The function of in the present day’s CFO is evolving quickly. What was as soon as a place primarily centered on historic reporting and compliance has expanded right into a forward-looking, strategy-driven management function. With information, analytics, and AI reshaping how companies function, finance leaders are actually on the forefront of digital transformation, together with in complicated areas like rebate administration.

On this weblog submit, we’ll discover how finance leaders can construct a compelling enterprise case for adopting AI-powered rebate administration, unpacking the important thing issues, potential pitfalls, and methods for gaining management buy-in.

The New CFO Mandate: Technique, Foresight, and AI

Not way back, a CFO’s main duty was to report on what had already occurred together with final quarter’s earnings, year-over-year efficiency, and so forth. However in in the present day’s enterprise panorama, that’s now not sufficient. Finance groups are actually anticipated to play an lively function in shaping the way forward for the enterprise, offering strategic steerage and state of affairs modeling to help selections.

AI is more and more central to this shift. Whether or not it’s forecasting income, optimizing working capital, or enhancing procurement methods, AI can floor insights and patterns which can be in any other case invisible to conventional instruments.

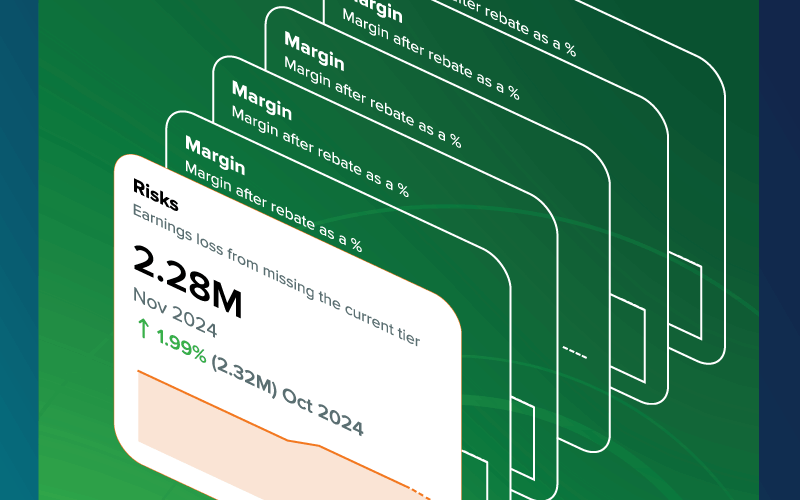

Rebate administration is one such space the place AI is poised to ship transformative worth. Rebates are inherently complicated, high-stakes, and data-heavy, making them a chief candidate for AI-driven optimization.

Why Rebate Administration Wants a Rethink

Rebates typically straddle a number of departments: gross sales, procurement, finance, authorized, and operations. That fragmentation can result in critical challenges:

- Missed rebate targets resulting from poor forecasting

- Over- or under-accruals impacting monetary accuracy

- Handbook processes consuming up time and rising error charges

- Lack of visibility into incentive constructions, tiers, and thresholds

On the similar time, rebates are important to margin efficiency and aggressive technique. For a lot of corporations, they signify the distinction between revenue and loss.

AI-powered analytic platforms like Allow may also help companies transfer from backward-looking reporting to forward-looking rebate technique unlocking predictive insights, automating complicated calculations, and aligning cross-functional groups in actual time.

However earlier than you’ll be able to implement such an answer, you’ll want buy-in. That begins with constructing a enterprise case that speaks the CFO’s language.

Step 1: Begin with the Present State

When making the case for AI funding, it’s tempting to steer with the answer. Resist that urge.

As a substitute, begin by totally mapping your present rebate processes. Contain all stakeholders, finance, procurement, gross sales, authorized, operations and doc how rebates are at present calculated, tracked, and analyzed. Determine ache factors like:

- Knowledge silos between departments

- Handbook monitoring in Excel or emails

- Problem forecasting efficiency in opposition to rebate tiers

- Incapacity to reconcile accruals precisely

This course of will naturally floor inefficiencies and dangers. Extra importantly, it can create shared alignment across the want for enchancment, a vital basis earlier than introducing AI into the dialog.

