Magnite introduced its third quarter 2025 monetary outcomes on November 5, 2025, exceeding expectations throughout key metrics as Linked TV promoting continued to drive development for the impartial sell-side promoting platform. The corporate reported contribution ex-TAC of $166.8 million, representing 12% year-over-year development.

“Q3 got here in sturdy, and we as soon as once more exceeded whole prime line expectations with CTV contribution ex-TAC rising 18% and 25%, excluding political,” said Michael Barrett, CEO of Magnite, through the earnings name. “DV+ continued to carry out nicely, rising consistent with expectations. Adjusted EBITDA was additionally sturdy at $57 million, beating expectations, leading to a margin of 34%.”

The outcomes demonstrated explicit power in Linked TV, the place contribution ex-TAC reached $75.8 million, marking 18% year-over-year development or 25% when excluding political promoting. This efficiency exceeded the corporate’s steering vary of $71 million to $73 million. Income for the quarter totaled $179.5 million, an 11% enhance in comparison with the identical interval in 2024.

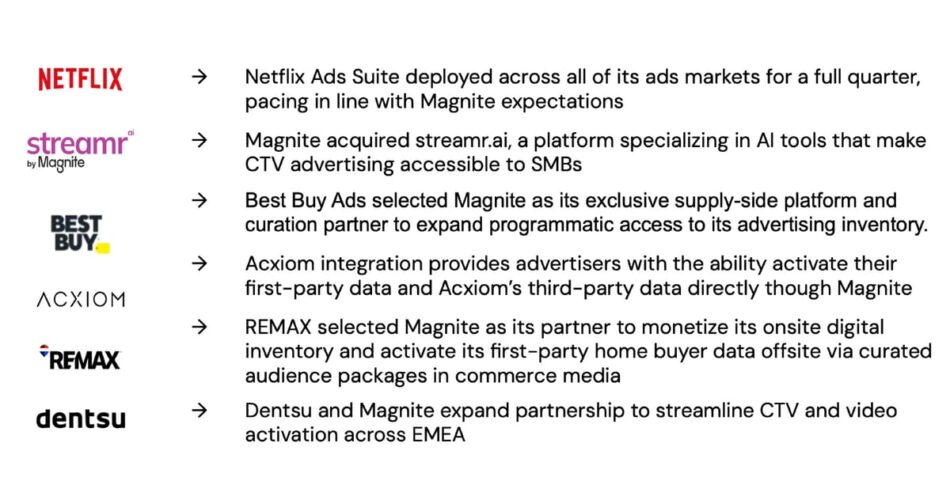

Barrett attributed the sturdy efficiency to a number of development drivers. “Our efficiency in CTV was pushed by development of our largest writer companions, important traction with company marketplaces, ClearLine adoption, constructive SMB developments and programmatic growth in stay sports activities,” he defined. “Our most important development got here from the trade’s largest gamers, together with LG, NBCU, Netflix, Roku, Vizio, Walmart and Warner Bros. Discovery.”

The Netflix partnership demonstrated continued momentum. “Relating to Netflix, we have supported the growth of their adverts enterprise to all ad-supported markets,” Barrett said. “The pacing of the Netflix ramp has gone very nicely, and we stay enthusiastic about our continued development alternative with them in 2026.”

Roku maintained its place as a fast-growing writer companion. “Roku additionally continues to be a really fast-growing writer with the Roku Alternate, the place Magnite is the popular programmatic companion,” Barrett famous. “This quarter, specifically, demonstrated particularly nice momentum the place our partnership noticed significant traction in sports activities and in attracting SMBs to their platform. We proceed to discover areas for additional growth of our relationship to drive extra income for them.”

Warner Bros. Discovery launched its NEO platform in September. “Warner Bros. Discovery has additionally made nice progress with its NEO platform launching in September,” Barrett mentioned. “NEO, a brand new advert platform, will present consumers direct entry to Warner Bros. whole premium video stock by one simplified and intuitive consumer interface the place Magnite helps to energy transactions.”

ClearLine, Magnite’s unified provide platform, expanded to over 30 purchasers through the quarter. Barrett highlighted current enhancements: “ClearLine continues to realize momentum with over 30 purchasers, and we just lately rolled out a variety of key enhancements to the product. Earlier this yr, we introduced that native house display screen items can be found by ClearLine.”

The corporate introduced plans to combine AI capabilities into ClearLine. “We additionally introduced plans to combine AI help and Agentic workflows into ClearLine, which shall be powered partially by know-how from our acquisition of streamer.ai, which we introduced in September,” Barrett defined.

The streamer.ai acquisition addresses a persistent problem in Linked TV promoting. “As I’ve talked about earlier than, the CTV promoting alternative for small and medium-sized companies is big, but it surely’s traditionally been bottlenecked by complexity and excessive value,” Barrett said. “To handle this, streamer.ai provides small companies the instruments to create manufacturing high quality CTV commercials in minutes and in a particularly cost-efficient method.”

