The unraveling of market enthusiasm continued within the fourth quarter of 2022 with the earnings studies from the U.S. hyperscaler cloud suppliers now all in.

As we stated earlier this yr, even the cloud is just not immune from the macro headwinds and the cracks within the armor we noticed from the info we shared final summer season are taking part in out into 2023. For essentially the most half, precise outcomes are disappointing past expectations, together with our personal. It seems that our estimates for the massive three hyperscaler income missed by $1.2 billion or 2.7% decrease than we had forecast from our most up-to-date November estimates. We count on decelerating development charges for the hyperscalers will proceed by way of the summer season of 2023 and received’t abate till comparisons get simpler.

On this Breaking Evaluation, we share our view of what’s taking place in cloud markets – not only for the hyperscalers however different corporations which have hitched a experience on the cloud. And we’ll share new Enterprise Expertise Analysis information that exhibits why these traits are taking part in out, ways clients are using to take care of their price challenges, and the way lengthy the ache is more likely to final.

Driving the cloud wave: two sides to the story

The cloud has been a big catalyst for corporations corresponding to Snowflake Inc., Databricks Inc., Workday Inc., Salesforce Inc., MongoDB Inc. with Atlas, and IBM Corp.’s Crimson Hat with OpenShift. Nevertheless, the elasticity of cloud know-how additionally signifies that what goes up can come down shortly.

