Ziff Davis delivered strong second-quarter monetary outcomes on August 6, 2025, with whole revenues climbing 9.8% to $352.2 million in comparison with $320.8 million within the prior 12 months interval. The technology-focused digital media firm exceeded analyst expectations whereas persevering with its transformation by way of strategic acquisitions and synthetic intelligence deployment throughout its promoting platforms.

The corporate reported adjusted earnings per share of $1.24, surpassing the consensus estimate of $1.22. Income efficiency marked the strongest quarterly progress since 2021, representing 4 consecutive quarters of year-over-year income will increase. Internet earnings reached $26.3 million for the quarter, with adjusted EBITDA rising 11.8% to $107.7 million.

Subscribe the PPC Land publication ✉️ for related tales like this one. Obtain the information every single day in your inbox. Freed from adverts. 10 USD per 12 months.

Promoting section drives efficiency

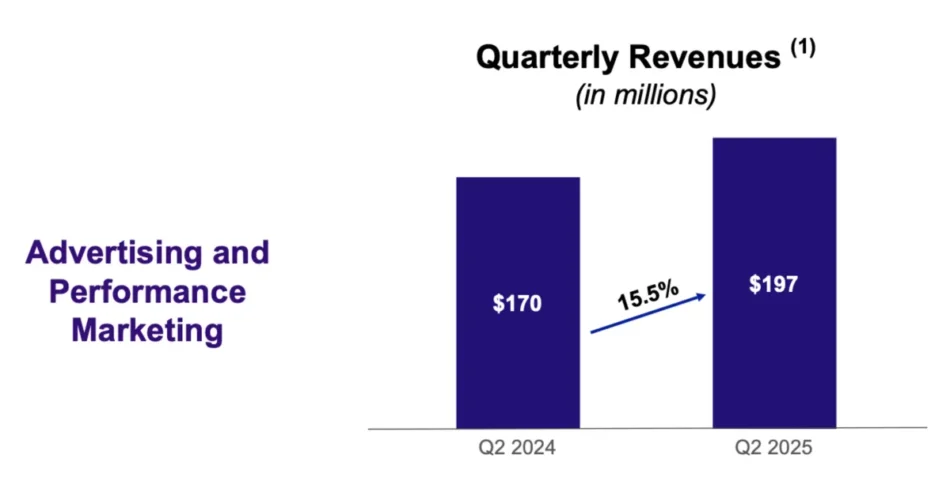

Promoting and efficiency advertising and marketing revenues surged 15.5% to $197 million through the quarter, based on Ziff Davis monetary statements. The expansion primarily stemmed from the corporate’s Well being & Wellness section, which generated $82.5 million in promoting revenues, and Expertise & Buying section, which contributed $78.8 million.

CEO Vivek Shah emphasised the importance of owned and operated net site visitors within the firm’s promoting technique. “35% of the corporate’s whole revenues are adverts on our O&O net site visitors, and about 40% of that comes from search,” Shah acknowledged through the August 7, 2025 earnings name. This positioning differentiates Ziff Davis from programmatic advertising-dependent opponents, with programmatic representing lower than $50 million of annual income.

The corporate’s new section reporting construction revealed Well being & Wellness as the most important promoting class, comprising 42% of whole promoting enterprise. Expertise and Buying mixed represented one other 40%, whereas Gaming contributed 16% of promoting revenues.

AI deployment throughout operations

Ziff Davis has accelerated synthetic intelligence integration all through its promoting and content material operations. The corporate launched a number of AI-powered initiatives through the quarter, together with proprietary viewers segmentation expertise and customer support automation.

In keeping with Shah, the corporate developed “an AI platform that creates exact viewers segments” powered by tons of of thousands and thousands of real-time information indicators collected throughout its portfolio. The platform, branded as “Halo” throughout the On a regular basis Well being group, permits advertisers to focus on customers with what the corporate phrases “second of affect options.”

AI implementation extends past promoting expertise. The corporate reported that its RetailMeNot platform deployed an AI customer support chatbot attaining roughly 50% case deflection fee for inbound inquiries. Inside the Lose It! weight reduction utility, AI-powered voice and photograph meal logging options elevated consumer engagement, with members logging meals three and a half instances quicker.

