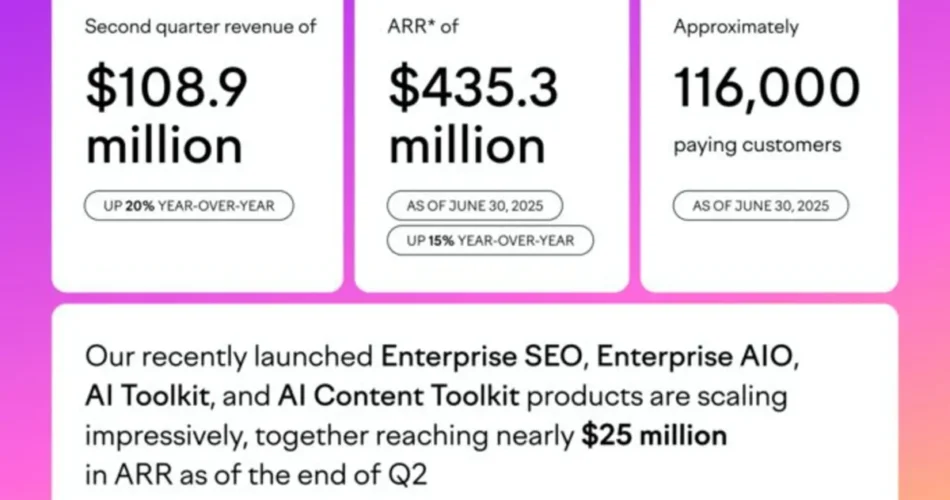

Semrush Holdings Inc. (NYSE: SEMR) reported second quarter 2025 income of $108.9 million, marking a 20% improve from the identical interval final 12 months, based on monetary outcomes introduced August 4, 2025. The web visibility administration platform firm demonstrated sturdy progress in its synthetic intelligence and enterprise product segments whereas confronting challenges in lower-tier buyer acquisition.

The Boston-based SaaS firm achieved annual recurring income (ARR) of $435.3 million as of June 30, 2025, representing 15% year-over-year progress. Clients paying greater than $50,000 yearly elevated 83% year-over-year, signaling strong adoption amongst enterprise purchasers. In response to firm executives, Enterprise website positioning has turn into the one largest contributor to each income and ARR progress inside only one 12 months of common availability.

“We posted sturdy income progress within the second quarter and have been particularly happy by the accelerated adoption of our AI and Enterprise merchandise,” mentioned Invoice Wagner, CEO. The corporate achieved roughly 116,000 paying clients as of June 30, 2025, whereas dollar-based internet income retention reached 105%.

Subscribe the PPC Land e-newsletter ✉️ for comparable tales like this one. Obtain the information daily in your inbox. Freed from advertisements. 10 USD per 12 months.

Enterprise phase drives substantial buyer worth enlargement

The corporate’s Enterprise website positioning resolution expanded to 260 clients with common ARR of roughly $60,000 per buyer. This represents important momentum for a product launched simply over a 12 months in the past. Enterprise clients now show dollar-based internet income retention constantly above 120%, highlighting the platform’s capacity to broaden inside current accounts.

Common ARR per paying buyer elevated to $3,756, representing progress of greater than 15% in comparison with the identical quarter final 12 months. This metric displays Semrush’s profitable cross-selling technique and motion towards higher-value buyer segments. In response to CFO Brian Mulroy, the corporate expects ARR from Enterprise and AI merchandise to method $50 million by the tip of 2025.

“Notably, our Enterprise website positioning product is gaining traction available in the market with new offers akin to Digital Ocean, HSBC, and the Royal Financial institution of Canada,” based on earlier firm statements. The enterprise phase’s progress aligns with marketing industry trends toward AI-powered search optimization as companies adapt to altering search landscapes.

Synthetic intelligence merchandise acquire fast market traction

Semrush launched AI Optimization (AIO) as an Enterprise Resolution in the course of the second quarter, offering companies with instruments to trace, management, and optimize model presence throughout AI-powered search platforms. Inside a number of weeks of launch, over 30 enterprise clients bought this new AI product for whole ARR of almost $1 million.

The corporate’s AI Toolkit grew to become the fastest-growing product in firm historical past, increasing from zero to $3 million in ARR inside months of its late Q1 2025 launch. In response to Wagner, utilization knowledge exhibits clients who buy AI Toolkit expertise a 20% improve of their exercise inside Semrush’s website positioning Toolkit, demonstrating complementary product adoption.

