It’s starting to look lots like… finances season.

This 12 months, folks aren’t ready till December to start out purchasing – and so they’re not messing round with their cash, both. Between inflation, tariffs, and the everlasting dread of January bank card payments, vacation buyers are beginning early, watching budgets, and rethinking financing.

We requested 4,000 folks within the US, UK, Canada, and Australia what their plans appear like for the vacations. And right here’s what got here out of it.

Vacation habits at a look

Vacation 2025 isn’t enterprise as traditional. Our survey reveals simply how a lot earlier, extra cautious, and extra calculated buyers have turn out to be:

- Late October to mid-November is the prime purchasing kickoff — ≈ one in three begin then, whereas one in 5 start earlier than October

- $250–$499 is the commonest spend vary throughout all 4 international locations

- AI is now a part of the purchasing toolkit, primarily used to seek out offers

- BNPL goes mainstream – 40–45% throughout US, UK, Canada, Australia might use it

- Tariffs are reshaping US habits as 33.0% discover greater costs, 19.2% keep away from worldwide websites, 18.7% store earlier

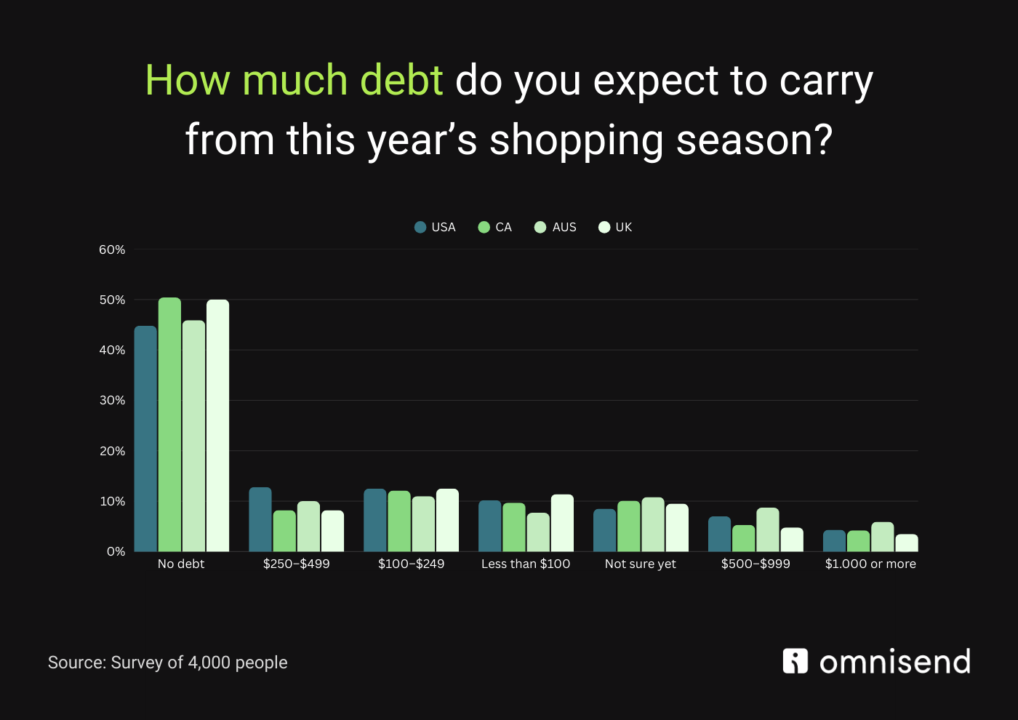

- Vacation debt lingers – ≈ 20% of adults throughout US, UK, Canada, Australia nonetheless carry final 12 months’s balances

Now let’s go deeper into these findings.

Individuals are purchasing earlier – and planning more durable

Let’s begin with timing.

In all 4 international locations, the most well-liked time to start out purchasing is late October to mid-November. Round a 3rd of individuals mentioned that’s after they kick issues off – together with 33.1% of US buyers, 34.3% within the UK, 31.6% in Canada, and 26.1% in Australia.

One other one in 5 are beginning earlier than October even hits. That’s 23.0% within the US, 20.9% within the UK, 18.8% in Canada, and 19.0% in Australia. Only a few individuals are leaving it till the final minute – round 4-7% throughout the board.

Black Friday and Cyber Monday are additionally nonetheless a factor, however not the principle factor. Curiosity is highest in Australia at 24.7%, then Canada at 20.6%, the US at 18.9%, and the UK at 14.9%.

So it’s protected to say that it’s not a one-day dash anymore. It’s a protracted, and a really cautious jog.

BNPL and AI are each on the rise

With costs up just about all over the place, individuals are leaning into instruments that assist them really feel extra in management.

BNPL (Purchase Now Pay Later) is catching on quick. Within the US and Australia, 44.8% of buyers say they’ll use it or are fascinated with it – with 18% of People saying sure, and one other 26.8% saying possibly. The UK isn’t far behind at 41.8%, and in Canada, 36.6% are open to it.

Furthermore, consciousness is almost common – solely 2.7% of US buyers say they’ve by no means heard of BNPL, in comparison with 6.9% in Canada, 2.1% within the UK, and simply 1.8% in Australia.

Mainly, BNPL is now a part of the vacation toolkit. Most individuals know what it’s, and lots are planning to make use of it.

