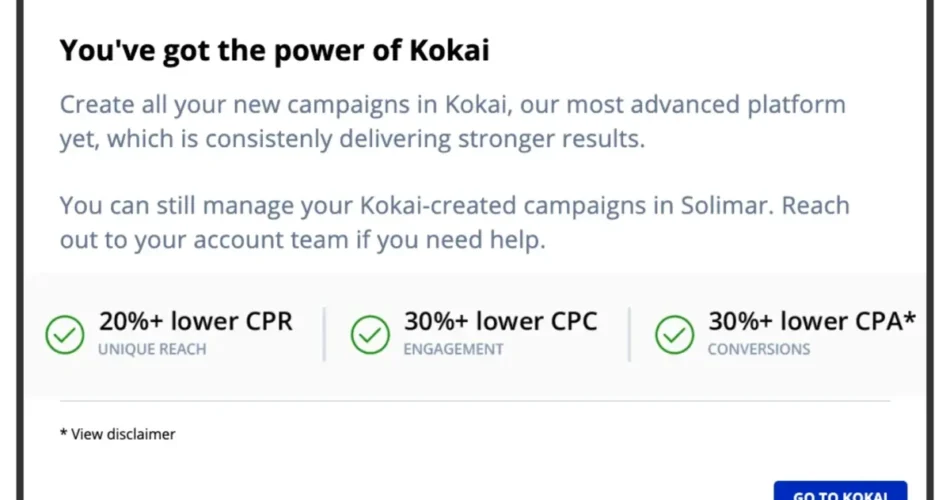

The Commerce Desk has begun proscribing businesses from launching new campaigns with out utilizing its Kokai platform, in accordance with inside notifications showing within the firm’s legacy Solimar interface. In keeping with Reddit posts from media consumers on August 13, 2025, customers trying to create campaigns by means of Solimar are actually introduced with messages directing them to “create all of your new campaigns in Kokai” whereas nonetheless permitting administration of Kokai-created campaigns by means of the older interface.

The notification comes regardless of assurances from The Commerce Desk that businesses may proceed utilizing their most well-liked interface. In keeping with a supply accustomed to Kokai’s growth speaking to AdExchanger, the restriction seems when “the media purchaser’s company or its mother or father holding firm determined to change to utilizing Kokai for all new marketing campaign creation.”

Platform transition challenges

The pressured migration to Kokai has generated resistance from programmatic promoting professionals. In keeping with suggestions posted on Reddit’s programmatic marketing community on March 16, 2025, one media purchaser criticized the platform’s person interface, stating that “ttd UI turned shit and overloaded” and that the periodic table-style menu system is “not intuitive.” The identical person famous that whereas The Commerce Desk “in all probability one of the best DSP” by way of options, “virtually each function prices extra cash.”

A number of {industry} professionals have expressed issues about Kokai’s performance in comparison with Solimar. In keeping with a remark from August 13, 2025, one dealer reported that “conversions dropped, cpm went wild and altering issues takes an excessive amount of time.” One other person described the platform transition as inflicting “aggressive” modifications that require “seemingly non publicized” strikes.

The Commerce Desk launched Kokai on June 6, 2023, as “a brand new strategy to digital promoting innovation that comes with main advances in distributed synthetic intelligence (AI), measurement, associate integrations and a revolutionary, intuitive person expertise.” In keeping with the corporate’s announcement, the platform was designed to course of greater than 13 million promoting impressions each second, with every impression probably containing 1000’s of distinct indicators.

Monetary efficiency decline

The platform transition has coincided with declining monetary metrics for The Commerce Desk. In keeping with the corporate’s February 12, 2025 earnings report, This fall 2024 income reached $741.01 million, lacking market expectations and representing development of twenty-two.3% year-over-year. This marked a big deceleration from the corporate’s earlier constant 25%-plus development charge.

The Commerce Desk’s Q1 2025 steering tasks income of “a minimum of $575 million,” translating to roughly 17% year-over-year development in accordance with analyst Stephen Ayers. The corporate’s inventory worth has declined 55% since November 2024, reflecting investor issues concerning the platform transition.

In the course of the February earnings name, CEO Jeff Inexperienced acknowledged implementation challenges, noting that the corporate had undergone its “largest reorganization in firm historical past in December.” The mixture of this reorganization and the slower-than-expected Kokai implementation seems to have created operational inefficiencies.

Technical implementation particulars

Kokai distributes synthetic intelligence capabilities throughout all facets of the digital media shopping for course of. In keeping with The Commerce Desk’s technical documentation, the platform’s AI improvements embody predictive clearing for optimum bidding, impression scoring primarily based on advertiser relevance, improved measurement and forecasting, elevated resilience with out identifiers, finances optimization, and KPI scoring.

