There are doubts in regards to the viability of a proposal from the Division of Authorities Effectivity (DOGE) to distribute $5,000 to taxpaying households all through the U.S.

Significance of the Proposal

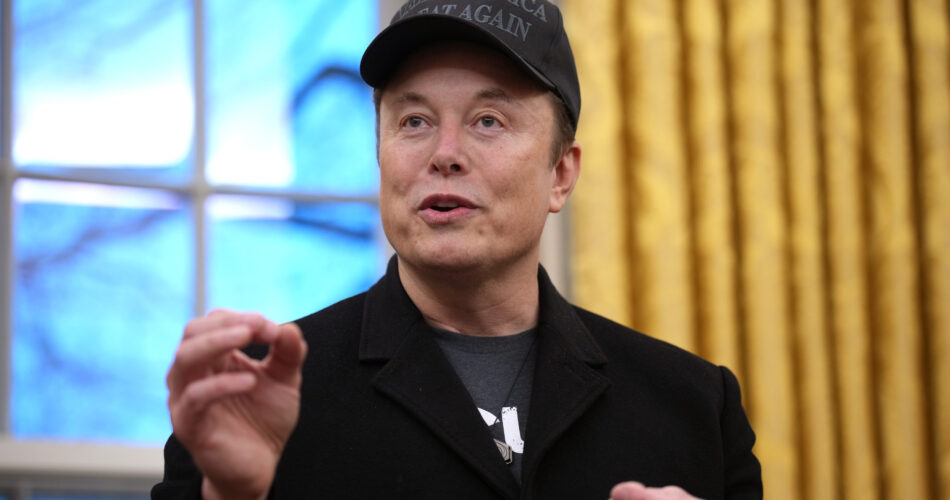

President Donald Trump and authorities appointee Elon Musk have each indicated that they’re considering a plan to offer $5,000 “DOGE Dividends” to Individuals, funded by financial savings recognized by DOGE. This company has been tasked by the president to cut back federal spending and get rid of alleged fraud and waste.

Key Particulars

Final week, James Fishback, CEO of the Azoria funding agency, proposed compensating American taxpayers for “the flagrant misuse and abuse of their hard-earned tax {dollars} uncovered by DOGE.”

In his four-page proposal, Fishback acknowledged that issuing $5,000 checks on to American taxpayers would “restore public confidence between taxpayers and their authorities, honoring this social contract and enhancing tax morale.”

He projected that the entire price could be roughly $400 billion, which is a good portion of the $2 trillion financial savings goal Musk outlined earlier this 12 months, an quantity that DOGE has but to method.

In consequence, considerations in regards to the affordability of those checks have arisen, with some Republicans voicing skepticism in regards to the proposal.

Andrew Harnik/GETTY

Feasibility of DOGE Checks

DOGE has created a “wall of receipts” on its web site to reveal transparency, showcasing over 1,100 canceled authorities contracts. Newsweek has examined this information and recognized almost $7.2 billion in financial savings to date—merely 1.8% of the sum wanted. In keeping with DOGE, this listing represents 20% of complete financial savings to date, attributed to delays in authorities reporting that may sluggish updates.

Final week, DOGE reported a discovery of $55 billion in financial savings. If correct, this nonetheless accounts for under 13.75% of the required $400 billion. Newsweek has reached out to DOGE for additional feedback through electronic mail.

Fishback’s proposal means that the checks could be distributed in mid-2026, permitting DOGE greater than a 12 months to acquire the mandatory financial savings to fund the initiative. Nonetheless, the intensive financial savings required raises considerations about feasibility.

“The $5,000 DOGE Dividend proposal is an bold imaginative and prescient, however as somebody who has navigated the complexities of balancing authorities budgets, it’s evident that the arithmetic and actuality merely don’t align,” acknowledged George Carrillo, CEO of the Hispanic Development Council and former Oregon state authorities official, in an interview. “To finance a $5,000 fee for every eligible family would necessitate $395 billion. This determine is exponentially greater than the sources Musk claims to have secured.”

