Scott Brinker’s State of Martech report has grown from a one-page emblem jigsaw to a small trade, co-authored with MartechTribe’s Frans Riemersma and apparently produced by a small military of elves reviewing hundreds of merchandise annually. The most recent version, launched yesterday, offers the now-expected deep evaluation of trade tendencies masking class development, the affect(s) of AI, stack architectures, and extra. It’s all fascinating and too sophisticated (or perhaps complicated?) to recap right here, so I can solely recommend that you simply learn it by yourself.

Scott Brinker’s State of Martech report has grown from a one-page emblem jigsaw to a small trade, co-authored with MartechTribe’s Frans Riemersma and apparently produced by a small military of elves reviewing hundreds of merchandise annually. The most recent version, launched yesterday, offers the now-expected deep evaluation of trade tendencies masking class development, the affect(s) of AI, stack architectures, and extra. It’s all fascinating and too sophisticated (or perhaps complicated?) to recap right here, so I can solely recommend that you simply learn it by yourself.

Along with information primarily based on the 15,384 distributors now listed (up 9% from 2024), the report analyzes outcomes from a survey of martech and advertising and marketing operations leaders. Once more, there’s numerous fascinating data, however I used to be after all drawn to the sections associated to Buyer Information Platforms.

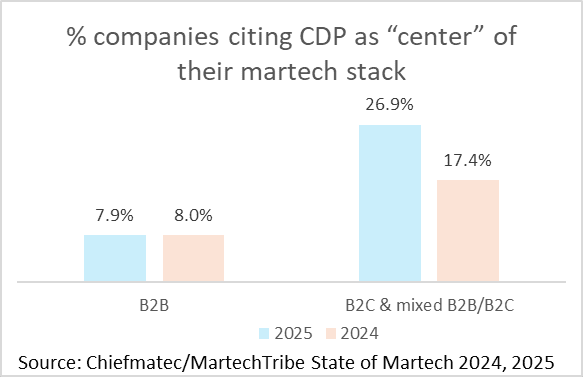

On its face, the report gives some fairly unhealthy information for the CDP trade: the fraction of corporations citing a CDP because the “heart” of their martech stack fell from 15.5% of their related 2024 survey to 12.5% in 2025. Nonetheless, the 2025 survey is predicated on simply 96 responses, that means that’s a swing of three solutions, so it’s not trigger for an excessive amount of alarm.* Nonetheless, it’s an fascinating end result, and much more intriguing while you separate B2B respondents (52% of the pattern) from others (14% B2C and 34% blended B2B/B2C). CDPs have by no means been extensively adopted within the B2B world, and certainly, their share is unchanged from 2024 (7.9%) to 2025 (8.0%). The flip facet to that’s within the B2C and blended group, the shift is bigger: from 26.9% in 2024 to 17.4% in 2025. However, once more, keep in mind the pattern measurement: that 17.4% represents seven responses. A shift of three solutions is effectively throughout the vary of statistical noise.)

Let’s put sampling points apart and assume there’s some drop-off in reliance on CDP. The query is what has taken its place?

Did you simply reply “cloud information warehouse, after all”? That’s not solely mistaken – the information warehouse share grew from 20.9% to 23.9%. However the huge winner was MAP/CEP (advertising and marketing automation/buyer expertise platform), which grew from 19.4% to 26.1%. CRM grew from 17.9% to 19.5%, or almost as a lot as information warehouses. Multi-product suites fell from 1.4% to zero, which hints fairly strongly that the respondents closely skewed away from giant enterprises.**

If we mix the MAP/CEP, CRM, and DXP or ecommerce classes into one thing like “customer-facing techniques”, the mixed share of that group grew from 43.3% to 52.1%. So if I have been to learn any development from this information, it could be that corporations are centering their martech stacks on customer-facing techniques, not on information warehouses.

That is truly in keeping with the tendencies we’ve seen within the CDP trade itself, the place the latest main acquisitions (ActionIQ by Uniphore , Lytics by ContentStack, mParticle by Rokt) all concerned merging a CDP right into a customer-facing product, and the place customer-facing distributors like MessageGears, Klayvio, Insider, Listrak, and Braze have added CDP (or CDP-ish) capabilities***. The CDP Institute classifies all of those techniques as CDPs, along with no matter else they do. So, the best way I see it, corporations that listing these merchandise because the “heart” of their martech stack are nonetheless constructing their stack on a CDP, even when they don’t name it one. That’s excellent news for the trade, not unhealthy.

The survey additionally takes one other take a look at the position of knowledge warehouses within the martech stack, asking “Do you could have a buyer information warehouse/lakehouse built-in together with your martech stack?” Greater than half the respondents (56.2%) stated they did, a quantity that climbs to 92% for B2C distributors and 80% for enterprise corporations. What’s fascinating right here is the relation of these solutions to the earlier query: many extra corporations have built-in a warehouse than are utilizing their warehouse as the middle of their martech stack. That is removed from stunning however, once more, means that the mere presence of a warehouse doesn’t imply that warehouse is the first buyer information retailer. Presumably all these non-central warehouses are performing as information sources to CDPs or customer-facing techniques with a CDP inside.

In case you’re a “warehouse-centric” composable CDP vendor, you might learn the comparatively small position of warehouse-as-central system both as trigger for alarm – the market isn’t as huge as you thought – or cause to rejoice – the potential for development is big. Each could possibly be true on the identical time. But when the first trade development is for CDP capabilities emigrate to customer-facing techniques (run by advertising and marketing or different enterprise models), then a shift of CDP capabilities towards the (IT-controlled) information warehouse appears to be the mistaken option to guess.

I ought to stress that CDPs are a bit participant within the Brinker/ Riemersma epic. Undoubtedly download the report (it’s free and ungated) and deal with whichever parts you discover most related. It’s all good.

————————————————————————————————————————————

*the 2024 survey had 168 responses, of which 60% have been B2B, 9% have been B2C and 31% have been blended. Doing that math, that’s 67 responses within the B2C and blended group, of which 18 cited CDP as the middle of their stack.

** the 2025 report says 30 of the 96 responded have been from ‘enterprise’ organizations, however doesn’t point out how these cut up between B2B, B2C and blended.

***as well as, no less than one unacquired CDP (BlueConic) has repositioned as a customer-facing system.

Source link