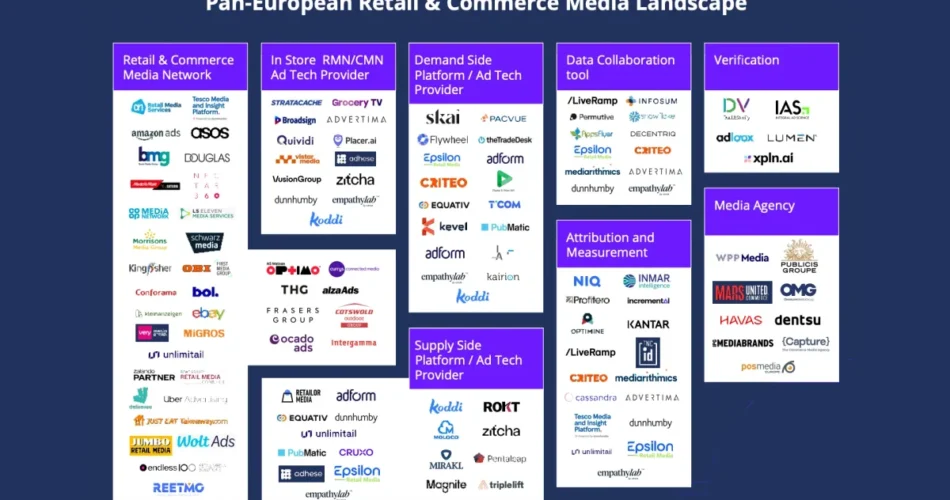

IAB Europe unveiled an up to date model of its Pan-European Retail & Commerce Media Panorama Map on October 14, 2025. The refresh follows the unique launch in Might 2025, reflecting the accelerated tempo at which new platforms and expertise suppliers proceed coming into the European retail and commerce media sector.

In response to the group’s announcement, the Retail and Commerce Media ecosystem demonstrates speedy enlargement. New gamers and platforms enter the house constantly, creating challenges for entrepreneurs, media consumers, and {industry} professionals trying to take care of present information of obtainable options. The up to date panorama consists of the most recent gamers and platforms shaping the ecosystem, guaranteeing stakeholders have entry to present market data.

Subscribe PPC Land publication ✉️ for related tales like this one. Obtain the information on daily basis in your inbox. Freed from adverts. 10 USD per yr.

The useful resource provides a structured snapshot of key sectors and members. Classes embody Retail & Commerce Media Networks, In Retailer RMN/CMN Advert Tech Suppliers, Demand Aspect Platforms and Advert Tech Suppliers, Knowledge Collaboration instruments, Verification providers, Attribution and Measurement suppliers, Media Businesses, and Provide Aspect Platforms. The framework supplies readability on the construction of the ecosystem and identifies alternatives inside it.

Marie-Clare Puffett, Trade Improvement & Insights Director at IAB Europe, serves as the first contact for the panorama useful resource. The file measurement measures 6.61 MB, accessible for obtain by IAB Europe’s web site.

Increasing classes outline market construction

The up to date map organizes tons of of corporations throughout eight distinct classes. Retail & Commerce Media Networks function main European retailers together with Amazon Advertisements, ASOS, Douglas, Kingfisher, Conforama, bol., Kleinenanzeigen, eBay, Migros, and unlimitail. MediaMarktSaturn and Zalando additionally seem amongst acknowledged networks, alongside rising gamers like REETMO and countless aisle.

In Retailer RMN/CMN Advert Tech Suppliers embody corporations delivering promoting expertise for bodily retail environments. The class consists of Stratacache, Grocery TV, Broadsign, Advertima, Quividi, Placer.ai, Vistar Media, adhese, VisionGroup, Zitcha, dunnhumby, empathydb, Koddi, and extra suppliers specializing in bridging digital promoting capabilities into brick-and-mortar areas.

Demand Aspect Platform and Advert Tech Supplier illustration consists of main programmatic gamers. Skai, Pacvue, Flywheel, theTradeDesk, Epsilon, adform, Criteo, Deliveroo Advertisements, Equativ, T’Com, Kevel, PubMatic, adform once more, kairion, empathydb, and Koddi populate this phase. The focus of established promoting expertise corporations signifies mature market infrastructure supporting retail media shopping for.

