Seems, you may’t tariff away a very good deal.

After months of headlines about value hikes and commerce tensions, U.S. buyers are heading again to Chinese language marketplaces, and never slowly. New Omnisend survey information exhibits that Temu and Shein are each seeing a rebound in weekly and month-to-month procuring exercise, together with a spike in U.S. search curiosity and app installs.

So what offers? It’d come right down to this: folks nonetheless need the bottom value, even when it takes longer to ship and even when they observed that it’s not fairly as little as earlier than.

Fast-glance findings

Right here’s what we noticed within the August 2025 Omnisend survey (U.S. information):

- Temu weekly U.S. buyers are up 13% since April

- 28% of respondents are procuring on Shein month-to-month, surpassing 2024 ranges (26%)

- Google searches for “Temu” surged +44% final month, “Shein” +25%

- 29% of customers reported increased costs, but procuring habits is up

Temu’s bounce and Shein’s rise each counsel one factor: when costs go up, buyers don’t depart, they simply get pickier.

The Temu rebound

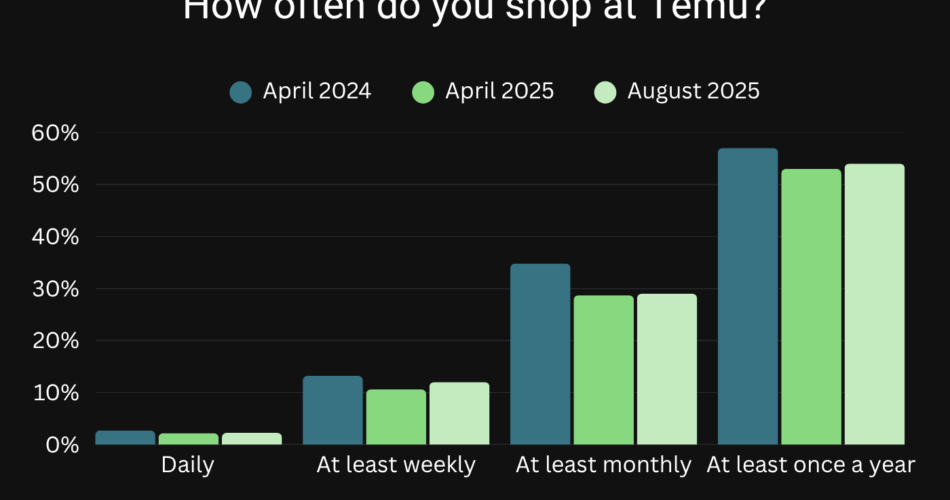

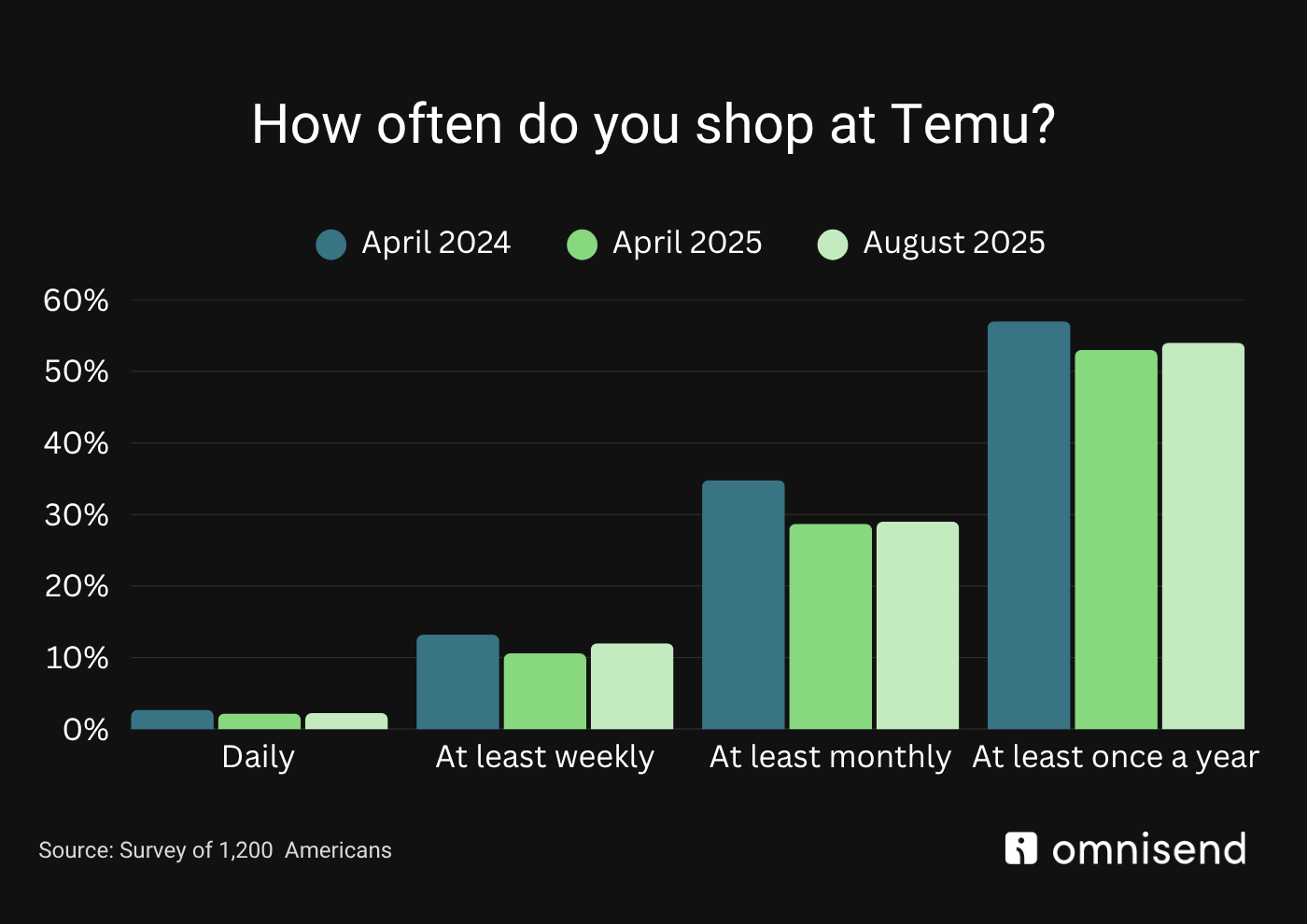

Let’s begin with Temu. After a slight dip this spring, weekly U.S. buyers have climbed again to 12% — a 13% bounce since April and simply wanting its 2024 excessive of 13.2%.

Month-to-month utilization is holding regular at 28.5%, and off-platform alerts affirm the pattern:

- +22% improve in U.S. website visits (Similarweb)

- +44% in Google search curiosity for “Temu”

So regardless of 29% of respondents reporting increased costs, site visitors and utilization are up. Customers could grumble, however they’re nonetheless clicking.

Shein retains climbing

If Temu is bouncing again, Shein is straight-up accelerating.

Over the previous few months, Shein has quietly pushed previous its 2024 benchmarks and is now pulling forward in almost each class that issues: procuring frequency, app downloads, website visits, and search curiosity.

Right here’s what the most recent numbers present:

- Weekly buyers hit 12% in August — up from 10% in April and better than 2024’s 11%

28% now store month-to-month, up from 23% in April and surpassing 2024’s 26% - Annual attain jumped to 48%, from 39.8% in April

And it’s not simply survey information — Shein is dominating digital alerts too:

- #1 in Similarweb’s U.S. Vogue & Attire class

- #2 most-downloaded procuring app within the U.S.

- Google searches for “Shein” rose 25% final month

It’s apparent now that Shein not solely holds its floor, however is rising previous pre-tariff benchmarks.

Worth beats friction (for now)

So why the rebound, even with the value hikes?

