This month, we convey you the July version of Future Horizon’s semiconductor report. Discover the most recent insights into the present market outlook under.

Govt Abstract

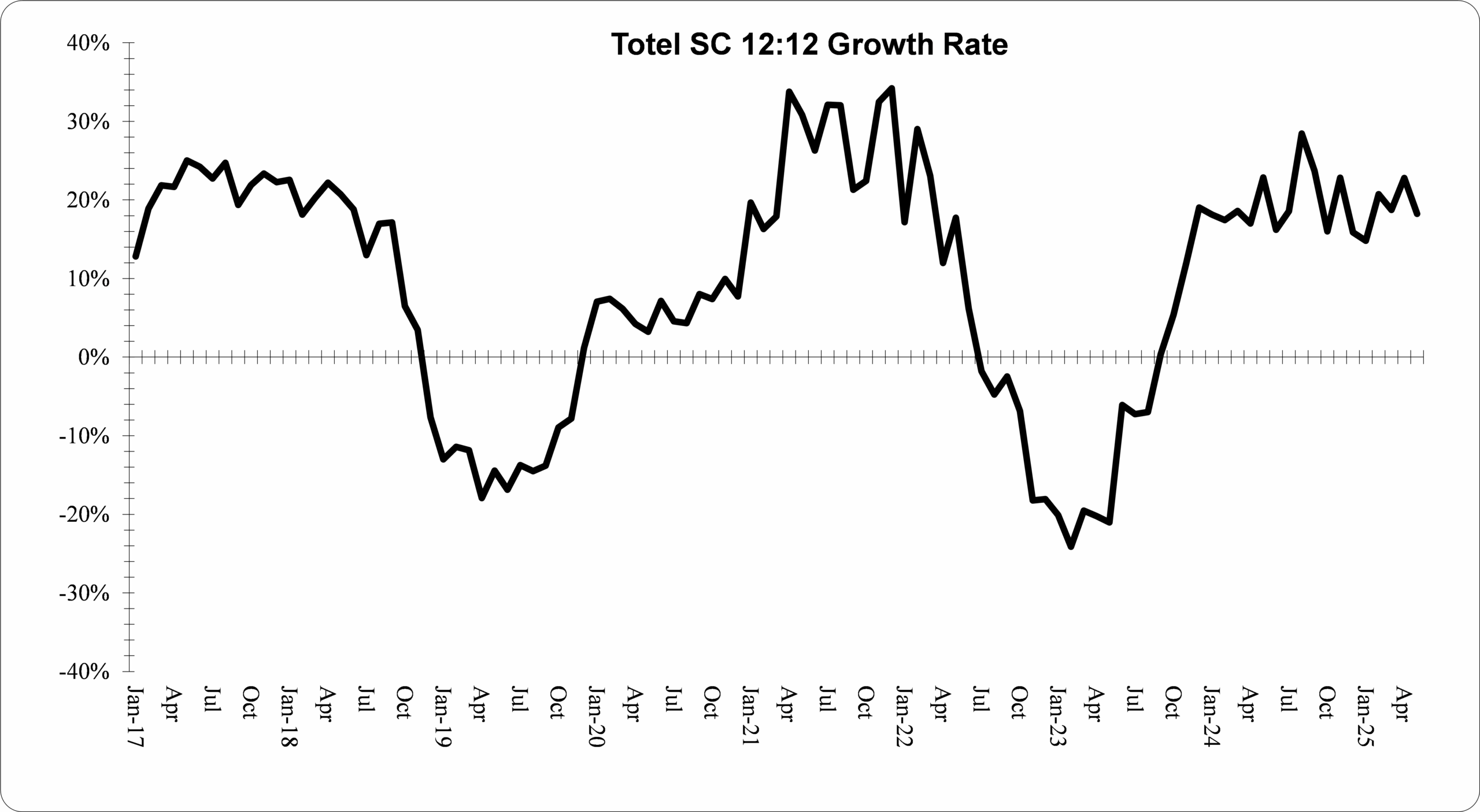

Annualised progress charges retreated barely in Could, with Whole Semiconductors rising 18.2 p.c, down from final month’s 22.8 p.c and March’s 18.7 p.c and, while nonetheless in double-digit progress terrain, was nonetheless sizeably down from August 2024’s 28.5 p.c cyclical peak.

Whole ICs continued to be the star sector performer, at a wholesome 22.9 p.c, albeit barely down from 25.1 p.c in April, with Opto at minus 5.5 p.c and Discretes at plus 4.8 p.c, vs. final month’s plus 16.0 p.c and plus 5.5 p.c respectively.

While the general IC market nonetheless confirmed sturdy double-digit progress, the general development is flat, at across the 20 p.c degree, various from August 2024’s 36.2 p.c peak to January 2025’s 14.8 p.c low.

Month-to-month Annualised SC Development Charge Traits

(Jan 2019-Could 2025 – % of US$)

Supply: WSTS / Future Horizons

We nonetheless count on to see this development flip down within the coming months, as per previous cyclical patterns, with the one uncertainty being when this may occur.

Market Development Indicators

The three/12 curve fell again barely in Could, to 19.8 p.c, vs. 20.6 p.c in April, 18.8 p.c in March and 17.1 p.c in February, while the 12/12 curve elevated to twenty.1 p.c, up from 19.6 p.c in April and March, extra in step with the curve having reached its conventional cyclical peak.

Consequently, the hole between the 2 curves reversed from final month’s plus 1.0 proportion factors to minus 0.3, pushing the expansion momentum indicator again into Loss of life Cross territory.

Given the depressed state of the non-AI market sectors, the worsening general world financial outlook, the nonetheless on-going extra stock and large overcapacity, April’s tour into calm waters seems possible a short-lived achieve earlier than shifting again into the storm, with the size and timing of the transition relying on how for much longer the present AI infrastructure increase prevails.

Catastrophe Ready To Occur

April’s complete CapEx spend as a p.c of semiconductor gross sales was 19.4 p.c in April, vs. 22.6 p.c and 18.4 p.c in March and February respectively. The long-term safe-haven development is 14 p.c.

The equal numbers for Wafer Processing (Entrance-Finish) Tools CapEx spend had been 16.4 p.c, 19.0 p.c and 13.0 p.c respectively, with the general development once more properly above the 11.0 p.c long-term safe-haven development.

The business is continuous to stubbornly over-spend on CapEx, with no signal but of any try to chop again, not to mention transfer again under the development line to compensate for the final two-plus years of extra capability funding.

The present development is parallel to the huge over-investment euphoria within the mid-1990’s reminiscence and 2000’s dot.com booms.

We must always all know by now how this situation will finish, we simply by no means know when, however previous experiences are extra typically forgotten than realized, permitting irrational exuberance and unhealthy practices to prevail.

Greed at all times overcomes concern earlier than the entire thing goes ka-boom.

A well timed reminder to replicate on Albert Einstein’s quote “Madness is doing the identical factor over once more and anticipating a distinct end result?”

Learn The Full Report Right here: https://www.futurehorizons.com/page/137/

Source link