Advanced Micro Devices Inc. disillusioned buyers with a tepid gross sales forecast as we speak, and its inventory was heading south throughout the prolonged buying and selling session.

The corporate’s inventory was down greater than 7% after hours, regardless of strong third-quarter earnings that met expectations and income that got here in forward of them.

AMD reported earnings earlier than sure prices reminiscent of inventory compensation of 92 cents per share, in-line with Wall Road’s forecast. Income for the interval rose 18% from a 12 months earlier, to $6.82 billion, above the Road’s consensus estimate of $6.71 billion.

The corporate stated its knowledge heart enterprise managed to double its income for the second quarter in a row, however its fourth-quarter steering fell simply shy of the analyst’s consensus. For the fourth quarter, AMD stated it’s focusing on gross sales of $7.5 billion, give or take $300 million, beneath the Road’s forecast of $7.54 billion. That will signify a decline of twenty-two% from the fourth quarter of fiscal 2023.

Regardless of that, the corporate is turning into extra worthwhile. AMD reported web earnings of $771 million on the finish of the third quarter, up from a revenue of simply $299 million one 12 months earlier.

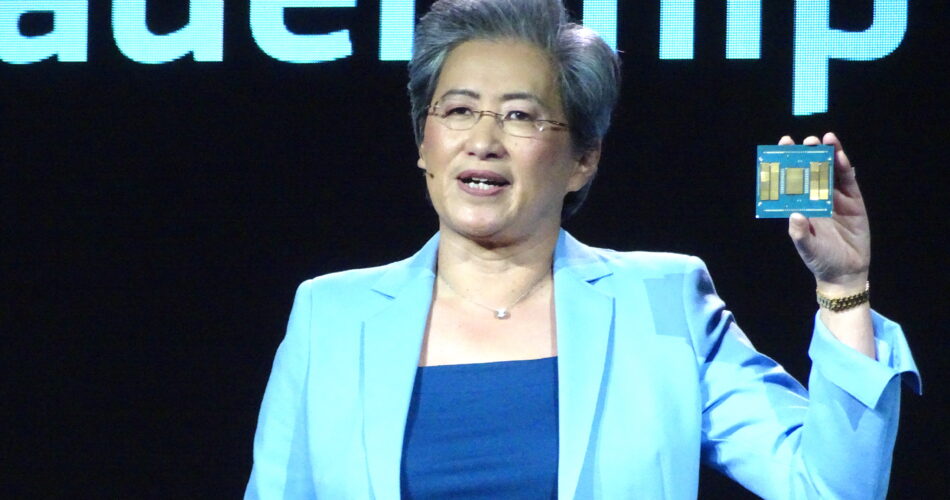

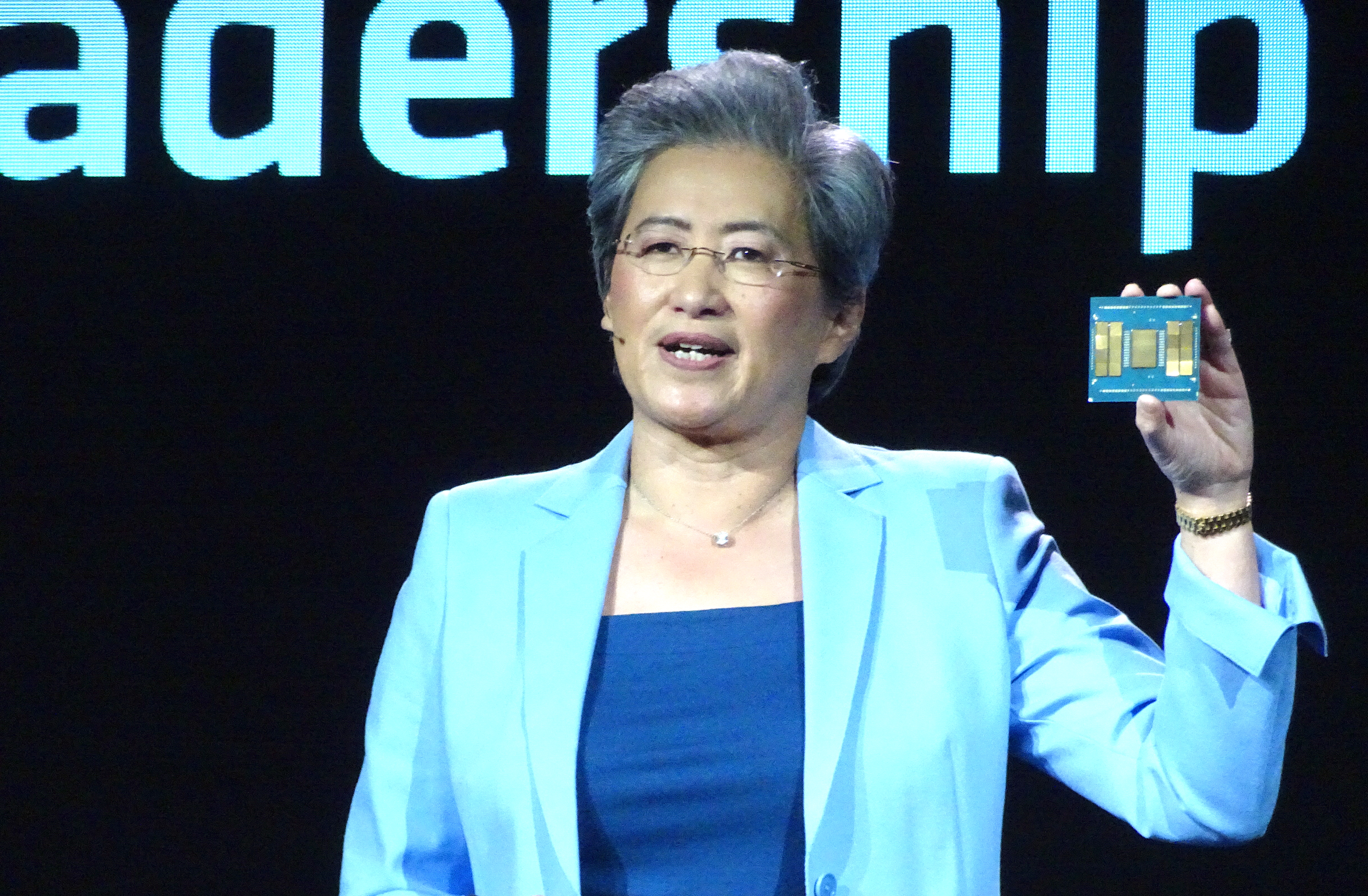

Digging into the numbers, it was AMD’s knowledge heart section that when once more confirmed essentially the most spectacular numbers, with gross sales greater than doubling from a 12 months earlier to $3.5 billion. On a convention name, AMD Chair and Chief Government Lisa Su (pictured) stated the information heart development was pushed by robust gross sales of the corporate’s Instinct-branded graphics processing units, which give an alternative choice to Nvidia Corp.’s GPUs for firms trying to run synthetic intelligence workloads.

All informed, knowledge heart income grew by 122% from a 12 months earlier, and Su stated there will likely be extra to return as the corporate remains to be seeing numerous demand from cloud infrastructure suppliers and different enterprises trying to construct out their AI infrastructure.

AMD additionally sells central processing models for private computer systems, laptops and servers, and that section of its enterprise, the shopper division, noticed gross sales rise 23% to $1.9 billion. Within the convention name, Su stated AMD’s CPUs energy numerous new, high-end laptops which were branded as “Copilot+” gadgets as a result of they’ve been custom-made to run superior AI fashions embedded with Microsoft Corp.’s Home windows working system.

As a result of the information heart section contributed extra income to the corporate’s whole, AMD was in a position to develop its gross margin to 54%, forward of the Road’s expectations.

AMD additionally operates a gaming sector that makes chips for video video games consoles and graphics playing cards for PCs, but it surely had a disappointing quarter, with gross sales falling 68% from a 12 months earlier. In keeping with Su, this was the results of a decline in “semi-custom income,” which pertains to chip gross sales for consoles such because the PlayStation 5 and Microsoft Xbox.

