Suppose you’re a serious provider of fertilizer to the agriculture market and you’ve got ambitions of digitally remodeling your enterprise. Your concept is to position hundreds of sensors in 10-foot-by-10-foot blocks throughout the fields your prospects farm. The sensors will regularly report on soil and atmospheric situations, enabling prospects to regulate their fertilizer allocations to maximise yields. In the meantime, your organization gathers helpful knowledge that it could possibly use to focus on gross sales to different purchasers.

Such a state of affairs is feasible at present, however the associated fee is past the technique of all however the largest agriculture conglomerates. The one technique to construct a community with the mandatory reliability could be to contract with one of many handful of wi-fi service suppliers that dominate the U.S. market. Even then, your organization must negotiate the small print of how such a community could be operated, what stage of management you’d have and who would personal the info.

Juniper Networks’ Thattil: “Something operators wish to do has to depend on the event cycle of the seller.” Picture: Juniper Networks

The fee equation could also be about to vary, nevertheless. The following era of wi-fi mobile networks – known as 5G — for the primary time will allow organizations to construct their very own networks and run functions on prime of them. An open commonplace for radio entry networks or RANs may deliver the prices of such a mission inside attain of many extra companies.

The Open RAN specification, which the O-RAN Alliance launched in 2018 and now maintains, is a reference structure for a set of interoperable {hardware}, software program and interfaces that may be constructed from off-the-shelf {hardware}. Supporters say it may have the identical affect on the telecommunications business that Unix and TCP/IP had on the info middle within the Nineties when open requirements disrupted the proprietary – and extremely worthwhile – area of some giant gear makers, introduced costs crashing down and altered the economics of knowledge processing.

The Alliance will be out in force at MWC 2023, the previous Cell World Congress occasion, in Barcelona this week with an assortment of technical classes and addresses by some main wi-fi carriers and companies constructing appropriate merchandise. (SiliconANGLE and its cellular video studio theCUBE can be onsite to report and analyze the information and interview prime executives and specialists.)

A RAN is the radio aspect of a mobile community. It hyperlinks wi-fi gadgets to transceivers and finally to the core community that connects to the web. RANs are usually put in in every of the cells that make up a mobile community.

It’s a specialised piece of {hardware} that’s constructed to accommodate the velocity and quantity wants which might be distinctive to wi-fi endpoints. “A RAN is a real-time software, so the degrees of latency which might be tolerable are considerably decrease than what we see in different elements of the community,” stated Sandro Tavares, director of product advertising and marketing for telecom enterprise at Dell Applied sciences Inc. “It’s additionally extraordinarily compute-intensive.”

Few can play

The necessity for velocity has meant that RANs have all the time required customized silicon. Only some giant corporations have the means to furnish that, which is why the market is dominated by only a few giant gamers, together with Huawei Applied sciences Co. Ltd., Samsung Electronics Co. Ltd., Cisco Programs Inc., LM Ericsson Telefon AB, Nokia Corp., Qualcomm Inc., Nippon Telegraph and Phone Corp. and NEC Corp. Designs are proprietary and elements are tightly coupled for stability and reliability.

Dell Tavares: “We count on our telecom enterprise to develop considerably.” Picture: Dell Applied sciences

The closed nature of the RAN market has inhibited innovation on the software program stage as a result of every gear supplier controls its personal working stack. It has additionally saved costs excessive. By some estimates, the price of deploying a RAN for a single cellular operator in a big metropolitan space can run to a whole lot of hundreds of thousands of {dollars}.

Telecom carriers have been keen to place up with the expense as a result of reliability is so essential to their operations, however Open RAN guarantees to fling open the doorways to competitors by making it doable for anybody to construct the antennas, radios and baseband items that make up a RAN in addition to software program that runs on prime of it.

