AppleInsider might earn an affiliate fee on purchases made by way of hyperlinks on our website.

You’ll want to file your taxes, however you may make the intimidating and complicated process a lot simpler to swallow by choosing up one in all these tax software program instruments.

Finishing your annual taxes can really feel like a chore, with a fancy listing of guidelines to comply with that may intimidate most individuals. Certainly, even tax professionals can generally want steering by way of the method of maximizing deductions and rising the potential refund.

To make your expertise as pain-free as attainable, we’ve got rounded up the perfect tax software program packages of 2023. We now have compiled the perfect mobile-friendly tax software program, minimizing your headache by laying out the professionals and cons of every.

Our listing takes under consideration the consumer’s consolation with tax submitting, the simplicity of the software program, the associated fee to file, and the perfect tax packages for easy or advanced returns, relying in your wants.

Distinction between easy and complicated tax returns

Earlier than you determine which software program would finest fit your wants, you need to first work out whether or not you may have a easy or advanced tax return.

A easy return usually signifies that you simply should file your W-2 earnings, your restricted curiosity and dividend earnings, have an ordinary deduction, and any unemployment earnings.

If in case you have a fancy return, it would imply you may have freelance earnings that makes use of a 1099 tax kind, earnings from abroad, earnings from investments and inventory gross sales, or are a enterprise proprietor or landlord.

If in case you have a easy return, every of the perfect tax software program choices beneath features a free choice to file. You may also try our listing of the highest tax software deals out there.

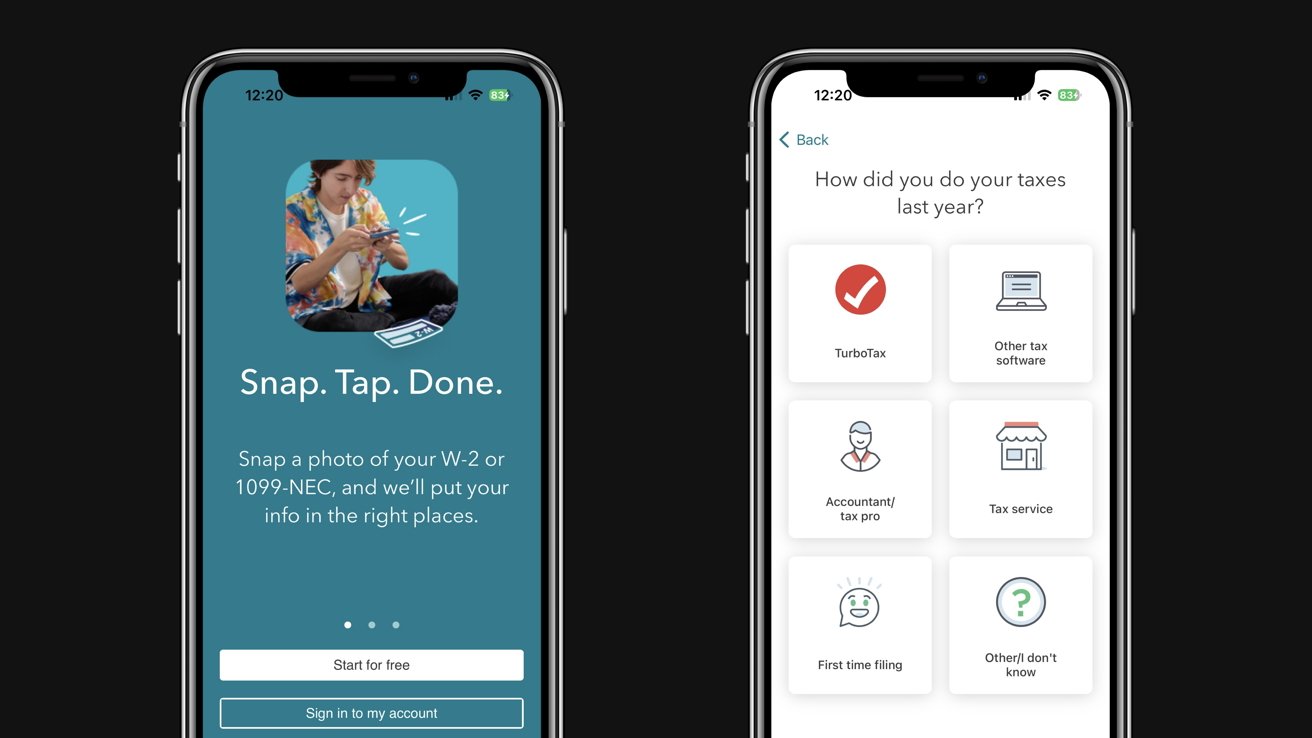

TurboTax

TurboTax takes the headache out of doing taxes. It stands out as a consequence of its stress-free consumer expertise and straightforward, DIY design.

