Editor’s take: The trade has modified quite a bit within the eight years since we wrote our first evaluation on the highest 5 chip firms. We anticipated semis had been not a development trade and the one method for firms to continue to grow was to win market share (onerous) or purchase different firms. That is very true in semiconductors as a result of most of those firms outsource their manufacturing to foundries like TSMC and GlobalFoundries.

Almost a decade later, a lot of the consolidation has taken place and there are few apparent offers left to be executed. So that you may assume our checklist ought to be largely unchanged, however that isn’t the case, however the causes for the modifications will not be the identical as they had been up to now.

Editor’s Notice:

Visitor writer Jonathan Goldberg is the founding father of D2D Advisory, a multi-functional consulting agency. Jonathan has developed development methods and alliances for firms within the cell, networking, gaming, and software program industries.

Ben Bajarin wrote an identical put up not so way back on the 5 “most essential” semiconductor firms. This struck a chord as we’ve got written similar analysis in the past. Bajarin has a strong checklist, and we thought his inclusion of Apple was good and essential. Nonetheless, we’ve got a special take.

Bajarin’s standards for inclusion on the checklist differs from ours. He seems at firms which might be driving or controlling compute platforms. Against this, our checklist is predicated on which firms will survive the continued trade consolidation, which isn’t the identical factor. So we cannot embody Apple or Google, as they don’t seem to be topic to the identical trade circumstances, however do benefit honorable mentions.

Right here is our checklist:

- The analog duopoly of Texas Devices and ADI

- Qualcomm

- Nvidia

- A Chinese language chip firm – TBD

- The smoldering ruins of Intel

Texas Devices and ADI are simple entries for the checklist, however are sometimes missed. Each firms make an enormous array of merchandise that almost all of us by no means take into consideration. With ADI’s acquisition of Maxim, there are actually no different analog firms of their scale. There are many smaller firms carving out particular niches which can go on to years of impartial worthwhile development, or find yourself as targets of certainly one of these two. Both method, there doesn’t appear to be something on the horizon to displace these two.

At one level, there have been critical considerations that Qualcomm may not be round that for much longer. However they’ve now survived a hostile takeover and launched into a smart new strategy which possible means they are going to be a serious participant for a few years to come back. We must always in all probability add MediaTek to this checklist as effectively, they appear to be in a strong place, however we already stretched the principles of the checklist with the 2 analog firms, and MediaTek operates underneath a really totally different set of company and geopolitical circumstances.

Nvidia is the third maintain over from our final checklist, and if something appears to have solely prolonged their relevance. That is constructed not solely on their dominance of the AI market however with their very bold plans to extend their reach all through the information middle.

Earlier than we flesh out the remainder of the checklist, a fast phrase on two firms that aren’t on the checklist. The primary is Marvell. We expect extremely of Marvell, they’ve been executing effectively on a strong technique for a few years, however there’s now the very apparent query of what do they wish to do subsequent? We’ve got seen arguments that they may very well be both predator or prey within the semis consolidation. Do they proceed their path of acquisitions or bundle themselves up on the market? Neither choice is nice, there will not be many good targets left, nor are there many motivated acquirors. If we needed to guess, our sense is that they’ve executed an important job and now wish to exit, the choice goes to require plenty of onerous work.

The opposite firm lacking from the checklist is Broadcom. They had been on it final time, however now we’ve got to query how for much longer they wish to be within the semis enterprise. As we’ve got argued, at coronary heart they’re much less of a semis firm and extra of a personal fairness fund that used to give attention to semis however is now targeted on software program. We might not be stunned if someplace down the street they begin divesting chip belongings. There are such a lot of extra targets in software program…

Taking their place on the checklist is a “To be decided” Chinese chip company. We have no idea which one, they could not even have been based but, however ten years from now there can be a global-scale, extremely aggressive Chinese language chip firm that everybody has to concentrate to. In fact, geopolitics may throw a wrench in that imaginative and prescient, however absent a drastic additional escalation we predict it is vitally possible that at the least one of many 1000’s of fabless firms in China at this time survives the gauntlet to emerge as a world participant.

And that brings us to Intel. We’re more and more of the view that Intel cannot survive in its current form. We aren’t completely happy about it, however our emotions don’t issue into the chilly, onerous actuality of the enterprise. In fact, there’s nonetheless large worth in what Intel has, they’ve a lot expertise, there are some key belongings that may survive. Whether or not via some miracle the present firm makes a comeback, or extra possible they’re cut up up and bought by others, that asset will ultimately generate worth for somebody.

Honorable Mentions

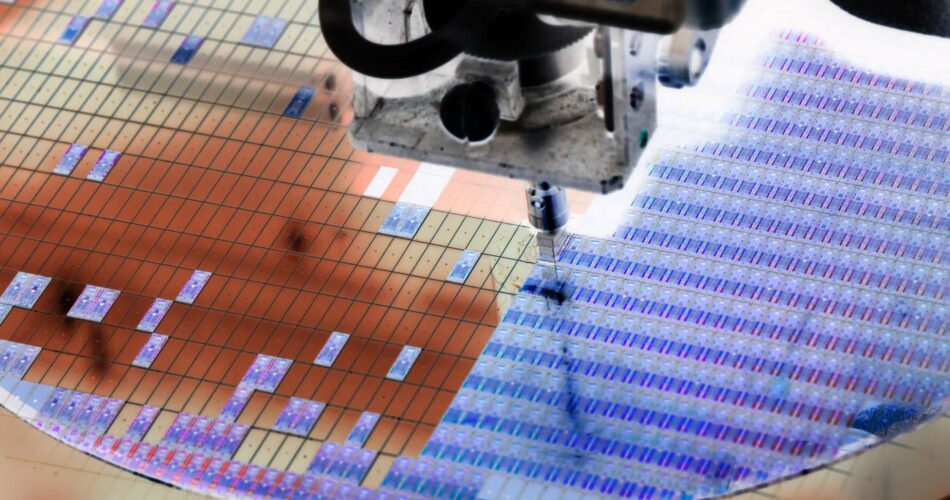

This checklist has a reasonably slim focus – fabless chip design firms. The broader ecosystem is already pretty effectively lined elsewhere. The entire world now realizes how irreplaceable TSMC and ASML have develop into, and so we’ve got not regarded on the wafer fabrication tools (WFE) area, which seems unlikely to vary any time quickly.

Equally, we’ve got not touched on the reminiscence sector as a result of it has been pretty steady for a decade. That could be altering now, with Samsung seemingly breaking the long-held truce within the sector sustaining its capability increasing capex whereas its friends are slicing sharply, and Western Digital struggling to digest its acquisition of Sandisk. Coupled with the abrupt curtailment of China’s reminiscence firms (notably YMTC), we may even see some change in reminiscence quickly, however we are going to go away that past our scope at this time.

Lastly, we have to contact with regards to all of the non-chip firms designing their very own chips.

Apple stays the most effective run semiconductor firm on the planet, albeit with indicators of latest stumbling. Equally, Google removes probably the most progressive semiconductor firm on the planet, whose efforts to broaden the pool of semis designers may alter the trade totally someplace down the street. Lastly, Amazon’s AWS is one other contender for this checklist having executed greater than anybody else to deliver Arm CPUs to the information middle, with the heft to change the platform dynamics of the entire trade.

Source link