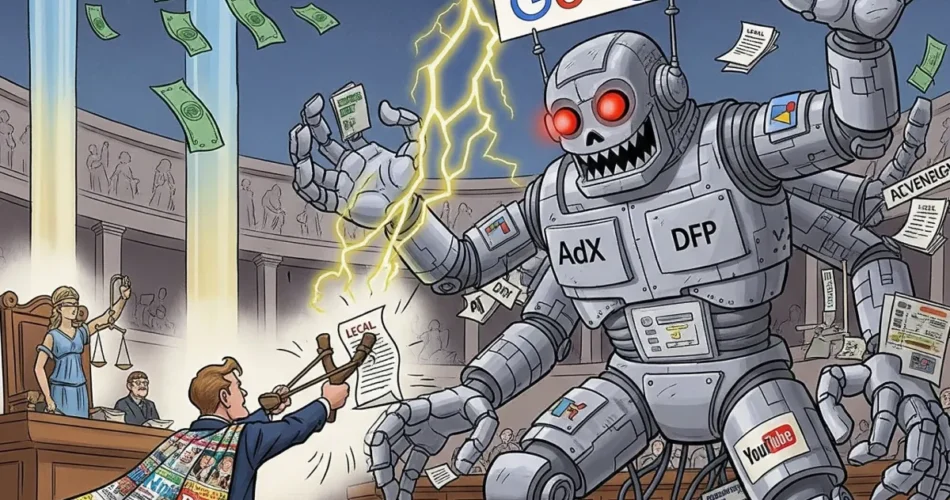

Dotdash Meredith Inc., the nation’s largest mixed digital and print writer working over 40 manufacturers together with Folks, Higher Properties & Gardens, and Investopedia, filed a complete antitrust lawsuit towards Google LLC on August 29, 2025, within the Southern District of New York. The criticism alleges Google’s monopolistic management of digital promoting expertise has brought on substantial monetary hurt to publishers and violated federal antitrust legal guidelines.

The 88-page criticism facilities on Google’s management of essential promoting expertise infrastructure that publishers depend upon to monetize their content material. In accordance with the submitting, Google monopolizes each the writer advert server market with over 90% market share by means of its DoubleClick for Publishers (DFP) platform and controls 60-70% of the advert change market by means of DoubleClick Advert Change (AdX). The lawsuit seeks financial damages, injunctive reduction, and restoration of aggressive situations in digital promoting markets.

In accordance with court docket paperwork, Dotdash Meredith serves greater than 175 million month-to-month customers—exceeding 60% of the U.S. inhabitants—throughout properties spanning well being, finance, leisure, and life-style content material. The writer operates 1.25 million on-line articles utterly free to shoppers, funded primarily by means of digital promoting income from tons of of thousands and thousands of day by day advert impressions.

Subscribe PPC Land publication ✉️ for comparable tales like this one. Obtain the information day-after-day in your inbox. Freed from adverts. 10 USD per yr.

Technical manipulation detailed in court docket submitting

The criticism outlines particular technical mechanisms Google allegedly employed to control promoting auctions and exclude opponents. Courtroom paperwork describe “Final Look” benefits that allowed Google’s change to view opponents’ bids earlier than submitting its personal, enabling it to win impressions by bidding only one penny above rival exchanges.

In accordance with the submitting, Google carried out “Venture Bernanke” starting in 2013, which manipulated inner public sale mechanics to depress writer income whereas rising Google’s earnings. Courtroom paperwork point out Google workers internally acknowledged the scheme was “inherently unfair” and operated below secrecy insurance policies, with one worker stating “the primary rule of Bernanke is we do not discuss Bernanke.”

The lawsuit describes Google’s “Enhanced Dynamic Allocation” system, which allegedly pressured publishers to make all stock obtainable to Google’s change, together with high-value direct offers beforehand reserved for particular advertisers. In accordance with the criticism, this method converts direct promoting agreements into non permanent costs that Google’s change can undercut by minimal quantities, probably displacing assured advertiser commitments.

Courtroom paperwork element “Dynamic Income Share” practices that allegedly allowed Google to selectively regulate its fee charges based mostly on opponents’ bids. The submitting signifies Google may cut back its commonplace 20% charge for aggressive impressions whereas rising prices for much less contested advert area, sustaining common fee ranges whereas successful extra market share.

Monetary impression on publishing trade

In accordance with the criticism, Google’s digital promoting manipulations have generated roughly $30 billion yearly for the corporate whereas systematically decreasing writer revenues. The submitting signifies these practices have compressed the premium that direct promoting gross sales historically commanded over programmatic purchases, with Dotdash Meredith experiencing a 50% discount in that premium differential.

