Big quotes: As telecommuting become the “new norm” for American workers, municipal governments and economic analysts are hitting the panic button.

“Remote work is poised to devastate America’s cities.” — New York Magzine.

“The ‘office apocalypse’ is upon us.” — Business Insider.

“[We’re entering a] work from home and the office real estate apocalypse.” — National Bureau of Economic Research.

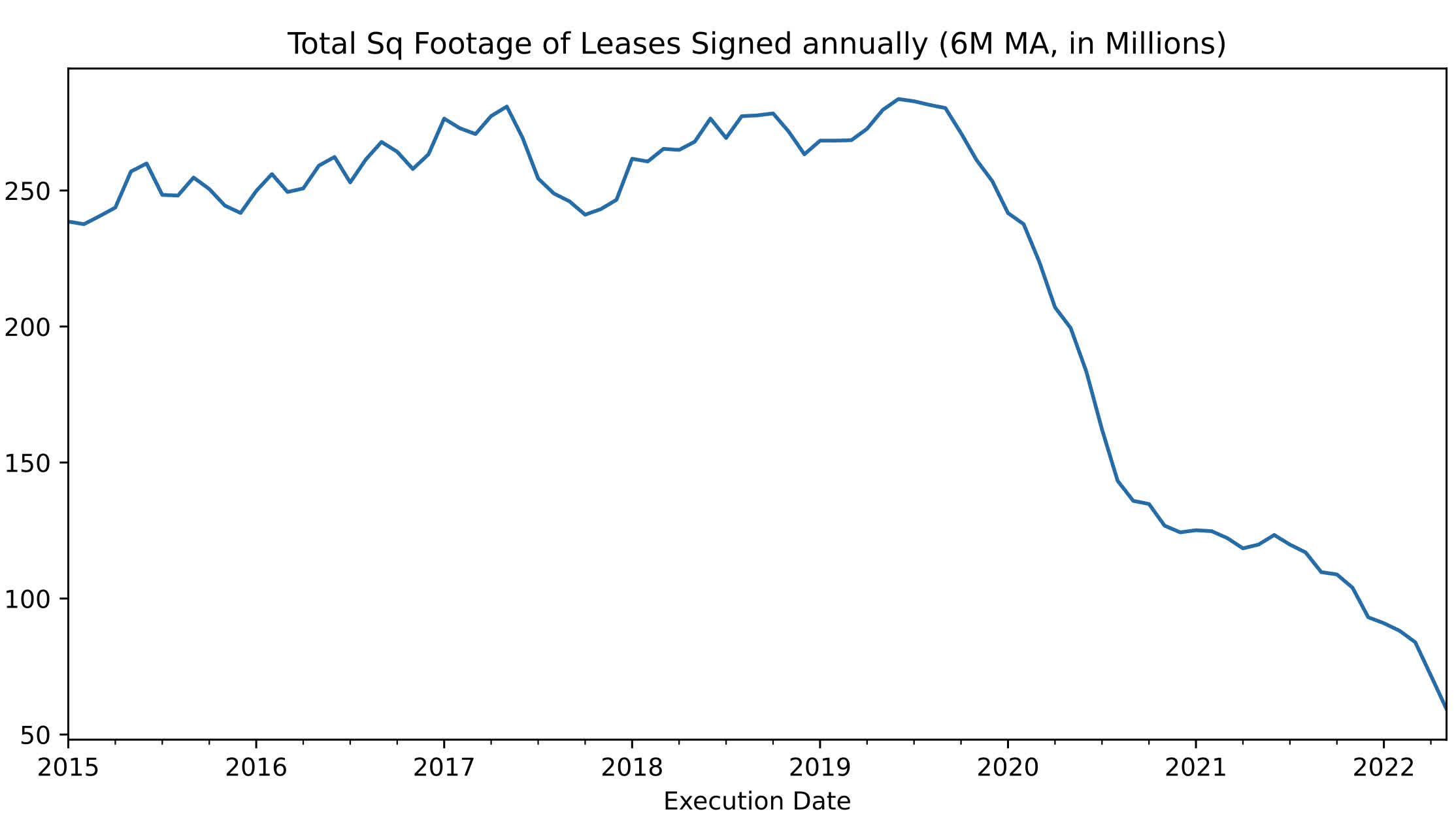

According to economic analysts, the growing work-from-home trend is “devastating” US cities. With nearly a third of the workforce working remotely, employers find little reason to keep their physical offices open. Tax revenue in large cities like New York, Los Angeles, and San Francisco plummeted as companies began shuttering offices. Meta closed shop on 450,000 square feet of office space in New York alone.

