Shopper habits patterns shifted towards selective spending in August 2025, in line with newly launched knowledge from Zeta International’s Financial Index. The AI-powered measurement system, which tracks over 245 million shoppers, recorded a 0.9% month-to-month decline within the Financial Index Rating to 67.2 on September 2, 2025, marking the fifth consecutive month-to-month lower.

In response to Zeta Global findings, households demonstrated rebalancing moderately than wholesale retreat from spending. The August knowledge reveals shoppers sustaining forward-looking intent whereas lowering non-essential purchases, pushed by back-to-school planning throughout attire, electronics, and dormitory necessities.

Subscribe PPC Land publication ✉️ for related tales like this one. Obtain the information every single day in your inbox. Freed from advertisements. 10 USD per yr.

“Proper now, shopper power is not about spending extra, it is about spending smarter,” mentioned David A. Steinberg, Co-Founder, Chairman, and CEO of Zeta International. The index synthesizes over 20 proprietary alerts together with spend, searching, credit score, and life-event indicators to disclose intent earlier than it turns into precise spending.

Discretionary spending contracts as credit score urge for food wanes

Discretionary Spend Propensity dropped 5.7% month-over-month in August, extending summer time’s downward development as households trimmed non-essential purchases. Credit score Line Enlargement Intent fell 22.8% month-over-month, representing its steepest retreat in latest months and signaling shoppers are hitting pause on borrowing urge for food.

The year-over-year perspective gives further context. Whereas Credit score Line Enlargement Intent declined dramatically on a month-to-month foundation, it remained up 9% in comparison with August 2024, pointing to extra resilient underlying traits beneath short-term volatility.

Labor market uncertainty weighs on shopper confidence, with Job Market Sentiment weakening 3.6% month-over-month. Automotive Buy Intent declined 7.1% month-over-month, amplifying alerts of pullback in big-ticket commitments throughout a number of sectors.

Sector-specific patterns reveal selective habits

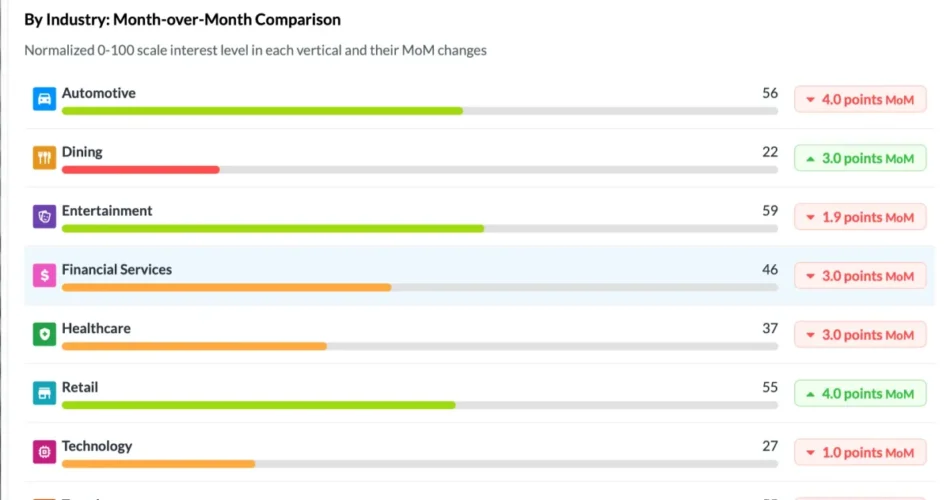

August sector traits show the sample of selective shopper habits throughout completely different industries. Retail rose 4.0 factors month-over-month as in-store exercise elevated and shoppers shifted from splurge to staple purchases. Again-to-school planning drove a transparent mid-August spike in retail engagement.

Journey fell 5.0 factors month-over-month, reflecting post-summer cooldown in bookings and mobility patterns. This decline aligns with seasonal expectations as summer time trip intervals conclude and shoppers return to common routines.

Automotive slipped 4.0 factors month-over-month, with an total 20-point decline year-over-year as a part of the bigger pullback in big-ticket classes. This substantial annual decline underscores sustained warning amongst shoppers contemplating main purchases.