“The present surroundings is caught with a couple of main distributors and something operators wish to do has to depend on the event cycle of the seller,” stated Jai Thattil, head of service supplier strategic advertising and marketing at Juniper Networks Inc., which is a vigorous proponent of Open RAN. “Whenever you open up the market, extra gamers will are available in, smaller distributors can construct new functions and deploy in days, time to market is faster and you’ll choose and select what you need.”

Programs makers rush in

The chance to get in available on the market for telecommunications gear has caught the eye of distributors that was once all however locked out of the market. Dell created a enterprise unit in 2021 that’s “aligning with the business’s complete transition to open applied sciences,” Tavares stated. “We count on our telecom enterprise to develop considerably.”

HPE’s Ram sees provider opposition to Open RAN starting to wane. Picture: HPE

Final week the company launched a line of bundled {hardware}, software program and subscription companies tuned to workloads on the fringe of a wi-fi community in addition to variations of its PowerEdge servers designed particularly for Open RAN deployment.

Hewlett Packard Enterprise Co.’s ProLiant DL110 server was constructed particularly to deal with RAN workloads. It’s optimized to deal with narrowband workloads with low energy necessities and has enlargement area for operating computing workloads on the edge. Final week HPE double down on its enterprise wi-fi community enterprise with the acquisition of personal mobile community expertise supplier Athonet S.r.l. “We’re the one ones which have deployed upwards of 10,000 websites of Open and digital RAN,” stated Geetha Ram, worldwide head of telco infrastructure at HPE.

IBM Corp. and its Purple Hat subsidiary are concerned in quite a few Open RAN deployments and each Intel Corp. and Superior Micro Units Inc. have operations devoted to the enterprise.

Cloud platform suppliers, which some individuals have steered may compete with wi-fi carriers sooner or later, are to date glad to play a supporting function. Amazon Net Providers Inc. is pitching itself as an ideal platform for applications constructed on prime of Open RAN. Microsoft Corp. is building analytics and control technologies for virtualized RANs and each it and Google LLC are members of the O-Ran Alliance.

Regardless of all the joy, quite a lot of technical and aggressive components have mixed to restrict industrial deployments to only a handful. Just one provider — Japan’s Rakuten Group Inc. — has guess its enterprise on Open RAN, with more than 300,000 cells at present deployed. Within the U.S. Dish Community Corp. is betting large on the expertise however the mobile wi-fi leaders have to date solely dabbled with checks.

Huge alternative?

For enterprises, Open RAN may considerably cut back the price of constructing non-public 5G wi-fi networks, opening up new functions which might be impractical at present due to value and complexity. By basically disaggregating the weather of the bottom station, the usual may allow enterprises to construct networks from elements that exactly meet their wants in addition to purchase and construct functions on prime of them.

Dell’Oro’s Pongratz: “Non-public wi-fi is an enormous alternative.”

Dell’Oro Group Inc. expects the non-public wi-fi RAN market to develop at a 24% annual compound price by 2027. Though the small-cell RAN market would solely be a comparatively tiny $1 billion at the moment, “non-public wi-fi is an enormous alternative,” stated Stefan Pongratz, a Dell’Oro vp. “We imagine there’s a very giant alternative to deal with the restrictions of enterprise Wi-Fi and cellular networks.”

Dell’Oro recently revised its Open RAN forecast upward, saying it expects the usual to account for between 15% and 20% of world RAN deployments by 2027. ABI Analysis Inc. is extra optimistic. It predicts that shipments of Open RAN gear will exceed 40% of whole RAN gear deployed in 2026.

“Vertically built-in gear doesn’t have the flexibility to fulfill the fragmented necessities of the enterprise,” stated Malik Saadi, ABI Analysis’s head of strategic expertise. “It’s essential to scale down or disaggregate. It’s essential to combine and match elements according to the necessities of the section.”

Implementation challenges

Though opening up one of many final proprietary bastions of data expertise infrastructure sounds good in concept, the sensible problems with transitioning to a brand new structure are advanced, notably in a enterprise that breathes reliability and efficiency.

