TransUnion launched its Q4 2025 Consumer Pulse study on November 21, 2025, revealing youthful customers are driving greater spending intentions and monetary optimism heading into the vacation buying season regardless of persistent financial uncertainty round tariffs and inflation.

The analysis confirmed 65% of millennials and 63% of Gen Z expressed optimism about their family funds over the following 12 months, in line with the patron credit score reporting firm. These figures considerably outpaced older generations, with Gen X at 50% and Child Boomers at 45% optimism. General shopper optimism stood at 55%, down three proportion factors from the identical interval in 2024.

Spending plans mirrored this generational divide. The research discovered 58% of Individuals deliberate to spend greater than $250 throughout the vacation season, representing a two-percentage-point improve from 56% final 12 months. Millennials and Gen X confirmed the most important year-over-year will increase in deliberate spending, whereas Gen Z at 16% and millennials at 18% deliberate to spend greater than older generations.

Half of customers mentioned they might spend between $100 and $500 this vacation season, with 18% planning to spend between $501 and $1,000. Twelve p.c anticipated to spend over $1,000, marking a two-percentage-point improve in comparison with 2024. The proportion of customers planning to spend the identical as final 12 months reached 46%, up from 44% in This fall 2024.

Bank cards emerged because the dominant cost technique for vacation purchases. Deliberate utilization of bank cards jumped 5 proportion factors from 2024 to achieve 42%, in line with TransUnion’s knowledge. Greater than 40% of customers anticipated to rely extra closely on bank cards, signaling continued shopper resilience even amid considerations about tariffs and inflation.

“Roughly six in 10 Individuals plan to spend over $250 this vacation season,” mentioned Cecilia Seiden, VP of Retail, eCommerce and CPG technique at TransUnion. “Nevertheless, many customers are struggling, as evidenced by current retail earnings experiences.”

The research, which surveyed 3,000 adults between October 1 and October 14, 2025, revealed persistent financial considerations weighing on shopper sentiment. Regardless of elevated spending intentions, 81% reported inflation as a top-three monetary concern. Groceries remained the value improve most regarding to customers at 79%, holding practically regular with 80% a 12 months in the past.

Insurance coverage considerations climbed from 43% in This fall 2024 to 47% in This fall 2025, whereas medical care worries elevated from 41% to 45%. The analysis confirmed 86% of customers expressed concern in regards to the influence of worldwide commerce tariffs on their family funds, up barely from 85% within the earlier quarter.

The information revealed stark polarization throughout earnings ranges concerning family monetary circumstances. Excessive-income households incomes $100,000 or extra yearly reported considerably higher positioning, with 79% stating their funds have been higher than or as deliberate at this level within the 12 months. In distinction, simply 51% of lower-income households reported comparable outcomes.

Revenue progress seemed to be moderating. TransUnion discovered 27% of customers reported their incomes elevated within the final three months, down two proportion factors from the earlier quarter and from a 12 months in the past. In the meantime, 56% mentioned their incomes stayed the identical, representing a four-percentage-point improve over each Q3 2025 and This fall 2024.

Expectations for future earnings progress additionally tempered. The research confirmed 48% anticipated their incomes to rise within the subsequent 12 months, in comparison with 53% in This fall 2024. One other 43% anticipated earnings to remain the identical, up from 40% final 12 months.

Excessive-income households demonstrated larger capability to take care of spending amid financial uncertainty. The analysis discovered 45% of high-income customers mentioned their incomes stored up with inflation, in comparison with simply 26% of low-income households incomes lower than $50,000 yearly and 36% of medium-income households incomes between $50,000 and $99,999.

US private consumption expenditure rose 0.6% in August 2025, in line with the Bureau of Financial Evaluation knowledge referenced in TransUnion’s report. This progress occurred regardless of 2025 being characterised by fixed financial change involving inflation pressures, tariff uncertainty and employment considerations.

Excessive-income households deliberate to take care of or improve spending essentially the most throughout a number of classes over the following three months. Medical companies led at 89%, adopted by digital companies at 83%, retail objects like clothes and electronics at 69%, discretionary spending on eating and leisure at 63%, and huge purchases like home equipment and vehicles at 56%.

The survey revealed 41% of customers deliberate to conduct their vacation buying on-line throughout Thanksgiving, Black Friday and Cyber Monday, whereas 33% supposed to buy in individual on Thanksgiving Day and Black Friday. These figures aligned with broader retail trends showing consumers concentrating purchases during traditional promotional periods.

