European broadcaster RTL disclosed plans on December 2, 2025, to remove roughly 600 full-time positions throughout its German operations, representing about 10 p.c of the workforce within the nation. The announcement comes lower than a month after the corporate’s RTL AdAlliance division introduced TV Key Facts 2025, an annual analysis report highlighting the enduring power of tv viewing throughout Europe. The juxtaposition illustrates the advanced actuality dealing with legacy broadcasters as they navigate structural adjustments in promoting markets whereas sustaining positions as viewers leaders.

RTL Germany CEO Stephan Schmitter described the workforce discount as essential to strengthen the corporate’s aggressive place in gentle of structural and financial challenges. “The media market is present process profound change,” Schmitter acknowledged within the announcement. The manager emphasised that remaining aggressive requires intensified deal with streaming operations, notably the RTL+ service obtainable in Germany and Hungary.

Subscribe PPC Land e-newsletter ✉️ for comparable tales like this one

The cuts will have an effect on all RTL Germany places by means of particular severance packages and early retirement preparations, in response to the corporate’s assertion. RTL Germany operates the flagship RTL channel, VOX, information channel ntv, and streaming service RTL+. Mother or father firm Bertelsmann owns RTL Group, which maintains broadcasting operations throughout a number of European markets.

Shares in RTL declined 2 p.c following the workforce discount announcement, reflecting investor issues concerning the promoting market deterioration cited by the corporate. In response to Reuters, RTL has struggled for years with weakened promoting revenues and intensifying competitors from American streaming platforms together with Netflix and Prime Video.

The timing creates a notable distinction with RTL AdAlliance’s TV Key Information 2025 presentation, delivered November 7, 2025, which emphasised tv’s continued relevance and attain throughout European markets. The thirty second version of the annual report featured in depth knowledge demonstrating sustained viewing ranges and advertiser curiosity in television-based content material. “For over three a long time, TV Key Information has embodied RTL AdAlliance’s data-driven imaginative and prescient, providing you, the media and promoting group, contemporary insights into how audiences have interaction with video content material throughout the full video panorama,” the presentation acknowledged.

The 2025 version centered on belief as its organizing theme. “In occasions of fragmentation, misinformation and infinite content material, trusted media issues greater than ever for viewers, for manufacturers, for advertisers, and for society really as a complete,” in response to the presentation introduction.

Throughout the TV Key Information presentation, RTL AdAlliance senior advertising director Aurelie Brunsu emphasised that advertisers and businesses really feel overwhelmed by knowledge amount and conflicting metrics from numerous platforms. “Everyone seems to be primary,” Brunsu acknowledged, referencing the problem of evaluating claims from publishers and platforms. The presentation aimed to offer significant context for whole video viewing habits fairly than selling any single format or supply technique.

Brunsu highlighted how world platform metrics can mislead advertisers when utilized to native markets. YouTube not too long ago claimed 200 billion views for short-form movies, which interprets to roughly 25 brief movies per particular person on Earth each day. Nonetheless, YouTube modified its view definition for brief movies in early 2025, now counting any second the video begins no matter watch time. Every loop counts as a further view. “Very clearly for a model there is no such thing as a actually worth with that metric,” Brunsu acknowledged through the presentation.

The report offered concrete examples of how world attain claims translate to native markets. Mr. Beast, one in all YouTube’s most well-known creators, reviews 447 million subscribers worldwide. BARB measurement in the UK, which tracks viewing on tv units, confirmed Mr. Beast’s weekly attain at 319,000 people aged 4 and older. This determine compares to Yorkshire Public sale Home, a lesser-known channel, demonstrating how perspective drastically adjustments when analyzing precise native viewers supply.

Analysis introduced in TV Key Information 2025 confirmed Europeans watched a median of three hours and 6 minutes of linear tv each day in 2024, sustaining power in contrast with different areas globally. North America averaged 2 hours and 31 minutes, whereas Asia reached 1 hour and 58 minutes. Africa led globally with 3 hours and 48 minutes of each day tv viewing.

Inside Europe, important variation exists between markets. Hungary leads with 4 hours and 54 minutes of each day viewing time, adopted by Portugal at 4 hours and 38 minutes, and Italy at 3 hours and 27 minutes. Spain and Germany each common 2 hours and 51 minutes. On the decrease finish, Denmark and Netherlands report roughly 2 hours of each day tv consumption, with Switzerland at 1 hour and 49 minutes.

