Your favourite on-line retailer hasn’t modified, however behind the scenes it’s paying extra simply to maintain the digital cabinets stocked.

Over the previous 12 months, new and ongoing tariffs have quietly raised the price of importing all the pieces from materials and electronics to packaging and components. For large retailers, these further prices could be absorbed, at the very least for some time. For smaller ecommerce manufacturers, each share level issues — and there isn’t an enormous money buffer to fall again on.

To grasp how they’re coping, Omnisend surveyed 200 U.S.-based ecommerce enterprise house owners in November 2025. We requested what tariffs have already pressured them to vary, and what they are saying they’d do if prices jumped once more in a single day.

Fast-glance findings

Right here’s what small and mid-sized on-line retailers instructed us about how tariffs are reshaping their companies — and your cart:

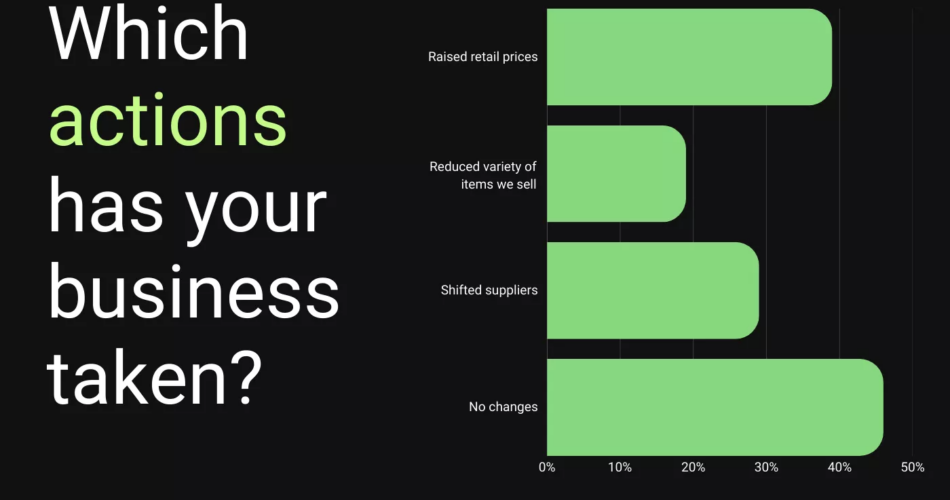

- Most shops have already needed to adapt. 54% of on-line retailers say tariffs have pressured them to make vital modifications to how they worth, supply, or promote merchandise.

- Worth tags are shifting. 39% have raised retail costs due to tariffs, whereas 29% have switched suppliers and 19% have decreased the variety of merchandise they promote.