Technical particulars and infrastructure

The corporate’s AI initiatives depend on first-party information assortment throughout its numerous property portfolio, which spans expertise, gaming, well being, connectivity, and cybersecurity verticals. These information indicators are processed by way of proprietary techniques that create addressable viewers segments deployable throughout owned properties, third-party networks, and social media platforms.

Privateness safety stays central to the implementation, based on firm statements. The AI platform operates solely on first-party information, avoiding reliance on third-party cookies or exterior monitoring mechanisms that face rising regulatory scrutiny.

Enterprise section efficiency

Expertise & Buying section revenues elevated 11.3% to $80.8 million, pushed primarily by the CNET acquisition accomplished in September 2024. The section benefited from CNET’s partnership renewal with Finest Purchase, enabling cross-platform promoting gross sales and content material integration throughout retail touchpoints.

Gaming & Leisure section grew 7.5% to $46.2 million, supported by IGN’s expanded occasion programming. The corporate’s IGN Stay occasion in Los Angeles throughout June reached over 300 million followers globally, up 91% year-over-year, with video views rising 26% to 202 million.

Well being & Wellness delivered the strongest section progress at 15.7%, reaching $99.5 million in quarterly revenues. The section continues increasing past pharmaceutical promoting to broader well being and wellness manufacturers, together with latest partnerships with way of life manufacturers and longevity-focused firms.

Connectivity section revenues rose 14.2% to $57.4 million, demonstrating double-digit natural progress. The section advantages from rising demand for community efficiency information from service suppliers and rising market growth throughout EMEA and APAC areas.

Cybersecurity & Martech section revenues declined 0.9% to $68.3 million however confirmed optimistic momentum with new product launches. The corporate launched Viper Built-in E mail Safety through the quarter, using AI-powered menace detection for small and medium companies.

Monetary place and outlook

Ziff Davis maintained a powerful steadiness sheet with $457 million in money and money equivalents as of June 30, 2025. The corporate carries $872 million in gross debt, leading to a 1.7x leverage ratio in opposition to trailing twelve-month adjusted EBITDA.

Throughout the quarter, Ziff Davis accomplished three acquisitions totaling roughly $11.4 million, increasing capabilities throughout Well being & Wellness and Cybersecurity & Martech segments. The corporate additionally repurchased 1.4 million shares for $33.9 million as a part of its ongoing capital return program.

The corporate reaffirmed its fiscal 2025 steering, projecting revenues between $1.442 billion and $1.502 billion, representing 5.0% progress on the midpoint. Adjusted EBITDA steering ranges from $505 million to $542 million, indicating 6.0% progress expectations.

For the advertising and marketing neighborhood, Ziff Davis’s outcomes spotlight a number of necessary developments affecting digital promoting methods. PPC Land’s analysis of pay-per-click advertising signifies rising emphasis on first-party information as privateness laws reshape focusing on capabilities.

The corporate’s success with AI-powered viewers segmentation demonstrates sensible purposes for advertising and marketing expertise. In contrast to experimental AI implementations, Ziff Davis studies measurable efficiency enhancements together with elevated consumer engagement and operational effectivity features.

Recent research shows 72% of marketers plan to increase programmatic advertising investment in 2025 as entrepreneurs search privacy-compliant focusing on strategies. Ziff Davis’s strategy, emphasizing owned media properties and first-party information, aligns with {industry} shifts away from third-party monitoring dependencies.

The corporate’s section diversification throughout expertise, well being, gaming, and cybersecurity gives advertising and marketing professionals insights into vertical-specific promoting efficiency. Well being & Wellness promoting significantly demonstrates power, reflecting demographic developments towards longevity and wellness-focused shopper spending.

Market positioning and aggressive dynamics

Ziff Davis operates in an more and more aggressive digital media panorama the place major platforms like Amazon are reducing their advertising dependencies. The corporate’s emphasis on owned and operated properties gives better management over income streams in comparison with platforms reliant on exterior promoting networks.

The corporate’s AI deployment technique focuses on sensible implementation fairly than speculative expertise adoption. Customer support automation, content material optimization, and viewers focusing on symbolize instant value-generating purposes fairly than experimental initiatives.