“We consider we’re approaching a time when each website positioning knowledgeable might want to add AI Search capabilities,” Wagner said in the course of the earnings name. The corporate launched a number of AI-powered enhancements, together with SearchGPT integration inside Place Monitoring instruments and an AI Site visitors dashboard enabling companies to watch model visibility throughout platforms like ChatGPT, Copilot, Gemini, and Perplexity.

Business evaluation signifies AI search optimization is fundamentally changing SEO practices, with Google’s AI Overviews now working in 200 international locations and 40 languages as of Might 2025. This technological shift creates new alternatives for platforms like Semrush that present complete AI search optimization instruments.

Decrease-tier buyer phase presents acquisition challenges

The corporate encountered continued softness in its lower-tier buyer phase, together with freelancers and fewer subtle customers who traditionally show larger churn charges. This buyer phase confronted further stress from dramatic will increase in paid-search cost-per-click in the course of the quarter, elevating buyer acquisition prices.

In response to Wagner, the corporate made strategic choices to not improve advertising spend pursuing quantity and near-term income on the expense of long-term worth. As a substitute, Semrush directed advertising and engineering sources towards high-growth, high-retention segments, particularly Enterprise and AI search merchandise the place buyer demand and returns show extra compelling.

Money circulation from operations reached $0.7 million within the second quarter, representing a money circulation margin of 0.6%. Free money circulation was damaging $3.6 million, primarily attributable to timing of money tax funds, collections, and pay as you go bills. The corporate maintains expectations for 12% free money circulation margin for full-year 2025.

Monetary outlook displays strategic useful resource reallocation

Semrush revised its full-year 2025 income steerage to $443.0 million to $446.0 million, representing roughly 18% progress on the midpoint. This represents a discount from earlier steerage of $448.0 million to $453.0 million, reflecting near-term income headwinds from strategic useful resource shifts towards higher-value segments.

For the third quarter 2025, the corporate expects income between $111.1 million to $112.1 million, representing roughly 15% year-over-year progress on the midpoint. Third quarter non-GAAP working margin is anticipated at roughly 11.5%.

The corporate maintains full-year expectations of 12% for each non-GAAP working margin and free money circulation margin, regardless of lowered income outlook and international trade headwinds from a weaker U.S. greenback. Non-GAAP working margin reached 11.0% within the second quarter, in comparison with 13.4% within the prior 12 months interval.

Market recognition and aggressive positioning strengthen

Forrester named Semrush as a Chief in website positioning Options, recognizing the corporate’s aggressive intelligence, strong analytics, and imaginative and prescient for website positioning because the “engine of digital discoverability.” This recognition comes because the SEO industry adapts to AI search disruption, with conventional optimization practices evolving to deal with synthetic intelligence-powered search environments.

The corporate introduced a $150 million share repurchase program, demonstrating confidence in enterprise fundamentals and dedication to shareholder worth. In response to Mulroy, “Our share repurchase program demonstrates our sturdy conviction within the enterprise, displays the energy of our steadiness sheet and free money circulation technology.”

Semrush ended the quarter with money, money equivalents, and short-term investments of $258.5 million, rising $27.0 million from the prior 12 months interval. This monetary place offers flexibility for continued funding in AI and enterprise product improvement.

Business context reveals broader transformation patterns

The corporate’s outcomes happen amid important adjustments in digital advertising practices. In response to Wagner, ChatGPT and Google’s AI Mode are rising total search alternative dimension quite than merely redistributing current search quantity. Firm knowledge exhibits constructive correlation between ChatGPT utilization and Semrush product utilization.

“The massive distinction is that the variety of sources has grown by an order of magnitude,” Wagner defined. Entrepreneurs should perceive prompts used to search out their merchandise, optimize content material for these prompts, and guarantee message visibility throughout web sites, YouTube movies, native evaluations, and platforms like Reddit and Quora.

This expanded search ecosystem creates alternatives for complete platforms like Semrush that present instruments for optimization throughout a number of touchpoints. Recent industry frameworks determine 4 distinct optimization classes: Reply Engine Optimization, Generative Engine Optimization, AI Integration Optimization, and Search Expertise Optimization.