Step 2: Determine and Quantify ROI

CFOs suppose when it comes to return on funding. A powerful enterprise case wants to indicate not simply theoretical advantages, however concrete, measurable outcomes. Keep away from imprecise guarantees like “we’ll save time” or “we’ll be extra strategic.” As a substitute, tie advantages to tangible metrics:

- Hours saved by automating handbook calculations

- Improved rebate seize by hitting thresholds extra constantly

- Lowered leakage from missed claims or under-reporting

- Quicker accrual reconciliation, resulting in extra correct financials

- Time to worth—how quickly after implementation will advantages start to materialize?

Break these down into short- and long-term worth. For instance, short-term features would possibly embrace reclaiming 300 finance hours per 12 months. Lengthy-term, the group would possibly recoup an extra $2M yearly by optimizing progress incentives embedded in provider agreements.

These projections ought to be grounded in actual information out of your course of audit. And they need to embrace assumptions spelled out clearly, to construct belief with skeptical stakeholders.

Step 3: Handle Frequent Dangers and Issues

Each tech funding carries threat. When proposing AI options, CFOs will possible concentrate on three key areas:

- ROI Uncertainty – Will this repay? What if adoption is gradual?

- Knowledge Safety – Can we belief the platform with delicate business data?

- Vendor Sustainability – Is that this supplier secure sufficient for the lengthy haul?

Your proposal ought to proactively deal with these questions. Reveal that:

- The AI platform has sturdy safety protocols (SOC 2, ISO 27001, and so on.)

- There’s a transparent adoption and alter administration plan

- The seller has a confirmed observe document with shoppers in your business

Bonus factors should you can present how the answer scales. As rebate applications develop extra subtle or new geographies come on-line, you’ll wish to guarantee your funding grows with you.

Step 4: Anticipate and Navigate Skepticism

Even with a rock-solid enterprise case, resistance is inevitable, particularly when AI is concerned. Some leaders could have AI fatigue; others could really feel it’s only a fashionable buzzword. That’s why it’s important to floor your proposal in real-world challenges and alternatives.

Body AI not as a magic wand, however as a sensible software to unravel particular, high-impact issues. As an example:

“We’re not shopping for AI for the sake of it—we’re fixing a $5M downside in rebate leakage.”

Assist stakeholders see AI as a option to eradicate mundane duties, cut back threat, and empower groups with insights—not as a job replacer.

Step 5: Seize the Strategic Worth of AI

Lastly, remind management that AI isn’t a one-off software. It’s a basis for steady enchancment. As AI evolves, corporations which have already embedded it into core workflows shall be positioned to maneuver quicker and smarter than their friends.

Consider AI-powered rebate administration because the launchpad for broader transformation:

- Automating the tail of provider negotiations

- Surfacing product combine methods primarily based on rebate influence

- Working what-if eventualities to optimize profitability

- Enhancing rebate transparency to strengthen provider relationships

The sooner your group will get comfy utilizing AI in finance workflows, the extra aggressive benefit you’ll acquire over time.

From Enterprise Case to Enterprise Affect

Constructing a enterprise case for AI in rebate administration isn’t about hype—it’s about worth. Begin together with your present actuality, quantify the chance, and clearly present how AI helps you get there. Handle stakeholder considerations head-on, and paint an image of a wiser, extra agile future powered by proactive insights.

Rebates are too strategic—and too complicated—to be left to spreadsheets and guesswork. With AI, finance leaders can transfer from reactive to predictive, from fragmented to unified, and from oversight to alternative.

If you would like a foolproof information to take again to your finance crew, start by downloading our eBook: Building the Business Case for AI-Powered Rebates. It’s filled with sensible steps and knowledgeable insights that can assist you safe buy-in and lead the cost.

Source link