Courtroom paperwork describe how Google’s practices pressured publishers into more and more unfavorable phrases. The criticism alleges Google’s “Unified Pricing Guidelines” eradicated publishers’ means to set differential value flooring for numerous exchanges and advertisers, eradicating a main instrument for income optimization and competitor diversification.

The submitting signifies Google’s anticompetitive conduct has resulted in decreased funding in content material creation and fewer promoting impressions obtainable on the market. In accordance with the criticism, truthful competitors would have produced increased writer revenues, enabling higher content material funding and in the end extra priceless promoting stock for entrepreneurs and extra related ads for shoppers.

Authorized precedent established

The lawsuit follows the Japanese District of Virginia’s April 17, 2025 ruling that discovered Google violated federal antitrust legal guidelines by monopolizing writer advert server and advert change markets. In accordance with that court docket’s 115-page opinion, Google “willfully engaged in a sequence of anticompetitive acts to accumulate and preserve monopoly energy” and “considerably harmed Google’s writer clients.”

Choose Leonie Brinkema particularly decided that Google’s conduct constituted illegal tying preparations and exclusionary practices that violated each Sections 1 and a pair of of the Sherman Act. The Virginia court docket discovered Google’s integration of promoting expertise merchandise created “clear conflicts of curiosity” that the corporate exploited to favor its personal companies over opponents.

In accordance with court docket information, that ruling emerged from a January 2023 lawsuit filed by the U.S. Division of Justice together with seventeen state attorneys common. The federal government’s case featured testimony from 39 stay witnesses and 20 deposition witnesses throughout a three-week trial that concluded in September 2024.

Purchase adverts on PPC Land. PPC Land has commonplace and native advert codecs by way of main DSPs and advert platforms like Google Advertisements. By way of an public sale CPM, you possibly can attain trade professionals.

Market focus considerations

The criticism describes an promoting expertise ecosystem the place Google participates at a number of ranges concurrently, creating conflicts of curiosity that hurt each publishers and advertisers. In accordance with the submitting, Google operates the dominant writer advert server, the most important advert change, and main demand-side platforms for each small and enormous advertisers.

Courtroom paperwork point out Google’s management extends past market share percentages to structural benefits that stop efficient competitors. The submitting describes how Google’s search promoting monopoly gives distinctive entry to thousands and thousands of small and medium-sized advertisers who usually use just one demand-side platform, normally Google Advertisements, making Google’s change important for publishers in search of to achieve that advertiser base.

In accordance with the criticism, Google’s acquisition technique has eradicated potential opponents somewhat than creating superior expertise internally. The submitting signifies Google bought DoubleClick in 2008 for its main advert server and change, then acquired rival AdMeld in 2011, which publishers had begun utilizing to introduce change competitors.

Regulatory scrutiny worldwide

The lawsuit references in depth worldwide regulatory consideration to Google’s promoting practices. In accordance with the submitting, the U.Ok. Competitors and Markets Authority concluded Google’s conduct creates conflicts of curiosity however lacked enough regulatory authority to implement cures. The Australian Competitors and Shopper Fee equally recognized dangerous practices and proposed corrective measures.

Courtroom paperwork point out the European Fee filed a case in June 2023 in search of to interrupt up Google’s promoting expertise enterprise. In accordance with the submitting, European regulators decided behavioral cures could be inadequate as a result of “every time a follow was detected by the trade, Google subtly modified its habits in order to make it harder to detect, however with the identical goals, with the identical results.”

The criticism notes the U.S. Home Antitrust Subcommittee studied Google’s conduct throughout 1.3 million paperwork and 7 hearings, concluding Google’s practices hurt “the free and various press” and endanger “political and financial liberty.”

Technical market manipulation

Courtroom paperwork present detailed technical descriptions of Google’s alleged manipulation ways. The submitting describes “Venture Poirot,” launched in 2018, which allegedly brought on a 20-30% income drop for header-bidding exchanges whereas Google’s personal show platform misplaced just one.9% of income by means of bid deflation towards non-Google exchanges.

In accordance with the criticism, Google carried out “Minimal Bid to Win” in 2019 as a substitute for its “Final Look” benefit. The submitting signifies this method gives successful bidders with details about the second-highest bid value after auctions conclude, which Google allegedly makes use of to tell comparable future auctions by means of predictive algorithms.