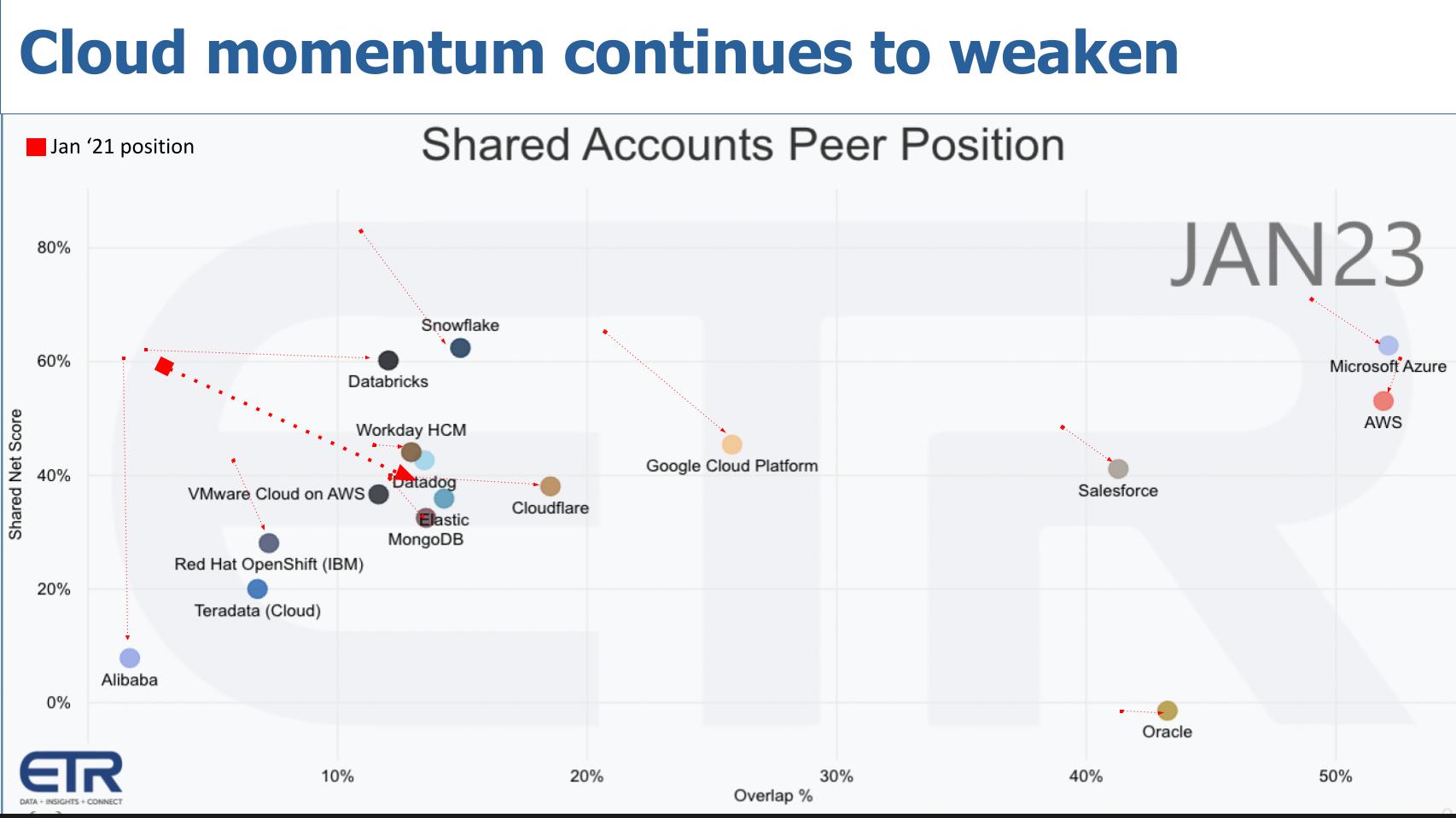

Above is an XY chart from the most recent ETR survey of knowledge know-how choice makers or ITDMs. N=1,525.

The graphic exhibits the spending momentum (Web Rating) on the vertical axis and market presence (Pervasion) on the horizontal aircraft. This information exhibits a number of corporations from the January 2023 survey. The purple dotted strains point out the positions of those corporations and the following directional motion from again in January 2021.

The information reveals that Amazon Web Services Inc. and Microsoft Corp.’s Azure proceed to widen their lead over Google Cloud Platform, with their infrastructure-as-a-service revenues 5 to 6 instances larger than GCP. Regardless of GCP’s efforts to achieve floor, its Web Rating has fallen beneath that of AWS and Azure. Google Cloud’s losses proceed and got here in flat at round $3 billion final yr– though they had been reduce to a $2 billion run charge within the fourth quarter.

AWS has held its place and continues to carry out effectively, together with Microsoft, which advantages from the inclusion of software program as a service in its cloud numbers. Nevertheless, many of the corporations on the chart have seen a lower in spending momentum.

Snowflake, Databricks and different software program platforms

Snowflake and Databricks are value calling out. Whereas Snowflake’s market presence has continued to develop, its clients have the choice to dial down consumption, much like different cloud corporations. Then again, Databricks, a non-public firm, has gained vital market presence and has maintained the Web Rating it had again in 2021.

Workday and Salesforce have carried out comparatively effectively. We’re exhibiting Workday’s flagship human capital administration providing, which has held floor. Salesforce has misplaced spending momentum, however its presence on the X axis continues to develop, underscoring the sticky nature of each platforms.

MongoDB at one level conveyed to buyers that it was much less uncovered to discretionary spending than analytics platforms corresponding to Snowflake. Typically each platforms have held up pretty effectively, with Snowflake exhibiting larger spending velocity within the survey and a bigger market presence.

Datadog Inc. has made vital progress on the X axis, however its Web Rating has declined dramatically.

Crimson Hat OpenShift momentum within the survey has dropped, however IBM’s latest announcement that OpenShift hit $1 billion annual recurring income means that it’s being bundled into IBM consulting’s modernization tasks.

Cloudflare Inc.’s Web Rating has remained sturdy since 2021, and it has gained vital market presence.

Oracle Corp., regardless of having a decrease Web Rating, continues to develop available in the market and clearly has thrived from a revenue perspective.

The underside line is, general, the info suggests a downward development available in the market that can doubtless proceed by way of the summer season.

