I’ve been a cheerful Zoho One consumer for greater than 5 years. Whereas I’ve moved advertising, conferences, calendars, and extra – my accounting software program has been caught with QuickBooks And, I’ve hated each minute of it.

Every month, I give QuickBooks $80. Take into consideration that. I’ve been paying twice the quantity for one app (Zoho One is about $40/month) as I do for a whole suite of built-in instruments that run my complete enterprise. And now that Zoho has launched its U.S. version of Zoho Payroll, the timing couldn’t be higher.

The Downside with Operating a Enterprise on Too Many Instruments

When you’re working a small enterprise, you’ve most likely felt this ache. You’ve received QuickBooks for financials, Trello for tasks, some sort of CRM, a payroll device that hardly talks to the rest, and possibly a dozen spreadsheets in between. That’s numerous toggling backwards and forwards, numerous guide knowledge entry, and numerous misplaced time.

Nothing integrates as easily because it ought to, and also you’re consistently second-guessing your numbers. Sound acquainted? That’s the place Zoho One is available in. It’s not only one device—it’s a whole ecosystem the place every little thing works collectively.

Zoho One – The Operating System for Small Business

Think about a world the place all your enterprise instruments play properly collectively (cue angelic choir). Whether or not it’s dealing with your funds, tasks, or advertising, Zoho One retains every little thing seamless and oh-so-simple. Plus, the worth? A fraction of what you’d pay for piecing collectively totally different apps. Speak about a BARGAIN!

When you’re able to take the leap from surviving to thriving, Zoho One is your trusty steed. Let’s trip into the sundown of effectivity, my buddies. Click on that button and prepare to supercharge your hustle!

We earn a fee in the event you make a purchase order, at no extra price to you.

And now with Zoho Payroll, I’ve lastly received an entire, built-in monetary system for my enterprise.

Let me stroll you thru the main points, and I’ll present you precisely why I’m so excited.

