Related tv promoting faces a strategic misalignment between marketing campaign targets and execution techniques, analysis from Gracenote suggests. The content material knowledge enterprise unit of Nielsen released findings on October 1, 2025, exhibiting that whereas media professionals prioritize model consciousness as their prime CTV goal, most proceed counting on slender audience-based concentrating on strategies higher suited to efficiency advertising and marketing.

The survey carried out between July 10-20, 2025, gathered responses from 600 U.S. model and company executives with management over advertising and marketing and promoting spend. Respondents represented industries together with media and leisure, telecommunications, retail, monetary providers, automotive, client packaged items, and healthcare.

Subscribe PPC Land publication ✉️ for comparable tales like this one. Obtain the information day-after-day in your inbox. Freed from adverts. 10 USD per yr.

Spending patterns and effectiveness considerations

The analysis reveals substantial price range shifts towards CTV. Practically 46% of respondents reported transferring 26% or extra of their paid media budgets to CTV over the previous three years. Amongst manufacturers in monetary providers, retail, know-how and healthcare, that determine reaches 52%.

At the moment, 27% of all survey respondents allocate 40% or extra of their complete budgets to CTV. For a similar 4 trade segments, the share rises to 31%. These allocations align with IAB projections that U.S. CTV advert spending will complete $26.6 billion in 2025, representing a 12% improve from 2024.

Regardless of rising investments, confidence in CTV effectiveness stays tepid. The survey discovered that 32% of respondents think about their CTV promoting “not very efficient,” with solely 27.8% score it “extraordinarily efficient” and 40.5% calling it “very efficient.”

Concentrating on technique disconnect

The effectiveness hole stems partly from strategic selections. Model consciousness emerged as the first goal for 30% of respondents, adopted by income progress at 28% and buyer acquisition at 22%. Buyer retention, which usually depends on efficiency advertising and marketing approaches, ranked fourth at 16%.

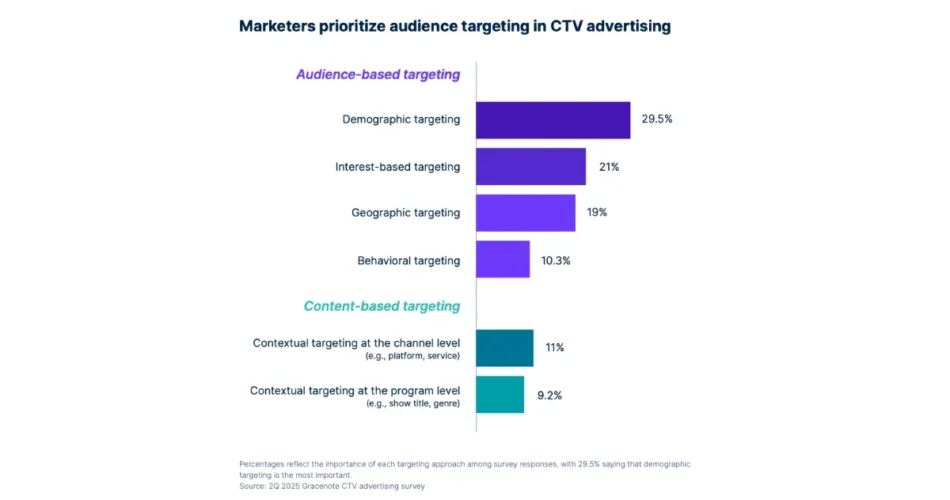

But concentrating on methods inform a distinct story. Demographic concentrating on topped the listing at 29.5% significance, adopted by interest-based concentrating on at 21% and geographic concentrating on at 19%. Behavioral concentrating on claimed 10.3%. Contextual targeting at the program level obtained solely 9.2% prioritization, whereas channel-level contextual concentrating on garnered 11%.

This sample reveals what Gracenote characterizes as a basic mismatch. Respondents are making use of bottom-of-funnel techniques to what they’ve recognized as top-of-funnel model constructing targets.

The contextual data hole

Familiarity with contextual promoting strategies seems restricted. Solely 45.2% of respondents reported being “very acquainted” with contextual concentrating on, whereas 38.8% stated they had been “considerably acquainted.” The remaining 16% indicated obscure familiarity or no familiarity in any respect.

The lack of expertise is notable given how contextual concentrating on addresses a number of of the challenges respondents recognized. When requested about their prime CTV promoting obstacles, 27% cited lack of perception into whether or not adverts reached their supposed viewers. One other 20% pointed to inadequate ROI visibility, whereas 17% talked about lack of perception into the place adverts seem.

Model security considerations, the place adverts seem in unsuitable contexts, troubled 14% of respondents. Lack of transparency into CTV stock affected 13%, and fraud considerations registered with 9%.

Purchase adverts on PPC Land. PPC Land has commonplace and native advert codecs by way of main DSPs and advert platforms like Google Adverts. Through an public sale CPM, you may attain trade professionals.

The analysis highlights technical infrastructure points hampering CTV promoting effectiveness. Practically 70% of respondents recognized lack of standardization and unification in content material metadata as no less than a modest problem when creating CTV campaigns and assessing outcomes. Amongst these, 20% referred to as it a big problem.

The significance of standardized metadata is obvious. When requested, 31.5% of respondents rated it “extraordinarily essential,” whereas 38.7% referred to as it “crucial.” The sensible affect proves substantial: 62% stated standardized metadata would supply larger confidence in CTV advert planning, and 54% indicated it might drive elevated CTV advert spending.

The metadata hole proves notably acute on free ad-supported tv channels. Gracenote tracked almost 1,850 energetic FAST channels as of July 2025, distributing greater than 182,000 TV reveals, films and sports activities applications. Half the accessible content material was produced throughout the previous 5 years.