Magnite introduced two consumer wins following the September acquisition of streamer.ai: ITV, the UK’s largest business broadcaster, and Wolt, a part of DoorDash. “We’re licensing Streamer to massive media house owners, commerce gamers, businesses, DSPs and different media consumers to allow them to assist their SMB purchasers simply break into CTV promoting, and the response has been very constructive,” Barrett mentioned.

Company spending demonstrated important development through the quarter. “We’re seeing businesses changing into extra lively of their programmatic SPO efforts, and it is driving spend now,” Barrett famous. “We have now lengthy supported businesses and have devoted groups in place to assist their development efforts on this space. As proof of this acceleration, advert spend from prime holds grew practically 20% in Q3 year-over-year.”

Barrett defined the mechanics of company market development: “A big driver of our development with businesses is from Magnite’s powered purchaser marketplaces. These non-public label marketplaces enable businesses to attach instantly with publishers to develop curated swimming pools of stock which can be enriched by proprietary knowledge are DSP agnostic and maximize working media spend.”

SpringServe, Magnite’s mixed CTV advert serving and supply-side platform, continued to distinguish the corporate’s providing. “Our mixed CTV advert serving and SSP platform, SpringServe, continues to be a big differentiator for us with publishers,” Barrett said. “In addition to providing a number one advert server in CTV, SpringServe performs a vital function because the mediation layer for publishers.”

The platform just lately added Viant’s Direct Entry product. “We simply added Viant’s Direct Entry product to our checklist of direct integrations that embody Amazon APS, Yahoo’s Backstage and Commerce Desk’s OpenPath,” Barrett mentioned. “SpringServe additionally permits publishers to maximise their yield by unifying demand from these direct advert server integrations instantly amongst consumers that connect with our SSP.”

Reside sports activities maintained its place as a development driver. “Reside sports activities continues to drive development in our enterprise, and we see large potential sooner or later as programmatic adoption continues to escalate,” Barrett defined. “We have now seen new contributions notably from Disney of NFL and faculty soccer in addition to Main League Baseball within the WNBA.”

Subscribe PPC Land publication ✉️ for related tales like this one

The Digital Video Plus (DV+) section achieved contribution ex-TAC of $90.9 million, representing 7% year-over-year development or 10% excluding political promoting. “On the DV+ facet of the enterprise, Q3 contribution ex-TAC was up 7% or 10% excluding the impression of political final yr,” Barrett said. “Our DV+ enterprise continues to profit from ramping companions in addition to new consumer wins. A notable replace is that our partnership with Pinterest started to ramp in Q3.”

Magnite’s commerce media providing confirmed continued growth. “We have been actually happy with the progress of our Commerce Media providing as our roster of companions continues to develop,” Barrett mentioned. “We have introduced partnerships with Finest Purchase, RE/MAX, Western Union, PayPal and Connective Media by United Airways. Commerce entities are drawn to the distinctive know-how Magnite offers.”

Audio emerged because the fastest-growing format throughout the DV+ section. “Our fastest-growing format in TV+ within the third quarter was audio,” Barrett famous. “We’re gaining traction on this space and see it as a big alternative sooner or later. Earlier this yr, Spotify introduced its new Spotify Advert Alternate or SAX, and chosen Magnite as its world programmatic companion.”

Barrett supplied insights on how agentic AI applied sciences will impression the promoting ecosystem. “Turning to AI. We delivered one other quarter of progress and have an more and more clear view of how Agentic applied sciences will present up throughout the trade and in our merchandise,” he said. “In October, an trade affiliation comprised of a number of the trade’s finest regarded executives launched the Advert context protocol or AdCP, a proposed normal for the way purchase and sell-side brokers will transact.”

He defined Magnite’s positioning for this technological shift: “Once you look into the construction, you see that the brokers are designed to function on prime of the transactional infrastructure that exists in the present day, a lot of which we have constructed. As at all times, these transactions should be vetted, negotiated, processed and cleared in a privacy-compliant method, jobs we excel at. We envision the brand new world as one the place sell-side property, specifically, are going to be much more invaluable and particularly Magnite with our sturdy writer relationships, SPO partnerships and main know-how.”

Purchase adverts on PPC Land. PPC Land has normal and native advert codecs by way of main DSPs and advert platforms like Google Adverts. Through an public sale CPM, you possibly can attain trade professionals.

David Day, Magnite’s Chief Monetary Officer, supplied detailed monetary efficiency metrics. “As Michael talked about, we had a really sturdy Q3 with standout efficiency in CTV, reaching 18% contribution ex-TAC development or 25%, excluding political, exceeding our expectations,” Day said. “DV+ carried out nicely and was consistent with our information. Adjusted EBITDA was stable as nicely, rising 13% to $57 million and beating expectations, leading to a 34% margin. We’re happy with these outcomes, notably the acceleration in CTV development, which was considerably above market development.”