Every day attain figures exhibit tv’s continued skill to mixture audiences. Portugal exceeds 80 p.c each day attain for linear tv, whereas France achieves 73.7 p.c each day attain. The UK sits nearer to 55 p.c each day attain. Every day attain in most markets defines as one consecutive minute of viewing time throughout a day.

Sensible tv penetration has expanded considerably throughout European markets, creating infrastructure for each conventional broadcasting and streaming supply. France leads with 84.3 p.c sensible TV penetration, adopted by Austria at 68.6 p.c and Italy at 72.8 p.c. Spain reaches 68 p.c sensible TV penetration. World comparisons present Japan at 47.6 p.c, Brazil at 74 p.c, demonstrating important variation in linked tv adoption charges.

Samsung knowledge introduced throughout TV Key Information 2025 confirmed growing utilization of purposes on sensible tv units. The information, overlaying Australia, demonstrated semester-over-semester progress in app engagement, reflecting how viewers entry numerous content material sources by means of tv screens.

Purchase advertisements on PPC Land. PPC Land has commonplace and native advert codecs by way of main DSPs and advert platforms like Google Advertisements. By way of an public sale CPM, you’ll be able to attain trade professionals.

The report emphasised that trusted media environments switch credibility to promoting manufacturers. Thinkbox analysis from the UK indicated that manufacturers promoting on tv and radio generate extra trustworthiness by default in contrast with digital-only platforms. Analysis confirmed viewers are 44 p.c extra prone to belief a model seen alongside skilled content material fairly than non-professional content material. This belief impact holds throughout age teams, together with viewers aged 16 to 34 years.

Stephane Coruble, CEO of RTL AdAlliance, concluded the presentation by noting that 75 to 80 p.c of promoting funding at present flows to 5 world platforms. The focus will increase in the USA, the place 91 p.c of latest promoting {dollars} directs to a few firms: Amazon, Google, and Meta. “We signify an alternate in media,” Coruble acknowledged, emphasizing RTL AdAlliance’s function connecting advertisers with trusted European broadcaster manufacturers.

Coruble emphasised that RTL AdAlliance brings “attain at scale” with “simplified product standardized product to make our stock easy to purchase in a model protected atmosphere.” The corporate gives innovation in expertise whereas sustaining what Coruble described as “the individuals’s enterprise” with specialists throughout Europe offering data wanted for shopper decision-making.

The presentation acknowledged streaming’s progress trajectory whereas highlighting linear tv’s sustained efficiency. Broadcast viewing stays dominant throughout most European markets, with nations together with Portugal, Greece, Bulgaria, and Hungary sustaining above 95 p.c reside viewing as a proportion of whole tv consumption. Sweden reaches 89 p.c reside viewing, whereas France hits 90 p.c. Time-shifted viewing reaches highest ranges in Belgium and Switzerland, the place promoting codecs have tailored to handle fast-forwarding by means of business breaks.

Switzerland confirmed 72 p.c reside viewing, representing the bottom proportion in Europe, whereas Netherlands reached 76 p.c and United Kingdom 78 p.c. “Nations which have the best time-shifted viewing charges comparable to Belgium and Switzerland, have developed particular promoting codecs to succeed in viewers who fast-forward by means of advert breaks,” the report acknowledged.

Streaming promoting elevated considerably in response to knowledge from IAB Europe introduced in TV Key Information 2025. The expansion derived primarily from promoting tiers on subscription video-on-demand platforms, notably following Amazon Prime Video’s automated migration of customers to advertisement-supported entry. Broadcaster video-on-demand companies, representing consolidated companies, nonetheless elevated 30 p.c throughout Europe in 2024.

Content material familiarity emerged as a key discovering within the analysis. Digital i knowledge monitoring viewing throughout 19 nations on world streaming platforms together with HBO Max, Disney+, Prime Video, and Netflix confirmed legacy packages dominating the highest 10 most-viewed exhibits by viewing hours. Associates, The Huge Bang Concept, and Gray’s Anatomy ranked among the many most-watched content material. The Huge Bang Concept, which broadcast from 2007 to 2019, ranked second in viewing hours throughout these platforms.

Legacy leisure codecs keep substantial audiences. The Masked Singer, first launched 10 years in the past, stays within the high 10 packages throughout seven nations out of 70 monitored worldwide in 2024. Dancing with the Stars, first launched 21 years in the past, ranks within the high 10 throughout six nations. “Familiarity in content material does matter quite a bit,” Brunsu acknowledged through the presentation.

