CTV’s advert spend jumped 16% final 12 months, a major rebound from 2023, when it lagged behind on-line and social video, in keeping with The IAB Digital Video Advert Spend and Technique Report launched immediately.

CTV’s resurgence marks a pivotal second as digital video has change into the dominant pressure within the TV/video market.

CTV is anticipated to develop one other 13% in 2025 to achieve $26.6 billion. That may put CTV firmly forward of on-line video, with CTV advert spend in 2025 projected to be 43% bigger than on-line video ($18.6 billion).

One vital pressure behind the rise is streaming platforms’ improved programmatic and self-serve activation instruments. These developments have made investing their advert {dollars} considerably simpler for manufacturers of all sizes.

This ease of activation, mixed with CTV’s concentrating on and measurement capabilities, make it the channel of selection in advertisers’ minds. Over two-thirds (68%) of advertisers mentioned CTV is crucial for his or her media plans, putting it on the prime of the “should purchase” listing, with social video shut behind at 62%.

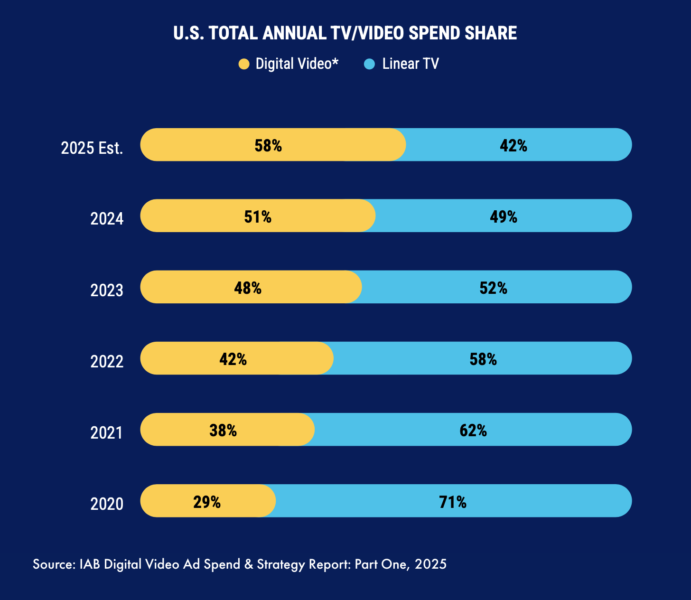

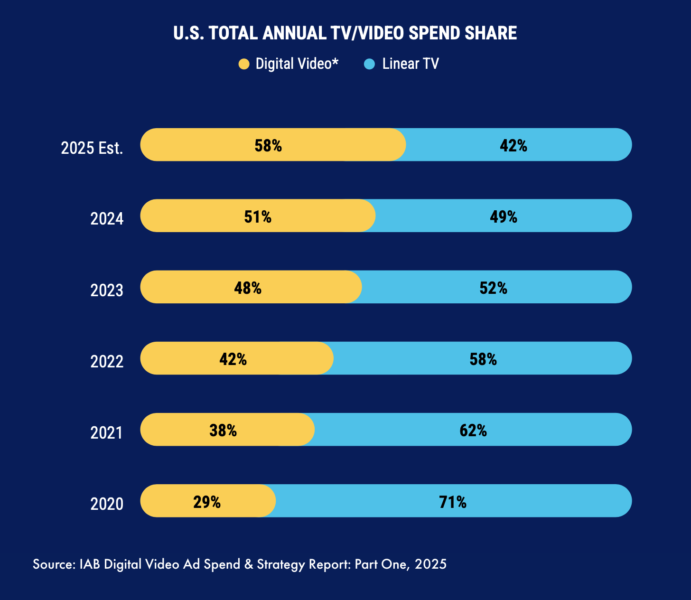

Digital video solidifies dominance, pulling forward of linear TV

CTV’s resurgence is a part of a broader enhance in all digital video promoting. Digital video — CTV, social video and on-line video — grew 18% in 2024 and is projected to develop one other 14% in 2025, reaching $72 billion. That’s two to a few occasions quicker than whole media general.

By the tip of the 12 months, digital video advert spending is anticipated to be almost 60% of whole TV/video advert spend, greater than doubling its share over the previous 5 years. Solely final 12 months, digital video promoting surpassed linear TV for the primary time. The hole will doubtless enhance in 2025, partly as a result of linear TV gained’t have the advert spend increase of presidential elections or the Olympics.

The place is the cash coming from?

The cash flowing into CTV primarily comes from reallocations. The highest sources of those funds (every cited by an equal share of these rising CTV spend) are:

- Linear TV (36%).

- Social media (36%).

- On-line video (excluding YouTube, 34%).

- Paid search (32%).

- Digital show (31%).

The reallocation from search and show highlights entrepreneurs prioritizing CTV’s concentrating on and attain capabilities.

Dig deeper: How to make CTV ads that stick

Key development classes and rising methods

Whereas most classes are projecting double-digit development in digital video in 2025, CPG, retail and pharma are projected to be the most important customers.

These classes are leveraging digital video for particular strategic benefits:

- CPG manufacturers’ spending is fueled by retail media networks and retail media information, a strategic push to diversify their video presence past social and on-line video, and the enlargement of broadcasters’ CTV choices.

- Retail, auto and restaurant manufacturers are specializing in real-time, location-based messaging and integrating shoppable advert codecs.

- Pharma manufacturers are more and more utilizing AI and information to personalize messaging, aligning with broader tendencies in CTV and social video. Notably, CTV is proven to drive excessive advert engagement charges for pharmaceutical adverts.

Market dynamics and methodology

As with all latest surveys about advertising, this one comes with a giant and cheap asterisk: “Attributable to ongoing financial uncertainty, together with tariffs, geopolitical battle and altering client sentiment, this 12 months’s market is extra dynamic than regular.”

The report relies on 364 surveys February 17 and March 7. Respondents had been verified as trade leaders who’re concerned in recommending, specifying, or approving promoting spending in digital video, spent a minimum of $1 million on promoting in 2024 and work at companies or instantly for a model marketer. It’s accessible to IAB members.

Source link