Eating noticed a 3.0-point month-over-month elevate reflecting seasonal leisure spend, a class that has skilled a 13-point year-over-year enhance. This constructive development suggests shoppers proceed prioritizing experiences and social actions regardless of broader spending warning.

Monetary Companies and Healthcare every declined 3.0 factors month-over-month, indicating decreased urge for food for credit score merchandise and elective care. These decreases replicate shoppers’ strategic postponement of discretionary monetary and medical providers.

Know-how edged down 1.0 level month-over-month after latest bursts of shopper enthusiasm. The modest decline suggests continued curiosity in expertise merchandise with some cooling from peak demand intervals.

Ahead-looking indicators present resilience

Regardless of discretionary spending pullbacks, August knowledge revealed constructive offsetting traits that counsel underlying shopper stability. Time Looking On-line rose 4.7% month-over-month, in keeping with digital planning and pre-holiday engagement patterns.

Out of House Motion climbed 2.0% month-over-month, suggesting Individuals proceed spending within the bodily world regardless of tightening budgets. This metric signifies sustained engagement with brick-and-mortar retail environments and repair institutions.

Retail Visitation Index inched up 2.2% month-over-month, representing a modest however notable enhance given declines in discretionary classes. The uptick demonstrates shoppers keep procuring behaviors whereas turning into extra selective about purchases.

These forward-looking indicators replicate evolving shopper priorities formed by each fast wants and longer-term warning. The overarching end result presents a shopper who’s selective and considerate moderately than impulsive, reallocating spend as an alternative of lowering exercise completely.

Purchase advertisements on PPC Land. PPC Land has commonplace and native advert codecs by way of main DSPs and advert platforms like Google Advertisements. By way of an public sale CPM, you possibly can attain {industry} professionals.

Financial uncertainty shapes advertising methods

The Zeta Financial Index knowledge arrives as advertising professionals navigate altering shopper habits patterns and economic uncertainty affects advertising spending. Earlier evaluation from PPC Land has documented how retail spending slowdowns impression digital promoting budgets, notably as retail media has emerged because the fastest-growing promoting section.

When shopper spending contracts, retailers usually regulate their advertising budgets accordingly, probably impacting the promoting ecosystem that has benefited from strong e-commerce development. The selective nature of present shopper habits suggests entrepreneurs should adapt methods to align with extra deliberate buy patterns.

The timing coincides with broader traits in digital promoting, the place performance marketing basics remain challenging despite AI advances. Trade evaluation reveals as much as 25% of efficiency media spend being misallocated throughout digital promoting campaigns, highlighting operational challenges that compound during times of shopper uncertainty.

Actual-time measurement gives aggressive benefit

Not like survey-based gauges or lagging studies, the Zeta Financial Index synthesizes real-time shopper habits alerts to disclose intent earlier than it turns into spending. This functionality gives entrepreneurs with main indicators moderately than reactive knowledge about accomplished transactions.

The system’s capacity to trace forward-looking intent turns into notably helpful during times of financial uncertainty. Whereas conventional metrics would possibly present declining spending, the index identifies the place demand is forming subsequent, enabling entrepreneurs to seize development alternatives whereas opponents wait on lagging studies.

Current developments in consumer data collection demonstrate similar real-time capabilities, as NIQ expanded its shopper panel to incorporate 250,000 individuals for enhanced market insights. These measurement capabilities replicate industry-wide recognition that conventional survey-based analysis strategies could not present ample velocity or granularity for present market circumstances.

Shopper belief evolution impacts knowledge methods

The August rebalancing patterns coincide with evolving shopper attitudes towards knowledge assortment and privateness. Analysis from PPC Land revealed that consumer trust crisis hits marketing as AI data use sparks privacy concerns, with 59% of shoppers opposing AI coaching use whereas demanding clearer knowledge controls.

These privateness issues create further complexity for entrepreneurs making an attempt to grasp shopper habits throughout unsure financial intervals. The Zeta Financial Index strategy of synthesizing behavioral alerts with out counting on individual-level monitoring could turn into more and more helpful as privateness laws tighten and shopper resistance to knowledge assortment grows.