The platform builds on The Commerce Desk’s pioneering AI work with Koa, launched in 2018. Whereas Koa assisted entrepreneurs in marketing campaign setup and efficiency optimization, Kokai distributes AI capabilities throughout varied facets of media shopping for on The Commerce Desk platform.

Recent updates to Kokai have targeted on bettering search capabilities and portfolio administration effectivity. In keeping with firm documentation from June 12, 2025, the platform now consists of “improved function discoverability” and “expanded search performance” permitting customers to go looking by advertiser, marketing campaign, or advert group along with looking out by associate.

The platform additionally options bulk modifying capabilities throughout advert teams. In keeping with documentation from June 11, 2025, media consumers can now “edit quicker with the power to regulate a number of advert teams without delay with out leaping from marketing campaign to marketing campaign” and may “filter by key efficiency indicator (KPI)” to shortly discover campaigns tied to particular objectives.

Company adoption patterns

Regardless of technical enhancements, some businesses are actively shifting away from The Commerce Desk because of Kokai implementation challenges. In keeping with a Reddit submit from March 16, 2025, one company consultant acknowledged they have been “actively shifting away from TTD due to this product for 2026 planning” and could be “onboarding” different platforms together with “DV360 & Yahoo largely.”

The identical person defined that the choice was pushed by performance and dealer effectivity issues somewhat than value concerns. “That is largely about performance and our dealer’s time in platform, time = cash, to say that it is ‘2 clicks’ essentially misunderstands the size and complexity of an enterprise buying and selling operation,” they famous.

Trade suggestions means that bulk add performance has been lowered with the Kokai transition. In keeping with feedback from March 16, 2025, options like fold placement optimization for viewability and engagement “now not in a position to be up to date through bulk add.” Moreover, enabling or disabling Koa optimizations for performance-based campaigns “just isn’t attainable to do through bulk add.”

The Commerce Desk maintains that over 70% of consumer spend now flows by means of Kokai as of Q2 2025. Nonetheless, the corporate’s purpose to achieve full consumer migration to Kokai by the tip of 2025 faces obstacles from businesses that want the legacy Solimar interface.

Trade implications

The pressured adoption of Kokai highlights broader tensions in programmatic promoting expertise adoption. In keeping with {industry} evaluation from February 21, 2025, some observers recommend The Commerce Desk’s platform modifications mirror a strategic shift towards direct model partnerships and away from conventional company relationships.

Chris Vanderhook, Co-Founder & COO of Viant Expertise, suggested in February 2025 that “TTD now treats businesses as a pass-through” and that “company reluctance to undertake Kokai” represented “the ultimate straw” in deteriorating relationships.

For the advertising and marketing neighborhood, these platform transitions reveal the challenges of balancing innovation with person expertise. In keeping with PPC Land’s previous analysis, the slower-than-expected Kokai implementation has created operational inefficiencies regardless of the platform’s superior AI capabilities.

The Commerce Desk’s strategy contrasts with opponents who’ve maintained parallel methods throughout main platform updates. The corporate’s determination to limit new marketing campaign creation to Kokai suggests confidence within the platform’s long-term worth regardless of present person resistance.

Govt departures

The Kokai transition has coincided with important management modifications at The Commerce Desk. Invoice Simmons, former VP of Product, introduced his departure on March 14, 2025, simply days after {industry} critics shared skepticism concerning the Kokai platform on social media.

In his LinkedIn departure announcement, Simmons acknowledged the timing of his exit, stating: “It is not misplaced on me that the exact same week that I am saying my departure, many critics of TTD’s Kokai platform are sharing their skepticism on social media.” Regardless of leaving, Simmons defended the platform, describing it as “a daring, basic reinvention of what a DSP may be, dramatically bettering promoting high quality and worth throughout the Open Web.”

Simmons steered that critics “solely see the floor—they have not seen the entire image but” and expressed continued perception in Kokai’s potential. He famous that “the most important concepts all the time face a tidal wave of doubt” when addressing platform skepticism.

The chief departure adopted The Commerce Desk’s December 2024 reorganization, which CEO Jeff Inexperienced described as the corporate’s “largest reorganization in firm historical past.” The restructuring included streamlining client-facing groups and reorganizing engineering operations into 100 scrum groups.

Present platform capabilities

Kokai now consists of a number of measurement improvements designed for linked TV and retail media channels. The platform options retail measurement information from associate retailers together with Albertsons Media Collective and Walgreens Promoting Group when viewers information is enabled.