“Tariff headlines and decreased advert spend on the Temu facet precipitated a quick wobble, however worth nonetheless guidelines,” says Marty Bauer, Ecommerce Knowledgeable at Omnisend. “Customers are delicate to cost hikes but stay keen to sift for offers – particularly when coupons, free delivery thresholds, and social buzz offset perceived value will increase.”

Nonetheless, that value sensitivity issues. The survey confirmed:

- 34% would swap away from Chinese language platforms if costs go up once more

- 24% would bounce ship for sooner delivery choices

- Others cited higher customer support, information/privateness issues, or a choice to assist U.S. companies

What U.S. retailers ought to take from this

It’s clear that Chinese language marketplaces aren’t going wherever, however that doesn’t imply home manufacturers can’t compete. In line with Marty Bauer, the technique isn’t to beat Temu or Shein at their very own sport, however to alter the sport completely.

Listed here are 4 strikes he recommends:

- Be current the place deal-seekers already store. Checklist margin-friendly SKUs on main marketplaces or associate with creators who showcase these channels so that you intercept price-sensitive site visitors with out undercutting your personal website.

- Outpace “China delivery” with velocity and readability. Provide same- or two-day supply, real-time monitoring, and no-hassle returns to erase the fulfilment benefit Chinese language sellers usually concede.

- Flip belief into your differentiator. Highlight native sourcing, product high quality, and sustainability in advertisements, packaging, and post-purchase emails to justify a better ticket.

- Sweeten the deal strategically. Use limited-time bundles, tiered loyalty rewards, and personalised SMS to ship worth with no blanket value minimize. The simplest approach to set these up is to make use of SMS automation instruments like Omnisend.

- Leverage first-party information. Construct segmented e mail/SMS flows that remind lapsed buyers of sooner delivery, straightforward returns, or loyalty perks each time they browse Temu or Shein.

Ultimate takeaway

Tariffs could have slowed Temu and Shein down, however solely briefly. Cut price hunters don’t keep away for lengthy, particularly once they’re used to scrolling for limitless offers. Whilst costs edge upward, buyers are already discovering their method again.

For U.S. retailers, meaning the battle received’t be received on reductions alone. Customers additionally need velocity, transparency, and belief within the manufacturers they purchase from. Ship on these, and also you’ve bought a preventing likelihood at protecting their consideration, even when low-cost giants are only a faucet away.

Need the total dataset, charts, or to talk with Marty Bauer?

Attain out to [email protected] for extra.

Source link