Credit score demand patterns confirmed shifts in shopper conduct. Plans to hunt new credit score or refinance current credit score within the subsequent 12 months fell to 30%, down from 33% in Q3 2025 and 31% a 12 months in the past. Nevertheless, demand remained significantly sturdy amongst youthful generations, with 44% of Gen Z and 46% of millennials planning to use for credit score.

Amongst these planning to use for credit score within the coming 12 months, 23% mentioned they might search a brand new auto mortgage or lease, up from 19% in Q3 2025. New bank cards remained the highest credit score motion at 55%, whereas 20% deliberate to extend accessible credit score on current bank cards.

Two-thirds of customers reported having ample entry to credit score and lending merchandise, whereas 68% mentioned they might be accredited in the event that they wanted one. The analysis confirmed 88% believed entry to credit score and lending merchandise was essential to attain monetary targets, although this determine declined two proportion factors from the earlier quarter.

Seiden emphasised the necessity for precision in advertising approaches. “Customers are making extra deliberate and value-driven selections to stretch each greenback,” she mentioned. “To win on this local weather, manufacturers and entrepreneurs have to shift from broad strokes to precision and focus through the use of focused, identity-powered insights that meet customers the place they’re and converse on to their wants.”

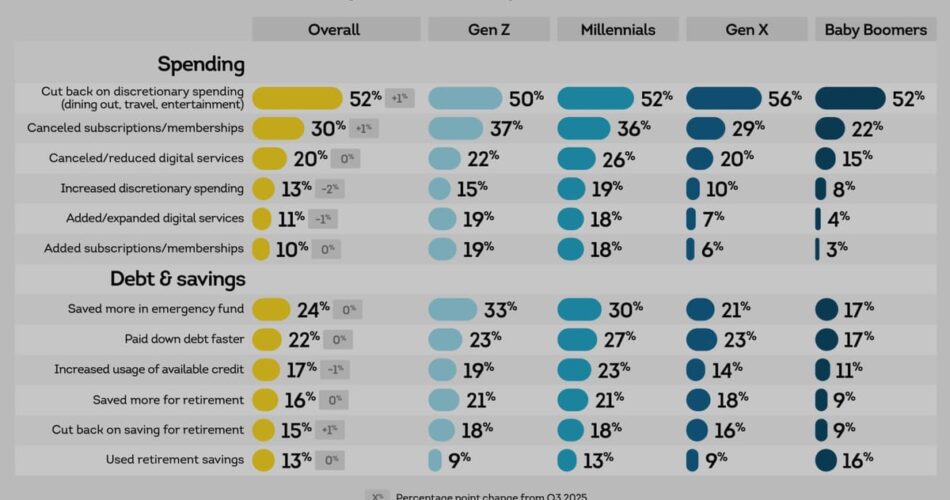

Finances changes mirrored financial pressures throughout shopper segments. The research discovered 52% of customers in the reduction of on discretionary spending akin to eating out, journey and leisure within the final three months. One other 30% canceled subscriptions or memberships, whereas 24% saved extra in emergency funds.

Credit score utilization elevated amongst customers managing family budgets. TransUnion knowledge confirmed 17% of customers elevated their utilization of obtainable credit score within the final three months, whereas 22% paid down debt sooner. Retirement financial savings noticed blended exercise, with 16% saving extra for retirement however 15% slicing again on retirement financial savings and 13% utilizing retirement financial savings.

Recent research indicated 34% of consumers began holiday shopping in October or earlier, pushed largely by tariff considerations affecting 71% of customers. This early buying conduct created challenges for entrepreneurs trying to optimize marketing campaign timing and finances allocation throughout prolonged promotional durations.

The This fall 2025 knowledge confirmed persevering with considerations about fraud and identification safety. TransUnion discovered 42% of customers reported being focused with an e-mail, on-line, telephone name or textual content messaging fraud scheme however didn’t fall sufferer, representing a three-percentage-point improve from This fall 2024. One other 7% mentioned they have been focused and have become victims, down from 9% a 12 months in the past.

Phishing schemes remained essentially the most regularly reported fraud kind at 46% of these focused, adopted by smishing at 45% and vishing at 34%. Older generations reported experiencing these scams extra regularly than youthful customers, with 51% of Gen X and Child Boomers focused by phishing in comparison with 30% of Gen Z and 43% of millennials.

Credit score monitoring habits diversified considerably throughout generations. The research confirmed 54% of customers reported monitoring their credit score not less than month-to-month, although 11% claimed they do not examine their credit score in any respect. Gen Z at 65% and millennials at 64% monitored their credit score not less than month-to-month on the highest charges amongst surveyed generations.