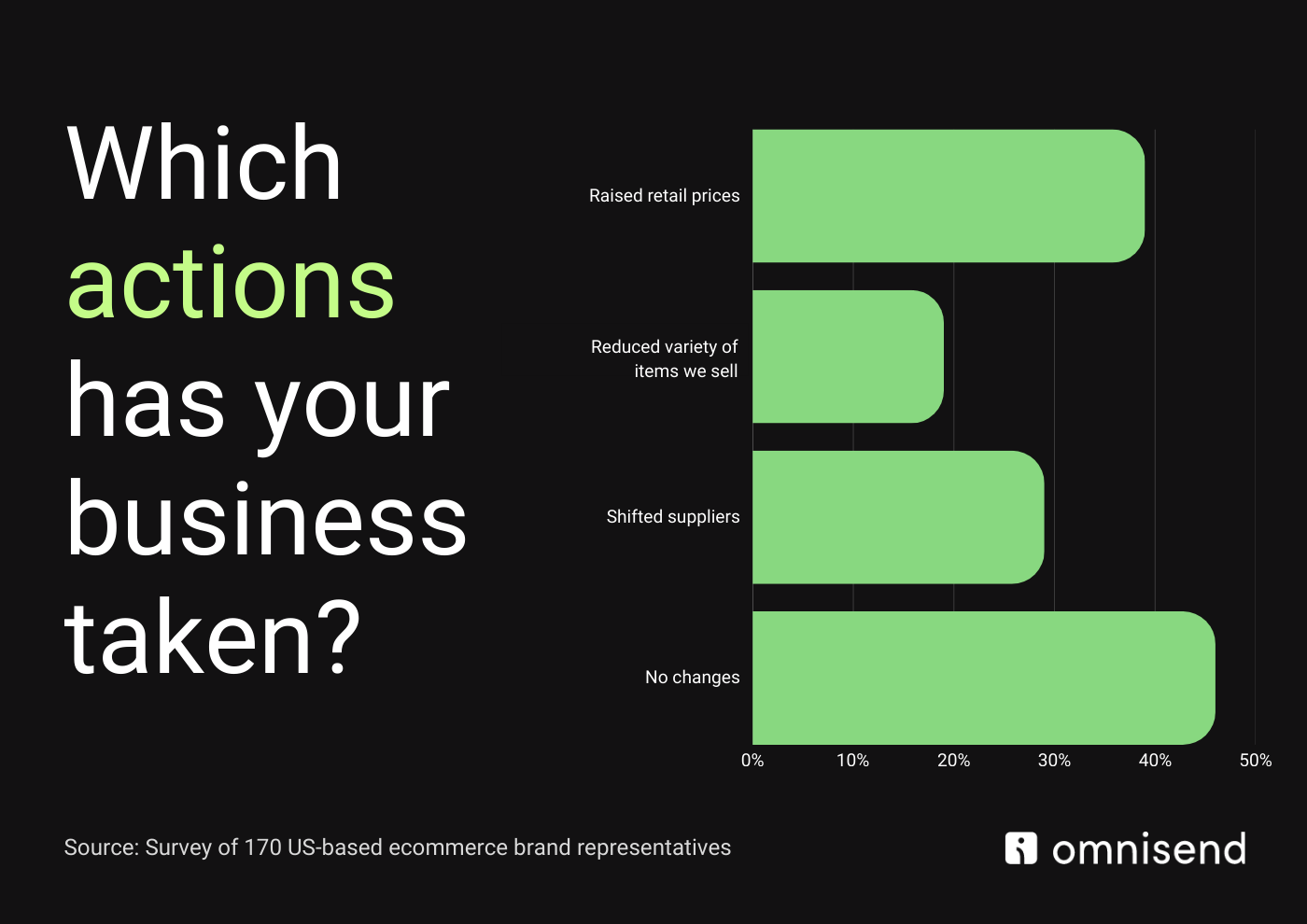

- Most will increase are modest — some aren’t. Amongst retailers who raised costs, 27% elevated them by as much as 5%, 52% by 5–10%, and about 20% by greater than 10%.

