2022 noticed notably much less funding for advertising and marketing expertise than earlier years, however there have been considerably extra new product bulletins, function updates and M&A exercise all year long.

At CabinetM, we’ve constructed a advertising and marketing expertise listing of 15,000+ merchandise to drive our advertising and marketing expertise administration instruments. Managing a listing of this measurement means holding monitor of recent merchandise, new classes, acquisitions and their related title adjustments, in addition to unlucky firm and product implosions.

For the final six years, we’ve printed this data weekly in our Friday publication to assist advertising and marketing groups keep abreast of shifts and adjustments. In late 2020, we determined to take a quarterly view to have a look at traits in product and class course. Since then, we’ve been publishing our MarTech Innovation Report each quarter. What follows are the important thing findings from our 2022 year-end report.

New product launches

In 2022 there have been 376 new product bulletins reflecting the output of the funding made in advertising and marketing expertise firms within the earlier two years. This was a major leap from 225 in 2021.

Funding

In distinction, funding in martech firms dropped from $39.8B in 2021 to $28.4B in 2022. It’s necessary to notice that these numbers don’t embody funding in AI content material creation startups which we didn’t begin to monitor till late This fall.

This would definitely have elevated the general numbers for 2021 and 2022 however could not have impacted the connection between the 2 years.

We consider that economic uncertainty and martech “funding fatigue” had been key components within the downturn in funding.