As for AMD’s embedded enterprise, which sells low-power chips for industrial and automotive functions, income there declined 25%, to $927 million.

Third Bridge analyst Lucas Keh stated the after-hours inventory decline suggests buyers have been hoping for the information heart section to drive much more development than what materialized, although they could even be involved concerning the weak spot in AMD’s shopper and embedded segments.

Though AMD’s inventory is headed within the fallacious path as we speak, it’s nonetheless up greater than 20% within the 12 months thus far. Nonetheless, the corporate could also be involved that rivals reminiscent of Nvidia and Broadcom Inc. have loved a lot better positive aspects over the identical interval, benefiting from enterprises’ insatiable demand for AI chips.

AMD might need hoped for higher, because it’s the world’s second-biggest provider of GPUs after Nvidia, but it surely nonetheless has motive to be optimistic about its longer-term prospects. In the course of the quarter, it introduced the next generation of its Instinct AI accelerator, the MI325X chip, plus a brand new networking platform based mostly on the AMD Pensando Salina knowledge processing unit. In keeping with the corporate, the MI325X accelerator gives 1.3 instances better efficiency than Nvidia’s strongest various, the H200 GPU, with 1.8 instances better capability and 1.3 instances extra bandwidth.

The chipmaker has been tight-lipped about its expectations for the MI325X accelerator. However it cites third-party knowledge that forecasts the AI GPU market to develop to greater than $500 billion by 2028, which suggests there’s monumental room for development if AMD can take extra market share away from Nvidia.

At present, the corporate solely instructions a small fraction of that market. In the course of the convention name, Jean Hu, AMD’s govt vice chairman, treasurer and chief monetary officer, stated the corporate expects to generate $5 billion in AI chip gross sales this 12 months, up from $4.5 billion in 2023.

“Buyer and companion curiosity within the MI325X is excessive,” Su stated when requested about its prospects. “Manufacturing shipments are deliberate to begin this quarter.”

Keh stated GPU gross sales will proceed to be the primary driver of AMD’s development going ahead, and though it stays the “clear quantity two” within the AI accelerator market, it might probably profit from Nvidia’s delays in bringing its next-generation Blackwell GPUs to market.

“AMD has an excellent alternative to realize incremental share from Nvidia with its 325x and 350 Intuition merchandise amidst the present Blackwell delay considerations,” he stated.

Photograph: Robert Hof/SiliconANGLE

Your vote of assist is necessary to us and it helps us hold the content material FREE.

One click on beneath helps our mission to offer free, deep, and related content material.

Join our community on YouTube

Be a part of the neighborhood that features greater than 15,000 #CubeAlumni specialists, together with Amazon.com CEO Andy Jassy, Dell Applied sciences founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and lots of extra luminaries and specialists.

THANK YOU

Source link