The world’s main telecommunications corporations are sometimes branded as monopolies that lack innovation. Telcos have been nice at operational effectivity, connectivity and dwelling off of transmission prices.

However in a world past phone poles and fundamental wi-fi providers, how will telcos modernize, turn into extra agile and monetize new alternatives caused by 5G, non-public wi-fi and a spate of recent improvements in infrastructure, cloud, knowledge, synthetic intelligence and apps? It has turn into desk stakes for carriers to evolve their hardened, proprietary infrastructure stacks to extra open, versatile, cloudlike fashions. However doing so brings dangers that telcos should rigorously stability as they attempt to ship constant high quality of service whereas on the identical time shifting sooner and avoiding disruption.

On this Breaking Evaluation and forward of MWC 2023, we discover the evolution of the telco enterprise and the way the trade is in some ways, mimicking a metamorphosis that passed off a long time in the past in enterprise info know-how. We’ll mannequin a number of the conventional enterprise distributors utilizing Enterprise Expertise Analysis knowledge and examine how they’re faring within the telecom vertical. And we’ll pose a number of the key points going through the trade this decade.

MWC 2023: not pre-COVID attendance however spectacular

First, let’s check out what the GSMA has in retailer for MWC 2023.

GSMA, the host of what was once known as Cell World Congress, has set the theme for this yr’s occasion as velocity. It has rebranded MWC to mirror the truth that cell know-how is just one a part of the story. MWC has turn into one of many world’s premier tech occasions highlighting improvements not solely in telco, cell and 5G however the colliding forces of cloud, infrastructure, apps, non-public community, good industries, machine intelligence and AI, and extra. MWC includes an infinite ecosystem of service suppliers, know-how corporations, and companies from all industries, together with sports activities and leisure.

As effectively, the GSMA, together with its venue associate on the Fira Barcelona, have positioned a significant emphasis on sustainability and public/non-public partnerships. Nearly each trade will likely be represented on the occasion as a result of each trade is affected by the traits and alternatives within the communications house.

GSMA has stated it expects 80,000 attendees at this yr’s occasion – not again to 2019 ranges however trending in that course. Attendance by members from China has traditionally been very excessive on the present and clearly the continued journey points from that area are affecting the general attendance. However nonetheless very sturdy. Regardless of these considerations, Huawei Applied sciences Co. Ltd., the large Chinese language know-how firm, has the most important presence of any exhibitor on the present.

And at last, GSMA estimates that greater than 300 million Euro in financial profit will outcome from the occasion, which takes place on the finish of February and early March in Barcelona.

The evolution of the stack: Constructing the telco cloud

The crew from SiliconANGLE theCUBE will likely be again at MWC this yr with a significant presence because of our anchor sponsor, Dell Applied sciences Inc., and different supporters of our content material program, together with EnterpriseWeb LLC, Arrcus Inc., VMware Inc., Snowflake Inc., Cisco Techniques Inc., Amazon Internet Providers Inc. and others.

On the coronary heart of our ongoing research and reporting is the significance of main carriers evolving their know-how stacks. It’s a subject that’s typically talked about and one which we noticed passed off within the Nineties when the vertically built-in IBM Corp. mainframe monopoly gave approach to a disintegrated and horizontal trade construction.