AI can be exhibiting up within the purchasing journey, principally to smell out offers. That’s the case for 28.0% of US buyers, 27.7% within the UK, and 25.3% in each Canada and Australia. Present concepts are the second commonest use – about one in 5 buyers in every nation. Some are even letting AI write their messages or assist with budgeting.

So, sure, Santa bought automated.

Tariffs are altering conduct – a minimum of within the US

A 3rd of People – precisely 33.0% – say they’ve observed greater costs as a consequence of tariffs. That’s already important, nevertheless it goes additional: 19.2% are avoiding worldwide platforms altogether, 18.7% are beginning their purchasing earlier, and 16.3% are shrinking their present lists.

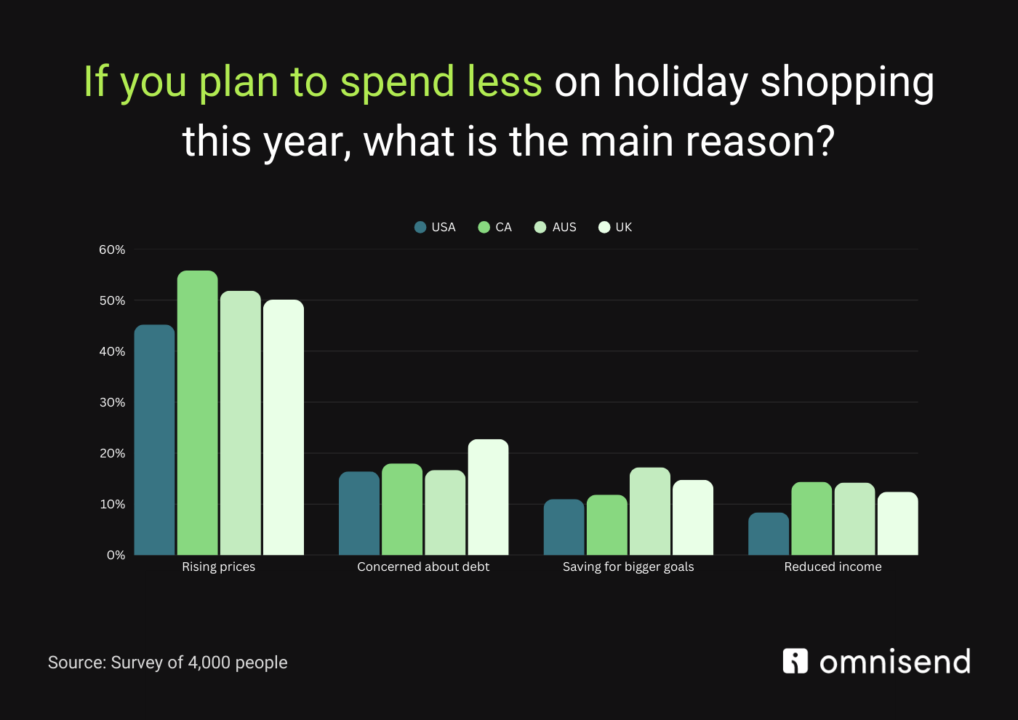

And there’s a much bigger story right here: round three out of 4 buyers in each nation say they’ll spend much less this 12 months than final. On the coronary heart of this pullback lies, in fact, inflation – known as out by 55.8% of Canadians, 51.9% of Australians, 50.1% of Brits, and 45.2% of People.

Within the US, tariffs are making issues even worse – 19.1% say import prices are one more reason they’re reducing again.

Debt remains to be a part of the image

Even with extra planning, final 12 months’s vacation spending left a mark.

Within the US, buyers racked up $55 billion in post-holiday debt – about $213 per grownup. In Canada, it totaled $6.08 billion, or $187 per grownup. Australians ended the season with $5.43 billion in debt, averaging $249 per grownup. And within the UK, buyers added £6.79 billion, which breaks all the way down to about £171 per individual.

That’s no small change. And it’s a giant cause individuals are tightening up this 12 months.

The place they’re purchasing (and what they’re shopping for)

Amazon remains to be the default. No shock there. However buyers are exploring cheaper alternate options.

Temu is large in Australia, with 32.2% of individuals utilizing it – and it’s rising in Canada too, the place 24.0% say they’ll store there. eBay remains to be going robust, particularly in Australia (36.9%) and the UK (30.2%). TikTok Store can be on the rise – notably within the UK, the place 10.5% of buyers are utilizing it.

High product classes?

Clothes is #1 all over the place. Tech leads within the US. Magnificence and meals are stronger within the UK. So sure – sensible items, with possibly a number of treats thrown in.

Vacation 2025 is quieter, earlier, and extra calculated

Individuals are nonetheless shopping for items. However they’re doing it otherwise:

They’re beginning early, purchasing round, utilizing BNPL and AI right here and there. Additionally they are inclined to keep away from worldwide sellers if the worth isn’t proper. And most significantly – maintaining budgets tighter than final 12 months.

Actually, the commonest spending vary this 12 months is $250–$499 – reported by 31.3% of People, 31.7% of Brits, 29.3% of Canadians, and 32.0% of Australians.

So in the event you’re a model, the message is fairly easy:

Make it straightforward. Make it helpful. And don’t assume individuals are within the temper to splurge.

It is a season of sensible purchasing – not simply purchasing purchasing.

Need to dive deeper into the info?

Source link