In short: Excessive inflation and a foreboding financial forecast for 2023 had customers shifting spending away from luxurious gadgets resembling high-end smartphones to extra vital purchases like fuel and meals in 2022. Whereas giants like Apple and Samsung picked up a couple of factors in market share, the general trade noticed declines within the fourth quarter not seen in 10 years.

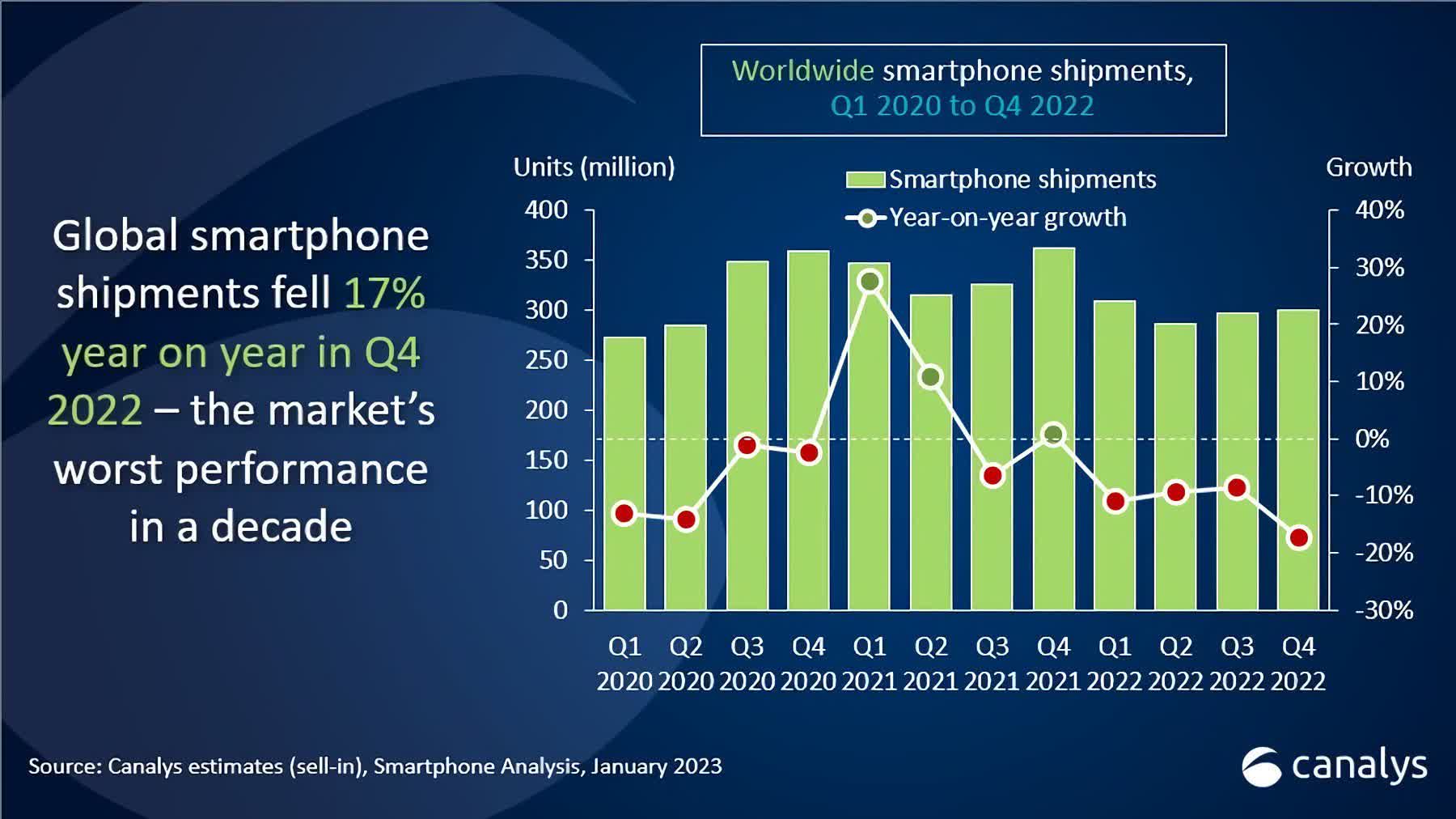

Smartphone distributors are licking their wounds after an all-around awful yr in gross sales. Analysts at Canalys estimate worldwide shipments for This fall 2022 dipped 17 % in comparison with 2021. Full-year gross sales have been all the way down to lower than 1.2 billion, a decline of 11 % year-over-year. The worst efficiency the trade has seen in a decade.

Apple and Samsung faired barely higher than the remainder, with the Cupertino powerhouse wresting away 25 % of the market over the Korean OEM’s 20 % — each features within the trade. Chinese language producers Xiaomi, Oppo, and Vivo all took a success, falling to 11, 10, and eight % market share, respectively. Apple’s current launch of the iPhone 14 line contributed to it stealing Samsung’s thunder, not less than till the Galaxy S23’s upcoming launch.

That mentioned, all distributors have had a tough yr whatever the features made in market share. The economic system is teetering on the point of a recession, and the tech sector, particularly, has seen a major contraction, as Canalys Analysis Analyst Runar Bjørhovde factors out.

“Smartphone distributors have struggled in a troublesome macroeconomic setting all through 2022. This fall marks the worst annual and This fall efficiency in a decade. The channel is very cautious with taking up new stock, contributing to low shipments in This fall.”

Producers have been capable of scale back stock on high-end inventories via the vacation season, however general, “This fall 2022 stands in stark distinction to This fall 2021’s” excessive demand and ebbing provide constraints. Even low- to mid-range demand fell sharply within the first three quarters. Of us in 2022 have been extra involved with paying their rising payments slightly than upgrading to the most recent and best.

Canalys expects OEMs to guard their market share all through 2023, prioritizing profitability and reducing prices. At finest, it predicts marginal progress within the sector, with the potential of gross sales remaining flat within the new yr.

“Although inflationary pressures will step by step ease, the consequences of rate of interest hikes, financial slowdowns, and an more and more struggling labor market will restrict the market’s potential,” mentioned Analysis Analyst Le Xuan Chiew. “This may adversely have an effect on saturated, mid-to-high-end-dominated markets, resembling Western Europe and North America.”

Chiew provides that Southeast Asia is the one area anticipated to see vital optimistic progress, however this would possibly not come till the second half of 2023.

Picture credit score: Trusted Reviews

Source link