For this reason TurboTax stays the trade tax customary as the perfect, all-encompassing software program.

TurboTax streamlines its software program with a Q&A guided format, asking the best inquiries to get you out and in of there, and with the most important refund, as quick as attainable. The “click on right here if this is applicable to you” part ensures you will not waste time on paperwork.

It gives a free version for easy returns, in addition to making issues simple if it’s worthwhile to re-do a kind. It will probably additionally import final 12 months’s tax return, has choices to improve all through the Q&A course of when you get caught throughout submitting, and does all your calculations for you.

As well as, for individuals who want to do taxes on the go, TurboTax has a cell app out there from the App Retailer.

Methods to file your taxes with the TurboTax app

A few of us are die-hard file-from-my-computer-only form of individuals. We get it — we wish to file taxes solely as soon as — accurately and precisely.

If you would like to strive submitting in your telephone this 12 months, you should use the app to file utilizing your iPhone or iPad, and even swap backwards and forwards between TurboTax On-line and the app.

The consumer interface is clear and would not differ a lot from the desktop model. It’s easy, protected, and safe to file your taxes with the TurboTax app.

TurboTax professionals

- Q&A steering interface is simple to make use of, with explanations as you go

- Free tax software program model out there for easy tax returns solely

- Dwell tax possibility begins at $130 for Fundamental and goes as much as $260 for Premier and Self-employed

- Restricted-time deal for 2022/2023, Live Basic (together with help from tax specialists) is free for easy tax returns; should file by 3/31

- A+ score from the Higher Enterprise Bureau

- Cell app out there

- For hairier IRS points, Audit help is obtainable

- The Dwell Full Service Choice has a tax skilled put together, signal, and file your return

TurboTax cons

- Sheer quantity of questions would possibly turn out to be overwhelming

- Dwell help prices additional

- Costlier than different packages

TurboTax plans and costs

The TurboTax app is free to download from the app retailer, is appropriate with iOS 14 or later, and is a 376.2 MB obtain.