Knowledge Collaboration instruments have emerged as vital infrastructure elements. The class options LiveRamp, Infosum, Permutive, Showheroes-e, Decentrio, AppsFlyer, Epsilon, Criteo, mediarithmics, Advertima, dunnhumby, and empathydb. These platforms allow safe knowledge sharing and viewers activation whereas sustaining privateness compliance throughout European markets.

Verification providers deal with model security and measurement accuracy considerations. DV (DoubleVerify), IAS (Integral Advert Science), adloox, Lumen, and xpln.ai present impartial validation of promoting supply and efficiency. The inclusion of specialised verification suppliers displays rising demand for transparency inside retail media campaigns.

Attribution and Measurement options bridge the hole between promoting publicity and gross sales outcomes. NIQ (previously Nielsen IQ), Inmar Intelligence, Profitero, Incrementa.1, Optimine, Kantar, Nielsen’s INC ID, LiveRamp, Criteo, mediarithmics, Cassandra, Advertima, Tesco Media and Perception Platform (powered by dunnhumby), dunnhumby, unlimitail, Epsilon, and empathydb supply varied approaches to connecting promoting funding with retail efficiency knowledge.

Media Company illustration spans holding corporations and impartial specialists. WPP Media, Publicis Groupe, Omnicom Media Group (OMG), Havas, dentsu, Mediabrands (Seize), and Posmedia seem on the panorama. Company involvement demonstrates the strategic significance of retail media inside broader advertising and marketing budgets and the necessity for specialised experience managing campaigns throughout a number of networks.

Provide Aspect Platform and Advert Tech Supplier class consists of Koddi, Rokt, Moloco, Zitcha, Mirakl, Pentaleap, Magnite, and Triplelift. These corporations facilitate stock entry for advertisers and demand companions, enabling programmatic transactions inside retail environments.

Purchase adverts on PPC Land. PPC Land has commonplace and native advert codecs by way of main DSPs and advert platforms like Google Advertisements. By way of an public sale CPM, you may attain {industry} professionals.

Market progress drives ecosystem enlargement

The timing of the panorama replace displays substantial momentum inside European retail media. European retail media spending reached €13.7 billion in 2024, representing 21.1% growth in keeping with IAB Europe statistics launched in October 2025. The expansion price considerably exceeded the broader promoting market’s enlargement, positioning retail media among the many fastest-growing digital promoting segments.

IAB Europe Chief Economist Daniel Knapp compiled the spending figures, indicating retail media now accounts for roughly one-fifth of whole digital promoting expenditure throughout European markets. The milestone marks a transition from experimental channel to strategic promoting infrastructure for manufacturers allocating advertising and marketing budgets.

First-party knowledge entry stays the dominant driver of buy-side funding. Research from IAB Europe’s second annual Attitudes to Retail Media Report reveals 87% of respondents cite this functionality as a key alternative. Level-of-sale client attain elevated in significance, rising from 74% to 79% of respondents prioritizing this functionality between 2024 and 2025.

Partnership dynamics show maturing relationships between manufacturers and retail media networks. Purchase-side stakeholders sustaining retailer partnerships for a couple of yr elevated from 50% to 63%. Manufacturers working with 4 to 6 retail media networks greater than doubled from 10% to 24%, signaling widespread diversification methods amongst European advertisers.

Technical infrastructure improvement advances standardization

IAB Europe’s Retail & Commerce Media Committee drives standardization efforts addressing fragmentation challenges. The organization released updated pan-European definitions on March 26, 2025, establishing consensus throughout the Nationwide Federation and IAB community all through Europe. The framework addresses three distinct classes: on-site retail media, off-site retail media, and in-store digital retail media.

Commerce Media Networks, which include Retail Media Networks, permit manufacturers and retailers to deal with buyers with services all through their shopping for journey, each on and off retail media platforms. The excellent definitions present standardized terminology for {industry} members working throughout 31 European markets.

Measurement standardization emerged as a vital precedence. IAB Europe opened public comment on October 9, 2025, for up to date Commerce Media Measurement Requirements V2. The revised framework incorporates {industry} suggestions collected over 17 months of implementation following the April 2024 preliminary launch.

The up to date requirements increase past conventional retail environments. Fast commerce receives devoted metrics for the primary time, reflecting the sector’s speedy progress throughout European markets. Future editions plan protection for journey and finance verticals, indicating the broadening scope of commerce media past conventional retail classes.

