heaviest streaming customers regardless of nation variations. These teams will possible drive future streaming potential, however present progress stays extra restricted than cell gaming’s broad demographic attraction.

Promoting implications for advertising professionals

The analysis highlights promoting alternatives opening for manufacturers as gaming turns into a key path to market. LoopMe discovered that players are greater than thrice as more likely to be receptive to promoting in gaming environments in comparison with cell net. This receptivity benefit combines with viewers worth and alternatives that stay out of alignment with present promoting funding within the channel.

“What the analysis highlights is the promoting alternatives opening for manufacturers as gaming turns into a key path to market. It is a medium that is being embraced by all age teams and all demographics,” commented Stephen Upstone, CEO and Founder at LoopMe. “And it is rising amongst frequent AI customers in addition to extra informal ones, providing manufacturers the potential to get in entrance of audiences that different channels may not serve effectively.”

The gaming promoting infrastructure continues maturing. IAB established standard metrics for gaming advertising measurement in June 2025, addressing transparency gaps as 80% of US web customers determine as players. The measurement framework targets standardization throughout gaming environments, establishing baseline metrics for show, video, audio, and customized promoting implementations.

Main platforms have expanded gaming promoting capabilities all through 2025. Meta outlined Q5 marketing strategies for mobile game developers in October 2025, highlighting decrease CPMs and CPAs throughout late December to mid-January durations. Roblox expanded its Google advertising partnership with rewarded video in August 2025, with 100 publishers now built-in because the characteristic exits beta.

Analysis persistently demonstrates gaming audiences’ business worth. IAB Poland found gamers outspend non-gamers across multiple product categories, with superior buying exercise in quite a few segments. Podcast advertising data from November 2025 showed gaming industry spending jumping 59% year-over-year, marking the quickest progress amongst all analyzed industries.

The convergence of cloud gaming and promoting expertise creates extra alternatives. Samsung expanded its mobile cloud gaming platform to Europe with AI-powered advertising optimization in August 2025, whereas Microsoft began testing free Xbox Cloud Gaming with ads in October 2025.

“We have discovered that players are greater than thrice as more likely to be receptive to promoting on this atmosphere in comparison with the cell net,” Upstone acknowledged. “And since viewers worth and the alternatives gaming affords are out of alignment with present promoting funding within the channel, this lack of competitors solely provides to its attractiveness.”

The promoting {industry} faces broader challenges from AI integration throughout search platforms. Comscore unveiled generative AI search measurement capabilities to trace AI-powered search queries, whereas IAB Australia research found instant answers are reshaping search measurement frameworks. Publishers and advertisers should adapt to new measurement paradigms as zero-click search turns into extra prevalent.

Programmatic infrastructure continues increasing into rising channels. PubMatic partnered with Kontext for AI chatbot advertising on December 9, 2024, establishing real-time advert technology frameworks for conversational interfaces. These developments show industry-wide recognition that shopper interplay patterns are shifting towards AI-powered experiences.

As digital promoting adjusts to this period of AI integration, cell gaming sheds its supporting function and strikes towards heart stage. The channel delivers scale and attain that competes with conventional broadcast channels whereas providing superior engagement metrics and receptivity to promoting content material. Manufacturers searching for to take care of visibility as search behaviors fragment throughout AI instruments face alternatives in gaming environments that seize rising consumer time and a focus.

Subscribe PPC Land e-newsletter ✉️ for related tales like this one

Timeline

- September 4-8, 2025: LoopMe surveys 66,819 customers throughout Australia, UK, and US to gauge generative AI utilization and habits

- November 2023: Comscore unveils generative AI search measurement capabilities to trace AI-powered search queries

- June 26, 2025: IAB establishes standard metrics for gaming advertising measurement framework

- July 2025: IAB Poland research reveals gamers outspend non-gamers across categories

- August 2, 2025: Roblox expands Google advertising partnership with rewarded video launch

- August 20, 2025: Samsung mobile cloud gaming platform expands to Europe with Moloco partnership

- October 4, 2025: Microsoft begins testing free Xbox Cloud Gaming with ads

- October 13, 2025: Meta unveils Q5 marketing strategy for mobile game developers

- November 9, 2025: Podcast advertising spending surges 26% as gaming industry leads growth with 59% year-over-year improve

- November 18, 2025: Google launches Gemini 3 with generative UI for dynamic search experiences

- December 9, 2024: PubMatic partners with Kontext for AI chatbot advertising

- December 2025: IAB Australia report finds instant answers reshape search measurement frameworks

- December 10, 2025: Google tests AI article summaries for select publishers amid visitors considerations

- December 11, 2025: LoopMe releases generative AI utilization analysis findings

Subscribe PPC Land e-newsletter ✉️ for related tales like this one

Abstract

Who: LoopMe, a worldwide chief in model efficiency, carried out complete shopper habits analysis throughout three main English-speaking markets. The survey reached 66,819 customers together with 11,211 within the US, 27,804 within the UK, and 27,804 in Australia. Stephen Upstone, CEO and Founder at LoopMe, supplied evaluation of the findings and their implications for advertisers.

What: The analysis measured generative AI adoption charges, utilization frequencies, behavioral adjustments in search and looking patterns, and leisure consumption shifts together with cell gaming and streaming. Key findings embody 19-21% present GenAI adoption throughout markets, 2-3x increased chance of utilizing AI for search versus conventional search engines like google, 19-22% reductions in net looking time, and 31-54% internet will increase in cell gaming time throughout the surveyed populations.

When: LoopMe carried out the surveys between September 4 and September 8, 2025. The corporate launched findings on December 11, 2025, through press launch distributed by means of GingerMay Advertising. Survey timing captured behaviors throughout late summer time 2025, reflecting adoption patterns roughly three months previous to public disclosure.

The place: The analysis spanned three international locations: the USA with 11,211 respondents, the UK with 27,804 respondents, and Australia with 27,804 respondents. Geographic distribution enabled comparability throughout mature English-speaking digital promoting markets with related technological infrastructure and platform entry. The findings apply to promoting alternatives throughout cell gaming environments together with cell units, PC platforms, and console methods.

Why: The analysis addresses basic questions on how generative AI adoption adjustments shopper habits on-line and creates new promoting alternatives. As AI instruments scale back conventional search engine utilization and net looking, entrepreneurs want information on the place shopper consideration shifts. Cellular gaming emerges as a major beneficiary of those behavioral adjustments, providing advertisers entry to engaged audiences throughout all demographics. The findings matter as a result of present promoting funding in gaming stays misaligned with viewers worth and receptivity ranges, creating alternatives for manufacturers to succeed in customers by means of an under-utilized channel experiencing progress pushed by broader technological shifts in info discovery and consumption patterns.

Source link