Inflation Considerations

There are apprehensions relating to the potential inflationary results of such funds. Michael Martin, vice chairman of market technique at TradingBlock, emphasised that whereas reaching financial savings could also be doable, “a extra essential query is whether or not these checks would finally profit Individuals and the financial system as a complete.”

“What impact would an enormous infusion of money into the financial system have on ongoing stubbornly excessive inflation? It could seemingly escalate prices,” he cautioned.

Direct funds to households throughout the COVID-19 pandemic reportedly contributed to inflation. Throughout Trump’s presidency, two rounds of COVID-related stimulus checks have been issued, which the Federal Reserve acknowledged contributed “to an increase in inflation of roughly 2.5 share factors.”

“Our findings point out that fiscal stimulus enhanced shopper demand for items with out considerably impacting manufacturing, resulting in elevated extra demand pressures in sure markets,” learn a Federal Reserve Board report. “Consequently, fiscal measures contributed to cost pressures.”

Preston Brashers, a analysis fellow in tax coverage on the conservative assume tank the Heritage Basis, additionally expressed considerations about inflation. He tweeted, “I admire DOGE’s initiatives, however that is misguided. There’s no necessity for ‘dividend checks.’ The dividend from lowering spending is that it brings inflation below management. Nonetheless, if the federal government distributes stimulus checks, inflation will rebound fiercely.”

In his proposal, Fishback asserted that DOGE checks wouldn’t be inflationary as they might be “solely funded by DOGE-driven financial savings, versus COVID stimulus checks which relied on deficit financing.”

Addressing the Deficit

The proposal to make the most of a number of the DOGE financial savings for direct funds has upset even Trump’s staunchest supporters.

“Politically, it could be implausible for us; sending out checks to everybody,” acknowledged Home Speaker Mike Johnson on the Conservative Political Motion Convention (CPAC) in Maryland final week. “But, if we adhere to our core ideas, fiscal duty defines us as conservatives, it’s our model.”

He contended that each one financial savings ought to be allotted in the direction of reducing the “$36 trillion federal debt.”

“Now we have a considerable deficit,” he remarked. “I consider we have to pay down the bank card, proper?”

Thomas J. Cryan, an legal professional and writer of the brand new ebook Disrupting Taxes, indicated that whereas it’s “troublesome to determine the accuracy of DOGE’s reported financial savings,” the “Treasury Division could have a fiduciary duty to make the most of these financial savings to minimize the $36+ trillion nationwide debt.”

Public Sentiment

James Fishback, in his proposal: “When a breach of such magnitude happens within the non-public sector, the counterparty sometimes reimburses the shopper for failing to meet their commitments. It’s time for the federal authorities to do the identical by returning funds to taxpayers primarily based on the findings of DOGE.”

George Carrillo instructed Newsweek: “Regardless of its superficial attract, this proposal dangers sacrificing long-term societal welfare for short-term political acquire. That examine could appear to be success in the meanwhile, however when it leads to weakened federal companies, better deficits, and compromised well being and security, the repercussions change into starkly evident. Individuals advantage insurance policies that harmonize ambition with sustainability, somewhat than flashy guarantees anchored in fiscal irresponsibility.”

Joseph Camberato, CEO at Nationwide Enterprise Capital, instructed Newsweek: “I see the place the idea originates, however distributing $5,000 checks will not be the very best method. Simply because we’ve saved some cash doesn’t indicate we must always begin handing it out. Because the outdated saying goes: you’ll be able to present a person with a fish, or you’ll be able to train him to fish. If we’re prudent, we must always reinvest these funds into initiatives that generate long-term worth, comparable to innovation, infrastructure, and companies that promote wealth creation throughout all strata.”

Subsequent Steps

In keeping with Cryan, any dividend fee to American taxpayers would necessitate congressional motion.

“DOGE doesn’t possess the constitutional authority to concern a Dividend Cost to the American populace; neither does the President have this authority. The facility of the purse resides with Congress,” he elaborated. “Consequently, such a fee would require laws.”

Source link