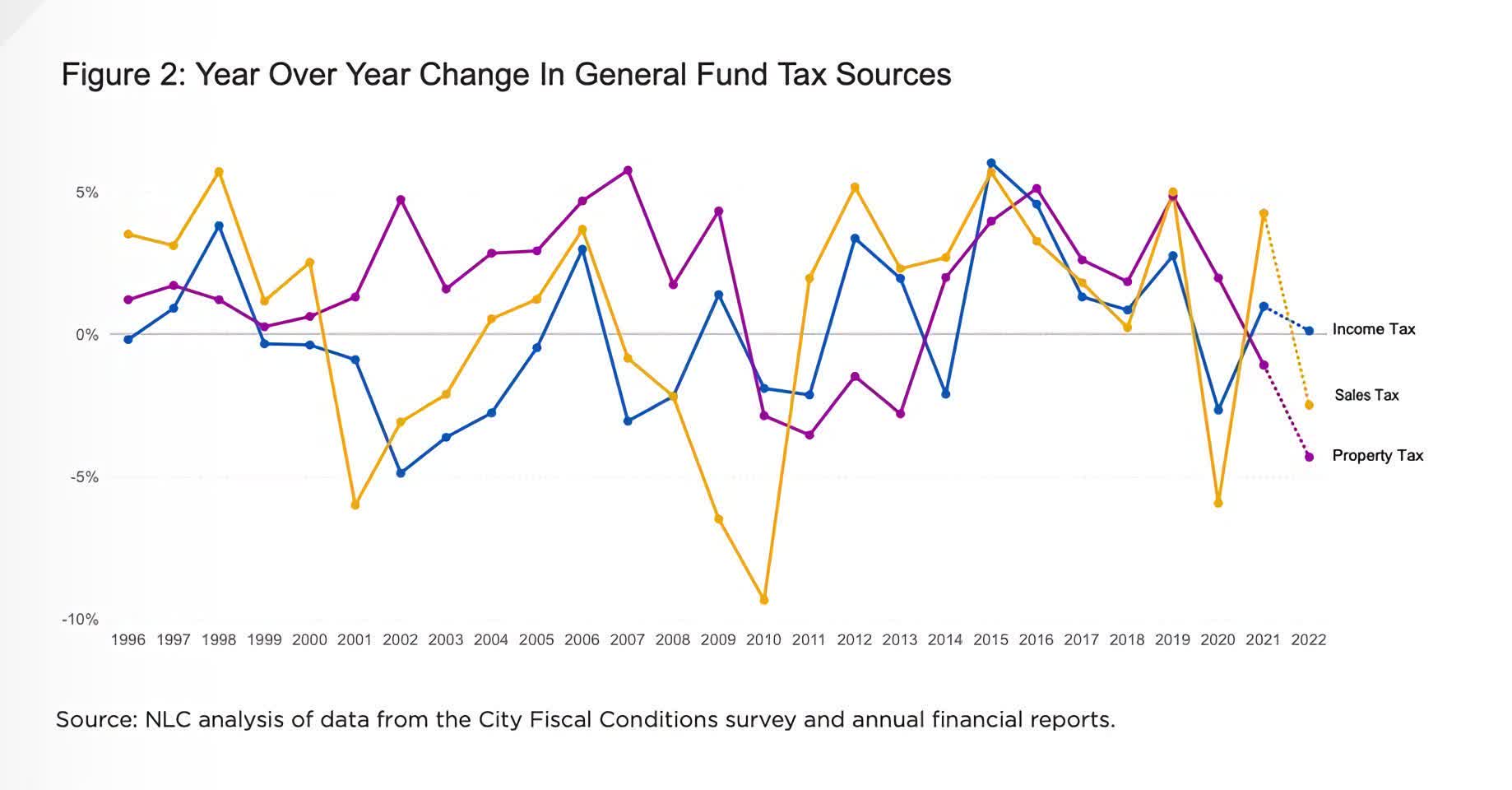

New York Magazine points out that property taxes account for a majority (one-third) of New York City’s revenue, and office buildings make up a fifth of that source. To put that in perspective, one of the city’s most lucrative tax districts, Manhattan, experienced a $5.24 billion decline in tax revenue since 2019.

Even switching to hybrid work schedules has not helped much. The New York State Comptroller reported that financial services firms in New York City only have 56 percent of their staff in the office during any given day of the week. This shift contributed to a 56.3-percent dip in the securities industry’s pretax revenue — a $17.5 billion loss in taxable profits. The problem doesn’t stop at property and corporate taxes, either.

Mass transit has taken a significant hit. The pandemic crippled the commuting industry. It has rebounded somewhat but still has not recovered to pre-covid levels thanks to fewer workers needing to report to the office physically. Ridership is still down 30 percent from 2019. Many transit systems were already operating with thin margins, so it’s unclear how long some can hold out.

Likewise, foot traffic has dramatically declined. Local shops are losing the frequent stops for lattes and cocktails from surrounding businesses and foot traffic now that more workers are homebound. This situation created a triple whammy for New York City.

The Big Apple lost a significant slice of money from sales tax — wham. Many shops went bankrupt and closed shop, flushing corporate and payroll taxes down the toilet — wham. Now, property owners struggle to fill those vacancies, leading to a sharp decline in property values and thus decreased property taxes — wham.

And the situation is no better on the west coast. Office vacancy rates in San Francisco, the heart of Silicon Valley, are hovering around 34-40 percent, according to the San Francisco Chronicle. Meta, Google, Salesforce, Airbnb, Twilio, and others have all dumped unused office space to cut costs.

Some analysts suggest cities convert offices into housing, reasoning that reasonably priced occupied apartments are better than expensive but empty offices. However, “better than nothing” will not likely satisfy local governments. The tax deficit caused by enterprise-to-consumer conversion will inevitably lead to higher income taxes for the working class. There is no win-win scenario.

It would seem that the grand experiment that was the unprecedented shutdown of the American economy has lasting adverse effects. Now the very government agencies that called for the drastic action are in a panic over how to close Pandora’s Box.

Source link