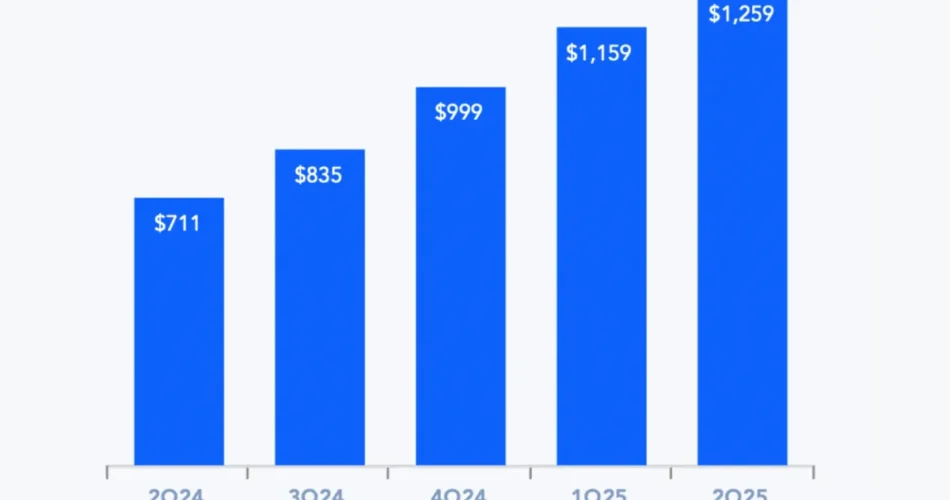

AppLovin Company accomplished its strategic transformation on June 30, 2025, as the corporate introduced second quarter monetary outcomes and finalized the sale of its Apps enterprise to Tripledot Studios for $400 million in money. The cell promoting platform reported income of $1.26 billion for the quarter ended June 30, marking a 77% improve from the identical interval final yr.

In accordance with AppLovin’s monetary statements, the corporate achieved internet revenue from persevering with operations of $772 million, representing a 156% improve in comparison with $301 million within the second quarter of 2024. Adjusted EBITDA reached $1.02 billion with an 81% margin, practically doubling from $511 million within the prior yr quarter.

The Palo Alto-based firm generated $772 million in internet money from working actions and $768 million in Free Money Circulation through the six months ended June 30, 2025. These figures mirror a considerable improve from $847 million and $833 million respectively in the identical interval of 2024.

Subscribe the PPC Land e-newsletter ✉️ for related tales like this one. Obtain the information daily in your inbox. Freed from advertisements. 10 USD per yr.

Apps Enterprise divestiture finalizes strategic focus

The June 30 completion of the Apps Enterprise sale marked a major milestone in AppLovin’s strategic pivot towards promoting know-how. In accordance with the acquisition settlement, Tripledot Studios acquired AppLovin’s gaming division for $400 million in money, topic to closing changes, plus fairness consideration representing roughly 20% of Tripledot’s fully-diluted fairness.

“On the finish of the quarter, we closed the sale of our apps enterprise to Triple Dot Studios,” CFO Matt Stumpf defined through the earnings name. CEO Adam Foroughi emphasised the strategic rationale: “Our aspirations are to assist any enterprise of any dimension be capable to purchase clients profitably. And if we will do this, we’ll obtain the targets that we have set for ourselves.”

The divested Apps Enterprise generated $640.8 million in income through the six months ended June 30, 2025, however recorded a loss from discontinued operations of $99.4 million because of a $188.9 million goodwill impairment cost taken within the first quarter. CFO Matt Stumpf famous that “this quarter, the monetary outcomes for the apps enterprise have been included inside discontinued operations, and we’ll maintain our commentary restricted to the promoting enterprise solely.”

Income surge pushed by promoting know-how enhancements

AppLovin’s promoting options demonstrated sturdy efficiency throughout key metrics. In accordance with the corporate’s quarterly replace, internet income per set up elevated 70% whereas set up quantity grew 8% in comparison with the second quarter of 2024. These enhancements mirror continued enhancements to the corporate’s AI-powered promoting suggestion engine, AXON.

“Income grew 77% to $1.26 billion. Web income per set up elevated 70% and installations elevated 8%,” the corporate reported in its monetary overview. The promoting platform now serves over 1 billion customers day by day throughout cell functions and continues to learn from enhancements in concentrating on accuracy and marketing campaign optimization.

Through the earnings name, CEO Foroughi highlighted the platform’s increasing attain: “The Max Market creates the provision that drives our progress in addition to the expansion available in the market. As advertising applied sciences within the trade proceed bettering, we anticipate the provision will continue to grow rapidly.”

