Tax refunds get delayed for a number of causes, and we’re in charge for a lot of of them. Specialists have their opinions on how one can keep away from these pitfalls and hasten up the method so that you just get your tax refund inside months. They usually all agree on a wide range of methods by which you may make it occur quicker.

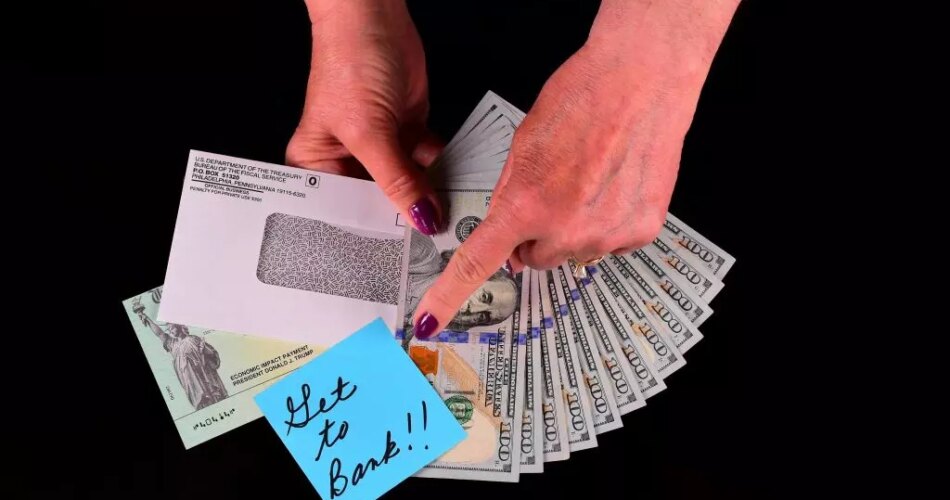

It’s the time of the yr when thousands and thousands of People, particularly within the low and moderate-income classes, eagerly anticipate their tax refund verify. The IRS began taking in federal earnings tax returns for the 2022 tax yr on January 23, 2023.

The IRS has made commendable progress within the velocity at which they’re disposing of the recordsdata this yr. However the common earnings tax refunds have gone down this yr considerably as most of the federal schemes linked to the pandemic have resulted in 2021. This contains the federal stimulus verify, the financial influence funds, and the expanded Baby Tax Credit score stimulus checks. the latter was paid for under the primary yr earlier than political obduracy put an finish to the child-poverty assuaging measure.

The typical tax refund quantity from the federal authorities has gone down this yr to $1,963 this yr as revealed by an evaluation of the 8M tax refunds despatched as on February 3, 2023.

And People throughout the earnings degree ought to anticipate lower than what they did final yr. final yr near two-thirds of filers in America had been entitled to the refunds with a median quantity that was a beneficiant $3,200, in accordance with a report by the Nationwide Taxpayer Advocate that they submitted to Congress.

For lots of taxpayers, tax refunds are an intrinsic a part of their monetary calendar. And for these getting lower than they acquired within the earlier yr, it turns into more durable to digest when the tax refund verify can be delayed.

When Do I Get My Tax Refund

The timing of your tax refund cost is dependent upon the way you filed your tax returns. The IRS usually issued ninety % of the tax refund funds inside 3 weeks. And taxpayers who’ve filed their earnings tax returns by way of the digital route could have their tax refunds deposited quicker and immediately into their financial institution accounts.

E-filing, or submitting electronically, is the easiest way to guard your account towards tax refund id thieves. Such scammers steal your information after which put it to use to dupe you.

Going the e-file method not solely protects you from id and tax refund crimes but in addition ensures that you just get your tax refund a lot sooner than you’ll get by way of the offline technique.

Although the submitting deadline is a way away on April 18 this yr for the 2022 tax yr, the sooner you file your earnings tax return, the quicker you’ll obtain your refund. It can additionally make the duty of scammers and id thieves all of the tougher to say your cash earlier than you do.

Hasten Your Tax Refund By Adjusting Your Withholding

You’ll obtain your tax refund even quicker in the event you modify your tax withholding on Kind W-4 and have much less quantity taken out of your paychecks for taxes.

We hardly ever give a lot thought to the numerous kinds we fill out after we be a part of a brand new job. However we’re prone to have stuffed out a W-4 form, which helps decide how a lot of your earnings your employer will withhold, or retain out of your paycheck to pay your federal taxes.

A much bigger legal responsibility means a smaller paycheck, nevertheless it might additionally guarantee an even bigger tax refund. Too little tax withhold will result in legal responsibility at tax time as a substitute of a tax refund.

So it’s about adjusting the right amount. A tax refund just isn’t all the time an excellent factor when you’re getting what you deposited by way of the tax yr within the first place. It’s particularly a shedding proposition whether it is big. An enormous refund can imply that you’ve got blocked a considerable sum and given an interest-free mortgage to the federal administration.

Even when your withholding quantity is true at a sure level, your wants would possibly change. You get it proper by way of Kind-4, although it hardly ever accounts for private adjustments.

Time For Adjusting Your Withholding

For many who have already stuffed out the W-4 kind, you may nonetheless regulate your tax withholding at any time of the yr. Some explicit improvement can set off a tax withholding checkup. It contains getting a really massive tax refund, getting married and transferring from particular person to joint submitting, getting divorced, and submitting as a person as a substitute of collectively.

Having youngsters or taking up grownup dependents, akin to a guardian, or beginning a second job or aspect hustle also can set off tax withholding checkups. A spike in earnings because of a bonus or a elevate can be a motive to verify your withholding quantity.

Staff who work remotely must also pay explicit consideration to their W-4. That is particularly vital for employees altering states or in the event that they work in numerous states from their employer. These are important points that should be checked out and reviewed at withholding.

For many who frequently obtain bigger tax refunds, it’s best to think about bringing down your withholding quantity. By this, you’ll obtain more cash in your common paychecks as a substitute of getting to attend for greater than an entire yr to obtain it as a refund at tax time.

However it isn’t a good suggestion to significantly cut back your total withholding and play to pay it at tax time. It’s significantly imprudent to scale back tax withholding throughout robust instances and factors to flawed monetary observe. It might invite penalties for too low withholding. The IRS Tax Withholding Estimator offers a good suggestion of what your splendid withholding quantity needs to be.

Whenever you owe taxes on the finish of the yr, it’s best to think about rising the withholding quantity. For some, it comes as a sort of compelled savings, even when it doesn’t collect any curiosity.

A piece of finance considers withholding as one thing destructive. However others say that the idea of compelled financial savings is helpful for low and moderate-income households as a powerful refund pays for holidays, actual property taxes, and different large bills, regardless that the federal government doesn’t pay any curiosity on such financial savings.

Source link