The Open RAN specification has been praised for its scope, however it is just 5 years outdated and continues to be evolving. “It’s not lack of demand that’s creating the issue however the maturity of the usual,” stated Saadi. “Specs create bugs and people must be mounted in subsequent releases,” he stated, noting that about 40% of the brand new options in launch 16 of the 5G specification mounted bugs from the earlier model.

The specification will inevitably mature over time, however the risk-averse telecom business is more likely to transfer slowly till Open RAN gear has been battle-tested. “They’re getting ready but it surely’s a gradual course of,” stated Juniper’s Thattil.

Safety is as a lot a difficulty as it’s for any open commonplace. The Open RAN spec “hasn’t been designed for safety from the beginning,” stated Sylvain Fabre, a Gartner Inc. senior director and analyst. “I’ve acquired all these open interfaces that must authenticate to one another.” A 2021 study commissioned by the German Federal Workplace for Info Safety concluded that the specification at the moment ”accommodates vital safety dangers” and “has not but been adequately specified in keeping with security-by-design” rules.

Proponents counter that the usual is, by definition, safer as a result of it permits a wider vary of protections to be employed for features comparable to menace detection, encryption, signature verification and nil belief administration.

Questionable ROI

The present case for return on funding can also be shaky. The market of third-party gear continues to be small and economies of scale have but to kick in. There are additionally questions on the price of integrating gear and software program from various suppliers. “Enterprise purchasers are seeing that the price of going to a standard operator continues to be cheaper than constructing it your self,” stated Raj Shah, managing companion at digital consultancy Publicis Sapient, the digital transformation consultancy arm of Publicis Groupe SA.

“Disaggregation requires standardization of a lot of interfaces,” together with these between RAN elements comparable to radio items, distributed items, centralized items and the RAN clever controller, Saadi stated. “These are nonetheless largely not standardized, though the O-RAN Alliance is engaged on that.”

The underside line: There are few compelling causes for carriers or enterprises to make large investments within the still-fledgling expertise on prime of their capital expenditures on present gear. “Carriers are very protecting of their community,” stated Randy Cox, head of product administration for clever cloud at Wind River Programs Inc. “They need the highest-performing community and so they don’t need simply anyone to the touch it. The draw back of disaggregation is that it provides complexities in integration.”

Startups wrestle

EdgeQ’s Ravuri: Entrenched suppliers have been reluctant to undertake Open RAN for worry of cannibalizing their present enterprise. Picture: EdgeQ

The specification’s gradual begin has created a little bit of a vicious cycle. “There was an expectation lots of new gamers would enter the market,” stated Vinay Ravuri, chief govt of EdgeQ Inc., which makes a chipset that matches inside the Open RAN working stack. “We’ve seen some however many have disappeared as a result of funding dried up or they didn’t see sufficient uptake. There wasn’t sufficient silicon beneath to deliver the associated fee construction down.”

That has made value justification a dodgy challenge for a expertise that “requires an enormous quantity of funding to deal with all the varied RAN segments,” stated Dell’Oro’s Pongratz.

“As soon as it’s up and operating it’s very cost-effective, however while you nonetheless have your legacy manner of doing issues, it’s going to value you extra,” stated Gartner’s Fabre.

In concept, the full value of possession ought to decline as extra gamers enter the market. “With a disaggregated community, patrons can choose and select what distributors they wish to work with and that drives decrease TCO,” stated Wind River’s Cox. “It additionally drives innovation with a number of gamers contributing to this disaggregated community.”

Skeptical view

Strand Seek the advice of is among the skeptics. The Copenhagen-based consultancy, which claims 170 cellular operators as purchasers, predicts that the Open RAN put in base can be beneath 3% in 2030. It says the economies of scale afforded by present requirements largely blunt any cost-saving advantages and that the advantages carriers may understand from adopting the usual would quantity to financial savings of about 30 cents monthly per subscriber.