The intersection of financial uncertainty and privateness issues suggests profitable advertising methods should steadiness personalization advantages with consumer management and transparency necessities. Firms that may show worth alternate for shopper knowledge whereas respecting privateness preferences could keep aggressive benefits throughout financial volatility.

Technical infrastructure allows complete monitoring

The Zeta Financial Index infrastructure processes alerts from over 245 million shoppers throughout a number of touchpoints and channels. This scale allows detection of delicate behavioral shifts which may not seem in smaller knowledge units or conventional analysis methodologies.

The system’s mixture of spend knowledge, searching patterns, credit score indicators, and life-event alerts gives multidimensional views of shopper intent. This complete strategy addresses limitations in single-source measurement techniques that will miss cross-channel habits patterns or fail to detect early-stage intent formation.

Current technological developments show related complete approaches, as Microsoft Clarity bridges ad gap with AI insights to supply unified views of promoting efficiency and behavioral analytics. These built-in measurement approaches replicate {industry} motion towards holistic moderately than siloed knowledge evaluation.

Implications for advertising funds allocation

The August findings counsel advertising professionals ought to put together for continued shopper selectivity moderately than widespread spending collapse. The excellence between rebalancing and retreating implies alternatives for manufacturers that may align messaging and concentrating on with evolving shopper priorities.

Classes exhibiting resilience, reminiscent of eating and retail staples, could warrant sustained or elevated advertising funding. Conversely, sectors experiencing pullbacks like automotive and monetary providers could profit from methods centered on sustaining model consciousness moderately than fast conversion stress.

The forward-looking indicators suggesting continued digital engagement and bodily world exercise level to alternatives throughout each on-line and offline channels. Nonetheless, the emphasis on selective habits implies inventive and concentrating on methods should show clear worth propositions moderately than counting on impulse-driven messaging.

Methodology and knowledge limitations

The Zeta Financial Index gives real-time shopper habits insights however shouldn’t be thought of funding recommendation or be relied upon to make funding choices, in line with firm disclosures. The index represents shopper habits patterns moderately than predictive financial forecasting.

The Financial Stability Index rating of 65.3 for Q3 2025, down 0.8% quarter-over-quarter, represents predicted stability for your complete U.S. inhabitants concerning their capacity to resist financial downturns. This measurement gives further context for deciphering month-to-month behavioral adjustments inside broader financial stability patterns.

The measurement system’s reliance on digital alerts and shopper touchpoints could not totally seize habits amongst demographics with restricted digital engagement. Moreover, the system’s deal with U.S. shoppers limits direct applicability to worldwide markets the place completely different financial circumstances and shopper behaviors could prevail.

Subscribe PPC Land publication ✉️ for related tales like this one. Obtain the information every single day in your inbox. Freed from advertisements. 10 USD per yr.

Timeline

Subscribe PPC Land publication ✉️ for related tales like this one. Obtain the information every single day in your inbox. Freed from advertisements. 10 USD per yr.

PPC Land explains

Understanding the terminology utilized in shopper habits evaluation and financial measurement gives important context for deciphering market traits and their implications for advertising methods.

Shopper Habits: The research of how people and households make choices about spending their out there sources on consumption-related gadgets. Within the context of the Zeta Financial Index, shopper habits encompasses each precise buy patterns and forward-looking intent alerts that precede spending choices. This complete strategy allows entrepreneurs to establish rising traits earlier than they totally materialize in gross sales knowledge, offering aggressive benefits for manufacturers that may adapt shortly to shifting preferences.

Financial Index: A composite measurement software that synthesizes a number of knowledge factors to supply a single rating representing total financial well being or shopper exercise. The Zeta Financial Index combines over 20 proprietary alerts together with spend, searching, credit score, and life-event indicators to create a real-time evaluation of U.S. shopper habits. Not like conventional financial indicators that depend on lagging knowledge, this index reveals intent patterns earlier than they translate into precise transactions.

Discretionary Spending: Shopper expenditures on non-essential items and providers that may be postponed or eradicated during times of monetary uncertainty. The August knowledge confirmed Discretionary Spend Propensity dropping 5.7% month-over-month, indicating households prioritized essential purchases whereas lowering non-obligatory spending. This selective strategy displays strategic monetary administration moderately than full spending cessation, distinguishing present patterns from recessionary habits.