Adjusted EBITDA reached $57.2 million, up 13% year-over-year, representing a margin of 34%. Internet revenue totaled $20.1 million, or $0.13 per diluted share, in comparison with internet revenue of $5.2 million within the year-ago interval. Non-GAAP earnings per share reached $0.20, in comparison with $0.17 for the third quarter of 2024.

Day mentioned the corporate’s infrastructure investments: “As we have mentioned, our know-how group has made important progress bettering operational effectivity and lowering per unit cloud prices, which is permitting us to handle important will increase in advert request volumes with modest whole value will increase.”

He introduced elevated capital expenditures. “Because of this, we determined to extend our CapEx funding by $20 million this quarter, particularly investing in two new knowledge heart build-outs in Ashburn, Virginia and Santa Clara, California to safe future knowledge capability wants,” Day defined. “We now count on CapEx for This autumn and the complete yr to be roughly $23 million and $80 million, respectively. For 2026 and past, we consider this elevated funding will result in further efficiencies and plan to reinvest a number of the financial savings in crucial development areas. We count on CapEx to be within the $60 million vary in 2026.”

The corporate’s steadiness sheet remained sturdy. “Our money steadiness on the finish of Q3 was $482 million, a rise from $426 million on the finish of the second quarter,” Day reported. “Working money circulate, which we outline as adjusted EBITDA much less CapEx, was $39 million.”

Day famous the corporate’s leverage place: “Internet leverage for the quarter was nicely under our objective of lower than 1 instances and got here in at 0.3 instances on the finish of Q3, down from 0.6 instances on the finish of the second quarter.”

Barrett supplied updates on the Google ad tech antitrust trial. “As you doubtless know, Choose Brinkema concluded a two-week trial on the cures section of the DOJ’s case in early October,” he said. “The post-trial briefing has just lately been filed and shutting arguments are scheduled for November 17.”

He defined the potential cures into account: “At this stage, having discovered that Google had illegally engaged in a sequence of anticompetitive acts to determine monopolies within the advert trade and advert server market, each structural and behavioral cures stay on the desk, structural referring to the compelled divestiture of components of their advert tech enterprise and behavioral being a algorithm and practices designed to rectify and prohibit Google’s unlawful anticompetitive conduct.”

Barrett expressed confidence within the consequence. “We expect there are deserves to each forms of cures and have faith that the courtroom will attain the fitting consequence. The treatment hearings in September didn’t change our constructive outlook about cures. In the end, our standpoint is that any resolution that helps restore competitors and eliminates Google self-preferencing habits shall be a giant win for the open Web in addition to Magnite particularly.”

He quantified the potential impression: “To that time, as we have mentioned beforehand, each 1% of market share that shifts to Magnite because of these cures may imply $50 million of further contribution ex-TAC on an annualized foundation and at a really excessive 90% plus flow-through margins. Evidently, we’re watching developments on this case very intently.”

Barrett additionally introduced Magnite’s personal authorized motion. “On a associated notice, we just lately introduced that we had filed our own lawsuit against Google regarding its anticompetitive conduct,” he said. “The go well with, which seeks monetary damages in addition to different cures, is a follow-on motion to the DOJ litigation and builds on the allegations proved in that case.”

For the fourth quarter of 2025, Day supplied steering: “For the fourth quarter, we count on contribution ex-TAC to be within the vary of $191 million to $196 million, which represents development of 6% to 9% or 13% to 16%, excluding political. Contribution ex-TAC attributable to CTV to be within the vary of $87 million to $89 million, which represents development of 12% to 14% or 23% to 25% when excluding political.”

He defined elements affecting the DV+ outlook: “In DV+, our information displays barely decrease development versus the year-to-date efficiency because of a few elements. First, in October, we have seen some further drop in vertical spend in automotive and a few further weak spot in know-how and in Residence and Backyard, indicating a barely softening macro surroundings. We’re additionally seeing some spend motion from on-line video to CTV, which makes a ton of sense given extra aggressive CTV CPMs and expanded SMB entry to CTV stock.”

Day additionally famous exterior elements: “Lastly, we have seen some near-term stress from a current characteristic change by a prime DSP companion affecting all SSPs.”

Looking forward to 2026, Day supplied preliminary steering. “Now turning to 2026. I wish to level out that our estimates don’t embody any potential market share positive aspects because of cures from the Google Advert tech trial,” he said. “We at present count on contribution ex-TAC development for 2026 to be not less than 11%. We additionally count on to get again into our goal margin vary, which is 35% on the low finish, inclusive of a large funding in individuals we’re making to assist our development initiatives and CapEx to be roughly $60 million.”