Technical specs embody refined measurement funnels with distinct definitions for gross and internet gross sales. The framework goals to offer clear, comparable metrics throughout networks. Research indicates 78% of stakeholders identify media measurement as requiring industry alignment, whereas 69% cite attribution standardization wants.

Certification programme establishes high quality benchmarks

IAB Europe’s retail media certification programme launched in October 2024. The initiative makes use of impartial auditors to confirm compliance with measurement requirements. Albert Heijn became the first certified network in September 2025, marking a milestone for European digital promoting transparency and advertiser confidence.

The Netherlands-based grocery store chain accomplished the certification course of following a profitable pilot audit carried out by ABC, one of many impartial auditors taking part within the programme. Albert Heijn’s certification covers Show (static) and Sponsored Merchandise throughout its on-site properties, together with each the corporate’s web site and cell utility.

Analysis from IAB Europe revealed that 70% of consumers cite lack of retail media requirements as funding limitations. The certification programme addresses these considerations by offering verified measurement methodologies and reporting frameworks. Advertisers can examine efficiency throughout completely different retail media networks utilizing constant attribution fashions.

A Certification Advisory group comprising Nationwide Federations, IABs, and the Chair of IAB Europe’s Retail Media Committee governs the programme. This group makes choices on key milestones together with auditor appointments, certification processes, and partnerships with different our bodies such because the Media Ranking Council.

Platform integration reduces operational complexity

A number of partnerships have emerged addressing fragmentation challenges inside retail media shopping for. Criteo became Google’s first onsite retail media partner through Search Ads 360 integration in September 2025. The collaboration allows advertisers to create, launch, and optimize campaigns throughout Criteo’s retail community straight inside Google Search Advertisements 360.

The combination launches by a restricted beta program for choose clients within the Americas, with plans for world enlargement. Criteo’s community of over 200 retailers can decide into receiving demand from Google Search Advertisements 360, connecting with world manufacturers throughout a number of classes. The partnership supplies unified measurement capabilities for retailers, giving manufacturers visibility into how their promoting drives incremental influence.

Retail media networks embraced real-time bidding for sponsored products through partnerships enabling programmatic solutions. Pentaleap and Teads introduced on July 24, 2025, a partnership delivering real-time bidding functionality for retailers’ onsite Sponsored Product Advertisements. The combination represents the primary programmatic answer enabling advertisers to activate Sponsored Product stock throughout a number of retail networks by a unified platform.

Andreas Reiffen, CEO and Co-Founding father of Pentaleap, acknowledged within the announcement, “What was as soon as inconceivable is now a actuality: due to Pentaleap’s industry-leading, lightning-fast advert serving expertise, retailers can now run SPAs by way of RTB for the primary time ever—turning onsite retail media into one thing actually programmatic.”

The Trade Desk announced on October 9, 2025, a platform enlargement enabling manufacturers and businesses to buy onsite retail media stock programmatically by integration with Koddi’s commerce media platform. Gopuff serves because the preliminary launch companion, with extra retailers anticipated to observe in coming months.

Offsite capabilities prolong retailer attain

European retailers have more and more expanded past on-site promoting into offsite environments. MediaMarktSaturn launched its first offsite retail media program in September 2025, extending promoting capabilities past owned digital properties by strategic partnership with Unlimitail.

The European client electronics big partnered with Unlimitail, a three way partnership between Publicis Groupe and Carrefour, to allow advertisers to succeed in MediaMarktSaturn clients by curated audiences throughout exterior web sites and functions. This system makes use of Epsilon Retail Media’s expertise platform for activation.

Torsten Ahlers, Managing Director Retail Media at MediaMarktSaturn, characterised the initiative as representing a strategic milestone within the firm’s retail media improvement. The enlargement builds upon MediaMarktSaturn’s present retail media basis, which incorporates onsite promoting codecs and in-store promotional alternatives.

Privateness-safe first-party knowledge assortment from transactions and loyalty packages varieties the technological basis for the offsite promoting answer. Manufacturers can join digital commercial publicity to each on-line and offline gross sales conversions, offering end-to-end marketing campaign measurement throughout a number of touchpoints. The system allows focusing on of each endemic advertisers promoting electronics merchandise by MediaMarktSaturn channels and non-endemic manufacturers looking for to succeed in high-intent expertise buyers.