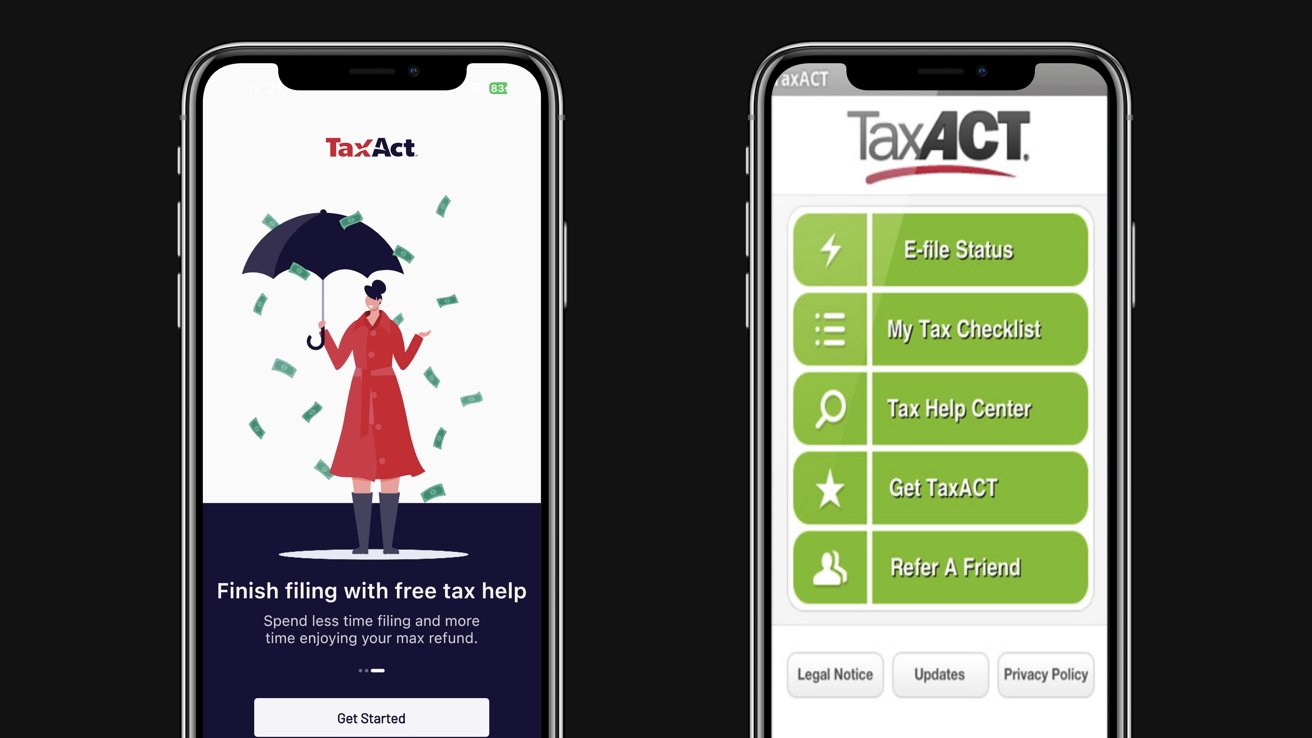

TaxAct

Whereas TurboTax and TaxAct each provide help, searchable data bases, and tech help, TaxAct provides each filer assist without cost, whereas TurboTax comes with a charge.

Methods to file your taxes with the TaxAct Categorical app

In case you do not have already got it, obtain TaxAct Categorical in your iPhone and create an account to get began.

With the TaxAct Categorical app, put together your federal and state tax return utilizing your iPhone or pill.

TaxAct professionals

- Extra inexpensive than different paid software program

- Dwell tax possibility begins at $35 for Fundamental and goes as much as $139.95 for Self-employed

- No matter tier, free assist is obtainable by way of the Xpert Help characteristic

- Free overview of your return earlier than submitting

- Faucet Most refund and accuracy assure, or will TaxAct will refund plan charges and pay any distinction within the refund or tax legal responsibility, plus cowl authorized or audit prices as much as $100,000

TaxAct cons

- Free model will not work when you deduct pupil mortgage curiosity, deduct mortgage curiosity, report enterprise or freelance earnings, or report inventory gross sales or earnings from a rental property.

- Even the free plan expenses per state return

TaxAct plans and costs

The TaxAct Categorical app is free to download from the app retailer, is appropriate with iOS 14 or later, and is an 86.2 MB obtain.

