Insurance coverage advertising has a relevance drawback. Communications are closely regulated, risk-averse by nature, and sometimes so templated they learn extra like a authorized boilerplate than buyer messaging. Most suppliers solely attain out at predictable moments – coverage renewals, declare updates, cost reminders – and even then, the content material feels generic and transactional.

That’s an issue. As a result of insurance coverage is deeply private. You’re coping with folks’s houses, well being, funds, and futures. And whereas the stakes are excessive, the client expertise can really feel low-effort and disconnected – extra like checking a compliance field than constructing a relationship.

Why conventional insurance coverage messaging falls flat

This isn’t an information drawback. It’s an information activation drawback. Most insurers sit on troves of wealthy behavioral, transactional, and contextual knowledge. However legacy martech stacks, siloed knowledge environments, and batch-driven workflows make that knowledge almost not possible to behave on in a significant, well timed means.

Advertising and marketing groups are caught working with stale viewers lists, manually exported and reworked from core programs into legacy advertising clouds that had been by no means constructed for right now’s knowledge volumes or regulation-heavy use instances. By the point a marketing campaign will get the inexperienced gentle, the information it’s based mostly on is already days and even weeks outdated. Your buyer may need moved homes, modified insurance policies, filed a declare, or been impacted by an area occasion, and your messaging now not is sensible.

Instance: A buyer provides a second automobile to their auto coverage, however as a result of your system solely syncs knowledge nightly, they obtain a cross-sell e-mail encouraging them to “add a automobile” – two days after they’ve already accomplished it. Or worse, they’re supplied a quote for a less expensive tier of protection than what they only bought. That sort of delay is irritating and, in a regulated house, can change into a legal responsibility.

And whereas compliance concerns are very real, they’re typically blamed for what’s in the end a workflow difficulty. The underlying danger comes from buyer knowledge being outdated, misclassified, or uncovered by poorly designed third-party programs. However the suitable infrastructure – one which prompts knowledge instantly out of your ruled knowledge warehouse – removes that danger. Nothing has to maneuver, and nothing will get misplaced in translation.

The shopper’s bar is greater than ever

Insurance coverage prospects aren’t simply evaluating you to different suppliers. They’re benchmarking each expertise in opposition to manufacturers like Amazon, Netflix, and Uber – manufacturers that tailor every interaction based on real-time behavior and context.

They anticipate:

- Proactive steering: Protection alerts, renewal reminders, lacking doc nudges – earlier than they change into a problem

- Situational relevance: Context-aware messaging that displays their location, what insurance policies they maintain, and what actions they’ve taken (or not taken)

- Cross-channel coherence: Seamless experiences throughout e-mail, SMS, cell, and name facilities with out duplication, contradiction, or confusion

Instance: Throughout wildfire season, California householders obtain preparedness checklists, protection reminders, evacuation ideas, and real-time updates. Florida prospects obtain the identical degree of help throughout hurricane season – however tailor-made to their distinctive danger.

This is what modern engagement looks like. It’s anticipated. And it’s doable when your knowledge is reside, accessible, and related.

Find out how to stand out: 3 methods for higher engagement

To distinguish in a crowded, compliance-heavy market like insurance coverage, you want to have the ability to activate your knowledge in actual time – with out compromising governance or agility. Right here’s how.

Actual-time segmentation that displays real-life habits

Neglect batch exports and static lists. Actual-time segmentation occurs instantly in your reside knowledge – no copies, no syncing, no lag. Buyer segments replace robotically as behaviors shift, insurance policies change, or places range – all in actual time. You’re querying data in place, straight from your warehouse, with zero ETL and 0 delay. Meaning extra correct focusing on, sooner execution, and no wasted time ready on outdated snapshots.

Advertising and marketing groups can construct dynamic segments like:

- Prospects in high-risk areas throughout an lively climate occasion

- New policyholders who’ve accomplished onboarding however haven’t downloaded your app

- Lately settled claimants eligible for satisfaction follow-up

- Policyholders exhibiting lapse-risk habits (missed funds, latest inactivity)

- Excessive-value prospects nearing renewal with declining engagement scores

Instance: An auto buyer concerned in a collision information a declare on-line. They’re immediately faraway from promotional journeys and positioned right into a declare help observe with updates on restore timelines, rental automobile availability, and out-of-pocket prices – throughout e-mail, SMS, and cell app.

Such a situational messaging doesn’t require weeks of IT requests or advanced automations. It simply wants entry to reside knowledge and versatile logic.

All the time-on intelligence out of your total knowledge ecosystem

Most conventional martech platforms drive you to repeat and add knowledge into their system earlier than you are able to do something with it – construct segments, personalize content material, execute campaigns. This strategy introduces friction, delays, and pointless complexity.