Strand additionally accuses the O-RAN Alliance of opacity. “Generally, there’s little literature on Open RAN that may be categorised as empirical, scientific, or peer-reviewed,” the corporate wrote in a report titled “Debunking 25 Myths of OpenRAN. “Exterior of some exceptions, most supplies are coverage advocacy promoted by OpenRAN suppliers.”

Maybe essentially the most daunting problem Open RAN faces is the reluctance of entrenched gear suppliers to embrace it. Though each main RAN maker has joined the O-RAN Alliance in a minimum of a contributing function, their stage of dedication varies broadly, with a few of the most entrenched gamers taking part solely in title.

“Firms like Nokia, Ericsson and Huawei haven’t embraced it as a result of their very own bacon is on the road and so they don’t wish to cannibalize their present enterprise,” stated EdgeQ’s Ravuri.

Adjustments in angle

Attitudes could also be starting to vary, nevertheless. When HPE’s Ram raised the subject of open requirements with NTT DoCoMo representatives at Cell World Congress in 2019, “they politely instructed me I used to be stuffed with it, that Open RAN won’t ever take off,” she stated. NTT has since carried out an about-face and now positions itself as an integration hub for gear primarily based on the specification.

“Vertically built-in gear doesn’t have the flexibility to fulfill the fragmented necessities of the enterprise,” says ABI Analysis’s Saadi. Picture: ABI Analysis

European operators, particularly, are going through government-imposed deadlines to strip expertise made by Huawei from their networks. “These operators have come to appreciate that the method of swapping Huawei gear for various gear is dear, difficult, and will compromise total efficiency,” Saadi stated. “Such a state of affairs can be unlikely if cellular networks are constructed with modularity in thoughts,” as is the case with Open RAN.

The chief expertise officer of Ericsson, which has been guarded in its feedback about the usual previously, just lately stated that Open RAN will be in 40% of radio systems by 2030.

Qualcomm and Vodafone Group plc final fall stated they will partner to develop 5G gear with large multiple-input multiple-output capabilities. MIMO is a wi-fi expertise that mixes a whole lot or hundreds of antennas in a single array to enhance protection and power effectivity. The blueprint “will mark some extent of no-return away from vertically built-in infrastructure,” stated ABI’s Saadi.

Progress is being made on different fronts as properly, albeit slowly:

- Vodafone final yr switched on its first Open RAN-based 5G site within the U.Okay. as a part of a plan to construct out 2,500 such websites by 2027.

- Telefónica S.A. has stated Open RAN will make up half of its new radio networks by 2025.

- Verizon Communications Inc. has deployed more than 8,000 virtualized cell sites towards a aim of getting greater than 20,000 in operation by the tip of 2025. Though the websites aren’t primarily based on Open RAN, virtualization is taken into account a key a part of shifting to a extra open set of protocols.

- Numerous wireless carriers in India, Thailand, Indonesia, Africa, the Center East and South America are additionally conducting proofs-of-concept or are in early deployment.

No cheerleader

In essence, although, many of the exercise has been tire-kicking. “There’s no lead cheerleader for Open RAN,” stated Gartner’s Fabre.

That stated, expertise developments could power the difficulty. At the same time as 5G continues to be creeping into the market, the subsequent era of mobile community expertise, known as 6G, is on the horizon with the promise of quicker speeds, higher protection and improved reliability. Giant-scale deployments are anticipated to start by 2030.

Wind River’s Cox: “With a disaggregated community, patrons can choose and select what distributors they wish to work with and that drives decrease TCO.” Picture: LinkedIn

Whereas 5G set the stage for community virtualization, 6G is anticipated to make it mainstream. Virtualized networks are software-defined, permitting them to be managed and configured completely in software program. That not solely dramatically reduces the necessity for discipline upkeep however provides operators unprecedented alternatives to exactly handle bandwidth and energy consumption.

For instance, carriers may briefly allocate further bandwidth to areas dealing with a catastrophe or enhance effectivity by turning towers on and off relying on the time of day or the day of the week, stated Juniper’s Thattil.