But FAST content material reveals vital metadata deficiencies in comparison with subscription streaming providers and digital multichannel video programming distributors. For sports activities programming on FAST channels, 68% lack imagery, 55% miss unique air date info, 39% haven’t any episode title, and 23% lack style classification.

Tv reveals on FAST platforms present comparable gaps: 68% lack manufacturing nation info, 46% miss unique air date knowledge, and 21% haven’t any style designation. Function movies fare considerably higher however nonetheless present substantial holes, with 79% lacking manufacturing nation particulars and 78% missing manufacturing firm info.

Present viewing patterns

The stakes for bettering CTV promoting effectiveness are appreciable given present viewing traits. In Q1 2025, CTV accounted for 48% of U.S. viewers’ tv time, surpassing conventional stay TV at 46%, based mostly on Nielsen Viewers Insights Knowledge.

Advert-supported content material represents greater than 45% of streaming viewership as of Q2 2025, up from 42.4% in Q1 2025. The three leading FAST platforms—Pluto TV, Tubi and The Roku Channel—accounted for five.7% of complete TV utilization in Might 2025, representing a 36% improve from the earlier yr.

Utilization patterns for particular person platforms present sustained progress. Nielsen Scarborough USA+ knowledge signifies that amongst folks 18 and older over the previous 30 days, Tubi utilization reached roughly 14% by the second half of 2024, up from roughly 10% within the first half of 2023.

Programmatic shopping for concerns

The significance of content material metadata extends to programmatic promoting, which accounts for 85% of CTV buys based mostly on IAB knowledge. Programmatic platforms require contextual alerts to make knowledgeable shopping for and promoting choices. When metadata is incomplete or inconsistent, these platforms lack the knowledge wanted for efficient transactions.

The technical necessities show particularly essential for stay sports activities occasions and TV present premieres, the place unique air date info incessantly goes lacking. A pattern evaluation of sports activities applications shared by Rain the Development Company discovered that amongst 28 sports activities applications, solely eight included content material title info. Three listed “television” in that area, whereas 5 offered particulars about particular person groups competing in MLB video games.

Amongst sports activities applications airing between mid-July and mid-August 2025, 55.4% lacked unique air date info earlier than metadata enrichment. This absence limits perception into whether or not a sport is stay or recorded—a vital distinction for advertisers.

“CTV has not delivered the size and premium attain that entrepreneurs count on of the biggest display in the home largely based mostly on the usage of slender concentrating on techniques,” stated Jake Richardson, VP of Partnerships at Gracenote. “By taking higher benefit of contextual concentrating on capabilities with their CTV campaigns, they’ve new alternatives to drive each return on adverts spend and the size they have been searching for.”

Market implications

The analysis means that regardless of CTV’s digital nature and audience-based concentrating on capabilities, the channel could not ship on efficiency guarantees corresponding to earlier digital channels like desktop, video and cellular. Manufacturers acknowledge CTV as the situation of extremely engaged audiences, however attaining each exact user-targeting and scale has confirmed troublesome.

Gracenote’s findings point out that entrepreneurs want to enhance audience-based methods with content-based initiatives to have interaction potential clients past current segments. This implies specializing in what folks watch along with who watches it.

The corporate has begun enabling simpler programmatic CTV promoting by product choices and partnerships leveraging its content material metadata, taxonomy and identification programs. These capabilities construct on Gracenote’s historical past powering leisure search and discovery options that join viewers to content material.

Subscribe PPC Land publication ✉️ for comparable tales like this one. Obtain the information day-after-day in your inbox. Freed from adverts. 10 USD per yr.

Timeline

Subscribe PPC Land publication ✉️ for comparable tales like this one. Obtain the information day-after-day in your inbox. Freed from adverts. 10 USD per yr.

Subscribe PPC Land publication ✉️ for comparable tales like this one. Obtain the information day-after-day in your inbox. Freed from adverts. 10 USD per yr.

Abstract

Who: Gracenote, Nielsen’s content material knowledge enterprise unit, surveyed 600 U.S. model and company executives with oversight of promoting and promoting spend, representing media/leisure, telecommunications, retail, monetary providers, automotive, CPG and healthcare industries.

What: Analysis revealed a strategic disconnect in CTV promoting the place 80% of entrepreneurs use audience-based concentrating on techniques regardless of prioritizing model consciousness targets, contributing to 32% viewing CTV as ineffective. The examine discovered restricted familiarity with contextual concentrating on (45% very acquainted) and recognized vital metadata standardization challenges affecting 70% of respondents. FAST channels confirmed substantial metadata gaps, with 55% of sports activities applications lacking unique air date info.

When: Gracenote fielded the survey between July 10-20, 2025, and launched findings on October 1, 2025. The analysis examined present CTV spending patterns, with projections indicating $26.6 billion in U.S. CTV advert spending for 2025, up 12% from 2024.

The place: The examine targeted on U.S. market dynamics, the place CTV viewing time reached 48% of complete tv consumption in Q1 2025, surpassing conventional TV’s 46%. Advert-supported streaming content material represented 45.3% of streaming viewership as of Q2 2025, with FAST platforms accounting for five.7% of complete TV utilization.

Why: The analysis issues for advertising and marketing professionals as a result of it exposes effectivity losses in CTV promoting. With 27% of respondents allocating 40% or extra of complete budgets to CTV, and 46% having shifted 26% or extra of budgets to the channel over three years, effectiveness considerations carry vital monetary implications. The findings counsel that restricted contextual concentrating on adoption and metadata standardization points stop entrepreneurs from attaining the size mandatory for model constructing targets, regardless of substantial price range commitments. The analysis identifies particular technical limitations—notably in FAST channel metadata—that programmatic platforms have to execute knowledgeable shopping for choices.

Source link