Liquidators at bankrupt crypto alternate FTX say they’ve to date situated $5.5 billion in belongings, and confirmed that $415 million stolen in a November hack remains to be lacking.

The report [PDF], introduced by FTX debtors to its unsecured creditor committee, stated that $1.7 billion in money, $2.5 billion in crypto, and $300 million in securities had been recovered up to now. The invention of lacking funds, FTX confirmed, represents “a considerable shortfall of digital belongings at each exchanges.”

“We’re making essential progress in our efforts to maximise recoveries, and it has taken a Herculean investigative effort from our workforce to uncover this preliminary info,” stated John Ray III, the CEO and Chief Restructuring Officer at FTX. “We’ll present extra info as quickly as we’re ready to take action.”

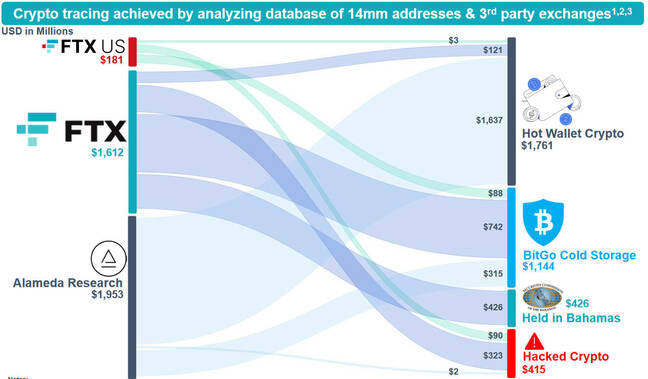

Of the lacking funds, FTX stated $323 million from FTX.com “was topic to unauthorized third-party transfers post-petition” – which is a corp-speak manner of claiming somebody nicked it – and $90 million was taken from FTX US in the identical method. Two million {dollars} was additionally stolen from FTX subsidiary and hedge fund Alameda Analysis.

Rumors of the stolen crypto began circulating quickly after FTX’s bankruptcy declaration on November 11 final 12 months – the identical day the thief reportedly pulled off the heist.

A desk from FTX’s presentation detailing the move of crypto right into a hacker’s wallets – Click on to enlarge

Preliminary estimates positioned the stolen quantity nearer to $370 million, Bloomberg reported alongside an announcement from the US Division of Justice that stated it was investigating the theft in late December.

SBF disputes the report

The saga of FTX begins with Sam Bankman-Fried – or SBF – and his alleged funneling of buyer funds to Alameda Analysis, which was then used to make dangerous investments and canopy subsequent losses.

SBF maintains his innocence on eight expenses related along with his alleged mismanagement of FTX amid guilty pleas from FTX CTO and co-founder Gary Wang and Alameda CEO Caroline Ellison.

Now out on parole and topic to accommodate arrest, SBF has a variety of spare time on his arms, a few of which he is used to start out a Substack. He is solely made a few posts, asserting his innocence and insisting that FTX’s US department remains to be solvent and will pay prospects.

Within the second put up, written in response to the FTX debtor report, SBF asserts the doc’s claims had been flawed as a result of they did not account for $428 million held in FTX financial institution accounts. All of that is SBF’s “greatest guess,” he admits within the put up, and Reuters notes the ex-wunderkind hasn’t had any entry to FTX’s inside information since stepping down from the corporate in November.

We reached out to FTX to search out out whether or not what SBF claimed was something greater than wild hypothesis. Whereas the corporate acknowledged receipt of our questions, we did not get a response. ®

Source link