Geographic rollout started in October 2025 throughout 5 preliminary markets, beginning with Germany earlier than increasing to Spain, Italy, the Netherlands, and Belgium. Turkey, Poland, Austria, Switzerland, Luxembourg, and Hungary will obtain entry in early 2026.

Mastercard unveiled its commerce media network on October 1, 2025, coming into a market projected to succeed in $100 billion by 2028. The funds community launched Mastercard Commerce Media from its Buy, New York headquarters, establishing a devoted digital promoting platform that leverages permissioned transaction knowledge from greater than 160 billion annual funds processed in 2024.

The community operates with an present base of 25,000 advertisers and reaches 500 million enrolled customers throughout owned channels, financial institution retailers, and publishing companions worldwide. The platform at present delivers as much as 22 occasions return on advert spend for advertisers throughout retail, journey, leisure, eating, and on a regular basis spending classes.

Strategic partnerships type the muse of Mastercard’s market entry. The community positive aspects scale by its present relationship with Citi, whereas a rising collaboration with WPP extends the platform’s attain to manufacturers and consumers in conventional media. Microsoft partnership goals to combine Mastercard Commerce Media inside Copilot Studio, positioning the community for agentic commerce functions.

Criteo partnered with DoorDash in a multi-year expansion announced October 6, 2025, designed to increase retail media promoting throughout DoorDash’s market for grocery, comfort, and non-restaurant retailers. Criteo will perform as an extension of DoorDash’s U.S. promoting gross sales workforce, working straight with manufacturers and businesses whereas the 2 corporations discover expertise integration alternatives over time.

Stephen Howard-Sarin, Managing Director, Retail Media Americas at Criteo, acknowledged, “That is an thrilling second for Criteo, DoorDash, and the advertisers and retailers we serve. Supply is an important new path within the CPG client journey, and DoorDash has turn into a must-buy vacation spot for comfort, grocery and alcohol manufacturers.”

Market projections point out sustained progress trajectory

Trade forecasts level to continued enlargement throughout world commerce media markets. Research from Omdia projects retail media will capture approximately 20% of total global advertising revenue by 2030, representing roughly $300 billion in spending in keeping with the September 4, 2025 report.

Maria Rua Aguete, Senior Analysis Director at Omdia, characterised the event as “unprecedented enlargement as retailers acknowledge the substantial income potential of their buyer knowledge and digital actual property.” The projection signifies retail media networks will exceed $300 billion in spending, marking a elementary transformation in how advertisers allocate budgets throughout digital channels.

A number of key elements drive this progress trajectory. Retailers actively search new income streams past conventional commerce operations, whereas manufacturers demand extra focused promoting options with measurable return on funding. The rising worth of first-party knowledge in a privacy-focused digital atmosphere creates extra momentum, mixed with technological developments enabling extra refined retail media choices.

European markets show notably sturdy efficiency inside this world context. European retail media spending grew 22.1% in 2024 in comparison with 6.1% progress for the broader promoting market, demonstrating retail media’s transition from experimental class to strategic promoting infrastructure. The focus of superior retail operations, refined promoting expertise infrastructure, and privacy-focused regulatory frameworks positions Europe as a number one marketplace for commerce media innovation.

Why this issues for advertising and marketing professionals

The up to date IAB Europe panorama map arrives as retail and commerce media undergoes elementary structural modifications. Advertising professionals face rising operational complexity managing campaigns throughout proliferating platforms whereas navigating numerous measurement methodologies and reporting frameworks.

Standardization efforts by IAB Europe present important infrastructure for scaling retail media investments. The group’s definition frameworks, measurement requirements, and certification programmes deal with fragmentation that has restricted progress potential. Clear categorization of ecosystem members allows extra knowledgeable decision-making about expertise partnerships and community choice.

Platform integration developments scale back workflow complexity. Unified entry to a number of retail media networks by established promoting platforms eliminates separate marketing campaign administration necessities. Programmatic capabilities prolong past conventional show and video into retail-specific codecs together with sponsored merchandise, creating alternatives for automated optimization throughout numerous stock sources.

First-party knowledge activation capabilities distinguish retail media from conventional digital promoting channels. Direct entry to transaction knowledge and buy conduct allows precision focusing on unavailable by third-party viewers segments. The privacy-safe nature of retail media knowledge collaboration addresses regulatory compliance necessities whereas sustaining promoting effectiveness.