The system incorporates three measurement indices: the Retail Gross sales Index for measuring on-line and offline retail gross sales towards retail advert spend; the TV High quality Index for assessing viewer advert experiences throughout streaming platforms; and the High quality Attain Index to assist entrepreneurs develop their buyer base by means of related profile focusing on.

The platform additionally includes a Associate Portal for streamlined integrations, permitting 1000’s of companions to attach straight with The Commerce Desk utilizing standardized adapters. This portal helps integrations for OpenPath, Unified ID 2.0, retail onboarding, measurement, third-party viewers information, and contextual focusing on.

Latest updates have targeted on marketing campaign administration effectivity. In keeping with documentation from July 13, 2025, Kokai now consists of instruments designed to “improve management and visibility of adverts throughout channels” with “quick and accessible” performance for managing “advanced, omnichannel campaigns.”

Market outlook

The Commerce Desk continues growing new merchandise regardless of Kokai implementation challenges. The corporate introduced “Ventura” in November 2024, described as a “new streaming TV working system” designed to supply a “a lot cleaner provide chain for streaming TV promoting.”

Digital promoting represents a considerable development alternative with an estimated whole addressable market of roughly $1 trillion and a 14.5% compound annual development charge. Related TV and retail media networks symbolize notably promising segments inside this market.

Nonetheless, The Commerce Desk faces ongoing challenges together with competitors from expertise giants like Alphabet and Meta, privateness regulation modifications, and the decline of third-party cookies. Whereas the corporate’s Unified ID 2.0 initiative goals to handle privateness issues, industry-wide adoption stays unsure.

The corporate maintains robust monetary fundamentals with $1.369 billion in money and money equivalents, $552 million in short-term investments, and a present ratio close to 2. Buyer retention charges exceed 95%, and the platform processed $12 billion in gross spend in FY24.

Timeline

- June 6, 2023: The Trade Desk launches Kokai platform with distributed AI capabilities, measurement instruments, Associate Portal, and The Programmatic Desk interface

- November 2024: The Commerce Desk pronounces “Ventura,” a brand new streaming TV working system anticipated to launch in H1 2025

- December 2024: The Trade Desk undergoes its “largest reorganization in company history”

- February 12, 2025: Q4 2024 earnings report shows slowing growth at 22.3% year-over-year, lacking expectations

- February-March 2025: Firm inventory worth drops 55% from November ranges

- March 14, 2025: VP of Product Bill Simmons announces departure from The Commerce Desk whereas defending Kokai towards {industry} criticism

- June 9, 2025: Trade Desk launches Deal Desk to handle promoting offers

- June 11, 2025: Work extra effectively in Kokai’s portfolio view replace launched

- June 12, 2025: Get to know Kokai’s new search capabilities replace launched

- July 13, 2025: Meet the Kokai instruments designed to save lots of you time replace launched

- August 13, 2025: Customers report pressured Kokai adoption for brand spanking new marketing campaign creation

Subscribe PPC Land e-newsletter ✉️ for related tales like this one. Obtain the information day-after-day in your inbox. Freed from adverts. 10 USD per yr.

Abstract

Who: The Commerce Desk, a number one programmatic promoting platform headquartered in Ventura, California, with businesses and media consumers utilizing the platform globally.

What: The Commerce Desk has begun proscribing new marketing campaign creation on its legacy Solimar interface, forcing customers to undertake its newer Kokai platform. This transition has generated important resistance from customers preferring the older system’s performance and interface design.

When: The pressured adoption was first reported by customers on August 13, 2025, although the Kokai platform was initially launched on June 6, 2023. The transition has been ongoing for almost two years with various ranges of person adoption.

The place: The restrictions seem inside The Commerce Desk’s platform interface globally, affecting businesses and advertisers who beforehand relied on the Solimar system for marketing campaign administration and creation.

Why: The Commerce Desk goals to finish migration of all shoppers from Solimar to Kokai by the tip of 2025, selling the newer platform’s synthetic intelligence capabilities and superior measurement instruments. Nonetheless, the pressured adoption comes amid person complaints about interface design, lowered performance, and implementation challenges which have impacted the corporate’s monetary efficiency and led to government departures.

Subscribe PPC Land e-newsletter ✉️ for related tales like this one. Obtain the information day-after-day in your inbox. Freed from adverts. 10 USD per yr.