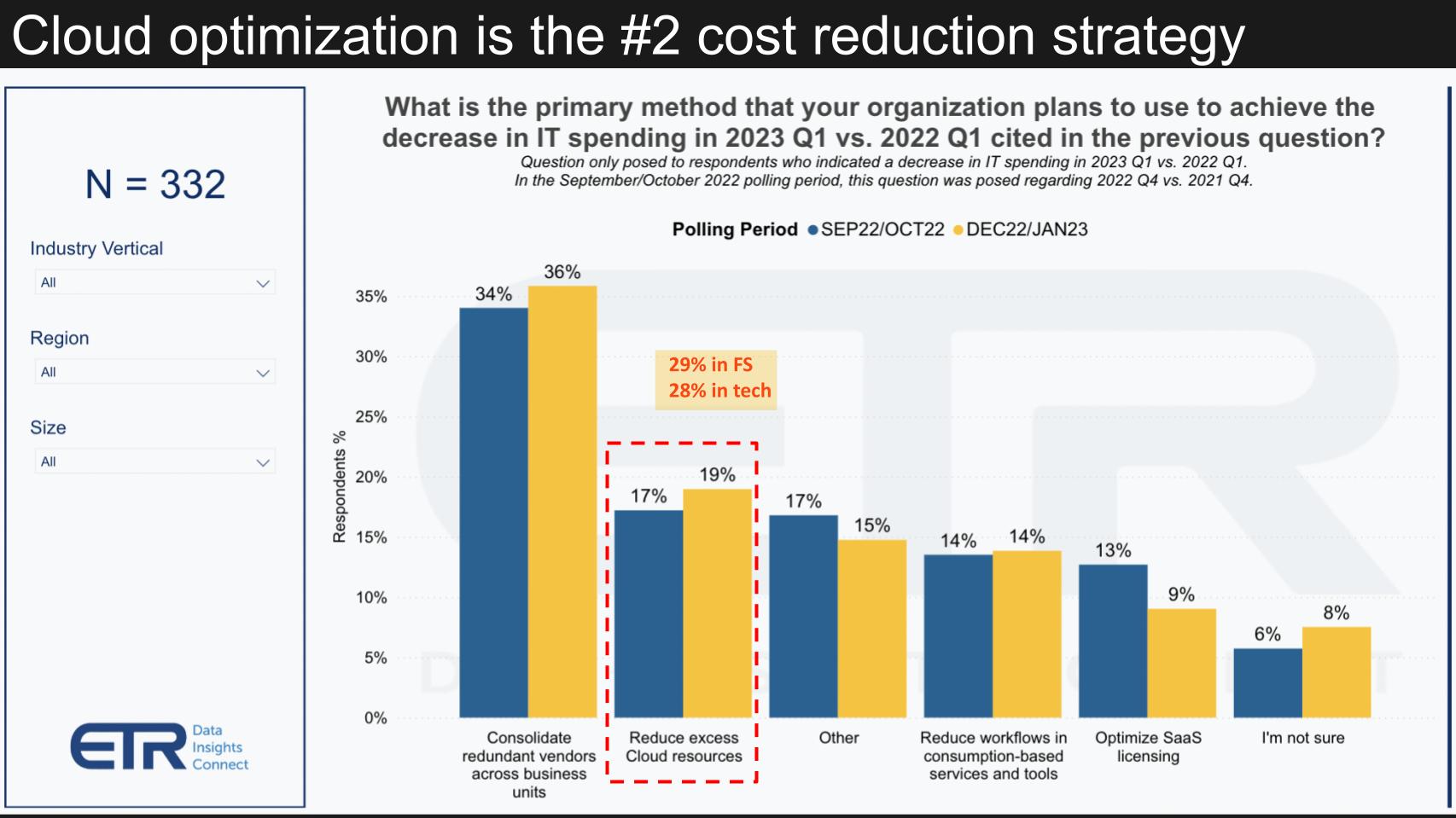

Optimizing cloud spend is a high buyer tactic

Above is a graphic from the newest ETR drill-down asking clients that stated they’re chopping spending what approach they’re utilizing to take action. As we’ve reported, consolidating redundant distributors is by far essentially the most cited method. However two key factors we need to make: 1) Decreasing extra cloud sources is the second most cited approach; and a couple of) Decreasing cloud prices jumps to 29% and 28% in monetary companies and tech/telco, respectively. In these two sectors, optimizing cloud prices is a a lot nearer second in these two bellwether industries.