Comparative efficiency demonstrates sustained progress trajectory

Semrush’s Q2 2025 efficiency compares favorably to historic outcomes and demonstrates accelerating progress in key segments. Second quarter 2024 income reached $91.0 million with 22% year-over-year progress, whereas Q2 2023 achieved $74.7 million with 19% progress. The present 20% progress charge displays sustained momentum regardless of market headwinds.

ARR progress patterns present evolution from $302.4 million in Q2 2023 (20% progress) to $377.7 million in Q2 2024 (25% progress) to present $435.3 million (15% progress). Whereas ARR progress charge has moderated, common income per buyer continues increasing, indicating profitable buyer worth optimization.

Greenback-based internet income retention has various throughout intervals, reaching 112% in Q2 2023, 107% in Q2 2024, and 105% at the moment. Firm management expects this metric to strengthen as enterprise buyer combine will increase and lower-retention segments symbolize smaller parts of the enterprise.

The evolution demonstrates Semrush’s strategic transition from volume-focused progress to value-focused enlargement, prioritizing higher-quality buyer relationships and sustainable unit economics over absolute buyer rely will increase.

Government management transitions sign strategic evolution

The earnings announcement displays management adjustments applied over the previous 12 months. Invoice Wagner assumed the CEO function from co-founder Oleg Shchegolev, bringing expertise in enterprise software program and AI product improvement. CFO Brian Mulroy continues guiding monetary technique and useful resource allocation choices.

This management workforce emphasizes disciplined progress approaches, balancing instant income alternatives with long-term worth creation. The strategic give attention to enterprise and AI segments displays administration conviction about sustainable aggressive benefits in these higher-value market segments.

Firm steerage and useful resource allocation choices show dedication to this strategic course, even when it creates near-term income stress from lowered funding in lower-value buyer acquisition actions.

Subscribe the PPC Land e-newsletter ✉️ for comparable tales like this one. Obtain the information daily in your inbox. Freed from advertisements. 10 USD per 12 months.

Timeline

Key Phrases Defined

The next phrases symbolize essentially the most incessantly talked about ideas all through Semrush’s Q2 2025 earnings evaluation, reflecting the evolving digital advertising panorama and the corporate’s strategic positioning.

Annual Recurring Income (ARR) represents the predictable income stream from subscription clients normalized to a yearly foundation. For Semrush, ARR reached $435.3 million in Q2 2025, rising 15% year-over-year. This metric offers buyers and administration with clear visibility into enterprise momentum and buyer retention patterns. ARR calculations exclude one-time funds and variable utilization charges, specializing in the dependable subscription basis that drives SaaS firm valuations. Robust ARR progress signifies profitable buyer acquisition and retention methods, whereas ARR composition evaluation reveals shifts towards higher-value buyer segments.

Synthetic Intelligence (AI) encompasses machine studying applied sciences built-in all through Semrush’s product portfolio to reinforce advertising capabilities. The corporate’s AI merchandise embody AI Optimization, AI Toolkit, and AI Site visitors dashboard, collectively approaching $50 million in ARR by year-end 2025. These options tackle the basic shift in search habits as customers more and more work together with AI-powered platforms like ChatGPT, Copilot, and Gemini. AI integration allows automated content material optimization, predictive analytics, and clever workflow administration that conventional advertising instruments can not present. For Semrush, AI represents each a product class and a aggressive differentiator within the evolving search ecosystem.

Enterprise clients symbolize Semrush’s highest-value shopper phase, sometimes characterised by annual spending above $50,000 and sophisticated organizational advertising wants. This phase elevated 83% year-over-year in Q2 2025, demonstrating profitable upmarket enlargement. Enterprise clients exhibit considerably larger retention charges, with dollar-based internet income retention constantly above 120% in comparison with the corporate common of 105%. These purchasers require subtle platform capabilities, devoted help sources, and integration with current enterprise software program methods. The enterprise focus displays Semrush’s strategic evolution from serving particular person entrepreneurs towards turning into mission-critical infrastructure for big organizations.

Search Engine Optimization (website positioning) represents the apply of enhancing web site visibility in search engine outcomes by technical enhancements, content material optimization, and authority constructing. Semrush’s Enterprise website positioning platform grew to become the one largest contributor to firm progress inside one 12 months of common availability, securing purchasers like Digital Ocean, HSBC, and Royal Financial institution of Canada. website positioning encompasses conventional rating components whereas adapting to AI-powered search environments that synthesize data quite than merely rating pages. The self-discipline requires steady evolution as search algorithms advance and person habits shifts towards conversational and voice-based queries.

