Verified Editorial content material, assessed by distinguished business authorities and skilled editors. Advert Disclosure

In current weeks, the cryptocurrency market has skilled vital uncertainty and volatility, stemming from the ever-changing international macroeconomic panorama. This turbulent market has brought on Bitcoin’s worth to fluctuate between $74,000 and $83,000 in only a few days.

Final week, BTC’s worth dipped to just about $74,000 as crypto merchants reacted anxiously to United States President Donald Trump’s announcement of latest commerce tariffs. Nevertheless, on Thursday, April 10, Bitcoin rebounded to the $83,000 mark after Trump introduced a pause on commerce tariffs for all nations besides China.

Is Bitcoin Rising as a ‘Mature Asset’?

Bitcoin’s worth has proven sensitivity to virtually each vital information merchandise within the international commerce area, highlighting the continuing volatility throughout the cryptocurrency market. But, an on-chain analytics specialist has indicated that at this time’s Bitcoin market volatility is considerably decrease in comparison with earlier incidents.

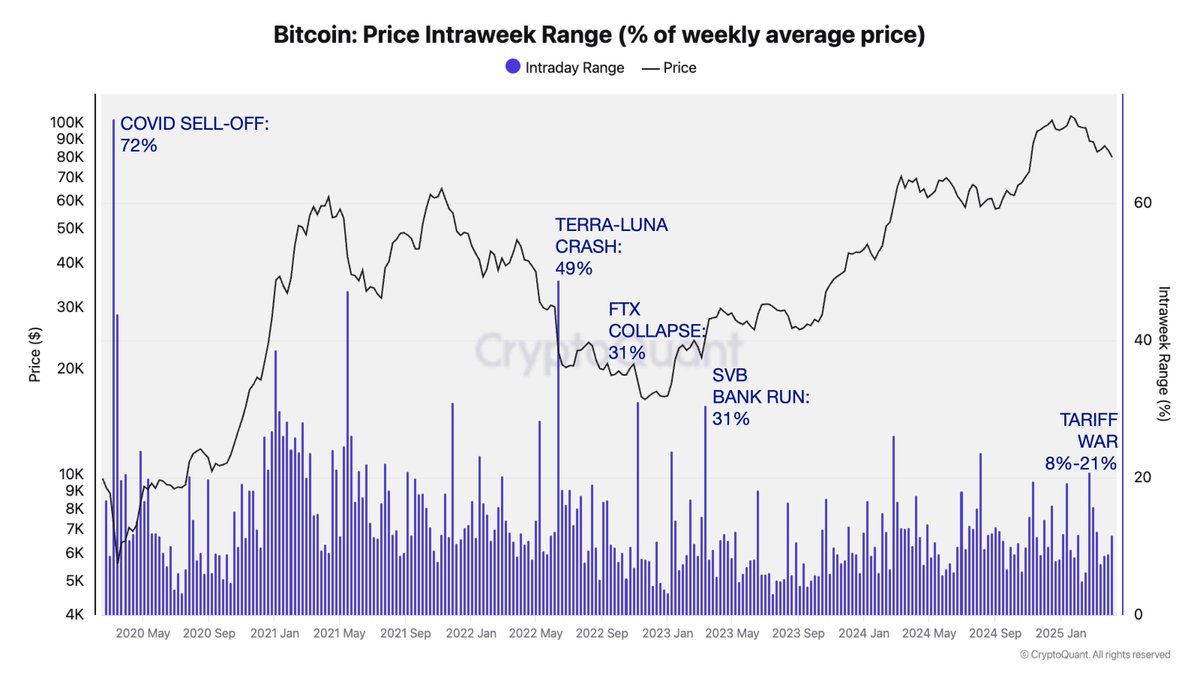

In a current publish on the social media platform X, Julio Moreno, CryptoQuant’s analysis lead, acknowledged that the present Bitcoin worth volatility throughout this era of worldwide commerce disputes has been “a lot much less” than previous occurrences, together with the market crash throughout COVID-19, the Terra-Luna collapse, the FTX debacle, and the Silicon Valley Financial institution (SVB) run.

The important thing metric in focus is the Value Intraweek Vary, which assesses the share change in Bitcoin’s common weekly worth. Information from CryptoQuant reveals that this metric reached an unprecedented excessive of 72% through the COVID-19 market crash in April 2020.

Supply: @jjcmoreno on X

The above chart illustrates that the BTC Intraweek Vary metric spiked to 49% following the downfall of the Terra Luna ecosystem in Might 2022. In the meantime, it recorded 31% after the collapse of the FTX change, led by Sam Bankman-Fried, in late 2022 and the SVB financial institution run in early 2023.

Amid rising commerce tensions between the USA and China, the Bitcoin Value Intraweek Vary at the moment lies between 8% and 21%. This decrease volatility signifies that Bitcoin has matured as an asset, that includes deeper liquidity and an improved market construction.

This comparatively steady worth habits will be attributed to the growing variety of long-term holders and regular adoption by firms, as institutional traders begin viewing the most important cryptocurrency much less as a high-risk funding and extra as a safeguard towards macroeconomic instability.

Bitcoin Value Overview

On the time of writing, Bitcoin’s worth is roughly $83,700, representing a 5% improve during the last 24 hours.

Bitcoin worth surpasses $83,000 on the every day chart | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for Bitcoinist is devoted to offering totally researched, correct, and neutral content material. We adhere to strict sourcing requirements, and each article is rigorously reviewed by our panel of main know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

Source link