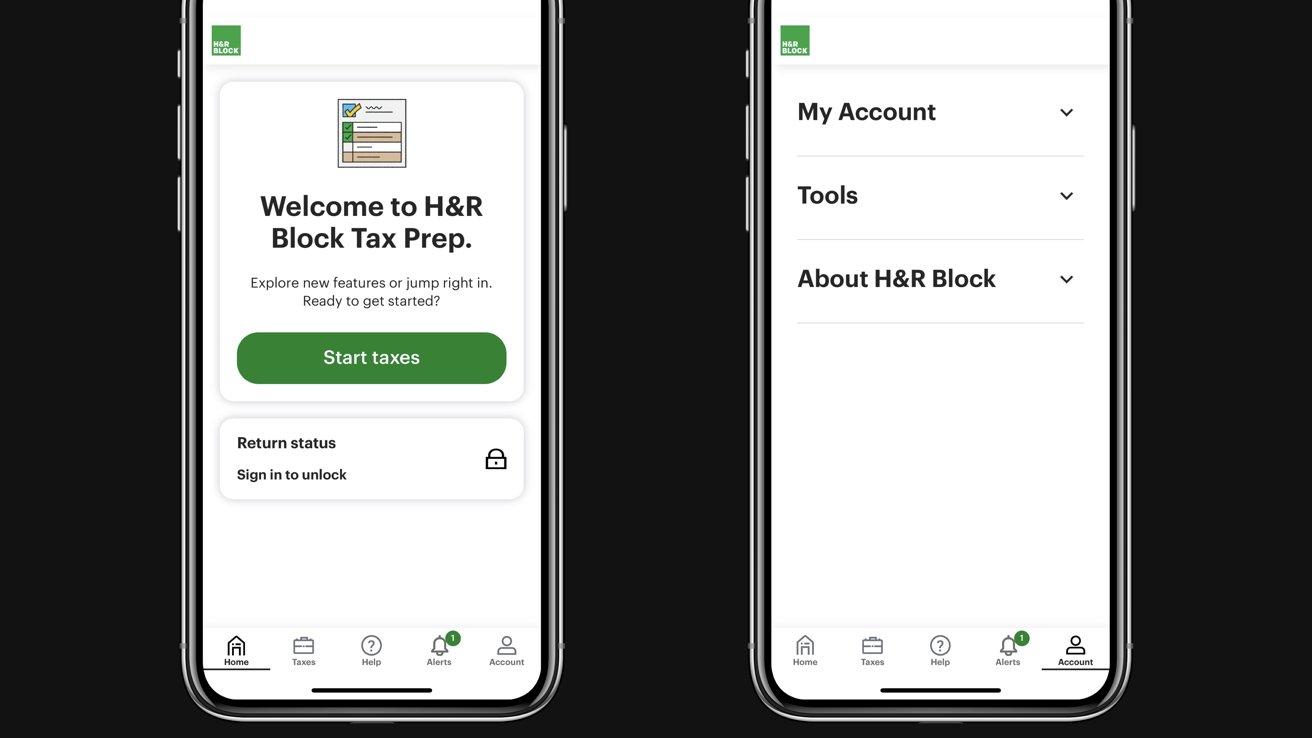

H&R Block

The primary distinction between H&R Block and TurboTax is the worth. If in case you have a extra advanced return, H&R Block’s do-it-yourself options are much less expensive than TurboTax’s.

In comparison with TurboTax, H&R Block’s interface is much less cluttered. The tax preparation software program asks you to fill within the fundamentals for every part, reminiscent of earnings after which deductions, earlier than shifting ahead, slightly than leaping in all places.

H&R Block has 1000’s of bodily places within the US. In case you want to finish your taxes in individual, H&R Block could be the clear selection in comparison with DIY on-line software program.

If doing all of your taxes with knowledgeable in individual would not go well with you, you even have the choice to finish your taxes your self on-line.

Methods to file your taxes with the HRB TaxPrep app

In case you do not have already got it, obtain H&R Block’s HRB TaxPrep in your telephone and create an account to get began.

Fill out the prompts to file your taxes.

H&R Block professionals

- Cell app out there

- A+ score from Higher Enterprise Bureau

- Free model for easy returns

- Easy step-by-step steering

- Over 11,000 bodily places (likelihood is you’ve got pushed by one in your metropolis)

- 100% accuracy assure; H&R Block will reimburse you for penalties or curiosity as much as 10,000

H&R Block cons

- Dwell help prices additional

- Pricier than different software program packages: chatting with a dwell skilled will run you no less than $69.99 for federal returns, with further charges for state

H&R Block plans and costs

Free: $0 for federal & state. Deluxe: $55 federal plus $37 for state. Premium: $75 federal plus $37 for state. Self employed: $110 federal plus $37 for state.

The H&R Block Tax Prep app is free to download from the app retailer, is appropriate with iOS 11 or later, and is a 59.3 MB obtain.