PPC Land explains

Kokai Platform: The Commerce Desk’s next-generation promoting expertise platform launched on June 6, 2023, designed to interchange the legacy Solimar system. Kokai incorporates distributed synthetic intelligence capabilities throughout all facets of digital media shopping for, processing greater than 13 million promoting impressions per second with every impression probably containing 1000’s of distinct indicators. The platform represents a basic architectural shift from reactive optimization to predictive decisioning, utilizing AI algorithms for bid clearing, impression scoring, measurement forecasting, and finances optimization throughout programmatic promoting campaigns.

The Commerce Desk: A publicly traded demand-side platform (DSP) headquartered in Ventura, California, that permits advertisers to buy digital promoting stock throughout web sites, cellular functions, and streaming providers by means of real-time bidding auctions. Based by CEO Jeff Inexperienced, the corporate went public in 2016 and has positioned itself as an impartial different to promoting platforms operated by main expertise corporations. The Commerce Desk generated $2.4 billion in income in 2024 whereas processing $12 billion in gross promoting spend by means of its platform.

Solimar: The Commerce Desk’s legacy promoting platform that preceded Kokai, utilized by businesses and advertisers for programmatic marketing campaign administration from roughly 2018 by means of 2025. Solimar featured a standard interface design that many customers discovered intuitive for marketing campaign setup, optimization, and reporting. The platform supported handbook marketing campaign creation, bulk modifying capabilities, and complete portfolio administration instruments that skilled merchants most well-liked for advanced enterprise-level promoting operations earlier than the pressured migration to Kokai.

Synthetic Intelligence (AI): Machine studying algorithms built-in all through Kokai’s structure to automate and optimize promoting selections in real-time. The Commerce Desk’s AI implementation builds on their earlier Koa system, distributing predictive capabilities throughout bidding methods, viewers focusing on, inventive optimization, and efficiency measurement. These AI methods analyze huge datasets to make split-second selections about advert placements, routinely adjusting campaigns primarily based on efficiency indicators and market circumstances to enhance advertiser return on funding.

Marketing campaign Administration: The method of making, optimizing, and monitoring digital promoting campaigns throughout a number of channels and platforms. Inside The Commerce Desk ecosystem, marketing campaign administration entails setting focusing on parameters, finances allocation, inventive asset task, and efficiency monitoring by means of both the legacy Solimar interface or the newer Kokai platform. Efficient marketing campaign administration requires balancing attain goals, value effectivity, and model security concerns whereas navigating advanced programmatic promoting environments.

Platform Transition: The technical and operational technique of migrating customers from The Commerce Desk’s legacy Solimar system to the newer Kokai platform, initiated in June 2023 and anticipated to finish by finish of 2025. This transition entails transferring marketing campaign information, retraining customers on new interface designs, updating API integrations, and guaranteeing continuity of promoting operations. The transition has confronted resistance because of interface complexity, lowered performance in sure areas, and operational disruptions affecting company workflows and marketing campaign efficiency.

Programmatic Promoting: Automated shopping for and promoting of digital promoting stock by means of real-time bidding auctions, enabling exact viewers focusing on and environment friendly finances allocation throughout web sites, cellular apps, and streaming platforms. Programmatic methods use information indicators and algorithms to make instantaneous selections about advert placements, permitting advertisers to achieve particular demographics whereas publishers maximize income from their obtainable stock. The Commerce Desk operates as a demand-side platform inside this ecosystem, representing advertiser pursuits in programmatic transactions.

Person Interface: The visible and interactive components by means of which advertisers and businesses entry The Commerce Desk’s platform performance, together with navigation methods, information visualization instruments, and marketing campaign administration workflows. Kokai launched a “Periodic Desk” design idea that organizes options into tile-based layouts, contrasting with Solimar’s extra conventional menu construction. Interface design considerably impacts person adoption charges, operational effectivity, and general platform satisfaction amongst buying and selling professionals who spend in depth time managing campaigns.

Related TV (CTV): Tv content material delivered by means of internet-connected gadgets together with good TVs, streaming sticks, and gaming consoles, representing The Commerce Desk’s largest and fastest-growing promoting channel. CTV permits advertisers to mix the visible impression and premium content material affiliation of conventional tv with the exact focusing on and measurement capabilities of digital promoting. The Commerce Desk’s platform reaches over 90 million households by means of CTV, capitalizing on the shift from linear tv consumption to streaming providers.

Income Progress: The share improve in The Commerce Desk’s quarterly and annual monetary efficiency, which has decelerated from constant 25%-plus development charges to 22.3% year-over-year in This fall 2024 and projected 17% development for Q1 2025. This slowdown coincides with the Kokai platform transition challenges and has contributed to investor issues, leading to a 55% inventory worth decline since November 2024. Income development serves as a key indicator of platform adoption success and market competitiveness within the programmatic promoting sector.

Source link