Modern data activation doesn’t transfer knowledge round. It prompts it the place it lives by connecting on to your ruled knowledge warehouse. You question your reside knowledge in place after which use the outcomes to drive real-time messaging and journey logic immediately, with out sustaining fragile pipelines. It’s sooner, cleaner, and constructed for enterprise scale.

This unlocks:

- Geo-targeted alerts: Ship flood-prep steering to houses with related protection in forecasted zones – inside minutes.

- Product-specific journeys: Set off totally different onboarding tracks for renters, householders, auto, or life. (And correctly cross-sell between them!)

- Coverage lifecycle workflows: Remind customers to replace cost strategies earlier than expiry or flag protection gaps throughout renewal durations.

- Behavioral nudges: Assist first-time policyholders perceive deductibles or doc uploads based mostly on app exercise.

Instance: Let’s say a chilly entrance is forecast to hit Denver. Inside seconds, you’ll be able to determine policyholders with frozen pipe protection within the affected space who haven’t filed a declare previously 12 months – and ship them a guidelines through e-mail to stop water injury. In the event that they don’t open the e-mail inside 24 hours, you’ll be able to observe up with a push notification. No batching, no knowledge lag, no redundant messaging.

All of that is pushed by real-time occasions, reside queries in opposition to your knowledge warehouse, and direct execution throughout each channel – with out ever exporting buyer information to a third-party system. These well timed, related interactions are what build trust and brand loyalty. And when renewal time rolls round, it’s what retains you high of thoughts – not simply as a vendor, however as a valued associate.

Unified cross-channel execution from one supply of fact

Insurance coverage advertising spans each messaging channel: e-mail, SMS, push, in-app, net, and even direct mail. However when these channels are siloed, cross-channel experiences change into disjointed with prospects getting repeated reminders, mismatched presents, and conflicting recommendation.

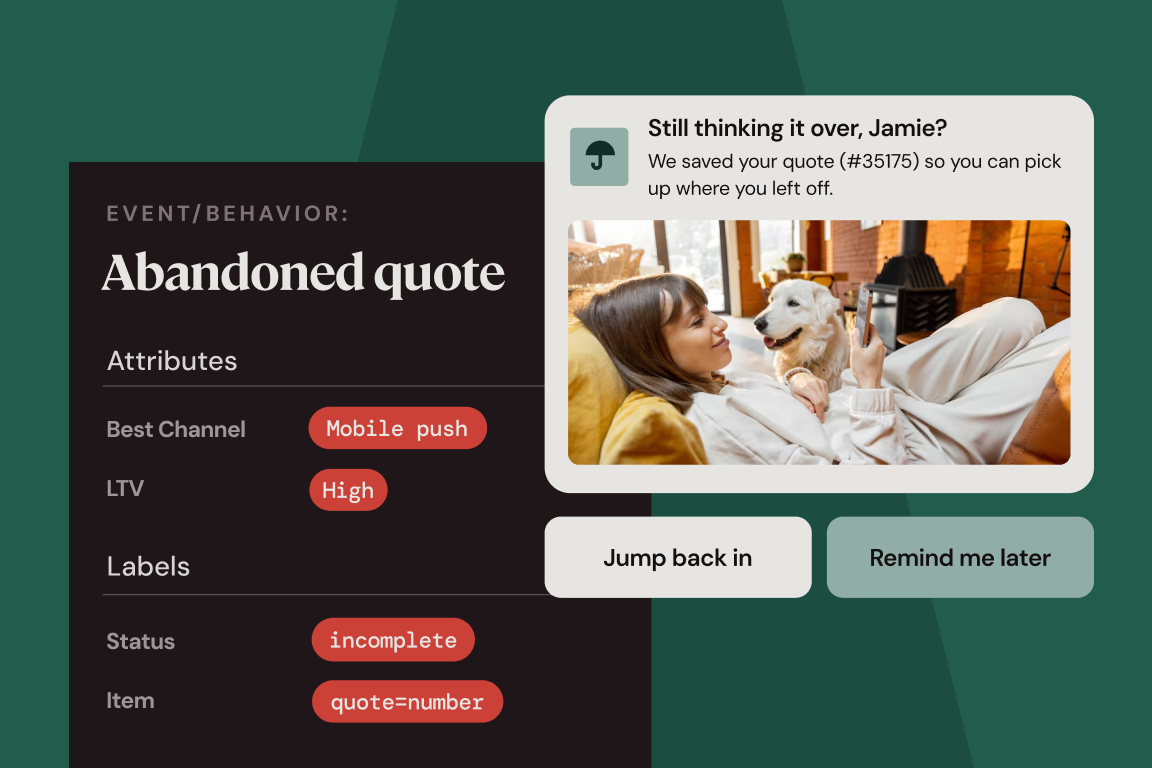

With unified customer profiles powering your cross-channel campaigns, you’ll be able to:

- Coordinate messages throughout channels in actual time

- Select the most effective channel per buyer based mostly on urgency, preferences, and engagement patterns

- React to behavioral alerts (or lack of them) to maintain prospects engaged

- Scale back fatigue by avoiding repeat messages or irrelevant presents

- Keep constant timing, message content material, and provide logic throughout each touchpoint

Instance: A buyer will get an e-mail asking them to add paperwork to finalize a declare. No motion taken? They obtain a follow-up SMS with a direct add hyperlink. Nonetheless nothing? You strive a push notification. If there’s nonetheless no response, they get routed to a name heart agent for human outreach, with full context included.

This type of marketing campaign execution isn’t doable with stitched-together level options. It requires a shared decisioning layer that pulls context instantly out of your trusted knowledge supply.

The MessageGears benefit for insurance coverage manufacturers

Most insurance coverage orgs have the information they should interact higher. They only don’t have the instruments or infrastructure to behave on it quick, precisely, or securely.

That’s precisely what MessageGears is constructed for:

- Dwell knowledge entry, no copies or syncs: MessageGears connects directly to your data warehouse or lake (Snowflake, BigQuery, Redshift, Databricks, and so forth.) so entrepreneurs are working with real-time, production-grade knowledge. No delays. No stale snapshots. You’re utilizing the freshest buyer context out there, pulled straight from the supply – each time you hit ship.

- Occasion-driven structure constructed for velocity and scale: Set off messaging immediately based mostly on any reside sign – from coverage updates and declare submissions to behavioral knowledge and geolocation pings. There’s no have to predefine each edge case. MessageGears listens to what’s occurring throughout your ecosystem and responds the second it occurs.

- True cross-channel execution from a single supply of fact: Whether or not it’s e-mail, SMS, cell, or net, MessageGears retains each touchpoint aligned along with your reside knowledge. You don’t have to duplicate logic or sync channels manually. Campaigns are powered by the identical real-time dataset, so that you keep away from workflow fragmentation, conflicting guidelines, and versioning nightmares.

- Versatile, self-serve segmentation for each talent degree: Advertising and marketing groups can build dynamic audiences without writing a line of code. Favor SQL? Your technical customers can go deeper, with full question management each time wanted. No extra bottlenecks. No extra back-and-forth with engineering. Simply correct focusing on that evolves as quick as your knowledge.

- Constructed-in governance: Safety and compliance are enforced on the supply. As a result of knowledge by no means leaves your firewall, it’s by no means compromised, mishandled, or accessed by anybody it shouldn’t be accessed by. It’s all built-in instantly into your advertising operations. No publicity. No vendor sprawl. No pointless danger.

- Enterprise-grade safety and compliance by design: MessageGears works inside your current infrastructure, so your buyer knowledge by no means leaves your setting. There’s no have to extract, transfer, or sync delicate info to third-party platforms. Each marketing campaign, viewers, and set off runs with built-in permissioning, auditability, and entry management – dramatically decreasing your danger publicity and simplifying compliance.

Whether or not you’re onboarding a brand new policyholder, sending pressing alerts, or nudging an at-risk buyer, MessageGears provides you the pliability and velocity to speak along with your prospects with what they want, after they want it – even in a extremely regulated setting like insurance coverage.

Construct belief in each interplay

Insurance coverage is constructed on belief. And each interplay is a chance to strengthen or weaken that belief. In case your messaging feels delayed, out of sync, or prefer it’s lacking the mark, it’s in all probability since you’re counting on outdated instruments and fragmented workflows. However fashionable insurance coverage prospects anticipate extra – and you have already got the information to ship it. You simply want the right platform to turn that data into action.

With MessageGears behind you, it’s not solely doable to have interaction higher – it’s scalable, safe, and helps the total policyholder journey. Don’t let your model get misplaced within the noise. Present your prospects you perceive them, you’re there for them, and also you’re totally different from the remainder.

Need to cease sounding like each different supplier?

MessageGears helps insurance coverage suppliers ship real-time, personalised buyer experiences at infinite scale – with out overhauling your tech stack, forcing you into workarounds, or compromising compliance. Preserve your knowledge the place it’s, keep strict governance, and nonetheless transfer quick. Let’s talk about how we can help you stand out.

Source link