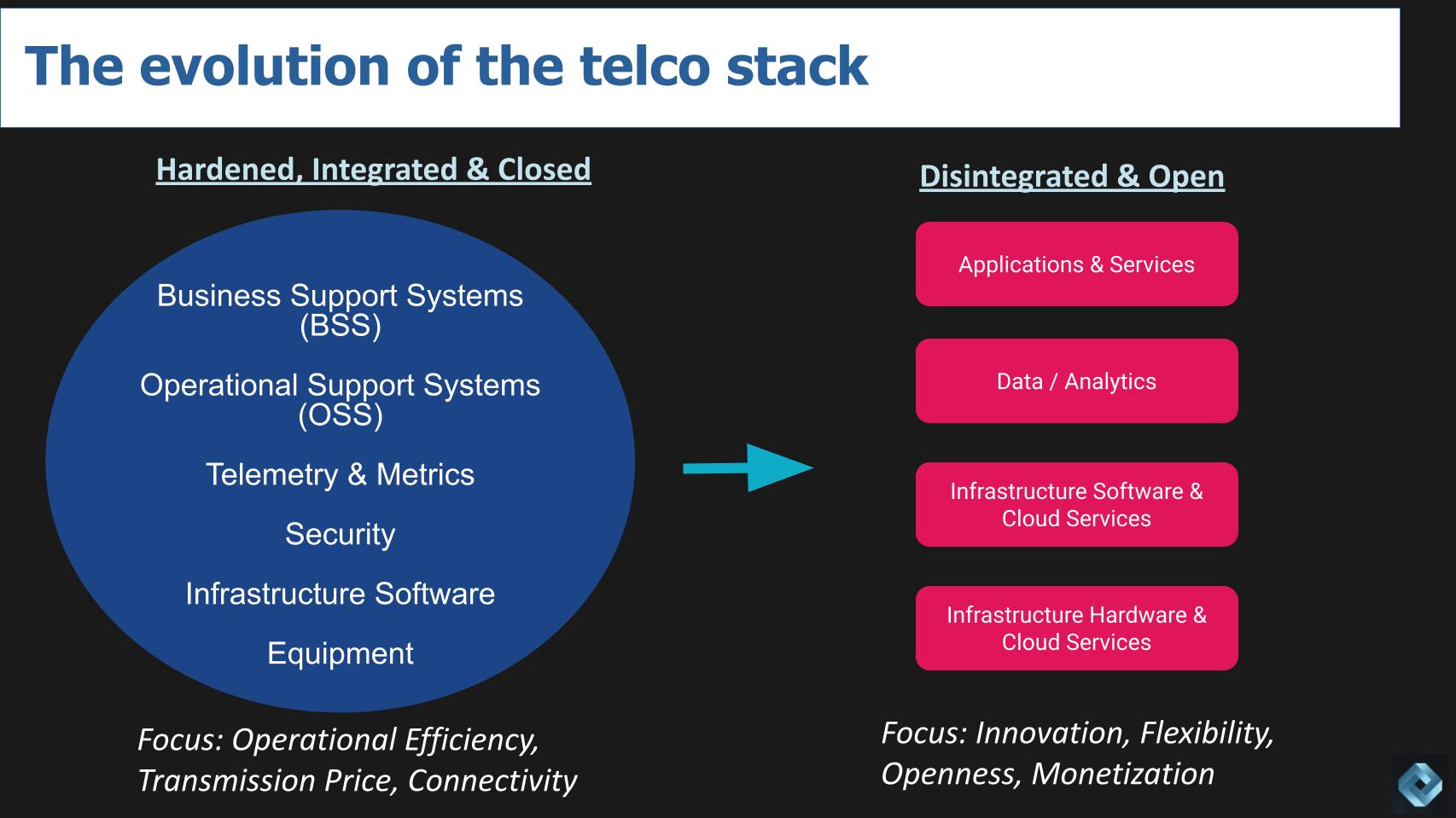

In some ways the identical factor is occurring right this moment in telecommunications, proven on the lefthand facet of the above diagram. Traditionally, telcos have relied on a hardened, built-in and extremely dependable and safe set of {hardware} and software program providers which have been totally vetted, examined, licensed and confidently deployed for many years.

And on the prime of that stack on the left are the crown jewels, the operational help techniques or OSS and the enterprise help techniques or BSS. The OSS offers with community administration, community operations, service supply, high quality of service, success assurance and the like. The BSS techniques take care of the customer-facing parts of the stack resembling income, order administration, product choices, billing and customer support.