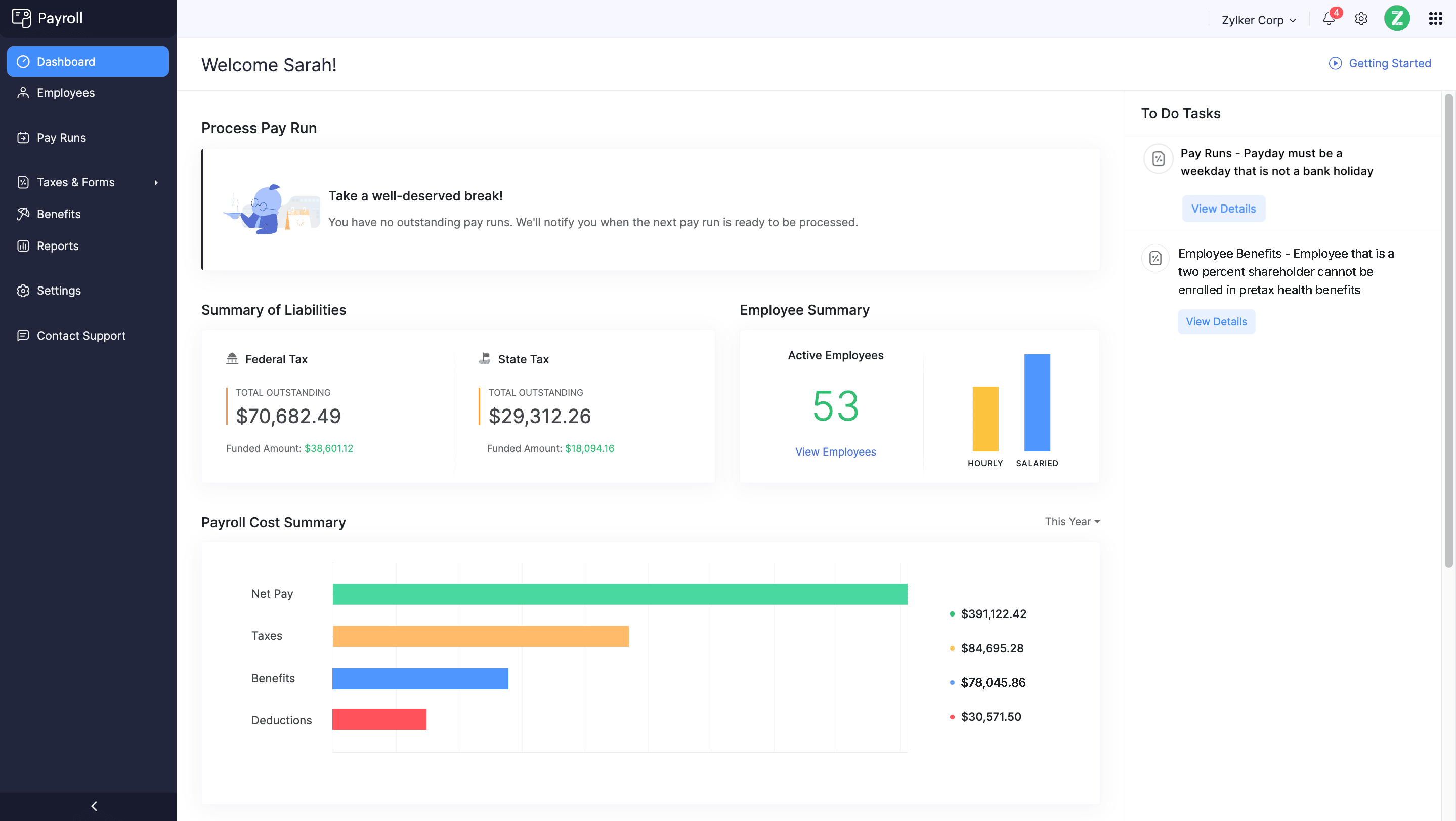

The Dashboard That Does It All

Let’s begin with the Zoho Payroll Dashboard, the place every little thing you want is true at your fingertips. This isn’t a kind of cluttered dashboards that offers you 20 charts however no actual solutions. It’s easy, clear, and exhibits me precisely what I have to know:

- How a lot you owe for federal and state taxes

- Your complete payroll prices, damaged down into web pay, taxes, advantages, and deductions

- A fast snapshot of your energetic workers and whether or not they’re hourly or salaried

Take a look at that! Every part is true the place it needs to be, with none of the litter or confusion. No extra leaping between methods or reconciling scattered knowledge. It’s multi function place, able to go.

Managing Worker Advantages Doesn’t Should Be a Headache

No workers? No drawback. I’m prepared to wager that you just’re avoiding providing complete advantages as a result of, let’s be trustworthy, it’s numerous work. Managing 401(okay)s, monitoring PTO, and maintaining with medical health insurance particulars isn’t precisely a small enterprise proprietor’s dream process. However Zoho Payroll makes it simple to handle all of that in a single spot.

That is what advantages administration seems like when it’s achieved proper. You possibly can arrange every little thing from retirement plans (401(okay)s, Easy IRAs, you title it) to medical, dental, and imaginative and prescient insurance coverage. It even tracks PTO balances and accruals mechanically. Meaning I can provide an actual advantages bundle to my workforce—full-timers, part-timers, even my digital contractors—with out the standard headache.

Taxes? Dealt with. Like, Actually Dealt with

Let’s speak about taxes, everybody’s favourite subject. When you’ve ever missed a payroll tax deadline, you understand how tense it may be. The fines add up quick, and the paperwork is brutal.

Zoho Payroll automates all the course of for federal, state, and native taxes in all 50 states. Meaning it calculates, recordsdata, and pays every little thing for you, on time, each time.

I imply, take a look at this. It’s clear, clear, and easy. Every part’s tracked, and you may see precisely what’s pending and what’s funded. No extra chasing down tax types or panicking on the final minute.

Online Payroll System | Cloud Payroll Software | Zoho Payroll

Zoho Payroll is a seamless, all-in-one payroll resolution for small companies. It automates tax compliance throughout all 50 states, simplifies advantages administration, and empowers workers with a cell self-service portal. Absolutely built-in with Zoho Books, Folks, and Expense, it’s the right device to streamline payroll and develop your enterprise effortlessly.