Measurement development allows extra refined finances allocation. Incrementality frameworks assist quantify the causal influence of retail media investments past fundamental attribution fashions. Unified measurement approaches facilitate cross-network efficiency comparability, supporting diversification methods as manufacturers increase partnerships past dominant platforms.

The panorama map paperwork an ecosystem transitioning from fragmented early-stage market to mature promoting infrastructure. Class readability, standardized definitions, and complete participant listings scale back data limitations for organizations evaluating retail media alternatives. As commerce media continues capturing rising shares of digital promoting budgets, accessible market intelligence turns into more and more worthwhile for strategic planning and aggressive positioning.

Subscribe PPC Land publication ✉️ for related tales like this one. Obtain the information on daily basis in your inbox. Freed from adverts. 10 USD per yr.

Timeline

- Might 2025: IAB Europe releases initial Pan-European Retail & Commerce Media Landscape Map

- July 15, 2025: IAB Europe publishes updated 101 Guide to Retail & Commerce Media 2025 Review

- July 15, 2025: IAB Europe releases retail media best practice guides for buyers and networks

- July 15, 2025: European retail media partnerships extend as measurement challenges persist

- July 24, 2025: Pentaleap and Teads announce RTB capability for sponsored products

- September 4, 2025: Omdia projects retail media to capture 20% of global advertising revenue by 2030

- September 9, 2025: IAB unveils incrementality framework for commerce media budgets

- September 10, 2025: Criteo becomes first onsite retail media partner for Google Search Ads 360

- September 23, 2025: Topsort partners with Skai to expand global retail media reach

- September 24, 2025: Albert Heijn earns first retail media certification under IAB Europe programme

- September 2025: MediaMarktSaturn launches first offsite retail media program with Unlimitail

- October 1, 2025: Mastercard launches commerce media network with $100B market potential

- October 6, 2025: Criteo partners with DoorDash for multi-year retail media expansion

- October 7, 2025: European retail media spending reaches €13.7 billion with 21.1% growth

- October 9, 2025: IAB Europe opens public comment on commerce media standards

- October 9, 2025: The Trade Desk enables programmatic retail media buying through Koddi partnership

- October 14, 2025: IAB Europe releases up to date Pan-European Retail & Commerce Media Panorama Map

Subscribe PPC Land publication ✉️ for related tales like this one. Obtain the information on daily basis in your inbox. Freed from adverts. 10 USD per yr.

Abstract

Who: IAB Europe’s Retail & Commerce Media Committee launched the up to date panorama map, with Marie-Clare Puffett, Trade Improvement & Insights Director at IAB Europe, serving as the first contact. The useful resource paperwork tons of of corporations throughout retail media networks, expertise suppliers, businesses, and platforms working all through European markets.

What: An up to date Pan-European Retail & Commerce Media Panorama Map offering complete categorization of ecosystem members throughout eight distinct segments: Retail & Commerce Media Networks, In Retailer RMN/CMN Advert Tech Suppliers, Demand Aspect Platforms, Knowledge Collaboration instruments, Verification providers, Attribution and Measurement suppliers, Media Businesses, and Provide Aspect Platforms. The 6.61 MB useful resource provides structured snapshots of key sectors and gamers throughout the ecosystem.

When: IAB Europe introduced the up to date panorama map on October 14, 2025, following the unique launch in Might 2025. The refresh displays steady ecosystem evolution as new gamers and platforms enter the market. The timing coincides with broader standardization efforts together with Commerce Media Measurement Requirements V2 public remark interval working by November 14, 2025.

The place: The panorama covers the Pan-European retail and commerce media ecosystem throughout 31 markets the place IAB Europe maintains presence. The useful resource addresses each established Western European markets and rising Central and Japanese European areas experiencing retail media progress. Geographic scope extends to retailers, platforms, and expertise suppliers working throughout a number of European international locations.

Why: The speedy enlargement of the retail and commerce media ecosystem creates data challenges for entrepreneurs, media consumers, and {industry} professionals trying to take care of present information of obtainable options. The up to date panorama supplies important market intelligence as European retail media spending reached €13.7 billion in 2024 with 21.1% progress, considerably outpacing the broader promoting market’s 6.1% enlargement. Standardization efforts by clear categorization allow extra knowledgeable decision-making about expertise partnerships and community choice as manufacturers more and more diversify retail media investments throughout a number of platforms.

Source link