Month-over-Month (MoM): A comparability metric that measures adjustments between consecutive months, offering insights into short-term traits and seasonal patterns. The August Financial Index Rating declined 0.9% month-over-month, representing the fifth consecutive month-to-month lower. This measurement strategy allows identification of rising traits whereas filtering out longer-term cyclical variations which may obscure fast market shifts.

Advertising and marketing Methods: Complete plans developed by companies to achieve goal audiences and obtain business targets by means of varied channels and techniques. Present financial uncertainty requires advertising methods that account for selective shopper habits, emphasizing worth propositions and strategic timing. The info suggests profitable methods should steadiness personalization advantages with transparency necessities whereas adapting to altering privateness expectations.

Credit score Line Enlargement Intent: A forward-looking indicator measuring shopper urge for food for elevated borrowing capability, reflecting confidence in future monetary stability. August knowledge confirmed a 22.8% month-over-month decline in Credit score Line Enlargement Intent, representing the steepest retreat in latest months. Nonetheless, year-over-year development of 9% suggests underlying resilience beneath short-term warning, indicating shoppers stay basically optimistic about longer-term prospects.

Retail Visitation Index: A measurement of shopper site visitors to bodily retail places, offering insights into brick-and-mortar engagement patterns. The index elevated 2.2% month-over-month in August regardless of declining discretionary classes, suggesting shoppers maintained procuring behaviors whereas turning into extra selective about precise purchases. This metric helps distinguish between searching intent and conversion probability in bodily retail environments.

Ahead-Trying Indicators: Metrics that predict future shopper habits based mostly on present intent alerts moderately than accomplished transactions. These embody Time Looking On-line (up 4.7% month-over-month) and Out of House Motion (up 2.0% month-over-month). Such indicators present entrepreneurs with early warning techniques about altering shopper priorities, enabling proactive technique changes earlier than opponents acknowledge rising traits.

12 months-over-12 months (YoY): A comparability metric that measures adjustments between the identical interval in consecutive years, serving to establish longer-term traits whereas accounting for seasonal differences. Whereas many month-to-month indicators confirmed declines, a number of year-over-year measurements remained constructive, reminiscent of Credit score Line Enlargement Intent up 9% and eating class up 13 factors. This angle helps distinguish between momentary volatility and basic shifts in shopper habits.

Huge-Ticket Classes: Excessive-value shopper purchases that usually require vital monetary dedication and cautious consideration, reminiscent of automotive and main home equipment. The info confirmed sustained pullbacks in these classes, with Automotive Buy Intent declining 7.1% month-over-month and automotive sector dropping 20 factors year-over-year. These patterns replicate shopper warning about main monetary commitments throughout unsure financial intervals, suggesting prolonged gross sales cycles and elevated emphasis on worth demonstration for costly merchandise.

Subscribe PPC Land publication ✉️ for related tales like this one. Obtain the information every single day in your inbox. Freed from advertisements. 10 USD per yr.

Abstract

Who: Zeta International analyzed shopper habits patterns affecting over 245 million shoppers throughout the USA, with implications for advertising professionals and retailers nationwide.

What: The August 2025 Zeta Financial Index declined 0.9% month-over-month to 67.2, exhibiting shoppers rebalancing spending priorities moderately than wholesale retreat from purchases. Discretionary spending dropped whereas forward-looking indicators like on-line searching and retail visitation remained secure.

When: Information covers August 2025 shopper habits, with outcomes introduced September 2, 2025. The index exhibits the fifth consecutive month-to-month decline, with patterns rising from July traits persevering with into back-to-school season.

The place: Evaluation focuses on United States shopper habits throughout a number of sectors together with retail, automotive, eating, journey, monetary providers, healthcare, and expertise, with knowledge collected nationwide by means of digital and bodily touchpoints.

Why: Financial uncertainty, labor market issues, and elevated warning round big-ticket purchases drove shoppers towards selective spending patterns. Again-to-school wants and seasonal elements supplied offsetting constructive traits, whereas ongoing privateness issues and advertising effectiveness challenges created further complexity for companies making an attempt to grasp and reply to altering shopper priorities.

Source link