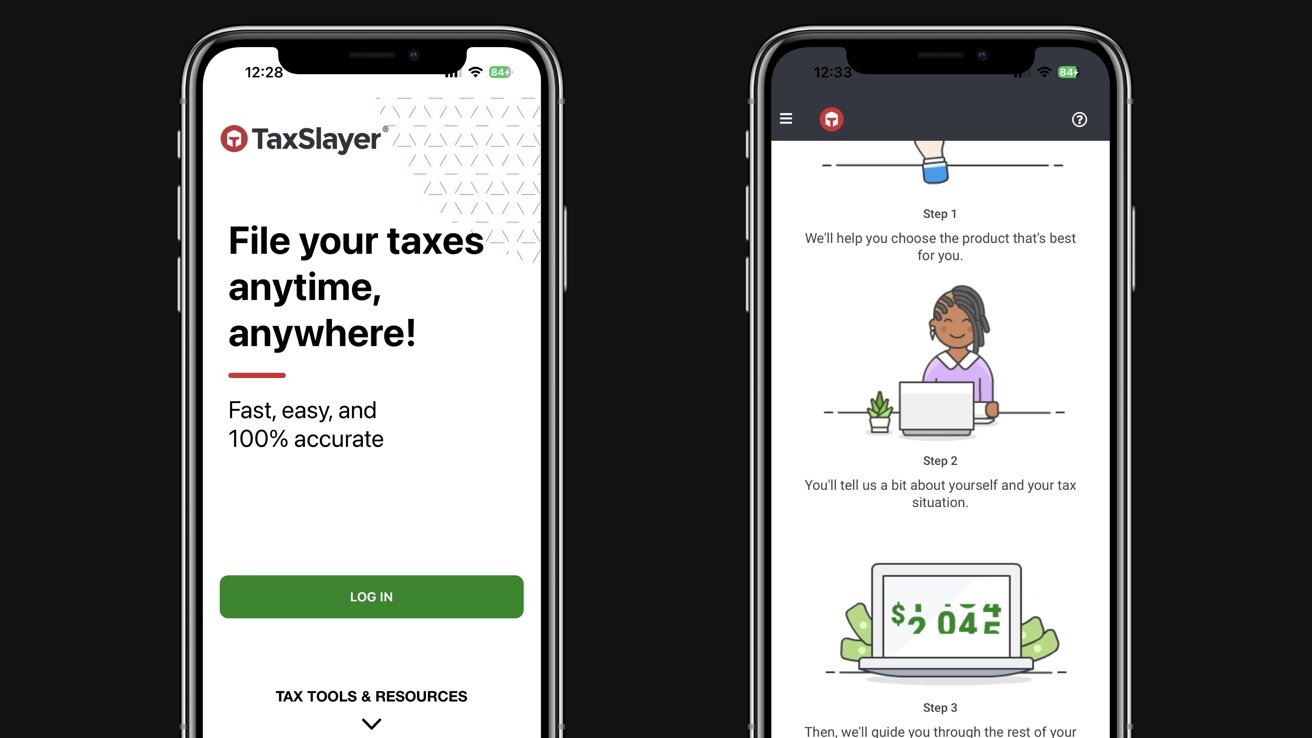

TaxSlayer

In case you are a tax professional and do not want additional assist, TaxSlayer is the no-fuss possibility for you. In contrast to TurboTax, TaxSlayer is a smaller-scale preparation service with a household enterprise really feel, providing its companies at a much lower cost than different software program packages.

Methods to file your taxes with TaxSlayer app

In case you do not have already got it, obtain TaxSlayer in your telephone and create an account to get began.

Comply with the prompts, and put together your federal and state tax return utilizing your iPhone or pill.

TaxSlayer professionals

- Free model out there

- Cell app out there

- A+ score from the Higher Enterprise Bureau

- Cheaper plans for these with extra advanced tax returns

- Free service for energetic navy members

- Most refund assure and accuracy; plan charges will probably be refunded if there’s an error

Taxslayer cons

- Fewer options than TurboTax — may very well be a professional or con relying in your tax preparation familiarity

- No dwell tax possibility

TaxSlayer plans and costs

The TaxSlayer app is free to download from the app retailer, is appropriate with iOS 14 or later, and is a ten.2 MB obtain.

Money App Taxes (previously Credit score Karma)

Like TaxSlayer, Money App Taxes is for individuals who have a sure familiarity with the tax world already. In contrast to different aforementioned tax software program, it’s the solely service that provides completely free federal and state submitting to all customers.

The truth is, paid upgrades are nonexistent, that means you will not be prompted to pay at any level of your service when you bear in mind that you’ve got a 1099 or have to itemize your deductions.

Money App Taxes is good for individuals who obtained earnings from employment or self-employment, financial institution curiosity, or a enterprise. In case you’re skeptical as to how this software program stays free, Money App Taxes recommends monetary merchandise to its customers, like loans and playing cards.

If the consumer chooses to benefit from one of many gives, Money App Taxes pockets some cash from that associate.

Nevertheless, observe that it’s going to warrant a bit extra work in your finish. For this reason tax familiarity is necessary when you select to make use of this software program.

In case you filed with totally different software program final 12 months, Money App Taxes permits you to simply import final 12 months’s return from H&R Block, TurboTax, and TaxAct.

Methods to file your taxes with the app

In case you do not have already got it, obtain Money App in your telephone and create an account to get began.

After downloading Money App, you can file your taxes from the app’s dwelling display, or in your pc at cash.app/taxes.

Money App Taxes professionals

- Free, with no paid upgrades

- Money App Taxes additionally 100% ensures the accuracy of its calculations

- Money App Taxes gives cell tax preparation for federal returns and sure state returns

- Audit help is included

Money App Taxes cons

- No individualized assist — self-prepared solely

- Solely out there in 40 states

- As of 2023, the Money App Taxes doesn’t help importing funding information

- Whereas it accommodates most tax varieties and conditions, it will not be appropriate for these with distinctive conditions (like these with overseas earnings or those that’ve labored in a number of states)

Money App Taxes plans and costs

It is going to cost the user $0 to file a federal and state return with Money App Taxes.

Money App is free to download from the app retailer, is appropriate with iOS 14 or later, and is a 397.1 MB obtain.

2023 tax submitting deadline

Whatever the finest tax software program you employ, tax filers have been in a position to submit their taxes since January 23, 2023. The deadline to submit your taxes is April 18, 2023.

Source link