Monetary place strengthens with sturdy money technology

AppLovin ended the quarter with $1.19 billion in money and money equivalents, together with $425 million in internet proceeds from the Apps Enterprise sale. The corporate’s steadiness sheet displays complete property of $5.96 billion as of June 30, 2025, in comparison with $5.87 billion at December 31, 2024.

“We generated $772 million of internet money from working actions and $768 million of Free Money Circulation,” in keeping with the corporate’s monetary overview. CFO Matt Stumpf famous through the earnings name: “This quarter, we repurchased and withheld roughly 900,000 shares for a complete value of $341,000,000 funded by way of free money movement.”

Through the quarter, AppLovin maintained its disciplined strategy to capital allocation. Lengthy-term debt remained steady at $3.51 billion, consisting primarily of senior unsecured notes. The corporate briefly borrowed $200 million underneath its revolving credit score facility through the quarter to fund share repurchases however repaid the total quantity by Could 2025.

Third quarter steering displays continued momentum

For the third quarter of 2025, AppLovin supplied income steering between $1.32 billion and $1.34 billion, with Adjusted EBITDA anticipated to vary from $1.07 billion to $1.09 billion. This represents continued sequential progress and maintains the corporate’s focused 81% Adjusted EBITDA margin.

The steering incorporates the total elimination of Apps Enterprise income following the June 30 divestiture. Administration emphasised that the promoting enterprise alone demonstrates the monetary energy to assist the corporate’s progress trajectory and capital allocation technique.

Worldwide growth and platform growth

AppLovin introduced plans to launch a referral-based self-serve platform on October 1, 2025, adopted by a world public launch of the Axon platform in 2026. The corporate expects this growth to allow companies of all sizes to entry its promoting know-how by way of automated onboarding and bank card billing methods.

“On 10/01/2025, we plan to open the Axon Adverts Supervisor on a referral foundation, completely timed for the vacation season,” CEO Foroughi defined through the earnings name. “Suggestions from these companions will information our world public launch within the 2026.”

The self-serve platform represents a major growth past AppLovin’s conventional managed service mannequin. Foroughi emphasised the corporate’s broader imaginative and prescient: “As we open up the platform, the aim that we’ve got is to see that any small enterprise of any sort can market on our platform.” He added that when the platform launches globally, “we plan to start paid advertising to recruit new advertisers, which can drive predictable compounding progress.”

Expertise infrastructure investments proceed

Analysis and growth bills declined to $44 million within the second quarter from $99 million within the prior yr, primarily because of diminished stock-based compensation prices. Nonetheless, the corporate continues investing in AI capabilities and platform enhancements to keep up its aggressive benefit in cell promoting know-how.

AppLovin’s MAX mediation platform maintains excessive penetration within the cell gaming market, whereas the corporate’s AppDiscovery platform permits advertisers to automate consumer acquisition campaigns. The combination of those applied sciences with AXON’s machine studying capabilities offers the inspiration for the corporate’s promoting suggestion engine.

Value of income elevated to $155 million from $122 million within the prior yr quarter, pushed primarily by larger knowledge heart prices to assist rising platform utilization. The corporate expects these infrastructure investments to assist continued income progress as advertiser adoption expands.

Subscribe the PPC Land e-newsletter ✉️ for related tales like this one. Obtain the information daily in your inbox. Freed from advertisements. 10 USD per yr.

Why this issues

AppLovin’s strong financial performance demonstrates the growing importance of AI-powered advertising technology in mobile marketing. The corporate’s capacity to enhance each concentrating on effectivity and marketing campaign scale concurrently represents a major technical achievement for programmatic promoting platforms.

The upcoming self-serve platform launch may democratize entry to classy promoting know-how beforehand accessible solely to giant enterprise shoppers. This aligns with broader industry trends toward automated campaign management and performance-based advertising models.

For digital advertising companies and advertisers, AppLovin’s deal with return on promoting spend optimization addresses key efficiency challenges in cell consumer acquisition. The platform’s expansion beyond gaming into e-commerce and other verticals reflects the growing application of mobile-first advertising strategies.

Subscribe the PPC Land e-newsletter ✉️ for related tales like this one. Obtain the information daily in your inbox. Freed from advertisements. 10 USD per yr.

Timeline

Subscribe the PPC Land e-newsletter ✉️ for related tales like this one. Obtain the information daily in your inbox. Freed from advertisements. 10 USD per yr.

Key terminology defined

AppLovin Company: The Palo Alto-based cell promoting know-how firm that has remodeled from a gaming-focused enterprise right into a pure-play promoting platform. Based by CEO Adam Foroughi, the corporate operates one of many largest cell promoting networks globally, serving over 1 billion day by day customers by way of its promoting options. The company went public on NASDAQ underneath the ticker APP and has demonstrated vital progress by way of its AI-powered promoting suggestion engine.