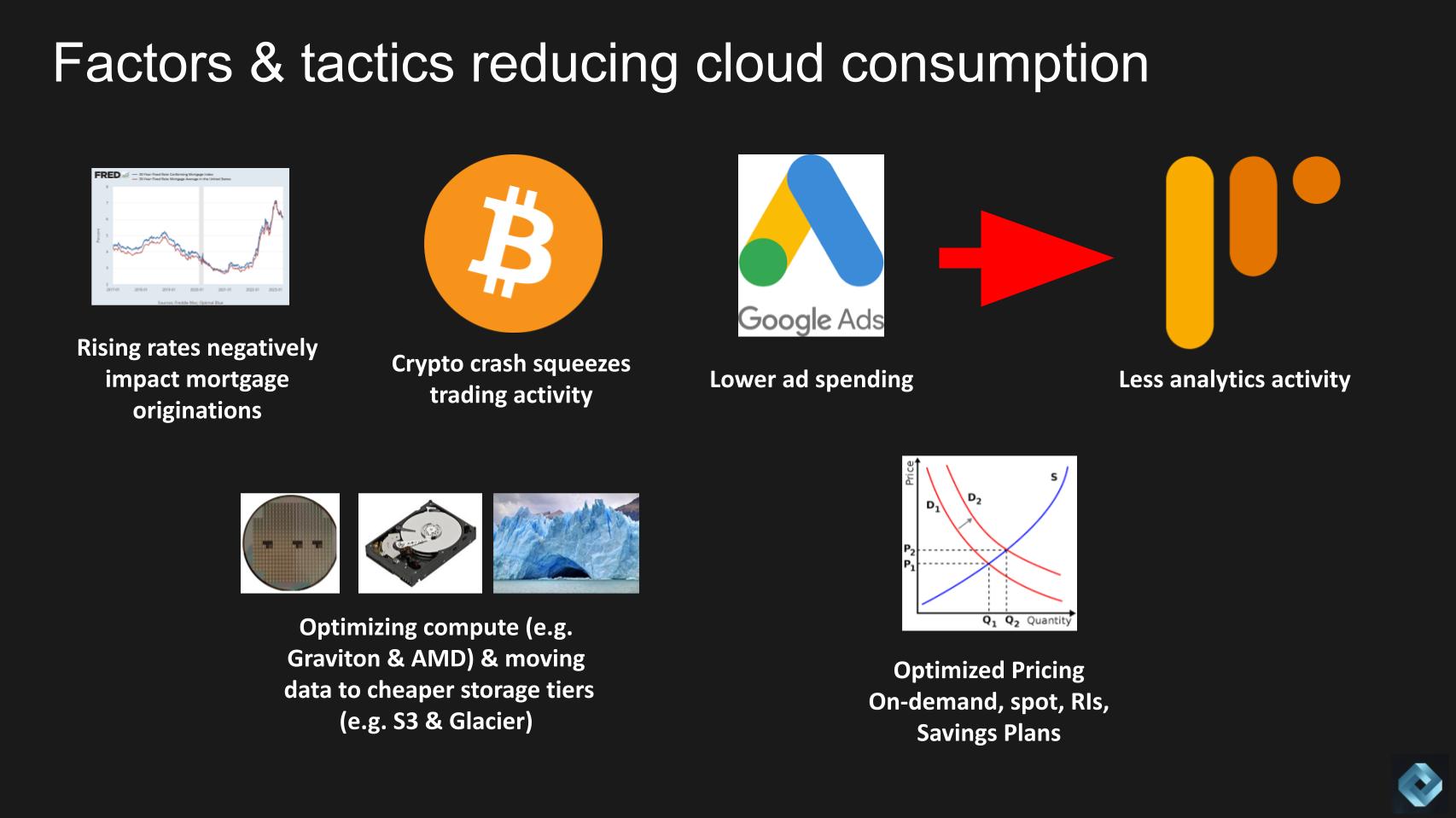

Analysis exhibits six key elements affecting cloud consumption

Cloud is nice as a result of you possibly can dial it up shortly. However it’s additionally straightforward to spin down sources to chop prices. We’ve recognized six elements that clients inform us are affecting their cloud consumption. There could also be extra, and we’d love to listen to others, however these are all pretty outstanding based mostly on our analysis.

- Rising mortgage charges imply banks are processing fewer loans;

- The crypto crash has meant much less buying and selling exercise and meaning much less cloud sources;

- Decrease advert spending has led to much less cloud spend and;

- A corollary impact the place corporations cut back the frequency of their analytic runs and sometimes use much less information, maybe compressing the corpus to carry out the evaluation over a shorter time interval;

- Very outstanding is down on the backside left of the graphic – utilizing lower-cost compute cases corresponding to Graviton from AWS or Superior Micro Gadgets Inc. chips and tiering storage to cheaper object shops or deep archive tiers;

- Lastly, optimizing based mostly on higher pricing plans, shifting from on-demand and utilizing spot pricing, reserved cases or optimized quantity financial savings plans to decrease prices.

All of this implies much less cloud useful resource consumption. Within the days when every part was on-premises, chief monetary officers would freeze capital spending and IT execs must try to do extra with much less, and sometimes that meant lots of guide duties that took an extended time period to hit the underside line. With the cloud it’s a lot simpler to maneuver issues round – it nonetheless takes some effort however it’s dramatically easier to take action.