The lawsuit describes how Google redacted essential information fields in 2018 that beforehand allowed publishers to check successful bids between completely different promoting exchanges. In accordance with the submitting, these “KeyPart” and “TimeUsec2” information fields enabled publishers to optimize their header-bidding methods, however their elimination decreased publishers’ means to detect and counteract Google’s anticompetitive conduct.

Writer income diversification efforts

Courtroom paperwork point out publishers have tried numerous methods to cut back dependence on Google’s platforms. The submitting describes client-side header bidding as a technical resolution that allowed a number of exchanges to compete in real-time for every promoting impression, initially producing favorable outcomes for publishers by means of elevated competitors and better costs.

In accordance with the criticism, Google’s responses to header bidding included technical limitations and preferential remedy for its personal change that undermined the aggressive advantages. The submitting describes how Google’s advert server continued offering inside info to Google’s change even when publishers carried out header bidding, sustaining synthetic benefits over opponents.

The lawsuit signifies Google actively discouraged adoption of client-side header bidding by means of misrepresentations about its server-side different referred to as “Change Bidding.” In accordance with court docket paperwork, Google workers internally acknowledged that change bidding’s claimed advantages had been “merely a narrative to discourage publishers from utilizing client-side header bidding.”

Timeline

The criticism traces Google’s promoting expertise dominance throughout a number of acquisitions and product integrations spanning over 15 years. The submitting signifies systematic implementation of anticompetitive practices started shortly after Google’s 2008 DoubleClick acquisition, with manipulation packages like Venture Bernanke working from 2013 by means of 2019.

In accordance with court docket paperwork, Google’s 2018 rebranding of DoubleClick merchandise as “Google Advert Supervisor” contractually tied beforehand separate advert server and change companies collectively, making it not possible for publishers to entry Google’s change with out additionally utilizing Google’s advert server.

The lawsuit signifies Google’s implementation of Unified Pricing Guidelines in 2019 eradicated publishers’ means to set differential value flooring, which had served as their main instrument for introducing competitors and mitigating Google’s dominance in promoting expertise markets.

- 2008: Google acquires DoubleClick for $3.1 billion, acquiring dominant advert server and change (following OpenX antitrust precedent)

- 2013: Venture Bernanke launched to control promoting auctions and depress writer income

- 2014: Enhanced Dynamic Allocation and Dynamic Income Share carried out (after DOJ antitrust victory)

- 2018: Google rebrands merchandise as Google Advert Supervisor, contractually tying advert server to change

- 2019: Unified Pricing Guidelines remove differential value flooring for publishers (amid growing regulatory scrutiny)

- January 2023: DOJ information antitrust lawsuit towards Google for advert tech monopolization

- April 17, 2025: Japanese District of Virginia guidelines Google violated antitrust legal guidelines (landmark court decision)

- August 4, 2025: OpenX information follow-on damages lawsuit (industry response to court ruling)

- August 29, 2025: Dotdash Meredith information complete antitrust lawsuit towards Google

Subscribe PPC Land publication ✉️ for comparable tales like this one. Obtain the information day-after-day in your inbox. Freed from adverts. 10 USD per yr.

Abstract

Who: Dotdash Meredith Inc. (working Folks, Higher Properties & Gardens, Investopedia, and 37+ different manufacturers) filed the lawsuit towards Google LLC and Alphabet Inc. The writer serves 175 million month-to-month customers with utterly free digital content material funded by means of promoting income.

What: Complete antitrust lawsuit alleging Google monopolized writer advert server and advert change markets by means of systematic manipulation together with Venture Bernanke, Final Look benefits, Enhanced Dynamic Allocation, and Unified Pricing Guidelines that artificially depressed writer revenues whereas rising Google’s earnings.

When: Filed August 29, 2025, following the April 17, 2025 Japanese District of Virginia ruling that established Google violated federal antitrust legal guidelines by monopolizing digital promoting expertise markets by means of exclusionary conduct over greater than a decade.

The place: Southern District of New York federal court docket, focusing on Google’s worldwide monopolization of promoting expertise markets that have an effect on each home and worldwide writer revenues by means of built-in manipulation programs.

Why: The lawsuit seeks financial damages and injunctive reduction to revive competitors in promoting expertise markets value tons of of billions yearly, aiming to guard content material creation funding and guarantee truthful competitors for the thousands and thousands of promoting impressions that assist free digital publishing throughout the web.

Subscribe PPC Land publication ✉️ for comparable tales like this one. Obtain the information day-after-day in your inbox. Freed from adverts. 10 USD per yr.