Traditionally telcos have been sturdy at operational effectivity and being profitable off transport and connectivity. However they’ve lacked the innovation in providers. They personal the pipes and that works effectively. However others – resembling over-the-top or OTT content material corporations (Netflix, Amazon Prime, Hulu…) or non-public community suppliers and more and more cloud suppliers – have been in a position to bypass the telcos to drive innovation and safe buyer relationships (and knowledge) immediately.

As with enterprise IT, we’re seeing a number of fashions emerge together with an embrace of the general public cloud, however extra typically hybrid fashions which may selectively faucet sure public cloud providers however sustaining management of core techniques in home.

The horizontal stack is rising

Within the early a part of final decade, community perform virtualization or NFV was touted by a lot of distributors to unravel the issue of rigid telco infrastructure. NFV failed. It turned out to be difficult and too costly and it obtained blindsided by the cloud working mannequin. Carriers have been left with the selection of shifting their stacks into the general public cloud or doing their very own time-consuming integration and testing to attain a extra versatile working mannequin.

The rightmost a part of the diagram above conceptualizes the place we expect the trade is headed. It addresses the pattern towards disaggregating key items of the stack. And although the similarities to the Nineties in enterprise IT are better than the variations, there are issues which are new. For instance, the granularity of {hardware} infrastructure is probably not as excessive the place competitors occurred at each layer of the worth chain with little or no infrastructure integration. That in fact modified within the 2010s with converged infrastructure and hyperconverged and software-defined… in order that’s totally different right this moment.

As effectively, the appearance of cloud, containers, microservices and AI… none of those was a significant factor within the disintegration of legacy IT. And that most likely implies that todays disruptors can transfer even sooner than did Intel Corp., Microsoft Corp., Oracle Corp., Cisco and Seagate Expertise within the Nineties.

As well as, although lots of the services and products will come from conventional enterprise IT names resembling Dell, Hewlett Packard Enterprise Co., Cisco, Pink Hat, VMware, AWS, Microsoft and Google LLC, the names may even embody totally different suppliers and are available from conventional community tools suppliers resembling Ericsson AB, Huawei and Nokia Corp.. And the associate ecosystem will likely be extra numerous as effectively with different names resembling Wind River Techniques Inc., Rakuten Inc. and Dish Community Corp.

Huge alternatives exist in knowledge too. Telecom corporations and their rivals should transcend telemetry knowledge into extra superior analytics and knowledge monetization. There may even be a completely new set of apps based mostly on the workloads and use instances starting from hospitals and sports activities arenas to race tracks, delivery ports and extra. You title it, just about each vertical will take part on this transformation because the trade evolves its focus towards innovation, agility and open ecosystems.

Tug-of-war: velocity versus high quality

Keep in mind additionally that this isn’t a binary state. There will likely be greenfield corporations disrupting the apple cart, however incumbent telcos will proceed to make sure newer techniques work with legacy infrastructure and, as we all know, that’s not an in a single day job. Which makes this all so fascinating due to the friction between the necessity for velocity juxtaposed with high quality.

As such, telco tools consumers will profit from these suppliers that may assist simplify integration with engineered techniques, pre-packaged layers of the stack and lab certifications that transcend reference fashions and truly assure the efficacy of SKUs that embody ecosystem parts.

How enterprise gamers fare in telecom sectors

As acknowledged, a number of conventional enterprise corporations are or will likely be taking part in on this house. ETR doesn’t have a ton of knowledge on particular telecom tools and software program suppliers, however it does have some fascinating knowledge that we reduce for this Breaking Evaluation.