Technical infrastructure investments help cross-platform promoting capabilities, enabling entrepreneurs to execute campaigns throughout web sites, purposes, and social media properties from unified platforms. This integration addresses rising demand for omnichannel promoting methods.

Ahead-looking concerns

Administration expects continued progress momentum by way of the rest of 2025, with explicit power anticipated in Well being & Wellness and Connectivity segments. The corporate tasks mid-single digit income progress for each third and fourth quarters, with This fall doubtlessly demonstrating stronger efficiency as a consequence of seasonal elements.

Synthetic intelligence improvement stays a strategic precedence, with further AI-powered merchandise deliberate for deployment throughout all enterprise segments. The corporate’s strategy emphasizes measurable enterprise outcomes fairly than technological capabilities, addressing enterprise issues about AI return on funding.

Worldwide growth continues by way of rising market penetration, significantly in EMEA and APAC areas for connectivity companies. The corporate’s international presence helps promoting purchasers in search of worldwide attain whereas sustaining native market experience.

Subscribe the PPC Land publication ✉️ for related tales like this one. Obtain the information every single day in your inbox. Freed from adverts. 10 USD per 12 months.

Timeline

Subscribe the PPC Land publication ✉️ for related tales like this one. Obtain the information every single day in your inbox. Freed from adverts. 10 USD per 12 months.

PPC Land explains

Synthetic Intelligence (AI): Synthetic intelligence emerged because the central expertise driver all through Ziff Davis’s Q2 2025 efficiency, with the corporate deploying AI throughout a number of operational areas together with viewers segmentation, customer support automation, and content material optimization. The corporate’s AI initiatives concentrate on sensible enterprise purposes fairly than experimental implementations, with measurable outcomes together with 50% customer support case deflection charges and accelerated consumer engagement metrics. Ziff Davis’s AI technique emphasizes first-party information utilization and privacy-compliant operations, positioning the corporate advantageously because the {industry} shifts away from third-party monitoring dependencies.

Promoting Income: Promoting income represents Ziff Davis’s main progress engine, rising 15.5% to $197 million throughout Q2 2025 and demonstrating the corporate’s profitable monetization of its numerous digital media portfolio. The promoting enterprise spans a number of verticals together with well being and wellness, expertise and buying, and gaming leisure, with Well being & Wellness comprising 42% of whole promoting revenues. The corporate’s emphasis on owned and operated net properties gives better management over promoting stock in comparison with programmatic-dependent opponents, with solely $50 million in annual programmatic income out of whole firm revenues exceeding $1.4 billion yearly.

First-Occasion Knowledge: First-party information serves as the inspiration for Ziff Davis’s AI-powered promoting platform, enabling the corporate to create exact viewers segments with out counting on third-party cookies or exterior monitoring mechanisms. The corporate collects tons of of thousands and thousands of knowledge indicators throughout its property portfolio, processing this info by way of proprietary techniques to ship what it phrases “second of affect options” for advertisers. This strategy aligns with industry-wide shifts towards privacy-compliant promoting methods, as regulatory pressures and platform modifications cut back the effectiveness of conventional monitoring strategies.

Section Efficiency: Section efficiency evaluation reveals the diversified nature of Ziff Davis’s enterprise mannequin, with 4 of 5 reportable segments demonstrating year-over-year progress throughout Q2 2025. Expertise & Buying grew 11.3%, Gaming & Leisure elevated 7.5%, Well being & Wellness expanded 15.7%, and Connectivity rose 14.2%, whereas solely Cybersecurity & Martech declined barely at 0.9%. This diversification gives stability in opposition to market volatility whereas enabling the corporate to capitalize on progress alternatives throughout totally different industries and shopper segments.

Income Progress: Income progress of 9.8% to $352.2 million throughout Q2 2025 represents Ziff Davis’s strongest quarterly efficiency since 2021, marking 4 consecutive quarters of year-over-year will increase. The expansion displays profitable integration of strategic acquisitions, efficient AI deployment, and powerful promoting market efficiency throughout the corporate’s core verticals. Administration tasks continued progress momentum by way of 2025, with full-year income steering starting from $1.442 billion to $1.502 billion, representing 5.0% progress on the midpoint in comparison with 2024 efficiency.