“In 6G there’s simply an assumption that the world can be virtualized,” stated Wind River’s Cox. “The standard distributors know that’s the case and they also’re having to adapt.” Rakuten has turned some heads with its claims that it manages its digital community of 300,000 cells with a workers of simply 250 individuals.

Nonetheless, virtualizing off-the-shelf {hardware} that isn’t purpose-built for real-time processing “is daunting,” wrote Sachin Katti, senior vp and common supervisor of the community and edge group at Intel in a recent blog post. “It’s a very demanding piece of the community infrastructure and the cornerstone to making sure your most essential name is rarely dropped. It must ship the high-speed and low-latency connectivity all of us want, however with out ever failing.”

A number of distributors, together with Dell, Qualcomm, EdgeQ and AccelerComm Ltd., are engaged on or have delivered accelerator {hardware} to beat the efficiency limitations of general-purpose CPUs.

Both-or?

In the long term, the RAN market received’t be a winner-take-all proposition. “It’s possible that Open RAN will coexist [with proprietary technology] for a very long time,” stated EdgeQ’s Ravuri. “The legacy won’t ever go away and the tail can be very lengthy, however I feel in 10 years will probably be a minimum of 50% of the market.”

HPE’s Ram agreed that legacy RAN expertise “is fairly weak. [Carriers] aren’t going to activate a change and alter issues. However is it going to occur over time? Completely sure,” she stated.

For enterprises, the tipping level may come when packaged companies emerge that make deploying 5G and successor networks easy.

“There’s a have to digitize the enterprise,” Saadi stated. “That is one thing they’re very eager about, however what they aren’t eager about is the disaggregation.” He sees non-public wi-fi networks evolving towards a subscription mannequin, very like client wi-fi companies at present. “Promoting gear on a capex foundation received’t work; it needs to be as a service,” he stated.

As soon as that and different obstacles get whittled away, deploying that non-public wi-fi community in a cornfield could change into a complete lot extra engaging.

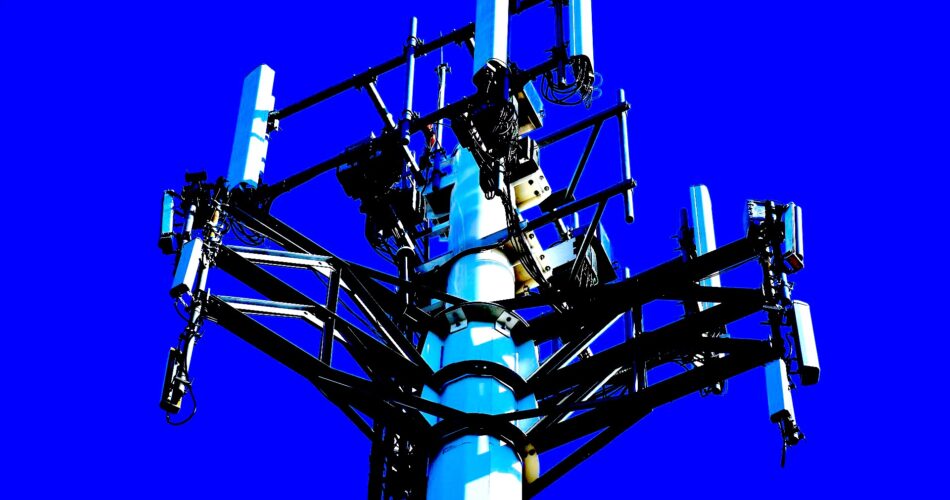

Picture: Maxwell Fury/Pixabay

Present your help for our mission by becoming a member of our Dice Membership and Dice Occasion Neighborhood of specialists. Be part of the neighborhood that features Amazon Net Providers and Amazon.com CEO Andy Jassy, Dell Applied sciences founder and CEO Michael Dell, Intel CEO Pat Gelsinger and lots of extra luminaries and specialists.

Source link