Trusted Editorial content material, evaluated by outstanding trade specialists and skilled editors. Advert Disclosure

Latest on-chain knowledge signifies that the most important Bitcoin holders have steadily resumed shopping for, whereas different market individuals have continued to distribute their holdings.

Preliminary Indicators of a Shift within the Bitcoin Accumulation Development Rating

In a current replace on X, on-chain analytics agency Glassnode mentioned the current shifts within the Bitcoin Accumulation Development Rating. This metric serves as an indicator to find out whether or not Bitcoin buyers are in an accumulation part.

The scoring depends on stability fluctuations in buyers’ wallets to make this evaluation. Moreover, it considers the dimensions of accumulation or distribution in relation to the pockets sizes concerned, giving larger weight to giant buyers’ actions.

A rating nearing 1 signifies that giant holders (or many small buyers) are actively accumulating, whereas a rating near 0 suggests a distribution part or an absence of accumulation exercise.

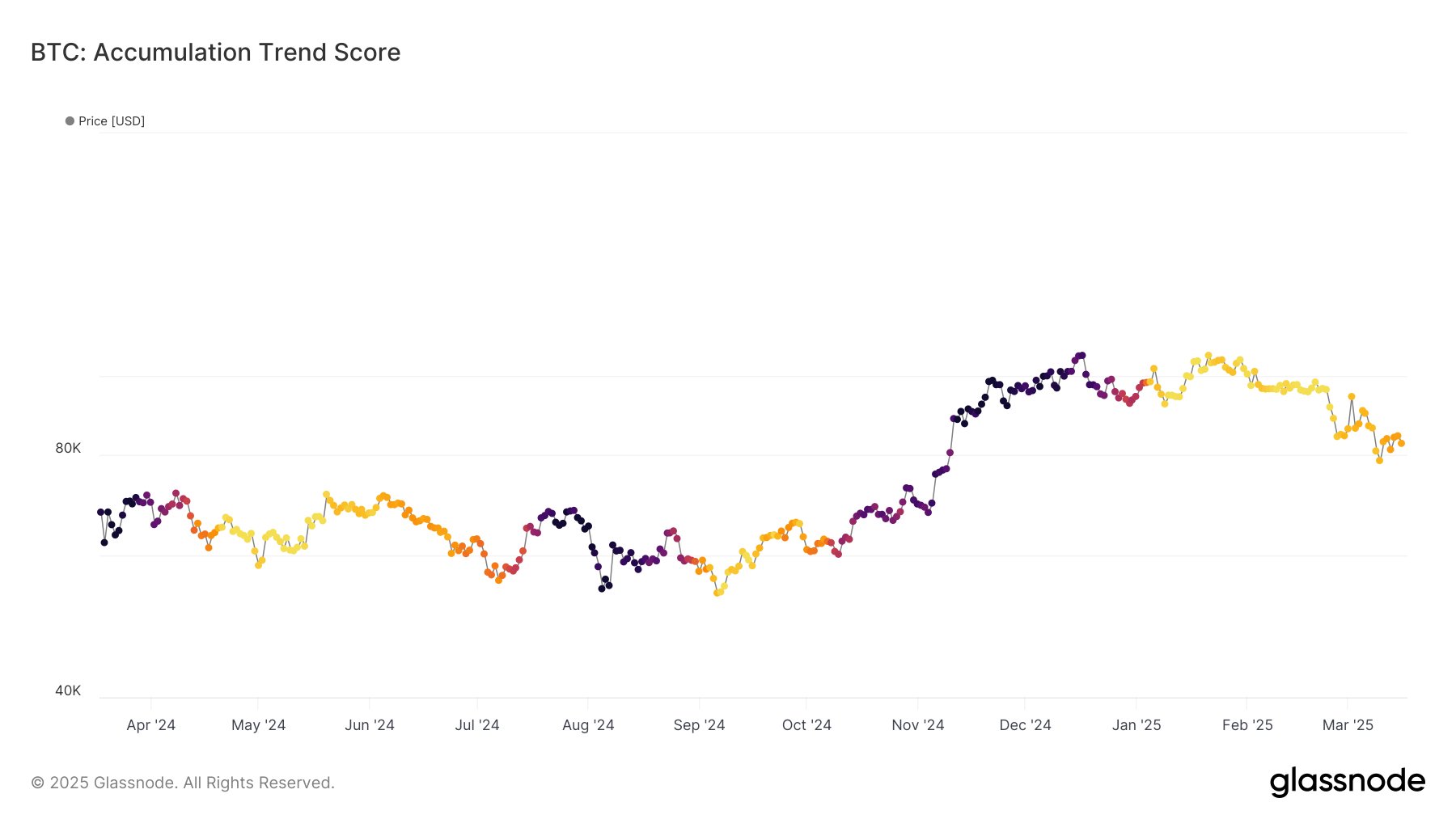

Right here is the chart offered by Glassnode that illustrates the development within the Bitcoin Accumulation Development Rating over the previous yr:

Buyers seem to have been distributing for some time now | Supply: Glassnode on X

The chart illustrates that darker shades symbolize accumulation, whereas lighter shades denote distribution. Notably, the metric displayed a darkish colour in the course of the rally noticed within the latter months of 2024, suggesting a surge in accumulation.