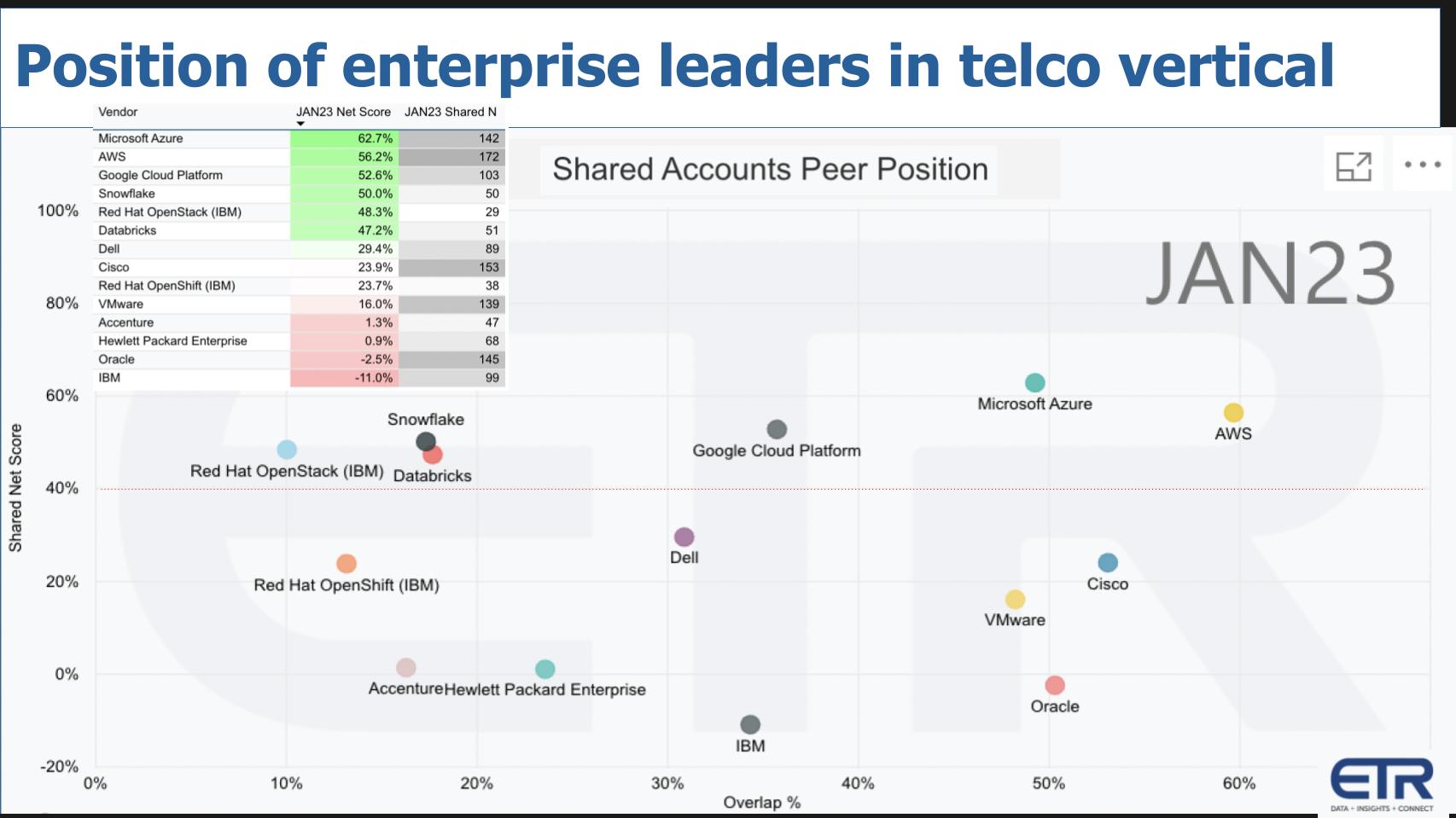

Above we present a graphic with a number of the names that we’ve adopted through the years in Breaking Evaluation and the way they’re faring particularly inside the telco sector.

The Y axis exhibits Web Rating or spending velocity and the horizontal axis exhibits the presence or pervasiveness within the knowledge set. The desk insert within the higher left informs how the dots are plotted. And that crimson dotted line at 40% signifies a extremely elevated stage. Under we touch upon a number of the cohorts and share with you the way they’re doing in telecommunications sector relative to their place total.