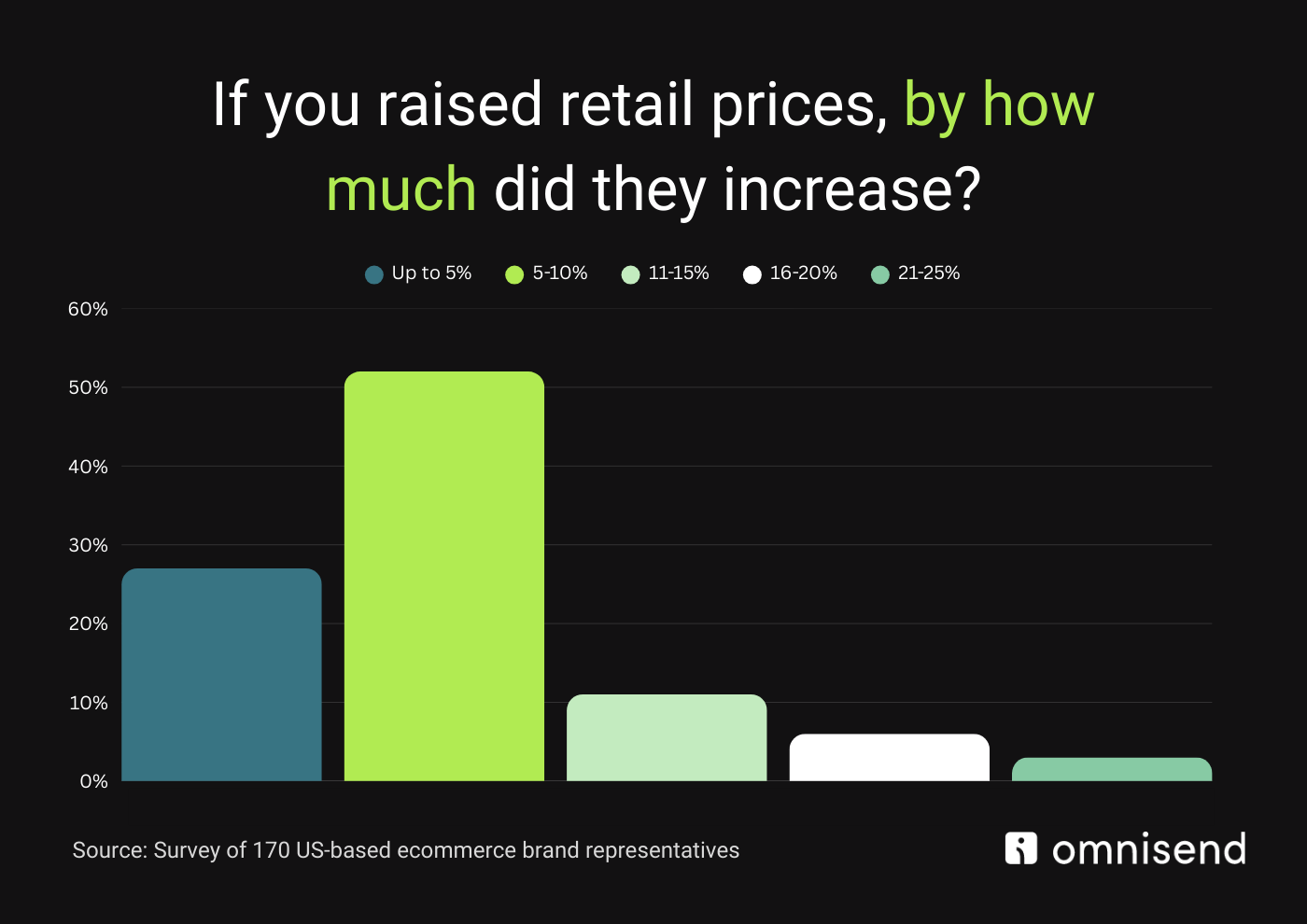

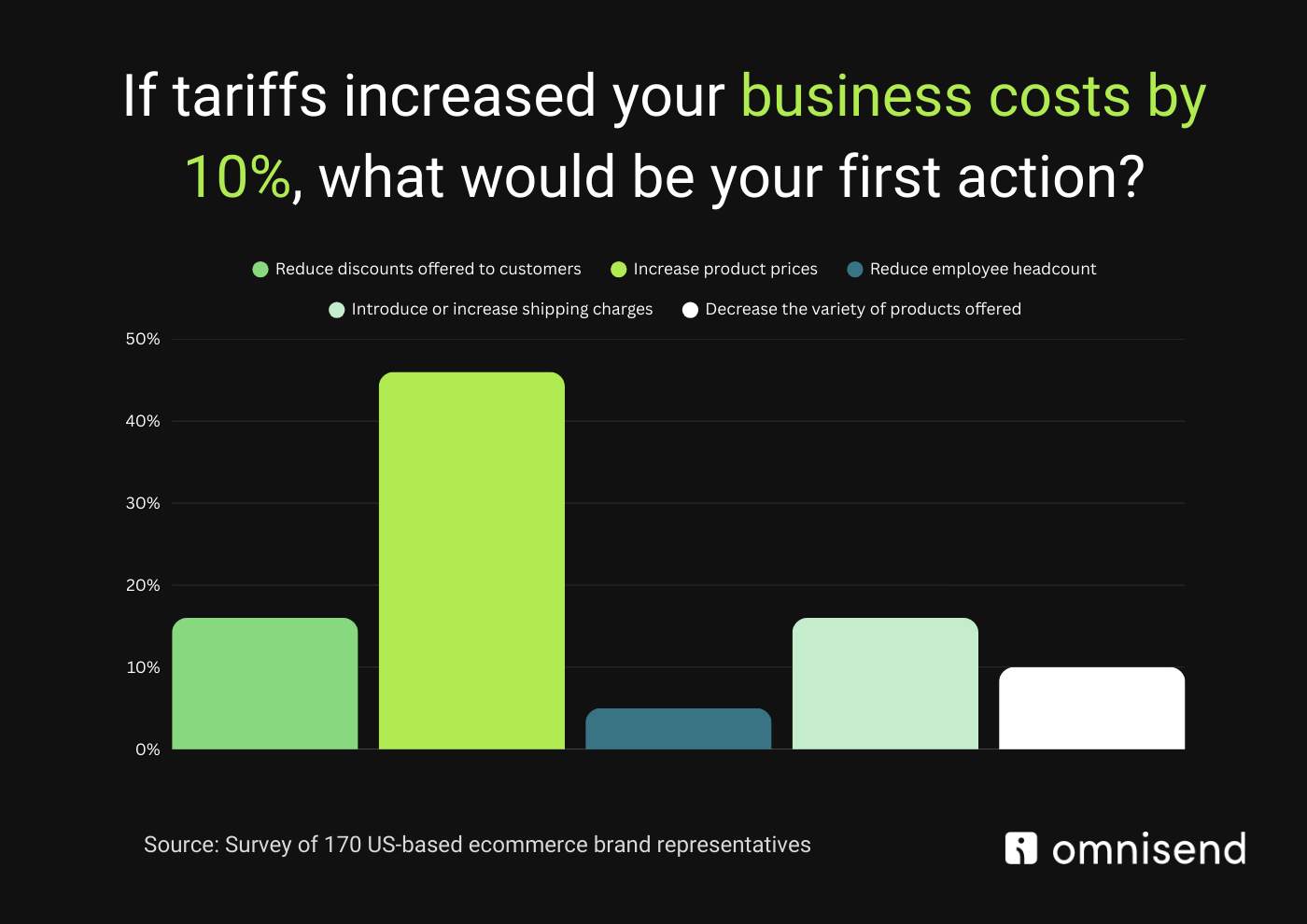

- If prices soar once more, buyers will really feel it first. Confronted with a ten% in a single day enhance in their very own prices, 46% of ecommerce companies say they’d elevate product costs, 16% would add or enhance transport charges, and one other 16% would reduce reductions.

- Jobs are the final lever. Solely 5% say they might take a look at lowering headcount first. General, 78% would make buying dearer in a roundabout way earlier than they’d think about layoffs.

What tariffs have already modified for on-line shops

Tariffs aren’t a future danger for ecommerce manufacturers — they’re already reshaping how on-line shops worth, supply, and inventory their merchandise. In our survey, 54% of on-line retailers say they’ve already made vital modifications due to tariffs, from elevating costs to remodeling their provider lists.

Increased prices are already within the price ticket

For a lot of manufacturers, tariffs have moved straight into their pricing. 39% of surveyed companies have raised retail costs due to tariffs, successfully passing at the very least a part of the additional value on to buyers.

Amongst those that elevated costs, most tried to maintain hikes comparatively modest — however they nonetheless add up within the cart:

- 27% raised costs by as much as 5%

- 52% elevated them by 5–10%

- and about 20% raised costs by greater than 10%

Even when every product solely prices somewhat extra, throughout a full order it may really feel like a noticeable soar.