The presentation featured a case research of High Chef France partnering with Accor to advertise Mercure model eating places. High Chef attracts 3 to 4 million viewers per episode throughout prime time from March to Could, with 12 to fifteen episodes per season. This system’s sixteenth season in 2025 demonstrated sustained viewers engagement. Final yr, 34 million individuals had been uncovered to the present not less than as soon as, illustrating the size of attain obtainable by means of established tv codecs.

The workforce discount at RTL Germany displays promoting income challenges that reach past Germany’s borders. RTL Group reduced its 2025 adjusted EBITA guidance from roughly €780 million to €650 million on November 18, 2025, citing tv promoting market weak spot in Germany and France. Second-half tv promoting income now expects to say no by excessive single-digit percentages fairly than develop 2 to three p.c as beforehand forecast.

The monetary revision demonstrated the magnitude of promoting market deterioration in RTL’s core territories. Conventional tv promoting declined 6.9 p.c through the first half of 2025, whereas digital promoting surged 27 p.c to €230 million, according to RTL Group’s financial reports. Digital promoting now represents 16.4 p.c of whole promoting income, up from 12.5 p.c within the first half of 2024.

Streaming companies RTL+ and M6+ pursue aggressive subscriber progress methods as European streaming adoption accelerates. Content material spending elevated from €338 million in 2024 with targets approaching €500 million by 2026, supporting authentic programming growth. The corporate reached 7.6 million paying subscribers throughout its streaming platforms by September 2025.

WPP Media knowledge introduced throughout TV Key Information 2025 provided various views on promoting spend classification past conventional tv, print, and digital categorizations. The evaluation segments spending into commerce (retail media), intelligence (search), location (out of doors and cinema), and content material classes. This framework gives clearer understanding of the place promoting funding flows inside digital channels fairly than treating all digital spending as equal.

Totally different markets present distinct spending patterns underneath WPP’s classification system. China demonstrates excessive retail media funding because the second-largest spending class, whereas France allocates considerably much less to retail media, positioning it equally to out of doors promoting ranges. Search represents the second-largest class in France, illustrating how native market dynamics form promoting allocation choices.

The presentation addressed the frequent statistic that 75 p.c of promoting spend in the UK directs to digital platforms. Nonetheless, this determine consists of substantial funding from small firms which have restricted alternate options past digital promoting attributable to price and accessibility obstacles. “We all know that the small firms they make investments massively,” Brunsu acknowledged. “They hardly have another choice that to put money into digital as a result of it is cheaper and it is simpler.”

For medium and enormous firms, analyzing promoting spend inside their particular aggressive set reveals completely different patterns. WPP’s content material class evaluation confirmed that established firms allocate budgets in a different way than general market averages recommend when small enterprise digital spending is separated.

Stagwell analysis introduced throughout TV Key Information 2025 demonstrated that promoting alongside high quality journalism produces no damaging model results even when content material addresses delicate subjects. Testing in contrast promoting subsequent to crime protection, Biden-Trump political tales, and inflation reporting towards impartial contexts together with enterprise, sports activities, and leisure programming. Buy intention confirmed no statistically important variations throughout these content material classes, supporting the argument that high quality journalism gives acceptable promoting environments no matter subject material.

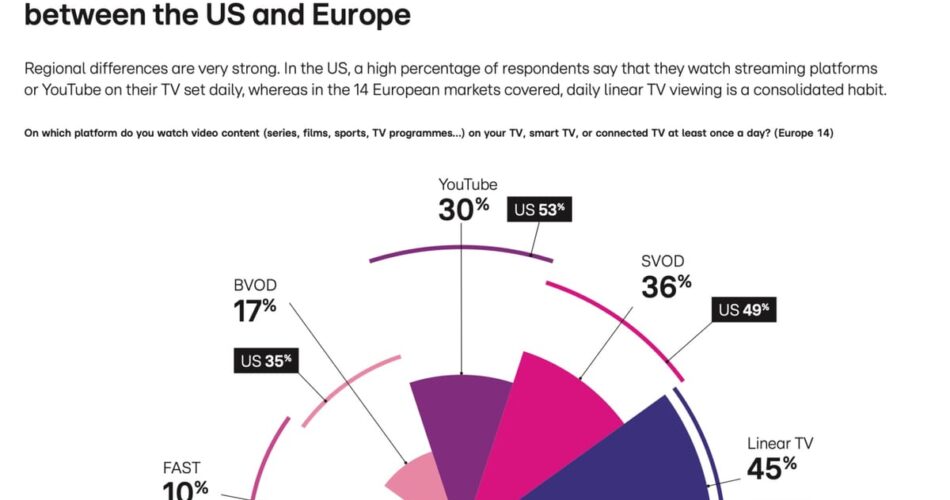

The problem dealing with RTL and comparable European broadcasters entails competing with platforms that function at world scale. The presentation emphasised how scale creates benefits but in addition famous that native experience and cultural relevance stay differentiators. European viewing patterns differ considerably, influenced by cultural tastes, financial situations, and expertise adoption charges.