Public clouds present better momentum in telco

Let’s begin with the general public cloud gamers. They’re distinguished in each trade and an fascinating group in telco. On the one hand, they can assist telecommunication companies modernize and turn into extra agile by eliminating heavy lifting, knowledge heart prices and all of the cloud advantages. On the identical time, public cloud gamers are bringing their providers to the sting, constructing out their very own international networks and are a disruptive pressure to conventional telcos. The next summarizes the place of hyperscalers relative to their common Web Rating within the ETR knowledge set:

- Azure’s Web Rating is mainly an identical in telco relative to its common;

- AWS’ Web Rating is greater in telco by round three proportion factors;

- Google Cloud Platform is eight proportion factors greater in telco with a 53% Web Rating.

So all three hyperscalers have an equal or stronger presence in telco than their common.

Subsequent let’s take a look at the normal enterprise {hardware} and software program infrastructure cohort: Dell, Cisco, HPE, Pink Hat, VMware, Oracle.

- Dell’s Web Rating is 10 proportion factors greater in telco than its total common.;

- Cisco’s Web Rating is just barely greater in telco;

- HPE’s Web Rating is definitely decrease by about 9 proportion factors; and

- VMware’s Web Rating is decrease by 4 proportion factors in telco.

Pink Hat is fascinating. OpenStack, as we’ve beforehand reported, is fashionable with telcos wanting to construct out their very own non-public cloud and the info exhibits:

- Pink Hat OpenStack’s Web Rating is 15 proportion factors greater in telco than its total common;

- Pink Hat’s OpenShift, then again, has a Web Rating that’s 4 proportion factors decrease in telco than its total common.

Oracle’s spending momentum is considerably decrease within the sector than its common regardless of the agency having a good telco enterprise. IBM and Accenture plc are each meaningfully decrease within the sector than their common total.

We’ve additionally highlighted two knowledge platform gamers, Snowflake and Databricks Inc.:

- Snowflake’s Web Rating is far decrease in telco, by about 12 proportion factors relative to its very excessive common Web Rating of 62.3% total. We consider, nevertheless, that Snowflake will likely be participant on this house as telcos have to modernize their analytics stack and share knowledge in a ruled method;

- Databricks’ Web Rating can also be a lot decrease than its common by about 13 factors.

Each corporations are superglued to the cloud and so their fortunes in telco ought to observe the same adoption curve, however based mostly on what we shared above concerning public cloud, there appears to be some catching as much as do for these companies. It’s probably as a result of they each play additional up the stack and that may take extra time.

Key points to discover at MWC 2023

Let’s shut out on what we’re going to be speaking about at MWC 2023 on theCUBE and a number of the key points we’ll be unpacking.

