U.S. on-line vacation buyers are anticipated to spend $240.8 billion in November and December this yr, in accordance with a forecast by Adobe. This represents a 8.4% enhance over final yr’s vacation season, considerably increased than last year’s 4.9% year-over-year growth.

Why we care. That is excellent news for retailers with a stable digital advertising technique. Lately, vacation spending has shifted to early gross sales occasions like October’s Amazon Prime Large Deal Days — this yr, operating October 8 and 9. Additionally, a section of customers unfold their gift-buying all through the whole yr. Understanding the place their clients slot in these tendencies will assist a enterprise take advantage of out of the vacation push.

Cell buying. The anticipated record-breaking spending may even elevate cell buying into uncharted territory. Cell purchases are anticipated to succeed in $128.1 billion this yr, up 12.8% YoY. This implies cell could have a 53.2% share of on-line buying versus desktops and laptops.

Cyber Week. Cyber Week, the 5 days from Thanksgiving to Cyber Monday, is about to drive $40.6 billion in U.S. gross sales, in accordance with Adobe. It is a 7% enhance over 2023.

“The vacation buying season has been reshaped lately, the place customers are making purchases earlier, pushed by a stream of reductions that has allowed buyers to handle their budgets in several methods,” mentioned Vivek Pandya, lead analyst, Adobe Digital Insights, in a launch.

Costly items. In analyzing shopper patterns during the last 5 years, Adobe discovered gross sales of the most cost effective items elevated 46%, whereas gross sales of the most costly items declined 47%. (Adobe divided items into 4 worth tiers.)

This yr, Adobe expects the development to reverse. Gross sales of the most costly items are anticipated to extend by 19% this vacation season, in comparison with pre-holiday gross sales. That is due to worth reductions, not as a result of buyers are feeling wealthier.

“These discounting patterns are driving materials modifications in buying habits, with sure customers now buying and selling as much as items that had been beforehand higher-priced and propelling development for U.S. retailers,” mentioned Pandya.

Final-minute vs. planning forward for holidays. Greater-income clients are most definitely to spend for holidays within the two months previous a vacation, in accordance with Klaviyo’s survey of over 8,000 customers globally. Shoppers with incomes underneath $100,000 are extra seemingly than different brackets to buy holidays final minute, however are additionally extra prone to do vacation buying all year long.

Right here’s the total breakdown of when customers spend by earnings degree:

Plans to spend extra. Eight in 10 customers mentioned they deliberate to spend as a lot or greater than final yr. Nineteen % of customers mentioned they’d spend extra, and 61% mentioned they’d spend the identical. Solely 20% mentioned they’d spend much less.

Lower than half (48%) of customers mentioned inflation impacts their present spending choices.

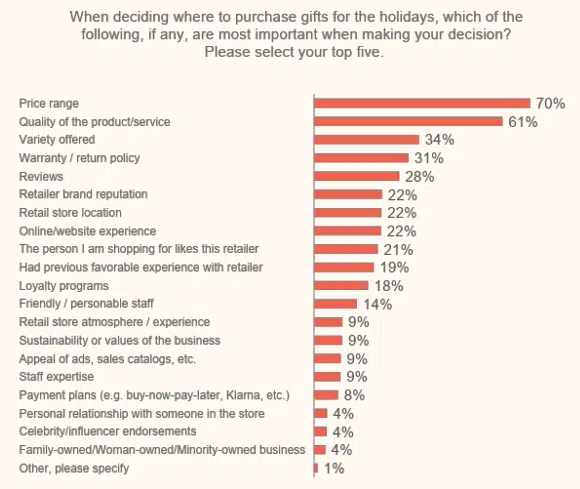

High elements. Pricing was the highest consider vacation spending. Right here is how different concerns ranked within the Klaviyo survey.

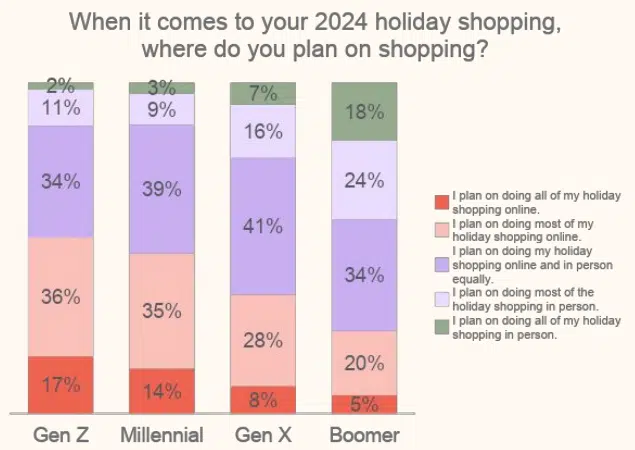

Procuring by era. The identical share (34%) of Gen Z and Child Boomer buyers plan to buy on-line and in-store. The variations between generations lie within the disparities among the many different two-thirds.

Over half (53%) of Gen Z will do most or all of their buying on-line, whereas solely 25% of Boomers will. Right here’s how buying behaviors break down by generations:

Dig deeper: Top ecommerce trends from record-breaking Amazon Prime Day 2024

Klaviyo’s 2024 Shopper Spending Report can be downloaded here (registration required).

Source link