Loosening Nielsen’s tight grip

Regardless of Nielsen’s stumbles in recent times, it’s onerous for opponents to get greater than a toehold.

At the same time as a few of these opponents have a good time the JIC accreditation, Nielsen’s panel + massive information foreign money has MRC accreditation, which gives a extra intensive measurement audit than the JIC.

Additionally, the JIC accreditation isn’t going to impression the present upfront season, in line with two advert patrons. It’s “too late at this level” within the upfront season to start out utilizing a brand new foreign money as a complete, a type of advert patrons mentioned, particularly with publishers already closing deals.

Nonetheless, the customer famous that they’ve been encouraging shoppers to lean into different currencies for superior audiences and data-driven linear.

For a lot of measurement upstarts, the perfect alternative to unseat Nielsen was in 2021, when it misplaced MRC accreditation for lowballing both local and national audiences through the COVID-19 pandemic. However Nielsen regained national accreditation in April 2023.

Publicly, Nielsen claims it welcomes competitors: “It makes us, and the business, higher,” a spokesperson mentioned.

However it has additionally hammered its rivals with a gentle drumbeat of lawsuits, submitting ten patent infringement complaints during the last three years towards opponents like TVision, HyphaMetrics, ACRCloud, and VideoAmp.

When VideoAmp obtained one lawsuit dismissed earlier this 12 months, Nielsen swooped in with a brand new grievance, proper earlier than the corporate’s second Vampfront occasion in April, the place it showcased new merchandise to shoppers.

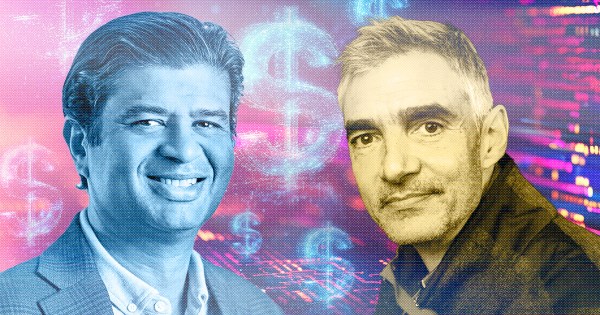

Nielsen’s huge assets give it the power to file its unending lawsuits to weaken its competitors, Liguori mentioned. Even dismissals have a value.

“It’s all a part of their technique to empty us of our monetary assets,” he informed ADWEEK. “While you’re a monolith, you’ll be able to play that recreation.”

Liguori added that Nielsen’s sturdy public relations staff additionally provides the corporate the higher hand: “It’s like a Lamborghini subsequent to a horse and buggy,” he mentioned.

A horse’s likelihood towards a Lambo

Since Liguori took over the corporate in 2024 amid the exit of former CEO Ross McCray and layoffs affecting 20% of VideoAmp’s workforce, the corporate has been vocal in messaging towards Nielsen, going to market with $600 million in funding and an providing comprising set-top-box and sensible TV information from 40 million households and 65 million units. It has additionally fortified itself with key partnerships with publishers akin to Disney, Warner Bros. Discovery, and Paramount.