Viewers peak occasions throughout Europe mirror native eating patterns and each day rhythms. France exhibits peak viewing at 21:15 with 24.4 million viewers, whereas Spain reaches most viewers at 22:15 with 12.4 million viewers, aligning with later dinner occasions. The UK peaks at 21:00 with 17.1 million viewers. France additionally demonstrates a big lunch viewing peak at 13:15 with 13.2 million viewers, whereas Spain exhibits lunch viewership of 9.5 million at 15:30.

Fiction programming led the highest 10 packages throughout European markets in 2024, representing 37 p.c of highly-viewed content material, adopted by leisure at 24 p.c. Inside leisure programming, expertise exhibits proceed dominating with 45 p.c of the class consisting of actuality competitions comparable to The Masked Singer and Dancing with the Stars.

Main sporting occasions exhibit tv’s skill to mixture huge audiences. The 2024 Summer season Olympics Opening Ceremony in France generated an all-time excessive viewers report with 24.4 million peak viewers at 21:15, attaining a 38.9 p.c score and 83.1 p.c share. In Italy, the UEFA Euro 2024 match between Croatia and Italy attracted 13.25 million viewers with a 23.1 p.c score and 58.4 p.c share.

RTL AdAlliance has pursued a number of initiatives to compete extra successfully towards world platforms. The company launched its AdManager platform in March 2025, offering self-service promoting capabilities for businesses and types throughout European markets. The platform allows impartial administration of Complete Video campaigns with real-time efficiency monitoring and funds management by means of a five-step course of: deciding on channels and placements, setting funds parameters, focusing on audiences by means of segmentation choices, importing inventive content material, and launching campaigns with built-in fee programs.

Partnership expansion represents another strategic approach. RTL AdAlliance added Austrian broadcaster ORF to its worldwide gross sales portfolio in October 2025, extending advertiser entry to premium stock throughout extra European markets. The corporate already works with France Télévisions in France and introduced cooperation with ORF in Austria past its historic deal with market leaders in every territory.

Premium content material acquisition stays central to RTL’s technique. The company secured Warner Bros. Discovery and DFB-Pokal deals in September 2025, positioning RTL Deutschland competitively in sports activities broadcasting. Groupe M6 secured exclusive broadcasting rights for the FIFA Women’s World Cup 2027, demonstrating sustained funding in premium content material regardless of promoting market challenges.

Know-how partnerships prolong RTL’s attain throughout distribution platforms. RTL+ became available on Sky Stream’s IPTV platform in August 2024, increasing viewers entry by means of cross-platform distribution. The corporate prolonged its streaming partnership with Deutsche Telekom till 2030, integrating RTL+ Premium into MagentaTV subscription plans.

Promoting expertise collaboration addresses one other aggressive dimension. ProSiebenSat.1 and RTL Deutschland announced an adtech partnership in February 2024, combining Digital Minds and Smartclip applied sciences to create European alternate options to dominant American promoting platforms. The collaboration goals to simplify marketing campaign administration throughout linear tv, sensible TV, and streaming platforms.

The workforce discount represents a big second for RTL Germany’s operations, affecting an organization that employs roughly 6,000 individuals throughout German places. The dimensions of cuts displays the magnitude of structural adjustments affecting European broadcasting economics as promoting income shifts towards digital platforms whereas content material manufacturing prices proceed growing.

RTL’s state of affairs mirrors challenges dealing with broadcasters throughout Europe. Conventional tv promoting markets face strain from a number of instructions: streaming platform competitors for viewing time, digital promoting platforms providing subtle focusing on capabilities, and altering consumption patterns notably amongst youthful demographics. Streaming surpassed traditional television in Germany for the first time in 2024, with 87 p.c of Germans aged 16 and above streaming content material in contrast with 86 p.c watching broadcast tv.

European broadcasters keep benefits by means of native content material information and regulatory frameworks supporting public service broadcasting. TV Key Information 2025 highlighted how legacy packages proceed attracting substantial audiences. The presentation showcased iconic packages from markets together with France, Germany, Italy, Spain, Austria, Belgium, and Netherlands which have maintained viewers loyalty throughout generations. This content material familiarity builds belief that transfers to promoting manufacturers showing in these environments.

