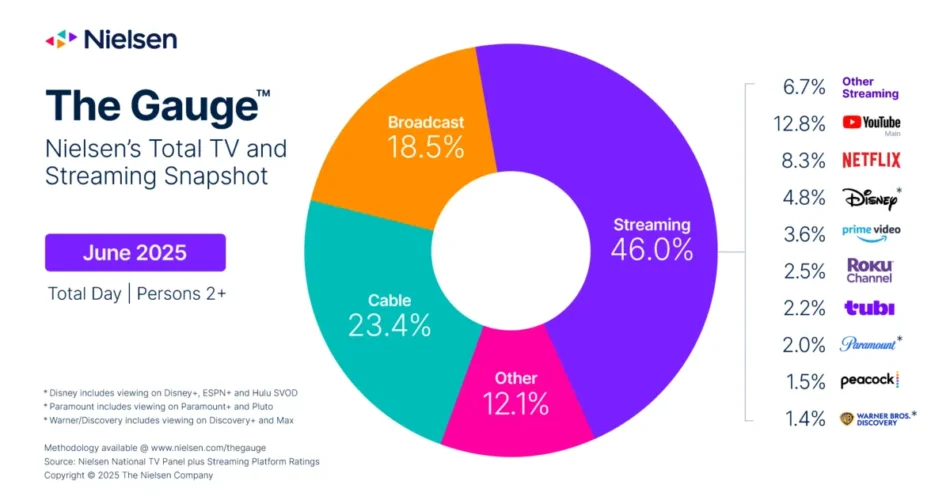

Netflix achieved its most important month-to-month development in current historical past throughout June 2025, capturing 8.3% of complete tv utilization whereas streaming platforms collectively reached 46.0% market share, based on Nielsen’s 50th monthly report of The Gauge released July 15, 2025.

The streaming large recorded a 13.5% viewing enhance over Might, including 0.8 share factors and accounting for 42% of streaming’s complete month-to-month achieve. This efficiency marks a pivotal second for Netflix’s promoting enterprise, which the corporate aims to double in 2025 following its profitable transition to programmatic promoting partnerships.

In response to Nielsen’s knowledge, Netflix’s surge was pushed by extremely profitable unique content material, with “Ginny & Georgia” main because the most-streamed title of the month at 8.7 billion viewing minutes. The platform’s content material acquisition technique proved equally efficient, as “Animal Kingdom” and “Blindspot” captured second and third positions with 5.71 billion and 5.69 billion viewing minutes respectively.

“The ‘Netflix Impact’ was in full view,” the report states, highlighting how acquired collection instantly gained recognition on the platform. The month concluded with the third season of “Squid Recreation” producing almost one billion viewing minutes per day throughout its closing three days of the measurement interval.

Subscribe the PPC Land publication ✉️ for related tales like this one. Obtain the information day by day in your inbox. Freed from adverts. 10 USD per 12 months.

Abstract

Who: Netflix, Peacock, Nielsen, and tv audiences together with vital viewing will increase amongst 6-17 year-olds throughout summer season break.

What: Netflix achieved its strongest month-to-month efficiency with 13.5% viewing development and eight.3% of complete TV share, whereas streaming platforms collectively reached 46.0% market share in Nielsen’s fiftieth month-to-month Gauge report.

When: June 2025 measurement interval (Might 26-June 29, 2025) with outcomes introduced July 15, 2025.

The place: United States tv market throughout broadcast, cable, streaming, and different viewing platforms measured by means of Nielsen’s complete methodology.

Why: Sturdy content material efficiency led by “Ginny & Georgia,” “Animal Kingdom,” “Blindspot,” and “Squid Recreation” season three, mixed with summer season viewing will increase amongst school-aged demographics and Netflix’s increasing promoting capabilities driving platform development.

Subscribe the PPC Land publication ✉️ for related tales like this one. Obtain the information day by day in your inbox. Freed from adverts. 10 USD per 12 months.

Peacock delivers sturdy efficiency amid summer season programming

Peacock secured the second-largest month-to-month enhance amongst streaming platforms with 13.4% development, pushed primarily by its unique collection “Love Island USA.” The fact present garnered 4.4 billion viewing minutes, establishing itself because the fourth most-streamed title of June. Peacock’s development contributed to a 0.1 share level achieve, bringing its complete tv share to 1.5%.

The efficiency represents vital progress for the NBCUniversal platform, which has expanded its attain by 0.3 share factors in comparison with June 2024. This development trajectory aligns with broader trade actions towards diversified content material methods and enhanced viewer engagement throughout summer season months.

