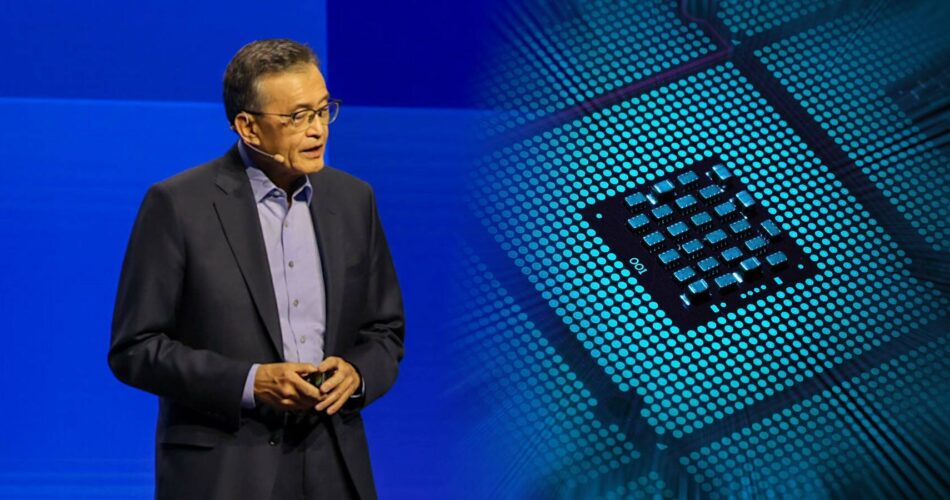

Intel’s new CEO Lip-Bu Tan is swinging the ax once more, with one other spherical of layoffs incoming as Chipzilla tries to reboot its core.

Earlier stories suggested Intel might shed as much as 20 p.c of its present workforce, or round 20,000 folks.

In a note to buyers throughout a Q1 2025 earnings name Thursday, Tan emphasised the necessity to streamline Intel’s operations and mentioned the period of its managers treating employees dimension as a key efficiency indicator has come to an finish.

“There isn’t any method round the truth that these vital modifications will scale back the scale of our workforce,” mentioned Tan. “As I mentioned after I joined, we have to make some very laborious choices to place our firm on a strong footing for the long run. This can start in Q2 and we are going to transfer as shortly as doable over the following a number of months.”

Tan used a novel time period for the pending layoffs throughout Intel’s convention name for buyers. “We have to get our stability sheet wholesome and begin the method of de-laborating this yr,” he mentioned.

The chopping began lengthy earlier than Q2. The beleaguered chipmaker laid off about 15 p.c of employees in August, ending 2024 with a headcount of 108,900 workers and the ouster of former CEO Pat Gelsinger.

Since then, the bleeding hasn’t stopped. From the beginning of the yr via March 29, 2025, Intel laid off or misplaced 1,900 workers, plus 400 from MobileEye and different subsidiaries. It additionally dropped about 4,000 with the divestiture of its NAND reminiscence enterprise, leaving it with a headcount of 102,600 as of final month.

The most recent headcount squeeze comes with Intel’s Q1 2025 revenue clocked in at $12.7 billion, flat year-on-year.

On the enterprise unit entrance, the chip maker’s the Consumer Computing Group (CCG) posted $7.6 billion in income, down 8 p.c; the Information Heart and AI (DCAI) division pulled in $4.1 billion, up 8 p.c; and Intel Foundry introduced house $4.7 billion, up 7 p.c.

Intel additionally booked $156 million in restructuring expenses for the quarter, in comparison with $348 million in the identical interval a yr in the past. Its working expense goal for 2025 has been lowered to $17 billion from $17.5 billion, and to $16 billion in 2026.

That deliberate belt-tightening contains cuts to analysis and improvement (R&D), and advertising, common and administrative (MG&A), is predicted to incur extra restructuring expenses, however Intel mentioned it has not but estimated these prices and thus has excluded them from its steering.

The chip biz additionally revised its Return to Workplace coverage, requiring hybrid workers to work from an Intel facility a minimum of 4 days per week, up from three presently, beginning September 1.

These new pushes adopted a management reshuffle. Tan, who beforehand helmed Cadence, was appointed Intel’s CEO in March, pledging to streamline operations and improve shareholder worth.

Talking final month on the Intel Imaginative and prescient 2025 occasion, Tan said, “Beneath my management, Intel will probably be an engineering-focused firm. … We are going to pay attention carefully and act in your enter. Most significantly, we are going to create merchandise that clear up your issues and drive your success.”

In an announcement accompanying Intel’s earnings launch, Tan indicated that he is nonetheless working to implement his imaginative and prescient for the corporate.

“The primary quarter was a step in the appropriate route, however there aren’t any fast fixes as we work to get again on a path to gaining market share and driving sustainable development,” he mentioned.

“I’m taking swift actions to drive higher execution and operational effectivity whereas empowering our engineers to create nice merchandise. We’re going again to fundamentals by listening to our prospects and making the modifications wanted to construct the brand new Intel.”

Requested to verify the reported 20 p.c headcount minimize, a spokesperson for the x86 titan instructed us: “We’ve not set any headcount discount goal. What we have now set is a brand new non-GAAP working expense goal to roughly $17 billion in 2025, down from our beforehand said objective of $17.5 billion, and $16 billion in 2026.” ®

Source link