Should you didn’t obtain this fee—or acquired a partial quantity—you should still be certified to assert it by submitting a 2021 federal tax return. Nevertheless, you should act rapidly because the deadline is April 15, 2025.

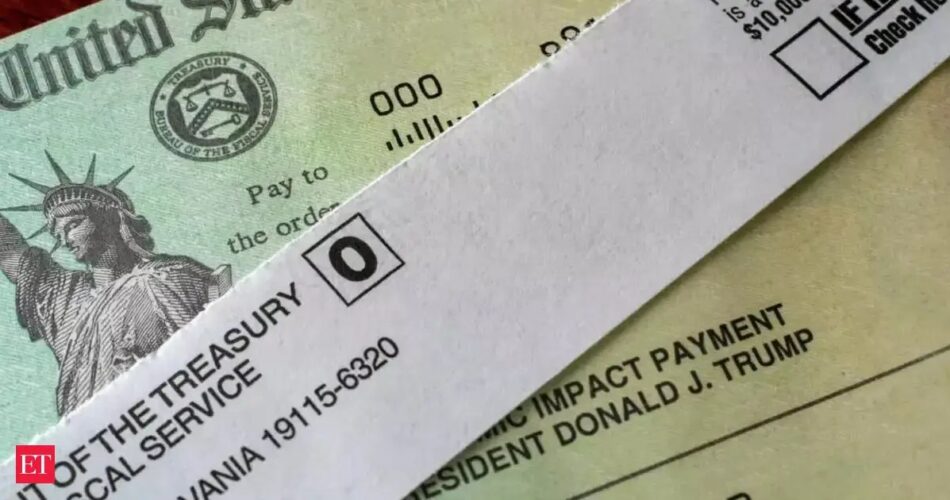

$1,400 IRS Stimulus Examine

Tuesday marks not solely Tax Day but in addition the three-year deadline for claiming tax refunds and credit for the yr 2021. This contains the $1,400 Restoration Rebate Credit score, which many have but to use for and obtain.

All through the COVID-19 pandemic, the federal authorities issued a number of rounds of stimulus funds to help People going through financial hardships. Nevertheless, quite a few people didn’t obtain these funds as a consequence of not submitting a 2021 tax return. This is applicable to individuals who weren’t required to file but have been nonetheless eligible for the stimulus.

ALSO READ: Trump’s ‘frequent victories’ in golf cited as proof for his ‘wonderful’ well being; the web is skeptical.

Didn’t obtain your $1,400 stimulus verify from 2021? You should still qualify. Should you missed the third spherical of Financial Affect Funds in 2021, there’s nonetheless time to assert it by means of the Restoration Rebate Credit score. The IRS is issuing funds robotically to those that filed however didn’t declare it—and should you haven’t filed but, you might have till April 15, 2025, to get what you’re owed. This may very well be your final alternative to obtain as much as $1,400 per individual, plus $1,400 for every dependent. Whether or not you’re a dad or mum, pupil, retiree, or thought you didn’t qualify as a consequence of low revenue, you would nonetheless be entitled to this cash—so don’t miss out.

For people who file by the suitable deadline, funds will likely be despatched both by way of paper verify or direct deposit utilizing the banking info offered on their 2024 tax returns.

The particular quantity acquired by every particular person is set by their adjusted gross revenue. These incomes $75,000 or much less in 2021 qualify for the total $1,400. For married {couples} submitting collectively, the revenue threshold rises to $150,000 for the 2021 tax yr.

Kevin Thompson, a finance professional and the founder and CEO of 9i Capital Group, beforehand said to Newsweek: “An important facet of the Restoration Rebate Credit score is that it’s refundable—this implies you may obtain the credit score even when you’ve got no tax liabilities. Not like most credit and rebates that solely cut back your taxable revenue to zero, refundable credit exceed what you owe, resulting in a refund of the additional quantity.”

ALSO READ: Blue-Origin rocket launch: Katy Perry and Jeff Bezos’ fiancée Lauren Sanchez set for area flight with an all-female crew.

Alex Beene, a monetary literacy teacher on the College of Tennessee at Martin, beforehand communicated to Newsweek: “Whereas it might appear unbelievable to the tens of millions of People who acquired stimulus checks all through the pandemic, there stays a small group of taxpayers who certified for funds and by no means acquired them.”

After April 15, taxpayers will lose the chance to obtain the stimulus verify funds, which will likely be returned to the U.S. Treasury.

Who Qualifies for the $1,400 Stimulus?

To obtain the total credit score, you should fulfill these standards:

U.S. citizen or resident alien for the tax yr 2021

Not claimed as a depending on another person’s 2021 tax return

Legitimate Social Safety Quantity (SSN) issued earlier than the tax return due date

Meet revenue eligibility standards (primarily based in your 2021 tax yr AGI).

Revenue Thresholds for Full Credit score

Single filers: $75,000 or much less

Married submitting collectively: $150,000 or much less

Head of family: $112,500 or much less

In case your revenue exceeds these quantities, the credit score will likely be steadily diminished and utterly phased out at:

$80,000 (single)

$160,000 (married submitting collectively)

$120,000 (head of family)

Easy methods to Declare the $1,400 Bonus?

1. If You Already Filed Your 2021 Tax Return (However Didn’t Declare the Credit score)

The IRS is processing these funds robotically. If you’re eligible, you’ll obtain your fee by means of direct deposit or verify primarily based in your most up-to-date IRS info. No additional motion is required.

2. If You Did Not File a 2021 Return

ALSO READ: Why are anti-Trump teams planning a protest in 50 US states on April 19? 10-point explainer

Comply with these steps:

Step 1: Go to IRS Free File (for incomes beneath $73,000) or use tax software program.

Step 2: File your 2021 tax return, even should you had no revenue.

Step 3: Use Type 1040 to assert the Restoration Rebate Credit score on the return.

Step 4: Submit the return earlier than April 15, 2025.

If you’re entitled to cash from this credit score, you’ll obtain it as a refund, even should you don’t owe taxes.

It’s possible you’ll be among the many 1 million eligible people if:

You had no taxable revenue and didn’t imagine you wanted to file.

You skilled a change in revenue between 2020 and 2021 that now qualifies you.

You added a brand new baby or dependent in 2021.

You have been incarcerated, homeless, or in one other circumstance the place your fee was not processed.

The IRS encourages people in these classes to file earlier than the deadline to keep away from completely lacking out.

Source link