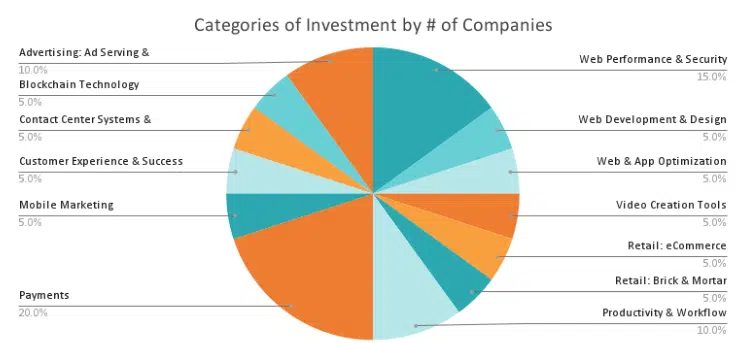

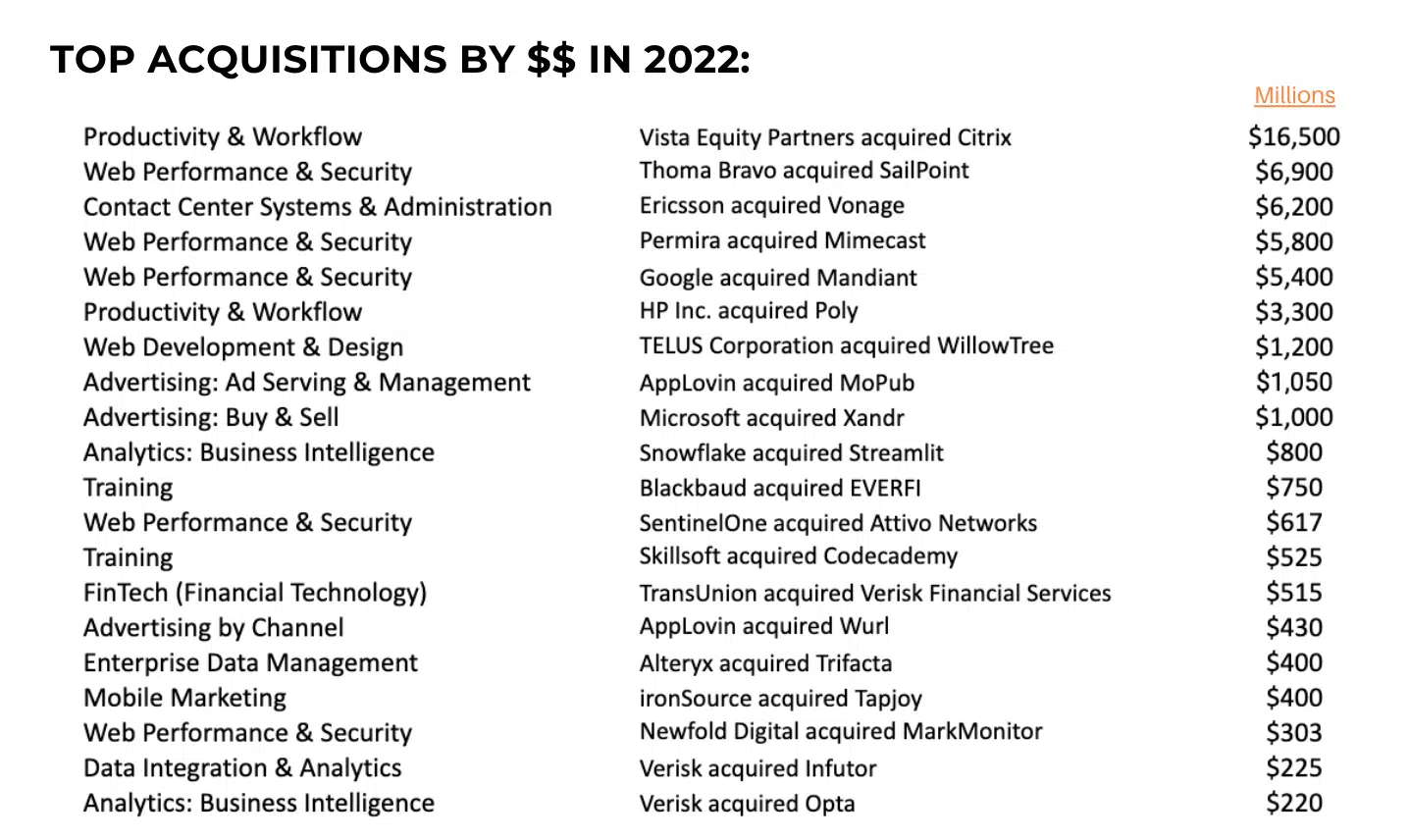

Mergers and acquisitions

M&A exercise in 2022, there have been 246 acquisitions for a complete worth of $54.9B in disclosed buy quantities in comparison with 196 in 2021 for a better whole worth of $101B in disclosed buy quantities.

Martech in 2023 and past

So the place does this go away martech as we transfer into 2023?

With a lot uncertainty in regards to the international financial system, most firms are taking a extra conservative strategy to advertising and marketing, advertising and marketing spend and expertise. Budgets are tightening and the stress to fulfill income aims will likely be intense.

In opposition to this backdrop, there continues to be a gradual drumbeat about the necessity to consolidate the variety of instruments within the trade and particular person martech stacks. With greater than 15,000 merchandise on provide, it doesn’t seem that the trade is consolidating as an entire.

Decreasing the variety of merchandise in particular person martech stacks continues to be a subject of dialog. This can be a easy and unrealistic reply to funds constraints.

If decreasing the variety of merchandise negatively impacts income, what have you ever achieved? Know-how bills could shrink however the price of buyer acquisition will rise and income targets will likely be missed.

Relatively than concentrate on decreasing the variety of instruments to cut back bills, advertising and marketing groups ought to rationalize their stacks to eradicate contract, product and purposeful redundancies and discard merchandise that nobody is utilizing.

On the identical time, there needs to be an ongoing analysis of stacks to ensure that tools are fully utilized, contributing to advertising and marketing and company aims and performing as anticipated.

It continues to astonish me how few firms know what’s truly of their stack or how properly these merchandise are performing. Ultimately there will likely be a reckoning and hopefully, it is going to be due to funds overruns and never due to knowledge privateness or safety points which is an actual threat when flying blind.

If it had been as much as me, I’d anoint 2023 because the “12 months of stack rationalization.”

Dig deeper: 5 strategies B2B marketing and sales teams can bank on as markets tighten

You ain’t seen nothin’ but

Regardless of financial issues and what could also be a tough 12 months for the trade, the outlook for martech seems to be nice. There’s a bent to say that the expertise panorama is simply too huge and over-invested, to which I say “ridiculous.”

Martech just isn’t one homogenous trade it’s made up of greater than 500 completely different classes a few of which have been over-invested (what number of extra CRMs do we’d like?), whereas others are model new and producing a ton of pleasure (i.e., AI-driven content material).

Innovation in our trade is pushed by altering client conduct, new channels to market, an more and more fragmented prospect base, laws and expertise innovation.

Scott Brinker captures this in his article, “2023 will be a chaotic year for martech, yet the start of a massive wave of growth” — a must-read for anybody in and across the trade.

Brinker predicts that development within the subsequent seven years will dwarf something that we’ve seen so far pushed by what he refers to as new expertise S-curves which he defines as:

I’d add data to this record (collection, compliance, compilation and enabling personalization).

I’m with him… there’s a lot innovation forward. Within the meantime, use this 12 months to rationalize, evaluate and refine your stack.

It’s possible you’ll obtain CabinetM’s full 2022 year-end MarTech Innovation report here. (Be aware: The report just isn’t gated and downloading won’t end in annoying emails and cellphone calls.)

Get MarTech! Every day. Free. In your inbox.

Opinions expressed on this article are these of the visitor creator and never essentially MarTech. Workers authors are listed here.

Source link