PPC Land explains

Google/AdX (Advert Change): Google’s DoubleClick Advert Change represents the dominant market for purchasing and promoting digital promoting area, controlling 60-70% of the advert change market in response to court docket findings. AdX operates as a two-sided platform connecting publishers promoting advert stock with advertisers in search of to buy that area by means of real-time auctions. The lawsuit alleges Google leveraged AdX’s market dominance to implement anticompetitive practices together with Final Look benefits and preferential entry to distinctive advertiser demand from Google’s search platform.

Writer/Publishers: Digital content material corporations like Dotdash Meredith that create web sites, articles, and different on-line media funded primarily by means of promoting income. Publishers promote promoting area on their properties to generate revenue that helps content material creation, with bigger publishers like Dotdash Meredith serving tons of of thousands and thousands of month-to-month customers throughout dozens of manufacturers. The lawsuit facilities on how Google’s practices systematically decreased writer revenues by manipulating the promoting public sale course of and limiting aggressive alternate options.

Promoting/Advert: The digital advertising ecosystem the place corporations pay to show promotional messages alongside writer content material, representing a $200 billion annual market that funds most free on-line content material. Trendy digital promoting operates by means of complicated real-time auctions the place advertisers bid on particular person web page views inside milliseconds, with refined focusing on based mostly on consumer habits and content material context. The case alleges Google’s management of a number of layers of this ecosystem created conflicts of curiosity that harmed each advertisers in search of truthful entry and publishers in search of aggressive income.

Market/Markets: The outlined financial areas the place competitors happens, particularly the writer advert server market and advert change marketplace for open-web show promoting that the Virginia court docket discovered Google monopolized. These markets contain distinct merchandise with separate features, although Google’s integration of companies throughout market boundaries allegedly created anticompetitive benefits. The lawsuit seeks to revive aggressive situations in these markets by means of financial damages and injunctive reduction requiring Google to compete pretty somewhat than by means of exclusionary practices.

Stock: The promoting area obtainable on writer web sites and cellular functions, consisting of particular person impressions that may show ads to customers visiting these properties. Publishers handle stock by means of refined forecasting and allocation programs that decide which ads seem wherein places and to which audiences. Google’s alleged manipulation of stock allocation by means of Enhanced Dynamic Allocation and different practices kinds a central factor of the antitrust claims, as these programs reportedly diverted high-value stock to Google’s change at below-market costs.

Change/Exchanges: Digital marketplaces that facilitate real-time auctions between publishers promoting promoting area and demand-side platforms representing advertiser pursuits. Exchanges function as intermediaries that accumulate bids from a number of consumers, choose winners, and deal with transaction processing whereas taking percentage-based charges for his or her companies. The lawsuit alleges Google used its advert server monopoly to drawback competing exchanges by means of info asymmetries and preferential remedy that prevented truthful competitors.

Income: The revenue publishers generate from promoting promoting area, which funds content material creation, expertise infrastructure, and enterprise operations for digital media corporations. Publishers usually earn income by means of each direct gross sales to particular advertisers and programmatic gross sales by means of exchanges, with completely different channels commanding various value premiums. The criticism alleges Google’s practices systematically depressed writer income under aggressive ranges whereas rising Google’s personal earnings by means of manipulated public sale mechanisms.

Public sale/Auctions: The true-time bidding processes that decide which ads seem on writer web sites, occurring inside milliseconds as customers load webpages. These auctions contain complicated interactions between advert servers, exchanges, and demand-side platforms that accumulate bids and decide winners based mostly on value and focusing on standards. The lawsuit particulars how Google allegedly manipulated public sale mechanics by means of initiatives like Bernanke and Final Look to safe unfair benefits over opponents whereas decreasing funds to publishers.

Competitors/Aggressive: The financial precept that a number of companies ought to compete pretty for enterprise alternatives, resulting in innovation, effectivity, and shopper advantages by means of market forces. Antitrust regulation protects aggressive processes by stopping monopolization and exclusionary practices that hurt rivals and in the end shoppers. The case argues Google’s conduct violated competitors rules through the use of its market energy to foreclose rivals somewhat than competing on product high quality or effectivity.

Federal/Antitrust: The physique of U.S. regulation designed to forestall monopolization and promote aggressive markets, primarily enforced by means of the Sherman Act and Clayton Act by the Division of Justice and Federal Commerce Fee. Federal antitrust enforcement has elevated considerably towards expertise corporations in recent times, with Google going through a number of simultaneous circumstances throughout search and promoting markets. This lawsuit represents non-public enforcement following profitable authorities prosecution, in search of financial damages and injunctive reduction below the identical authorized theories that proved profitable within the Japanese District of Virginia case.

Source link