Trusted Editorial content material, evaluated by distinguished trade specialists and skilled editors. Advert Disclosure

Over the previous week, Bitcoin’s value has remained inside the $81,000 to $86,000 consolidation vary, indicating important indecision between bullish and bearish sentiments. Whereas many on-chain metrics recommend a bearish outlook for the main cryptocurrency, latest knowledge hints that the bull run might not be completed simply but.

BTC Buyers Are Not in a State of Full Panic: Insights from Blockchain Agency

In a latest replace on the X platform, blockchain analytics firm Glassnode highlighted {that a} particular group of Bitcoin holders, generally known as “short-term holders” (STH), are experiencing escalating market stress. This statement is drawn from the unrealized losses of this group of buyers.

To make clear, an unrealized loss is one which exists on paper; the investor continues to carry and has not bought the asset regardless of its declining worth. A loss turns into “actual” solely when the holder sells the asset for lower than the unique buy value.

In keeping with Glassnode, the unrealized losses for Bitcoin buyers have been rising lately, notably pushing the short-term holders in the direction of a big +2σ threshold. The STH Relative Unrealized Loss metric hitting this excessive +2σ degree has traditionally correlated with rising promoting stress.

Nonetheless, Glassnode identified that the dimensions of the STH losses nonetheless stays inside the vary usually related to a bull market. In actual fact, the magnitude of those losses is minor in comparison with the market-wide sell-off skilled in 2021, suggesting that the bull cycle should have life in it.

Supply: @glassnode on X

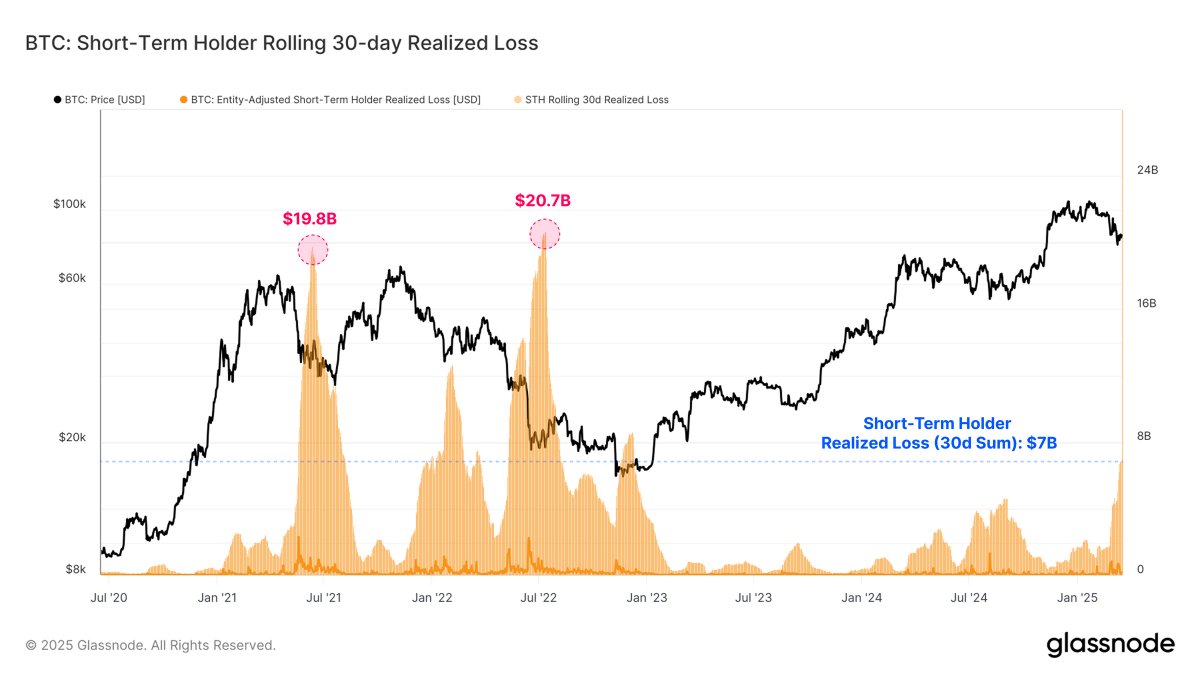

Furthermore, Glassnode revealed that the rolling 30-day realized losses for Bitcoin’s short-term holders have now exceeded $7 billion, marking the biggest sustained loss occasion within the present cycle. Regardless of this important determine, it stays significantly much less extreme than the capitulation occasions noticed on the onset of earlier bear markets.

For example, throughout main value corrections in Might 2021 and 2022, Bitcoin’s realized losses soared to roughly $19.8 billion and $20.7 billion, respectively. Provided that the realized losses at the moment stay properly under these capitulatory occasions, there’s a chance that the market has but to achieve a full-blown panic state.

Bitcoin Value Overview

On the time of this writing, Bitcoin’s value is roughly $84,300, reflecting a 0.3% enhance over the past 24 hours. Knowledge from CoinGecko signifies that the flagship cryptocurrency has seen a minor decline of simply 0.6% over the previous week, underscoring the market’s present volatility.

The value of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist focuses on offering totally researched, correct, and neutral content material. We adhere to rigorous sourcing requirements, and each bit is meticulously reviewed by our crew of main know-how specialists and veteran editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.

Source link