Freezes and cuts are again

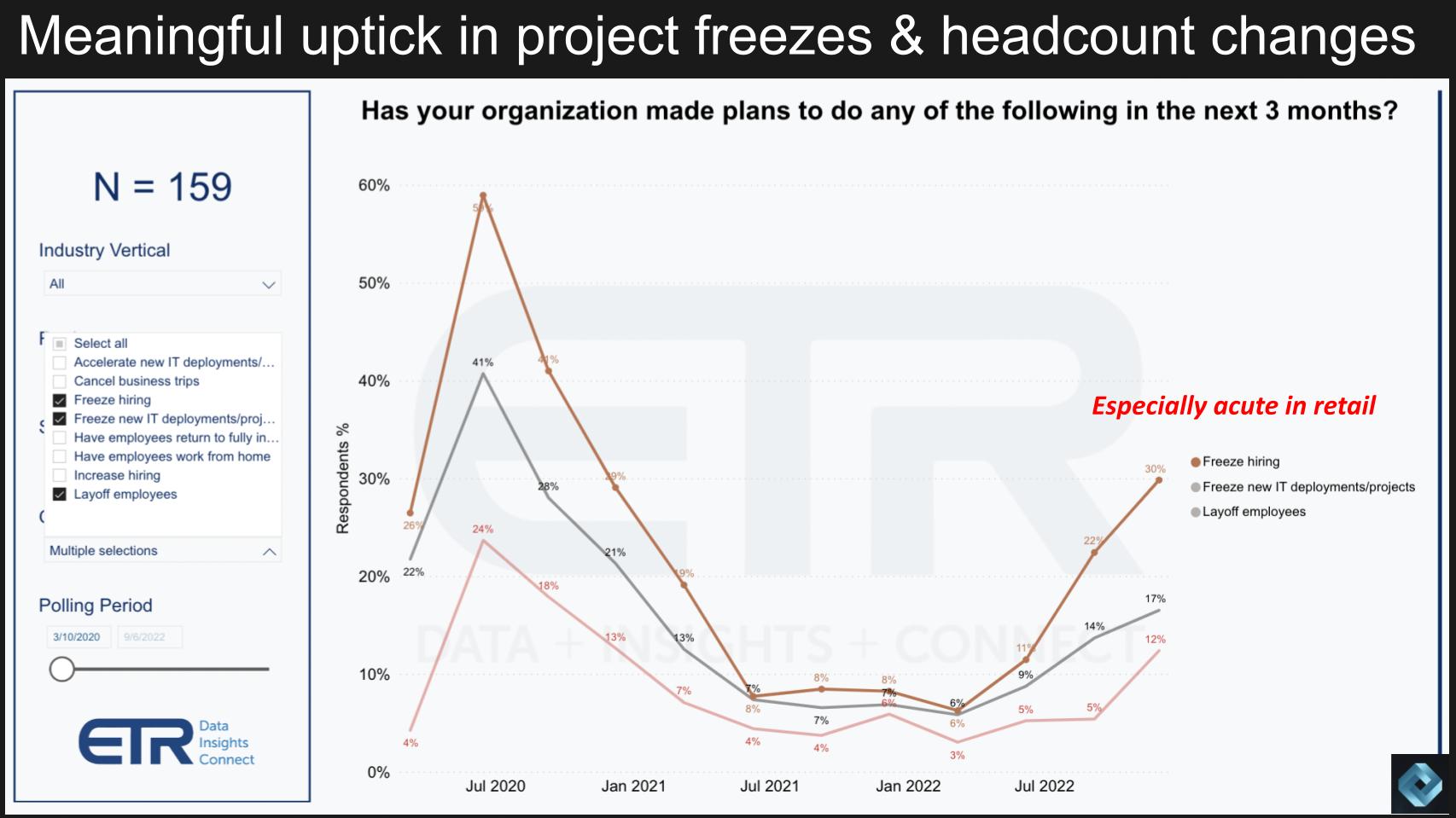

The graphic beneath exhibits information from a latest ETR survey with 159 respondents and you may see the significant uptick in hiring freezes, freezing new IT deployments and layoffs. As we’ve reported, this has been trending up since earlier this yr.

Word the callout. This development is very outstanding in retail sectors. That’s a little bit of a priority as a result of oftentimes client spending helps the economic system make a softer touchdown out of a pullback, so this can be a potential canary within the coal mine. If retail corporations are pulling again, it’s as a result of customers aren’t spending as a lot and that might set off a unfavourable cycle.