Youngsters and youngsters drive viewing surge

Summer time break from college created substantial shifts in viewing patterns, with 6-17 year-olds rising their complete tv utilization by 27% in comparison with Might. This demographic allotted two-thirds (66%) of their tv time to streaming platforms, demonstrating the pronounced choice for on-demand content material amongst youthful audiences.

Netflix and Peacock significantly benefited from this demographic shift. Viewing from 6-17 year-olds jumped 32% for Netflix and 37% for Peacock versus Might, indicating sturdy enchantment of their content material libraries to school-aged audiences. This pattern helps Netflix’s strategic deal with numerous programming that appeals throughout age teams, significantly because the platform advances its sophisticated targeting capabilities for advertisers in search of youthful demographics.

The “Different” class, encompassing online game console utilization and set-top field utilization, skilled a 14% general enhance versus Might. Amongst 6-17 year-olds, this class surged 41%, reflecting elevated gaming and various leisure consumption throughout trip durations.

Conventional tv faces continued strain

Broadcast and cable tv collectively misplaced market share regardless of a number of shiny spots in programming. Mixed broadcast and cable share declined from 44.2% in Might to 41.9% in June, marking the primary time broadcast viewing fell under 20.0% share at 18.5%.

Broadcast tv discovered success by means of high-profile sports activities programming. The NBA Finals on ABC dominated the month’s high telecasts, with the seven video games representing the highest-rated broadcasts. This sports activities programming helped elevate broadcast sports activities viewership by 17% in comparison with Might, demonstrating the continued worth of reside occasions in attracting massive audiences.

ABC secured every of the highest 12 telecasts in June, together with the NBA Trophy Presentation and ABC World Information Tonight, reinforcing the community’s power in each sports activities and information programming.

Cable tv skilled blended outcomes regardless of general share decline. NBA Convention Finals on ESPN and TNT ranked as the highest two cable telecasts, whereas a busy information cycle drove cable information viewing up 12% versus Might. Particular programming additionally offered highlights, together with the Military 250 Parade on FOX Information Channel, which attracted 2.8 million viewers, and CNN’s “Goodnight and Good Luck,” drawing 2.4 million viewers.

Technical measurement and promoting implications

The June 2025 measurement interval spanned Might 26 by means of June 29, 2025, following Nielsen’s broadcast calendar methodology with Monday-through-Sunday measurement weeks. This complete strategy offers crucial knowledge for advertisers evaluating cross-platform marketing campaign effectiveness.

For advertising professionals, these viewing patterns maintain vital implications. Netflix’s dominant efficiency, mixed with its expanding programmatic advertising capabilities through partnerships with Yahoo DSP, The Trade Desk, and Google DV360, creates substantial alternatives for reaching engaged audiences throughout peak viewing durations.

The focus of viewing amongst youthful demographics throughout summer season months significantly advantages advertisers concentrating on back-to-school campaigns and youth-oriented merchandise. Netflix’s skill to seize 32% development amongst 6-17 year-olds whereas sustaining broad enchantment throughout all demographics positions the platform as more and more helpful for numerous promoting methods.

Streaming continues market transformation

The 46.0% streaming share represents a 5.4% month-over-month enhance, underlining the accelerating transformation of tv consumption patterns. This development occurred regardless of the seasonal nature of June viewing, historically a interval when tv utilization decreases attributable to outside actions and trip journey.

Netflix’s 42% contribution to streaming’s month-to-month achieve demonstrates the platform’s outsized affect on trade tendencies. This efficiency helps the corporate’s aggressive enlargement into promoting expertise, together with the launch of its proprietary Netflix Adverts Suite platform and advanced targeting capabilities at postal code level across EMEA markets.

The information reveals elementary shifts in how audiences eat tv content material. Streaming platforms now command almost half of all tv viewing, whereas conventional broadcast and cable proceed shedding floor to on-demand alternate options. This transformation creates each challenges and alternatives for advertisers in search of to succeed in fragmented audiences throughout a number of platforms.

For the promoting trade, these tendencies necessitate subtle cross-platform methods that account for various viewing behaviors throughout demographics and seasons. Netflix’s technical infrastructure enhancements, together with Campaign Manager 360 integration for cross-media measurement, present instruments for navigating this advanced panorama.

Market implications for advertisers

Netflix’s distinctive June efficiency coincides with the platform’s strategic push into promoting income development. The corporate has systematically expanded its programmatic promoting capabilities all through 2024 and 2025, creating new alternatives for entrepreneurs to succeed in extremely engaged audiences.

The viewing patterns revealed in Nielsen’s report assist Netflix’s positioning as a premium promoting surroundings. With restricted advert stock in comparison with conventional tv and excessive viewers engagement ranges, the platform instructions premium pricing that displays its distinctive worth proposition.