We earn a fee in the event you make a purchase order, at no extra price to you.

Zoho Payroll vs QuickBooks On-line

However wait! QuickBooks is the usual – is it well worth the problem of switching?

Actually, that’s not for me to say. In spite of everything, it’s taken me just a few years to get right here. However as quickly as the chance offered itself, I used to be in.

I get it. For years, QuickBooks On-line has been the go-to for small enterprise accounting and payroll, however the comparability begins to crumble while you dig slightly deeper. Not less than it has for me.

Function

Zoho Payroll

QuickBooks On-line + Payroll

Month-to-month Value

$90 (Zoho One – 55+ apps included)

$80 (accounting + payroll solely)

Integration

Absolutely built-in with Zoho Books, CRM, and Zoho Expense

Restricted integration with third-party apps

Tax Submitting

Automated for federal, state, and native taxes throughout 50 states

Federal and state taxes; setup required for some compliance

Advantages Administration

401(okay), IRA, medical health insurance, PTO monitoring

Fundamental advantages with fewer built-in choices

Worker Self-Service

Cellular app for pay stubs, tax updates, PTO monitoring

Accessible, however much less streamlined

Whenever you break it down, Zoho Payroll does every little thing QuickBooks Payroll does—and extra—at a decrease price, with seamless integration throughout all your enterprise operations. QuickBooks seems like a standalone device with add-ons, whereas Zoho Payroll seems like a part of a much bigger, smarter system.

The Worker Expertise: A Cellular App That Makes Life Simpler

Right here’s the half my workforce loves essentially the most: the Zoho Payroll worker self-service portal. When you’ve ever had somebody electronic mail you asking for a duplicate of their pay stub or desirous to understand how a lot PTO they’ve left, you’re going to like this too.

This cell app is a game-changer. Staff can view their pay stubs, replace their tax withholdings, examine their advantages, and even observe PTO—all from their telephones. It’s like giving them their very personal payroll assistant. And you realize what meaning for me? Fewer emails, fewer interruptions, and a happier workforce.

Expense Reimbursements Made Easy

When you’ve received a digital workforce like I do, likelihood is you take care of numerous expense reimbursements. Zoho Payroll integrates seamlessly with Zoho Expense, which suggests accepted reimbursements stream straight into payroll. No extra monitoring down receipts or manually including reimbursements to paychecks.

It’s clean, seamless, and automated. Precisely the way it needs to be.

W-4 Varieties? Paperwork-Free

Onboarding a brand new workforce member? Zoho Payroll even handles digital W-4 types. Staff can full, confirm, and submit their types proper from the platform. No extra scanning, printing, or chasing down paperwork.

It’s a kind of small touches that makes a giant distinction while you’re working a small enterprise.

Why This Issues for Your Enterprise

Right here’s the underside line: in the event you’re juggling a number of software program instruments to handle your enterprise, you’re working tougher than it’s worthwhile to. I’ve spent years making an attempt to make disconnected instruments work collectively, and I can let you know firsthand—it’s not price it. With Zoho One, every little thing from payroll to advertising to undertaking administration occurs in a single place. And now with Zoho Payroll, I lastly have a monetary system that’s absolutely built-in and constructed to develop with my enterprise.

This isn’t nearly saving cash (though the financial savings are actual). It’s about saving time, decreasing stress, and making higher enterprise choices as a result of all of your knowledge is lastly working collectively.

For $90 a month, I’m working my total enterprise on Zoho One. That’s CRM, electronic mail advertising, undertaking administration, and now payroll—all for a similar worth I used to be paying for QuickBooks alone.

When you’re nonetheless juggling a dozen instruments or hesitating to rent as a result of payroll feels too sophisticated, let this be your signal: it doesn’t must be. Zoho Payroll is right here, and it’s every little thing small enterprise house owners like us have been ready for.

2025 is my 12 months of integration. What about you?

Source link