Adjusted EBITDA: Earnings Earlier than Curiosity, Taxes, Depreciation, and Amortization, adjusted for particular objects together with stock-based compensation and transaction-related bills. AppLovin defines this metric as a key measure for assessing monetary efficiency and makes use of it for inner planning and forecasting functions. The corporate achieved an 81% Adjusted EBITDA margin in Q2 2025, demonstrating its capacity to transform income progress into profitability whereas sustaining operational effectivity.

AXON promoting suggestion engine: AppLovin’s proprietary AI-powered know-how platform that optimizes cell promoting placements in real-time. The system constantly improves by way of each self-learning capabilities and directed engineering enhancements, enabling advertisers to scale their spending whereas sustaining return on promoting spend targets. AXON represents the core technological differentiator that drives AppLovin’s aggressive benefit in cell promoting attribution and marketing campaign optimization.

Apps Enterprise divestiture: The strategic sale of AppLovin’s cell gaming division to Tripledot Studios for $400 million in money, accomplished on June 30, 2025. This transaction eradicated the corporate’s recreation growth operations and permits AppLovin to focus completely on promoting know-how options. The divestiture included ten gaming studios that collectively generated $1.5 billion in income throughout 2024, representing a major shift within the firm’s enterprise mannequin.

Income progress: AppLovin’s monetary efficiency indicator displaying 77% year-over-year improve to $1.26 billion in Q2 2025. This progress stems from enhancements in each internet income per set up (up 70%) and set up quantity (up 8%), demonstrating the platform’s capacity to concurrently enhance effectivity and scale. The income growth displays continued adoption of AppLovin’s promoting options throughout cell gaming and e-commerce verticals.

Free Money Circulation: Web money supplied by working actions minus purchases of property and gear and principal funds on finance leases. AppLovin generated $768 million in Free Money Circulation throughout Q2 2025, representing a considerable improve that helps the corporate’s capital allocation technique together with share repurchases and know-how investments. This metric demonstrates the corporate’s capacity to transform income progress into tangible money technology.

Cellular promoting platform: The technological infrastructure that allows AppLovin to attach advertisers with cell app publishers by way of programmatic promoting auctions. The platform operates at large scale, processing billions of promoting requests day by day whereas optimizing for efficiency metrics corresponding to value per set up and return on promoting spend. AppLovin’s platform differentiation comes from its integration of machine studying algorithms with real-time bidding capabilities.

MAX mediation platform: AppLovin’s cell app monetization answer that helps publishers maximize promoting income by connecting them with a number of promoting networks. MAX maintains excessive market penetration in cell gaming and serves as a important provide supply for AppLovin’s promoting market. The platform permits publishers to optimize their promoting stock by way of automated mediation and real-time bidding mechanisms.

Self-serve platform: The upcoming automated promoting administration system scheduled for referral-based launch on October 1, 2025, adopted by world availability in 2026. This platform will allow companies of all sizes to entry AppLovin’s promoting know-how by way of bank card billing and automatic onboarding, increasing past the corporate’s conventional managed service mannequin. The self-serve strategy represents a major market growth alternative for AppLovin’s promoting options.

E-commerce promoting: AppLovin’s growth past cell gaming into e-commerce and different verticals, leveraging its AI know-how to assist on-line retailers purchase clients by way of cell promoting campaigns. This diversification technique has contributed to income progress and demonstrates the broader applicability of AppLovin’s promoting optimization know-how. The e-commerce focus aligns with rising cell commerce developments and represents a considerable complete addressable market growth alternative.

Subscribe the PPC Land e-newsletter ✉️ for related tales like this one. Obtain the information daily in your inbox. Freed from advertisements. 10 USD per yr.

Abstract

Who: AppLovin Company, a cell promoting know-how firm primarily based in Palo Alto, California, led by CEO Adam Foroughi and CFO Matt Stumpf.

What: AppLovin reported second quarter 2025 monetary outcomes displaying $1.26 billion in income (77% progress) and accomplished the sale of its Apps Enterprise to Tripledot Studios for $400 million in money.

When: The monetary outcomes cowl the quarter ended June 30, 2025, with the Apps Enterprise divestiture closing on the identical date. Outcomes have been introduced on August 6, 2025.

The place: The cell promoting platform operates globally, serving over 1 billion day by day customers, with headquarters in Palo Alto and operations increasing internationally by way of the deliberate October 2025 platform launch.

Why: The sturdy outcomes mirror continued enhancements to AppLovin’s AI-powered promoting know-how and the strategic completion of its transformation from a gaming-focused firm to a pure-play promoting know-how platform, enabling deal with higher-margin promoting options.

Source link