The presentation featured manufacturers discussing their approaches to trust-based media planning. Rishma Pier representing Wero, a European fee initiative backed by 16 banks, emphasised that “belief is actually on the heart of every thing we do.” Marine Jaïs from AXA acknowledged that “belief is the guts of our enterprise” for insurance coverage manufacturers. Each emphasised deciding on media companions fastidiously and supporting high quality journalism by means of promoting investments.

AXA has switched from visibility-based key efficiency indicators to consideration metrics over the previous three years, attaining elevated return on funding on model campaigns whereas lowering carbon footprint by means of diminished promoting wastage. The corporate developed algorithms with consideration companions to bid on placements that ship acceptable consideration ranges for inventive influence.

Trying forward, RTL faces the problem of executing its streaming transformation whereas managing declining conventional tv income. The corporate expects streaming operations to succeed in profitability by 2026, depending on digital promoting income progress and operational effectivity enhancements. Roughly 9 million paying subscribers throughout streaming companies signify the strategic goal by 2026, creating expanded stock for digital promoting campaigns.

The workforce discount announcement underscores the urgency of this transition. Whereas TV Key Information 2025 introduced knowledge demonstrating tv’s continued viewers power, the enterprise actuality entails promoting markets shifting sooner than viewing habits change. European viewing time stays excessive by world requirements, with the 2024 common of three hours and 6 minutes declining solely 16 minutes from the three hours and 22 minutes recorded in 2000, regardless of the emergence of Netflix, YouTube, smartphones, tablets, and linked tv units throughout this era.

For the advertising group, RTL’s state of affairs illustrates the disconnect between viewers attain and promoting income allocation. Tv maintains substantial each day attain throughout European markets, however these viewers figures haven’t translated into proportional promoting funding as budgets migrate to digital platforms promising extra granular focusing on and attribution.

The approaching months will take a look at whether or not RTL’s strategic initiatives can stabilize income efficiency and justify the workforce discount. The corporate’s medium-term adjusted EBITA goal of €1 billion stays unchanged regardless of short-term challenges, reflecting confidence that investments in streaming, expertise, and content material partnerships will finally generate returns. As Coruble acknowledged through the TV Key Information presentation: “Trusted media protects democracy, nevertheless it’s additionally good for the enterprise.”

Subscribe PPC Land e-newsletter ✉️ for comparable tales like this one

Timeline

Subscribe PPC Land e-newsletter ✉️ for comparable tales like this one

Abstract

Who: RTL, the European broadcaster owned by media conglomerate Bertelsmann, introduced the workforce discount affecting staff throughout all German places. RTL Germany operates the flagship RTL channel, VOX, information channel ntv, and streaming service RTL+. RTL AdAlliance, led by CEO Stephane Coruble, serves as the corporate’s worldwide promoting division.

What: The corporate plans to remove roughly 600 full-time positions representing about 10 p.c of the German workforce by means of particular severance packages and early retirement preparations. The cuts come lower than a month after RTL AdAlliance introduced TV Key Information 2025, annual analysis highlighting tv’s sustained viewing power throughout Europe with common each day viewing time of three hours and 6 minutes, down solely 16 minutes from 2000 ranges regardless of streaming platform emergence.

When: RTL disclosed the workforce discount plans on December 2, 2025, following the November 7, 2025, TV Key Information 2025 presentation and November 18, 2025, monetary steerage revision that lower revenue expectations by 16.7 p.c from €780 million to €650 million.

The place: The job cuts have an effect on all RTL Germany places the place the corporate employs roughly 6,000 individuals. The broader promoting income challenges prolong throughout Germany and France, RTL Group’s core European markets the place tv promoting declined extra severely than anticipated throughout 2025, with second-half TV advert income anticipated to fall by excessive single-digit percentages.

Why: RTL cited weak spot in promoting revenues as conventional tv promoting declined 6.9 p.c within the first half of 2025 whereas digital promoting surged 27 p.c, reaching 16.4 p.c of whole promoting income. RTL Germany CEO Stephan Schmitter acknowledged the media market undergoes profound change requiring intensified streaming focus to stay aggressive. The corporate has struggled for years with weakened promoting markets and competitors from American streaming platforms together with Netflix and Prime Video, whereas 75 to 80 p.c of promoting funding flows to 5 world platforms, and 91 p.c of latest US promoting {dollars} directs to Amazon, Google, and Meta.

Source link