This yr, nevertheless, the development has reversed, with the indicator reaching a lighter shade and a worth close to zero. Given this distribution development amongst giant holders, it’s comprehensible why Bitcoin has encountered bearish worth motion.

Apparently, the indicator has just lately proven an uptick, now exceeding the 0.1 threshold. This will point out that some shopping for is happening at present decrease costs. As famous by Glassnode, “Whereas distribution stays prevalent, this shift suggests preliminary indicators of accumulation.”

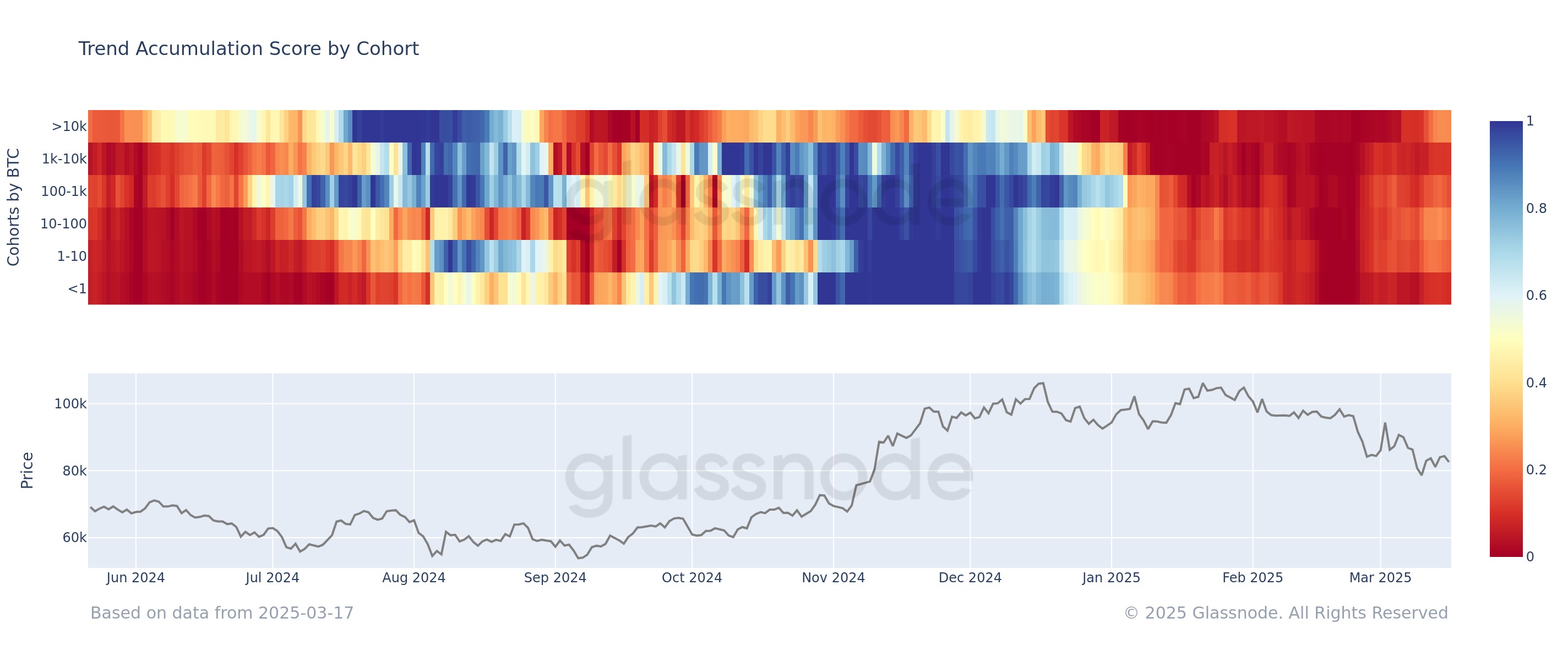

As beforehand outlined, the Bitcoin Accumulation Development Rating prioritizes bigger entities, which might obscure the actions of smaller buyers. Subsequently, right here’s another model of the indicator that displays the metric’s worth throughout totally different dealer classes:

Conduct throughout the teams appears inconsistent at current | Supply: Glassnode on X

The graph reveals that the most important Bitcoin holders, these possessing over 10,000 BTC, have just lately seen an increase of their metric worth, suggesting a gradual shift in direction of shopping for.

Conversely, whereas these mega whales have demonstrated this shopping for development, these categorised as whales (holding between 1,000 and 10,000 BTC) have continued to have interaction in important distribution. In the meantime, the smallest buyers, known as “shrimps” (holding lower than 1 BTC), have mirrored the whale exercise by promoting.

As defined by Glassnode,

This development signifies that whereas general promote stress continues, some giant entities are starting to soak up Bitcoin provide. Whether or not this signifies a turning level or merely a brief respite in distribution stays to be decided.

BTC Value Overview

Following current volatility, Bitcoin’s worth has stabilized across the $84,000 mark.

BTC worth motion over the previous 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist prioritizes delivering well-researched, correct, and neutral content material. We adhere to rigorous sourcing requirements, and each web page is totally reviewed by our workforce of prime know-how specialists and skilled editors. This ensures the integrity, relevance, and worth of our content material for our readers.

Source link