“Tariffs are approaching high of already greater prices for transport, labor and advertising and marketing, and most on-line retailers don’t have the identical cushion big-box chains do. When your margins are skinny, even a small enhance in prices forces robust decisions, and that exhibits up as greater worth tags, fewer ‘free transport’ presents, and sure merchandise quietly disappearing from the location.”

— Marty Bauer, Ecommerce Skilled at Omnisend

Quiet modifications to suppliers and product ranges

Worth is barely a part of the story. To handle greater import prices, 29% of outlets have switched suppliers, in search of higher phrases or merchandise that aren’t hit as laborious by tariffs.

On the similar time, 19% have decreased the variety of merchandise they promote, which implies some objects merely vanish from digital cabinets — typically with none announcement.

When tariffs push prices up, particularly for smaller retailers, tweaking catalogs and provider lists turns into a survival technique. As an alternative of 1 massive change, buyers see smaller shifts: barely greater costs, fewer free transport presents, and a bit much less selection every time they browse.

What occurs if prices soar once more

Tariffs have already pushed many retailers to regulate. However what if prices rose once more in a single day? We requested how companies would reply to a 10% enhance in their very own prices — and the reply is obvious: buyers would really feel it first.

Costs are the primary lever

With a ten% value spike, 46% of ecommerce companies say they might elevate product costs. For many on-line shops, the quickest method to keep afloat is to cost extra at checkout. Usually which means small will increase throughout many merchandise, however the consequence is similar: a better whole within the cart.

Delivery and reductions are subsequent in line

If retailers aren’t elevating product costs, they’re typically trying on the extras round them. 16% of respondents say they might add or enhance transport charges, and one other 16% would reduce reductions if prices rose by 10%.

In observe, which means fewer promo codes, fewer blanket gross sales, and stricter guidelines round perks. “Free transport” thresholds would possibly transfer greater, sure places would possibly now not qualify, and the codes prospects are used to seeing of their inboxes might develop into much less beneficiant or much less frequent.

Much less selection on the shelf

A smaller however nonetheless vital share of companies would reply by chopping again on what they promote. 10% say they would scale back product selection if prices jumped 10%.

Reasonably than closing complete classes, this typically exhibits up on the edges: particular colours or sizes going out of inventory and never returning, area of interest or lower-margin objects disappearing from the location, and collections being quietly simplified in order that stock is simpler — and cheaper — to handle.

Jobs are the final resort

Once we look throughout all of the responses, one factor stands out: solely 5% of outlets say they’d think about lowering headcount first. Earlier than chopping jobs, most companies would like to regulate what prospects see and pay.

Taken collectively, round 78% of outlets say their first transfer can be to make on-line buying dearer in a roundabout way — by means of greater costs, added charges, fewer reductions, or much less selection — successfully turning tariffs right into a direct value for patrons lengthy earlier than they present up as layoffs.

Tariffs: a hidden surcharge on on-line buying

Tariffs are appearing like a quiet surcharge on ecommerce. As an alternative of displaying up as a separate line merchandise, they’re pushing on-line shops to elevate costs, trim reductions, and reduce merchandise lengthy earlier than they contact their staffing plans.

That leaves each side beneath stress. Retailers are working to guard already skinny margins in a higher-cost surroundings, whereas buyers are adapting to greater cart totals, fewer promo codes, and a bit much less selection every time they browse.

For extra information cuts, charts, or interviews with Omnisend’s ecommerce specialists, contact [email protected].

Methodology

- In November 2025, Omnisend surveyed 200 U.S.-based ecommerce enterprise house owners throughout a mixture of sectors and firm sizes.

- Respondents have been requested if and the way they’d already modified their enterprise due to tariffs.

- They have been additionally requested how they might reply to a hypothetical 10% in a single day enhance in prices, together with potential modifications to pricing, transport charges, reductions, product selection, and headcount.

- All figures on this article come from that survey.

Source link