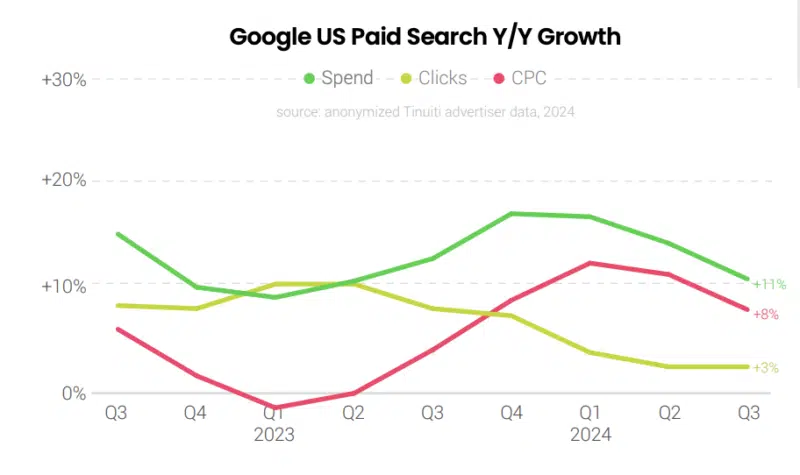

Google search promoting spending rose 11% year-over-year in Q3 2024, displaying resilience regardless of slower pricing progress and the introduction of AI-powered options in response to Tinuiti’s newest Digital Adverts Benchmark Report.

General efficiency.

- Google search advert spending grew 11% YoY in Q3 2024, decelerating from 14% progress in Q2.

- Click on progress remained secure at roughly 3% YoY.

- Price-per-click (CPC) progress moderated to eight% YoY, down from 12% in Q2.

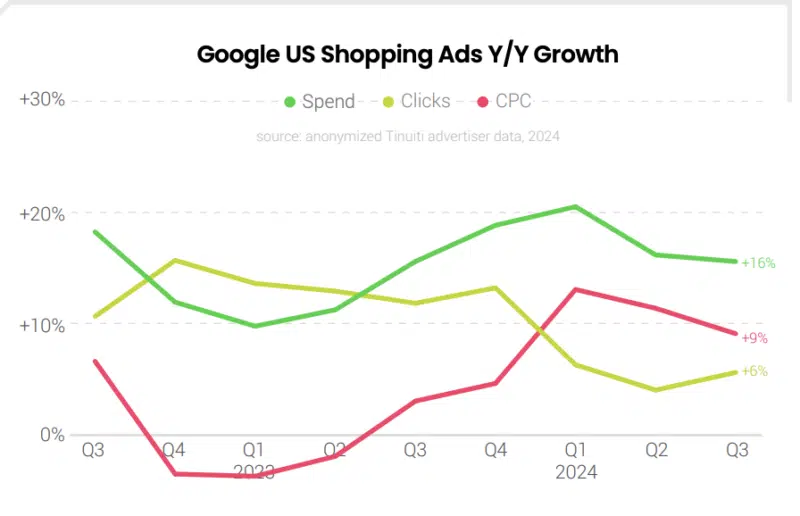

Procuring Advert momentum.

- Procuring advert spend maintained sturdy 16% YoY progress in Q3, matching Q2 efficiency.

- Click on quantity improved to six% YoY progress, up from 4% in Q2.

- Procuring CPC progress decelerated to 9% YoY, persevering with a downward development.

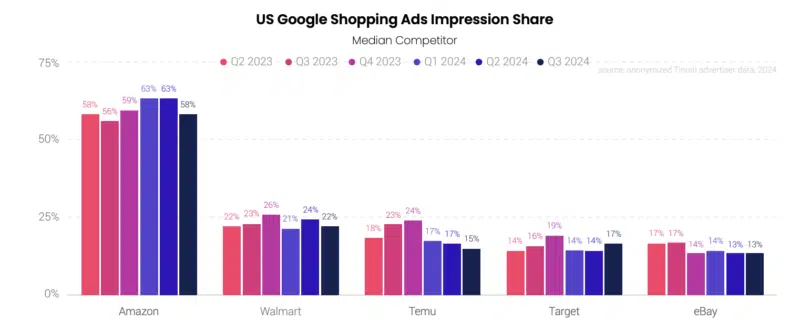

Aggressive panorama.

