We’re current this month’s excerpt from Future Horizons’ April report on the semiconductor market. Learn on to find the most recent insights and outlook for the business.

Government Abstract

Annualised development charges turned up in February, with Complete Semiconductors rising 20.7 p.c, up from final month’s 14.8 p.c, however nonetheless down from November 2024’s 22.8 p.c excessive and August 2024’s 28.5 p.c cyclical peak.

Logic continued to be the star sector performer, at a wholesome 35.8 p.c development, up from 29.7 p.c in January, with second-place Reminiscence rising 26.6 p.c, down from 29.9 p.c in January.

Analog ICs moved again into optimistic territory in February, rising 8.8 p.c, vs. minus 0.4 p.c in January, as too did Complete Micro, rising 2.6 p.c up from final month’s minus 0.4 p.c.

The general IC market ended up rising 24.1 p.c year-on-year, up from final month’s 19.4 p.c quantity however considerably decrease than November 2024’s 29.5 p.c development and August 2024’s 36.2 p.c peak.

The general tendencies, nonetheless, are nonetheless indicating retrenchment vs. restoration, having been now on a downward development for the final six months. We don’t anticipate this development to show up anytime quickly.

Annualised development charges are, nonetheless, only one facet of the coin. Our most well-liked measure is the month-on-month income development tendencies, which we imagine are a extra correct reflection of the general business well being.

Fortunately, February noticed month-to-month gross sales develop 6.5 p.c vs. January, reversing January’s 5.6 p.c, December’s 8.7 p.c and November’s 8.7 p.c decline.

Much more fortunately, this development was broadly unfold throughout all IC sectors bar Analog, which remains to be gripped in recession.