Hyperscaler IaaS income outlook

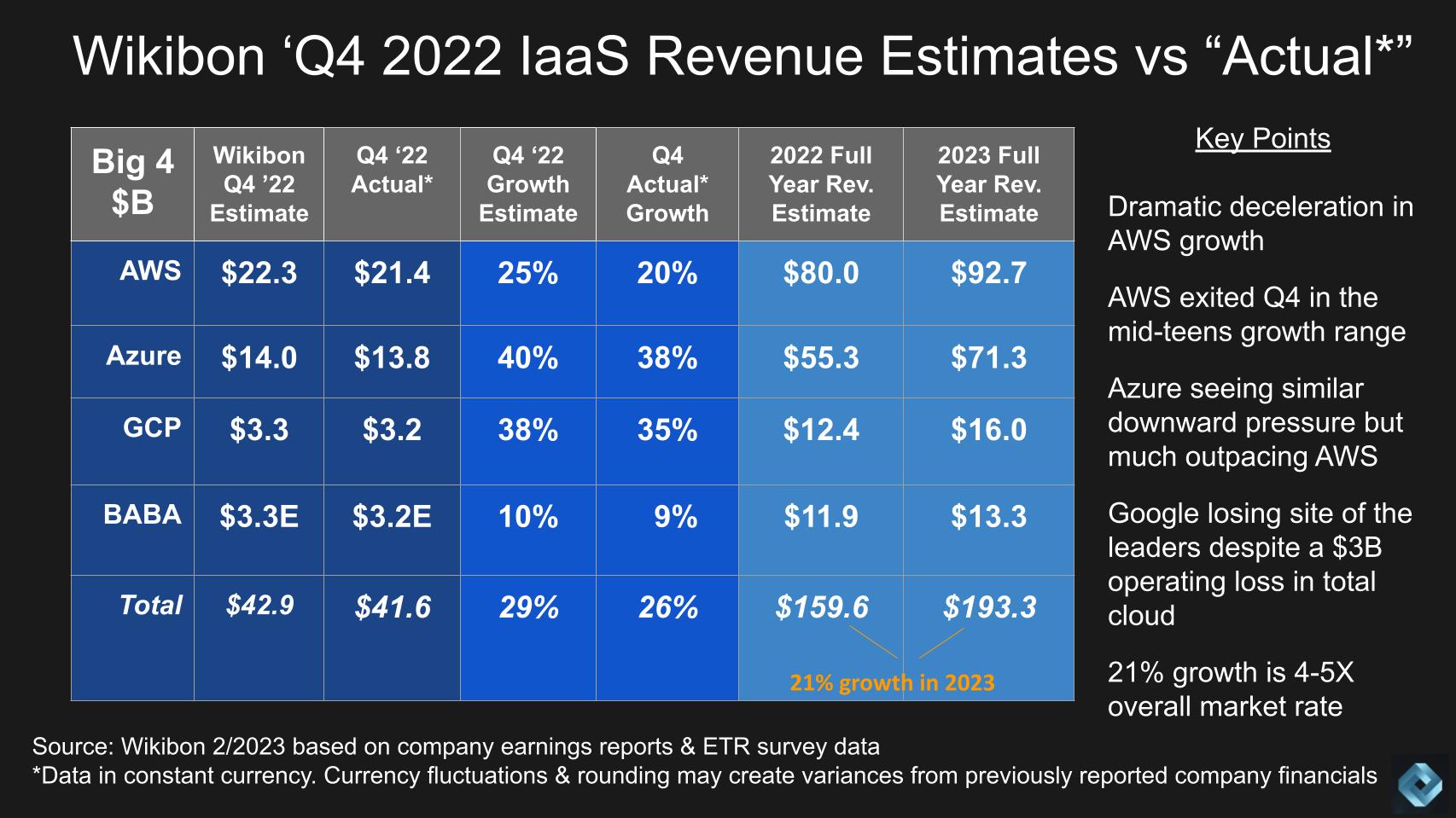

Let’s boil this all the way down to the market information. Within the graphic beneath, we present our estimates for This fall IaaS income in contrast with the “actuals.” We put actuals in quotes as a result of Microsoft doesn’t report Azure income and Alphabet doesn’t share GCP income. Reasonably, every agency buries the figures in its general cloud numbers, which embrace SaaS. Microsoft and Alphabet make normal statements and supply a number of crumbs on Azure and GCP, respectively, and depart it to us to triangulate.

Wikibon began modeling quarterly AWS revenues within the first quarter 2013, two years earlier than Amazon formally started to report AWS revenues. We’ve added Azure, GCP and Alibaba Cloud over time and in 2019 started partnering with ETR to refine our estimates.

Wanting on the information above, we had AWS rising 25% year-over-year in This fall 2022 ($22.3 billion) and AWS got here in at 20% development ($21.4 billion), a big delta relative to our expectations. Azure was two factors off our forecast, coming in at 38% development, GCP three factors off, coming in at 35%, and Alibaba has but to report however we’ve shaved a bit off that forecast based mostly on some survey information.

For the yr, the massive 4 hyperscalers generated virtually $160 billion in income… $7 billion decrease (about 5%) than what we anticipated coming into 2022.