In the course of the Q&A session, Barrett addressed questions on Commerce Desk’s current software program adjustments. “Sure, so in late Q3, Commerce Desk made a software program change to their working system that prioritized OpenPath as a default path for provide,” he defined. “And since that occurred, we have labored with all of our main consumers, which embody company holding corporations to reconnect Magnite as a most well-liked provide path.”

He elaborated on Magnite’s worth proposition: “As we famous within the script, Magnite powers lots of the Holdco purchaser marketplaces, so connection to Magnite is important for his or her enterprise. So there was impression. We mission impression for This autumn and that type of softer DV+ information that we put forth. However we do really feel as if the majority of the impression has already occurred that it has been restricted to DV+.”

Barrett expressed assist for ecosystem enhancements whereas highlighting Magnite’s significance: “I’ll say we positively assist Commerce Desk’s objective of cleansing up the ecosystem and slicing out provide gamers that present little or no worth. And I guarantee you this transfer will do this. However I additionally assume this reveals Magnite’s significance to the shopping for group, the profile of the media that we provide, the providers that we offer constructing their companies, by our marketplaces on our rails and clearly, the significance that we convey to the provision facet.”

Relating to demand-side platform partnerships, Barrett famous: “Sure, hear, our spend from the main DSPs stay very sturdy. We’re closing that hole that we had highlighted a number of quarters in the past, the place the overall advert spend was outpacing the contribution ex-TAC development. And that is narrowed, however we nonetheless have a really wholesome spend sample. And with all DSPs, and Amazon, specifically, is having a banner yr, and we actually take pleasure in that partnership each with Amazon as a purchaser of stock and Amazon as a writer the place we may also help them monetize the stock there.”

On the SMB alternative, Barrett defined the strategic strategy: “The thought of Streamer is to assist people like that, not simply Mountain, however different DSPs that will not have the instruments to draw SMB {dollars} or retailers or businesses. And so the thought is that we provide the streamer product to these people which have direct relationships with SMBs. The thought is not for us to be chasing SMBs ourselves, however to ensure that, that spend winds up on our platform. And that is why we’re tremendous excited concerning the Streamer acquisition as a result of it accomplishes that.”

Day concluded with optimism concerning the firm’s trajectory: “The third quarter was actually constructive for Magnite as we proceed to see important traction from our companions and from our strategic initiatives. I am excited concerning the progress in our enterprise and stay up for continued momentum into 2026.”

The earnings report underscores Magnite’s position as the biggest impartial sell-side promoting firm, with explicit power in Linked TV promoting. The corporate’s 99% protection of the CTV provide market, as revealed within the March Jounce Provide Benchmarking Report, positions it to capitalize on continued development in streaming promoting.

Timeline

- September 2025 – Warner Bros. Discovery launches NEO platform with Magnite powering transactions

- September 2025 – Magnite acquires streamer.ai for AI-powered CTV inventive manufacturing

- Early October 2025 – Choose Brinkema concludes cures section hearings in Google advert tech trial

- November 5, 2025 – Magnite studies Q3 2025 outcomes with $166.8 million contribution ex-TAC

- November 17, 2025 – Closing arguments scheduled in Google advert tech cures section

- March 2025 – Jounce report reveals Magnite’s 99% CTV market protection

- April 17, 2025 – Federal court rules Google illegally monopolized advert server and trade markets

- Might 2025 – Magnite reports Q1 2025 with 15% CTV development

Subscribe PPC Land publication ✉️ for related tales like this one

Abstract

Who: Magnite, the biggest impartial sell-side promoting firm, reported third quarter 2025 monetary outcomes with CEO Michael Barrett and CFO David Day presenting the efficiency.

What: The corporate exceeded expectations with contribution ex-TAC of $166.8 million (12% year-over-year development) and notably sturdy Linked TV efficiency at $75.8 million (18% development, or 25% excluding political promoting). Main partnerships with Netflix, Roku, and Warner Bros. Discovery drove outcomes, alongside development in company marketplaces and the acquisition of streamer.ai for small enterprise CTV promoting entry.

When: Outcomes had been introduced on November 5, 2025, overlaying the quarter ended September 30, 2025. The corporate supplied steering for This autumn 2025 and full-year 2026 expectations.

The place: Magnite operates globally as an omni-channel sell-side platform, with U.S. income representing 75% of whole income ($134.7 million) and worldwide income contributing 25% ($44.8 million) within the third quarter.

Why: The outcomes matter for the advertising group as a result of they reveal continued development in programmatic Linked TV promoting, with implications for the way advertisers entry streaming stock. The pending Google antitrust remedies may considerably reshape the digital promoting panorama, probably shifting market share to impartial platforms like Magnite. The corporate’s growth of instruments for small enterprise CTV entry and company market momentum signifies evolving pathways for advertisers to achieve streaming audiences.

Source link