Seasonal viewing will increase amongst youthful demographics create specific alternatives for manufacturers concentrating on back-to-school durations, youth merchandise, and family-oriented providers. Netflix’s skill to draw and retain youthful viewers whereas sustaining broad enchantment positions the platform strategically for numerous promoting campaigns.

The information additionally highlights the significance of content material technique in driving platform efficiency. Netflix’s success with each unique collection like “Ginny & Georgia” and “Squid Recreation,” in addition to acquired content material like “Animal Kingdom” and “Blindspot,” demonstrates the platform’s subtle strategy to content material curation and viewers engagement.

Terminology information

Programmatic promoting: Automated shopping for and promoting of digital promoting stock by means of real-time bidding platforms. This expertise permits advertisers to buy advert placements throughout a number of platforms concurrently, utilizing algorithms to optimize concentrating on, pricing, and placement selections. Netflix’s enlargement into programmatic promoting permits entrepreneurs to entry its premium stock by means of acquainted demand-side platforms, streamlining marketing campaign administration throughout streaming and conventional digital channels.

Related TV (CTV): Tv content material delivered by means of internet-connected units reasonably than conventional cable or broadcast alerts. CTV encompasses sensible TVs, streaming units, gaming consoles, and cell units used to observe tv content material. For advertisers, CTV represents a rising alternative to succeed in cord-cutting audiences with focused, measurable campaigns that mix tv’s visible affect with digital promoting’s precision concentrating on capabilities.

Cross-media measurement: Analytics methodology that tracks marketing campaign efficiency throughout a number of promoting channels and platforms concurrently. This strategy permits entrepreneurs to know how audiences work together with ads throughout tv, digital, cell, and streaming environments. Superior cross-media measurement helps optimize price range allocation and inventive methods by figuring out which platform mixtures ship the best return on promoting funding.

First-party knowledge integration: The method of mixing a platform’s proprietary viewers info with advertiser marketing campaign concentrating on parameters. Netflix’s first-party knowledge contains viewing behaviors, content material preferences, system utilization patterns, and demographic info collected immediately from subscribers. This integration permits extra exact viewers concentrating on whereas sustaining privateness compliance, as knowledge stays throughout the platform’s managed surroundings reasonably than being shared externally.

Non-public market (PMP): Invitation-only programmatic promoting public sale the place choose advertisers can bid on premium stock earlier than it turns into obtainable in open exchanges. PMPs provide advertisers assured entry to high-quality placements whereas offering publishers with better management over which manufacturers seem alongside their content material. Netflix’s PMP choices give advertisers precedence entry to its streaming stock with enhanced concentrating on capabilities and model security controls.

Demand-side platform (DSP): Software program expertise that permits advertisers and businesses to buy digital promoting stock throughout a number of advert exchanges and provide sources by means of a single interface. DSPs automate the bidding course of, optimize campaigns in real-time, and supply complete reporting throughout all bought stock. Netflix’s partnerships with DSPs like The Commerce Desk and Google DV360 enable advertisers to incorporate streaming stock inside current programmatic campaigns.

Share factors: Measurement unit representing share modifications in viewers share or market penetration over particular time durations. In tv measurement, gaining one share level means capturing an extra one p.c of complete viewing time throughout all measured platforms. Netflix’s 0.8 share level achieve in June represents substantial viewers migration, as every share level sometimes represents tens of millions of viewing hours throughout the measured inhabitants.

Viewability verification: Technical measurement confirming that digital ads have been really seen by customers reasonably than loaded however not displayed. Viewability requirements sometimes require 50% of an commercial’s pixels to be seen for at the very least one second for show adverts, or two seconds for video content material. Netflix’s partnerships with verification suppliers like DoubleVerify guarantee advertisers obtain clear reporting on precise commercial publicity charges.

Upfront commitments: Annual promoting gross sales agreements the place manufacturers decide to spending predetermined quantities on tv stock earlier than the programming season begins. These agreements sometimes safe most well-liked placement, pricing ensures, and viewers supply guarantees in alternate for early monetary dedication. Netflix’s 150% enhance in upfront commitments demonstrates rising advertiser confidence in streaming platforms as viable alternate options to conventional tv shopping for.

Advert-supported tier: Subscription service degree that gives decreased pricing in alternate for accepting promoting interruptions throughout content material consumption. This monetization mannequin permits streaming platforms to seize price-sensitive shoppers whereas producing further income by means of promoting gross sales. Netflix’s ad-supported tier has grown to symbolize 40% of recent sign-ups, creating substantial stock for advertisers whereas sustaining subscription income streams.

Subscribe the PPC Land publication ✉️ for related tales like this one. Obtain the information day by day in your inbox. Freed from adverts. 10 USD per 12 months.

Timeline

Source link