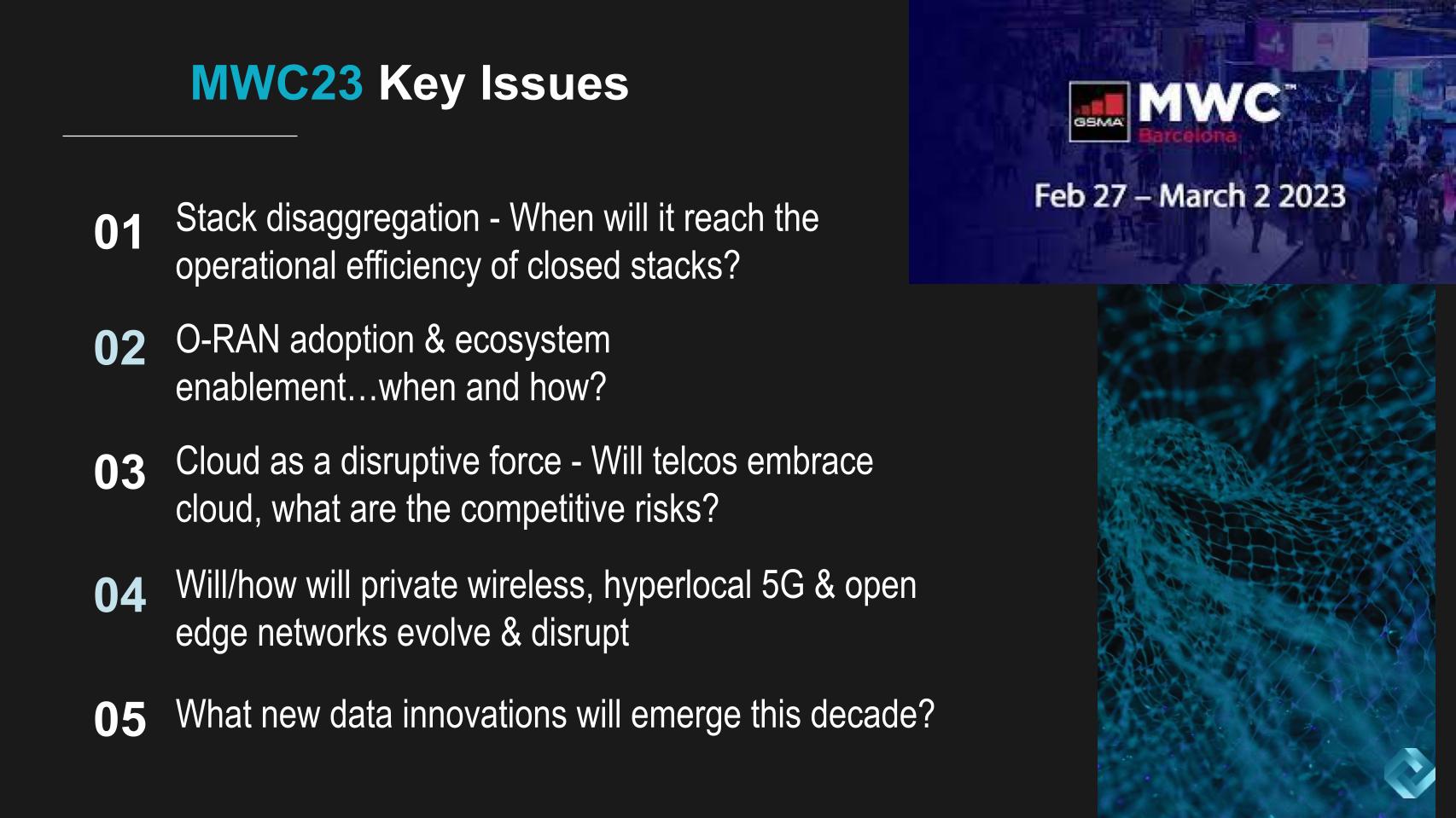

Stack disaggregation

We’ve talked about stack disaggregation right this moment, however the important thing right here would be the tempo at which it would attain the operational effectivity and reliability of closed stacks. Telcos are engineering-heavy companies and far of their work takes place within the “basements” of their companies. They have an inclination to maneuver slowly and cautiously. Though they perceive the significance of agility, telcos will likely be cautious as a result of that’s of their DNA. On the identical time, in the event that they don’t transfer quick sufficient, they may get harm.

In order that will likely be a subject of dialog and we’ll be in search of proof factors. The opposite remark we’ll add is round integration. Telcos, due to their conservatism, will profit from higher testing and people companies that may innovate on the testing entrance with labs and certifications for his or her ecosystems will likely be in a greater place. Open typically means Wild West, so the extra gamers resembling Dell, HPE, Cisco, Pink Hat and the like that provide integration capabilities out of the field, the sooner adoption will go.