Income progress measures the year-over-year improve in whole firm revenue, reaching 20% for Semrush in Q2 2025 with $108.9 million quarterly income. This progress charge displays profitable execution of cross-selling methods, enterprise market penetration, and new product adoption. Income composition evaluation reveals rising contributions from higher-margin enterprise and AI merchandise, whereas lower-tier segments face acquisition challenges attributable to elevated buyer prices. Sustainable income progress requires balancing instant alternative seize with long-term buyer worth optimization, significantly as market dynamics shift towards AI-driven search behaviors.

Buyer acquisition describes the method of attracting and changing prospects into paying subscribers, presenting rising challenges in Semrush’s lower-tier segments attributable to dramatic paid-search value will increase. The corporate strategically lowered advertising spend in segments with declining unit economics, redirecting sources towards enterprise and AI merchandise with superior returns. Efficient buyer acquisition requires understanding whole buyer lifetime worth relative to acquisition prices, channel effectiveness evaluation, and segment-specific conversion optimization. For SaaS corporations like Semrush, acquisition technique should steadiness instant income technology with sustainable unit economics.

Greenback-based internet income retention measures the income enlargement from current clients over time, accounting for upgrades, downgrades, and churn throughout the buyer base. Semrush achieved 105% retention in Q2 2025, indicating clients elevated their platform spending regardless of some account losses. This metric offers perception into product stickiness, buyer satisfaction, and enlargement income potential. Values above 100% show natural progress from current relationships, decreasing dependence on new buyer acquisition. Enterprise segments sometimes exhibit larger retention charges attributable to deeper platform integration and switching prices.

Working margin represents the share of income remaining after deducting working bills, offering perception into enterprise effectivity and profitability. Semrush achieved 11.0% non-GAAP working margin in Q2 2025, down from 13.4% within the prior 12 months attributable to strategic investments and international trade impacts. Working margin evaluation reveals the steadiness between progress investments and instant profitability, with larger margins indicating mature enterprise operations. For rising SaaS corporations, margin developments mirror strategic decisions about market enlargement, product improvement, and aggressive positioning investments.

Free money circulation measures precise money technology after accounting for capital expenditures and dealing capital adjustments, offering perception into enterprise sustainability past accounting income. Semrush expects 12% free money circulation margin for full-year 2025 regardless of damaging $3.6 million in Q2 attributable to timing components together with tax funds and pay as you go bills. Free money circulation allows dividend funds, share repurchases, and progress investments with out exterior financing. Robust money technology helps Semrush’s $150 million share repurchase program whereas sustaining flexibility for strategic acquisitions and product improvement.

Market positioning describes Semrush’s aggressive standing throughout the digital advertising instruments panorama, strengthened by Forrester’s recognition as a Chief in website positioning Options. The corporate’s place advantages from complete platform capabilities, proprietary knowledge property, and early AI search optimization instruments. Efficient positioning requires differentiation from opponents like Ahrefs, Moz, and BrightEdge by distinctive worth propositions and market phase focus. Semrush’s enterprise and AI emphasis creates aggressive moats by integration complexity and switching prices that shield buyer relationships and allow premium pricing methods.

Subscribe the PPC Land e-newsletter ✉️ for comparable tales like this one. Obtain the information daily in your inbox. Freed from advertisements. 10 USD per 12 months.

Abstract

Who: Semrush Holdings Inc. (NYSE: SEMR), CEO Invoice Wagner, CFO Brian Mulroy, and roughly 116,000 paying clients globally

What: Q2 2025 monetary outcomes exhibiting $108.9 million income (20% YoY progress), $435.3 million ARR (15% YoY progress), and 83% improve in clients paying $50,000+ yearly, with sturdy adoption of AI and Enterprise merchandise together with AI Optimization and AI Toolkit

When: Outcomes introduced August 4, 2025, masking quarter ended June 30, 2025, with convention name held August 5, 2025

The place: Boston-based firm with international operations throughout Austin, Dallas, Amsterdam, Barcelona, Belgrade, Berlin, Munich, Limassol, Prague, Warsaw, and Yerevan serving 116,000 clients worldwide

Why: Outcomes mirror profitable strategic pivot towards higher-value enterprise and AI product segments amid altering search panorama pushed by synthetic intelligence adoption, whereas dealing with buyer acquisition challenges in lower-tier segments attributable to elevated paid-search prices and market dynamics

Source link