The analysis methodology concerned a web based survey of three,000 adults carried out in partnership with third-party analysis supplier Dynata. The survey achieved statistical significance at a 95% confidence degree inside plus or minus 1.8 proportion factors. TransUnion carried out the analysis throughout the first two weeks of the US authorities shutdown that started October 1, 2025, although solely 35% of respondents listed jobs amongst their prime three monetary considerations.

Purchase adverts on PPC Land. PPC Land has normal and native advert codecs by way of main DSPs and advert platforms like Google Advertisements. By way of an public sale CPM, you may attain trade professionals.

Retail sales data from October 2025 showed 5% growth as customers ready for the vacation season, offering proof supporting strategic vacation planning. The timing of shopper spending rebounds following September’s month-to-month decline prompt concentrated demand throughout November and December promotional durations.

The implications lengthen past retail into promoting technique. Retail media networks are projected to capture approximately 20% of total global advertising revenue by 2030, exceeding $300 billion in line with trade forecasts. The focus of shopper spending throughout vacation durations makes fourth-quarter planning essential for retailers and advertisers balancing stock availability with advertising funding.

TransUnion’s findings arrived as holiday spending forecasts indicated consumers would spend $890.49 per person on average, representing the second-highest quantity in 23 years of monitoring by the Nationwide Retail Federation. The correlation between bank card utilization intentions and total spending patterns prompt customers maintained buying energy via strategic use of obtainable credit score.

The generational divide in monetary optimism and spending conduct offered distinct alternatives and challenges for entrepreneurs. Youthful customers demonstrated larger willingness to take care of or improve spending regardless of financial uncertainty, whereas older generations exercised extra warning amid persistent inflation and tariff considerations.

Subscribe PPC Land publication ✉️ for comparable tales like this one

Timeline

- October 1-14, 2025: TransUnion carried out This fall 2025 Client Pulse survey of three,000 adults in partnership with Dynata

- October 1, 2025: US authorities shutdown started throughout survey interval

- October 9, 2025: September retail spending data showed 0.49% monthly decline as consumers paused before holiday season

- October 16, 2025: National Retail Federation announced consumers plan to spend $890.49 per person on holiday items

- October 27-28, 2025: Wunderkind survey revealed 34% of consumers began holiday shopping in October with 71% citing tariff concerns

- November 7, 2025: National Retail Federation released Global Port Tracker projecting November-December import volume slowdown

- November 2025: Retail sales grew 5% in October as consumers prepared for holidays

- November 21, 2025: TransUnion launched This fall 2025 Client Pulse research displaying youthful customers driving vacation optimism

- November 28, 2025: Black Friday represents 12 months’s largest promotional gross sales occasion

- December 1, 2025: Cyber Monday follows as second main vacation buying date

Subscribe PPC Land publication ✉️ for comparable tales like this one

Abstract

Who: TransUnion surveyed 3,000 American adults aged 18 and older throughout all states in partnership with third-party analysis supplier Dynata, with quotas balancing responses to census statistics on age, gender, family earnings, race and area. Generations have been outlined as Gen Z (18-28 years outdated), millennials (29-44), Gen X (45-60), and Child Boomers (age 61 and above).

What: The This fall 2025 Client Pulse research revealed youthful customers driving greater monetary optimism and vacation spending intentions regardless of financial uncertainty, with 65% of millennials and 63% of Gen Z optimistic about family funds over the following 12 months, 58% of Individuals planning to spend greater than $250 this vacation season (up from 56% final 12 months), millennials and Gen X displaying the most important year-over-year will increase in deliberate spending, and over 40% of customers anticipating to rely extra on bank cards with deliberate utilization leaping from 38% to 42% year-over-year.

When: TransUnion carried out the net survey October 1-14, 2025, spanning the primary two weeks of the US authorities shutdown, and launched outcomes on November 21, 2025, forward of the Black Friday (November 28) and Cyber Monday (December 1) buying durations that historically mark the beginning of the vacation buying season.

The place: The analysis coated United States resident demographics with all 50 states represented in survey responses, inspecting shopper attitudes and behaviors about family budgets, spending, debt, credit score entry, fraud safety and identification monitoring throughout earnings ranges, generational cohorts and geographic areas.

Why: This issues for the advertising group as a result of the info demonstrates basic shifts in shopper conduct pushed by generational variations in monetary optimism, financial considerations about inflation and tariffs affecting 81% and 86% of customers respectively, rising reliance on bank cards for vacation purchases requiring precision concentrating on somewhat than broad-stroke approaches, and polarization throughout earnings ranges the place high-income households at 79% reported higher monetary positions in comparison with simply 51% of lower-income households, requiring entrepreneurs to deploy focused, identity-powered insights assembly customers at totally different financial positions with related worth propositions throughout the trade’s most important income interval.

Source link