OpenRAN and the ecosystem

O-RAN, or open radio entry networks, enable operators extra simply to combine and match RAN subcomponents from totally different distributors and innovate sooner. O-RAN is an rising community structure that permits using open applied sciences from an ecosystem. Over time, nearly all RAN will probably be open, however questions stay as to when the trade will be capable of ship the operational effectivity of conventional RAN. Rakuten, for instance, is an organization with an emphasis on bettering the operational effectivity of OpenRAN. Dish Community can also be embracing O-RAN however coming at if from extra of a service innovation angle. So we’ll check this assertion and examine the place the varied fashions on the spectrum match.

Cloud as a telco enabler and disruptor

On the one hand, cloud can assist drive agility, optionality and innovation for incumbent telcos… however the flip facet is it could possibly do the identical for startups making an attempt to disrupt. And whereas some telcos are embracing the cloud, many are being cautious. In order that’s going to be an fascinating matter of debate.

Hyperlocal non-public networks

Personal wi-fi networks, 5G, Wi-Fi 6 and native non-public networks are being deployed and this pattern will speed up. The significance right here is that the use instances will likely be broadly diverse. The wants of a hospital will likely be totally different than these of a sports activities venue or a distant drilling website or a live performance venue. Personal networks will make the most of spectrum throughout a variety of frequencies and are beholden to quite a lot of native legal guidelines and licensing restrictions. New applied sciences and spectrum utilization selections are rising to facilitate sooner adoption. We’ll be probing for the speed it will happen.

Information, AI, ethics, privateness and compliance

As at all times, we’ll be trying on the knowledge angles. It’s in theCUBE’s DNA to observe the info to grasp the alternatives, dangers, challenges and applied sciences that drive knowledge worth. Actual-time AI inference on the edge and altering knowledge flows will carry new providers and monetization alternatives. With the appearance of personal networks, many companies will likely be bypassing conventional telecommunications carriers to construct these out to achieve proprietary entry to buyer relationships and knowledge.

How will this disrupt industries and incumbents? What dangers are concerned by way of ethics, privateness, governance and the like and which gamers will emerge as winners?

Go to theCUBE at Stand CS 60

The information group at SiliconANGLE and theCUBE broadcast crew will likely be on location at MWC 2023 on the finish of this month with an excellent set. We’re within the walkway between Halls 4 and 5 proper in Congress Sq.. We’ve a full schedule with an excellent lineup, so in case you have editorial concepts, information tales, clients that need to share their tales, don’t hesitate to achieve out.

See you in individual or online.

Keep up a correspondence

Many because of Alex Myerson and Ken Shifman on manufacturing, podcasts and media workflows for Breaking Evaluation. Particular because of Kristen Martin and Cheryl Knight, who assist us preserve our neighborhood knowledgeable and get the phrase out, and to Rob Hof, our editor in chief at SiliconANGLE.

Keep in mind we publish every week on Wikibon and SiliconANGLE. These episodes are all accessible as podcasts wherever you listen.

Electronic mail [email protected], DM @dvellante on Twitter and touch upon our LinkedIn posts.

Additionally, take a look at this ETR Tutorial we created, which explains the spending methodology in additional element. Be aware: ETR is a separate firm from Wikibon and SiliconANGLE. If you want to quote or republish any of the corporate’s knowledge, or inquire about its providers, please contact ETR at [email protected].

Right here’s the complete video evaluation:

All statements made concerning corporations or securities are strictly beliefs, factors of view and opinions held by SiliconANGLE Media, Enterprise Expertise Analysis, different company on theCUBE and visitor writers. Such statements aren’t suggestions by these people to purchase, promote or maintain any safety. The content material offered doesn’t represent funding recommendation and shouldn’t be used as the premise for any funding resolution. You and solely you might be liable for your funding choices.

Disclosure: Most of the corporations cited in Breaking Evaluation are sponsors of theCUBE and/or shoppers of Wikibon. None of those companies or different corporations have any editorial management over or superior viewing of what’s printed in Breaking Evaluation.