Market Development Indicators

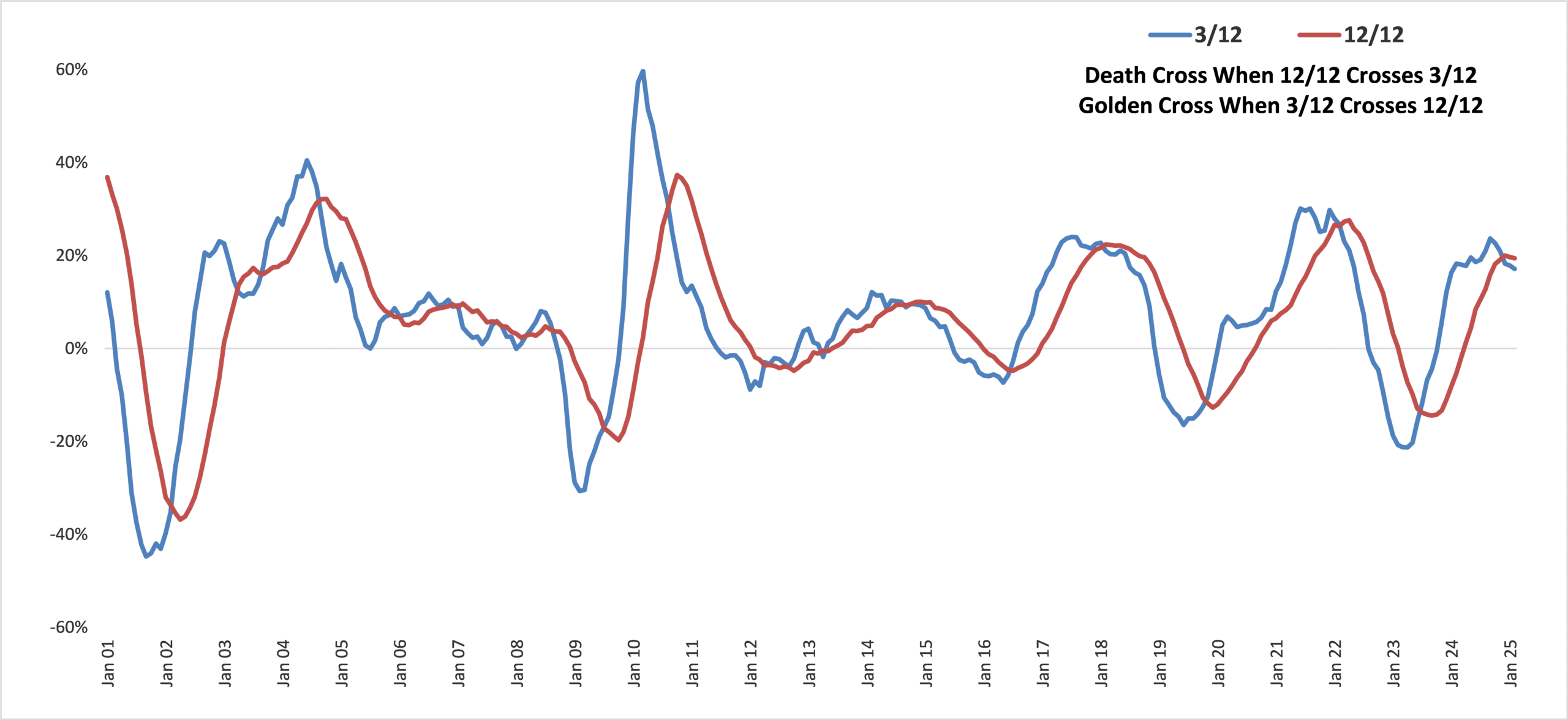

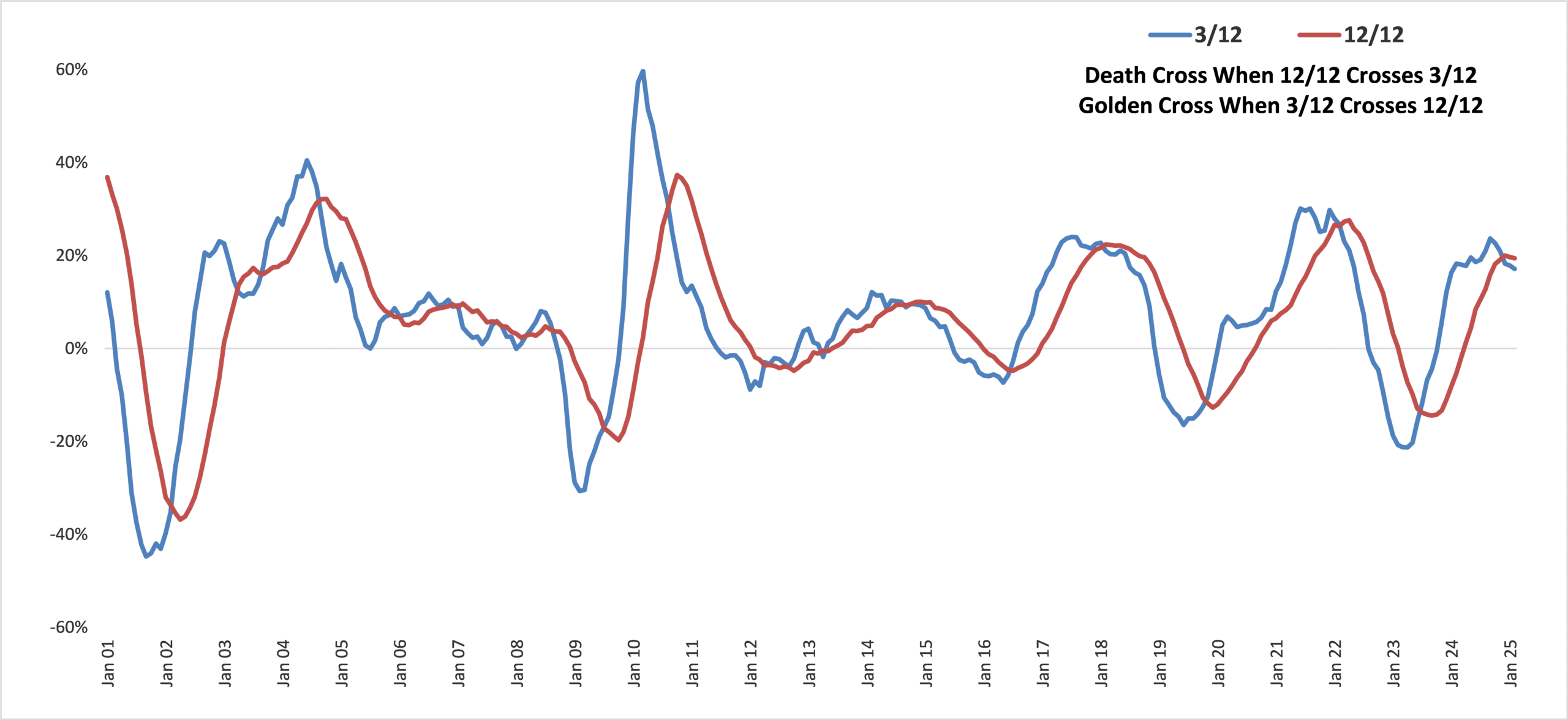

December 2024 noticed the business transfer into demise cross territory, with the three/12 curve declining additional in February, to 17.1 p.c, vs. 17.9 p.c in January 2025, 8.2 p.c in December 2024, and September 2024’s 23.7 p.c peak.

On the similar time, the 12/12 curve continued its gradual decline, at 19.4 p.c vs. 19.7 p.c in January and its 20.2 p.c December cyclical peak.

Because of this, the hole between the 2 curves widened barely to 2.3 proportion factors, vs. 1.8 proportion factors in each January 2025 and December 2024.

WW SC Development Momentum Indicator

(Jan 2001-Feb 2024 – % of US$)

There are three potential eventualities now in play, relying on how the three/12 curve performs out.

State of affairs 1: The 12/12 curve continues its cyclical decline however the 3/12 curve flattens off heralding a modest Golden Cross someday within the mid- to late-2025, as in 2018.

State of affairs 2: The 12/12 curve continues its cyclical decline with the three/12 curve following its extra typical decline trajectory, paving the best way for an prolonged business stroll in Loss of life Cross territory all through the entire of 2025, as in 2014.

State of affairs 3: The 12/12 curve turns again up while the three/12 curve continues its decline, heralding a a lot stronger Golden Cross someday within the first half of 2025, as in 2003.

At this juncture, it’s exhausting to foretell which state of affairs is almost certainly however, if the broader chip market continues its gradual and modest restoration and the present AI-inspired increase doesn’t crash and burn, then State of affairs 1 is the almost certainly final result.

You may learn the total March report right here: https://www.futurehorizons.com/page/137/

Source link