- Amazon dominates buying advert impressions with 58% share in Q3, although down from 63% in Q2.

- Notable mid-September dip to 45% share earlier than fast restoration.

- Walmart holds a distant second place with 22% share.

- Temu’s presence declined considerably in comparison with 2023.

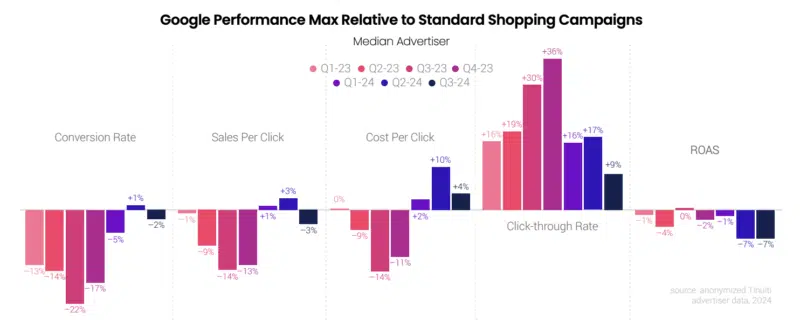

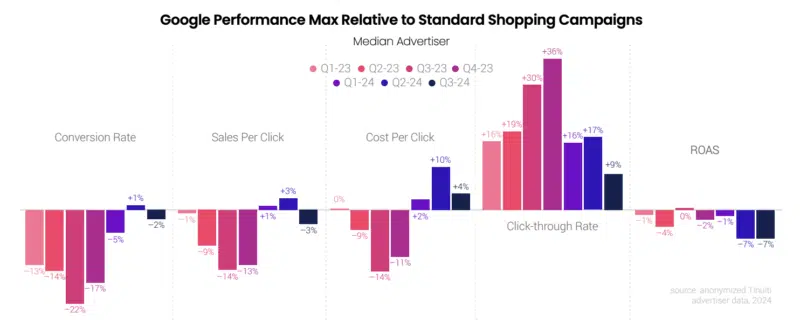

Efficiency Max (PMax) traits.

- 92% adoption price amongst buying advertisers in Q3, up 1 level from Q2.

- Non-shopping stock reached 29% of PMax spend in September, up from 21% in June.

- YouTube contributed simply 1% of PMax placement impressions.

- Cellular apps maintained regular 10% share of impressions.

Marketing campaign efficiency metrics.

- PMax conversion charges fell 2% beneath customary Procuring campaigns in Q3.

- PMax gross sales per click on shifted from +3% to -3% versus customary campaigns.

- Return on advert spend (ROAS) remained secure quarter-over-quarter.

- Conventional textual content advert spending grew 7% YoY, down from 13% in Q2.

Influence of Google AI Overviews.

- Cellular non-branded key phrases noticed 14% CTR decline from April to July.

- CTR recovered in August and September throughout segments.

- Non-brand cell CTR stays 4% beneath April ranges however 6% above early 2023.

- Procuring advert CTR rose 14% on cell between April and September.

Why we care. The information means that whereas Google’s AI Overviews initially impacted advert efficiency, advertisers are adapting and discovering methods to take care of progress, significantly by buying advertisements and Efficiency Max campaigns.

Key takeaways.

- Procuring advertisements reveal resilience amid broader market modifications.

- PMax adoption stays excessive regardless of slight efficiency deterioration.

- Main retailers keep dominant positions in buying advert impressions.

- Google AI Overviews affect seems to be stabilizing.

- Cellular continues to be a vital battleground for advert efficiency.

The report. Tinuiti’s Q3 2024 Digital Ads Benchmark Report.

New on Search Engine Land

Source link