For 2023 we’re anticipating 21% development for the marketplace for a worldwide income whole of $193.3 billion. Although decrease than our earlier outlooks, that’s nonetheless 4 to 5 instances the general spending forecast for the market, which we reported last week at 4% to five% development.

Azure is closing the hole on AWS with a greater profitability mannequin

We count on AWS to return in at about $93 billion this yr with Azure closing in at greater than $71 billion. Regardless of Amazon focusing buyers on the truth that AWS’ absolute greenback development continues to be bigger than its rivals, by our estimates Azure will are available in at greater than 75% of AWS’ forecasted income. We really feel that may be a vital milestone particularly as a result of by our estimates, Azure is rising at a charge double that of AWS.

Notably, AWS’ working margin declined considerably this previous quarter, dropping from 30% of income to 24%. Though that is nonetheless extraordinarily wholesome and we’ve seen fluctuations like that earlier than, Microsoft we expect has the higher hand with regards to profitability. Particularly, Microsoft has a marginal price benefit as a result of: 1) It has a captive cloud on which to run its huge software program property; and a couple of) Software program marginal economics, regardless of AWS’ awesomeness and excessive levels of automation, are simply higher.

The upshot for AWS is the ecosystem. AWS is positioning very neatly as a platform for information companions corresponding to Snowflake and Databricks, safety companions corresponding to CrowdStrike Holdings Inc., Okta Inc., Palo Alto Networks Inc. and others, in addition to SaaS corporations that could be extra aggressive with Microsoft. Although AWS has aggressive merchandise in database, for instance, AWS seems extra completely happy to “spin the meter ” with companions — extra so in our view than the opposite cloud gamers.

From a profitability standpoint, AWS is prepared to share margin with companions, which we expect will result in a bigger marketplace for IaaS, and that underscores is the lengthy recreation AWS is taking part in.

The subsequent wave of AI in cloud

The key hyperscalers all have sturdy tales in machine studying and synthetic intelligence. Microsoft, in fact, is hyping its OpenAI LLC funding and ChatGPT and individuals are shifting to Azure to get it. Amazon has to have a response in our view. AWS has a robust AI story, and it’s going to should make some strikes there. In the meantime, Google is emphasizing itself as an AI-first firm. The truth is, Google spent a minimum of 5 minutes of steady dialog on its final earnings name, pitching its AI chops to analysts.

That is an space we’re watching intently as the thrill round giant language fashions and conversational AI continues.

Assumptions for 2023

Communicate

Many due to Alex Myerson and Ken Shifman on manufacturing, podcasts and media workflows for Breaking Evaluation. Particular due to Kristen Martin and Cheryl Knight, who assist us maintain our neighborhood knowledgeable and get the phrase out, and to Rob Hof, our editor in chief at SiliconANGLE.

Keep in mind we publish every week on Wikibon and SiliconANGLE. These episodes are all accessible as podcasts wherever you listen.

E mail [email protected], DM @dvellante on Twitter and touch upon our LinkedIn posts.

Additionally, try this ETR Tutorial we created, which explains the spending methodology in additional element. Word: ETR is a separate firm from Wikibon and SiliconANGLE. If you want to quote or republish any of the corporate’s information, or inquire about its companies, please contact ETR at [email protected].

Right here’s the total video evaluation:

All statements made concerning corporations or securities are strictly beliefs, factors of view and opinions held by SiliconANGLE Media, Enterprise Expertise Analysis, different friends on theCUBE and visitor writers. Such statements aren’t suggestions by these people to purchase, promote or maintain any safety. The content material introduced doesn’t represent funding recommendation and shouldn’t be used as the idea for any funding choice. You and solely you’re chargeable for your funding choices.

Disclosure: Lots of the corporations cited in Breaking Evaluation are sponsors of theCUBE and/or shoppers of Wikibon. None of those corporations or different corporations have any editorial management over or superior viewing of what’s printed in Breaking Evaluation.