Well being & Wellness: Well being & Wellness emerged as Ziff Davis’s strongest-performing section, producing $99.5 million in quarterly revenues with 15.7% year-over-year progress, pushed by each pharmaceutical promoting and broader wellness model partnerships. The section advantages from demographic developments towards longevity-focused shopper spending and increasing past conventional pharma purchasers to incorporate way of life manufacturers and wellness-focused firms. Medical research capabilities, significantly being pregnant publicity registries and scientific trials, present aggressive differentiation in reaching specialised healthcare audiences that conventional promoting platforms wrestle to entry successfully.

Owned and Operated Properties: Owned and operated properties symbolize a strategic aggressive benefit for Ziff Davis, with 35% of whole firm revenues derived from promoting on these instantly managed digital belongings. This strategy gives better income predictability and better margins in comparison with third-party platform dependencies, whereas enabling extra subtle viewers focusing on by way of direct information assortment. The corporate’s portfolio consists of main manufacturers throughout expertise, gaming, well being, connectivity, and cybersecurity verticals, creating numerous monetization alternatives whereas decreasing reliance on exterior platform coverage modifications.

Strategic Acquisitions: Strategic acquisitions proceed driving Ziff Davis’s growth technique, with the corporate finishing three acquisitions throughout Q2 2025 totaling roughly $11.4 million whereas integrating earlier main acquisitions together with CNET. The CNET acquisition, accomplished in September 2024, significantly contributed to Expertise & Buying section progress by way of expanded advertiser relationships and content material syndication alternatives. Administration maintains a disciplined strategy to acquisitions, specializing in companies that improve present platform capabilities, broaden addressable markets, or present technological aggressive benefits.

Privateness-Compliant Promoting: Privateness-compliant promoting methods have grow to be important for digital media firms as regulatory modifications and platform insurance policies remove conventional monitoring strategies, with Ziff Davis positioning itself advantageously by way of first-party information emphasis and owned property focus. The corporate’s AI-powered viewers segmentation operates solely on first-party information, avoiding third-party cookie dependencies that face rising restrictions throughout main browsers and platforms. This strategy permits continued efficient focusing on whereas sustaining compliance with evolving privateness laws together with GDPR and rising state-level privateness legal guidelines.

Digital Media Portfolio: Digital media portfolio diversification throughout expertise, buying, gaming, well being, connectivity, and cybersecurity verticals permits Ziff Davis to serve each shopper and enterprise audiences whereas decreasing dependence on any single market section. The portfolio consists of established manufacturers like IGN, CNET, On a regular basis Well being, and Speedtest, every commanding important viewers attain inside their respective classes. This diversification technique gives stability throughout market volatility whereas creating cross-promotional alternatives and enabling complete advertiser options throughout a number of touchpoints and viewers segments.

Subscribe the PPC Land publication ✉️ for related tales like this one. Obtain the information every single day in your inbox. Freed from adverts. 10 USD per 12 months.

Abstract

Who: Ziff Davis Inc. (NASDAQ: ZD), a digital media and web firm led by CEO Vivek Shah, reported monetary outcomes that exceeded analyst expectations whereas demonstrating strategic AI deployment throughout promoting operations.

What: The corporate delivered 9.8% income progress to $352.2 million in Q2 2025, surpassing estimates with adjusted earnings per share of $1.24. Promoting revenues grew 15.5% whereas the corporate deployed AI-powered viewers segmentation, customer support automation, and content material optimization instruments throughout its platform portfolio.

When: Outcomes have been introduced on August 6, 2025, overlaying the quarter ended June 30, 2025, with administration discussing efficiency throughout an August 7, 2025 earnings convention name.

The place: New York-based Ziff Davis operates globally throughout expertise, buying, gaming, well being, connectivity, and cybersecurity verticals, serving each shopper and enterprise audiences by way of owned and operated digital properties.

Why: The sturdy efficiency displays profitable AI integration, strategic acquisitions together with CNET, and efficient monetization of first-party information belongings amid industry-wide shifts towards privacy-compliant promoting methods and away from third-party monitoring dependencies.

Source link