Salesforce.com Inc. beat expectations with its fourth quarter financial results today, with each segment within its main Subscription and Support business generating over a billion dollars in revenue. It followed that by raising its guidance for the current quarter and full year, sending its stock higher in extended trading.

The company reported earnings before certain costs such as stock compensation of 84 cents per share on revenue of $7.33 billion in the quarter, up 26% from a year ago. That was better than expected, with Wall Street looking for earnings of just 75 cents per share on revenue of $7.24 billion.

For the full year fiscal 2022, Salesforce posted revenue of $26.49 billion, up 25% from the year before.

Salesforce Chairman and co-Chief Executive Marc Benioff said the company delivered “another phenomenal quarter” based on “tremendous demand from customers”.

Salesforce’s other co-CEO, Bret Taylor (pictured), said customers were driving the company’s success and enabling it to generate disciplined, profitable growth at scale. “Our Customer 360 platform has never been more strategic or relevant in driving the growth and resilience of our customers around the world,” he said.

Salesforce is best known for its customer relationship management software suite. Its biggest business unit, Subscription and Support, did $6.83 billion in revenue, up 25% from the same period one year ago. The company’s other main business is Professional Services and Other, which generated sales of $500 million in the quarter, up 46% from a year ago.

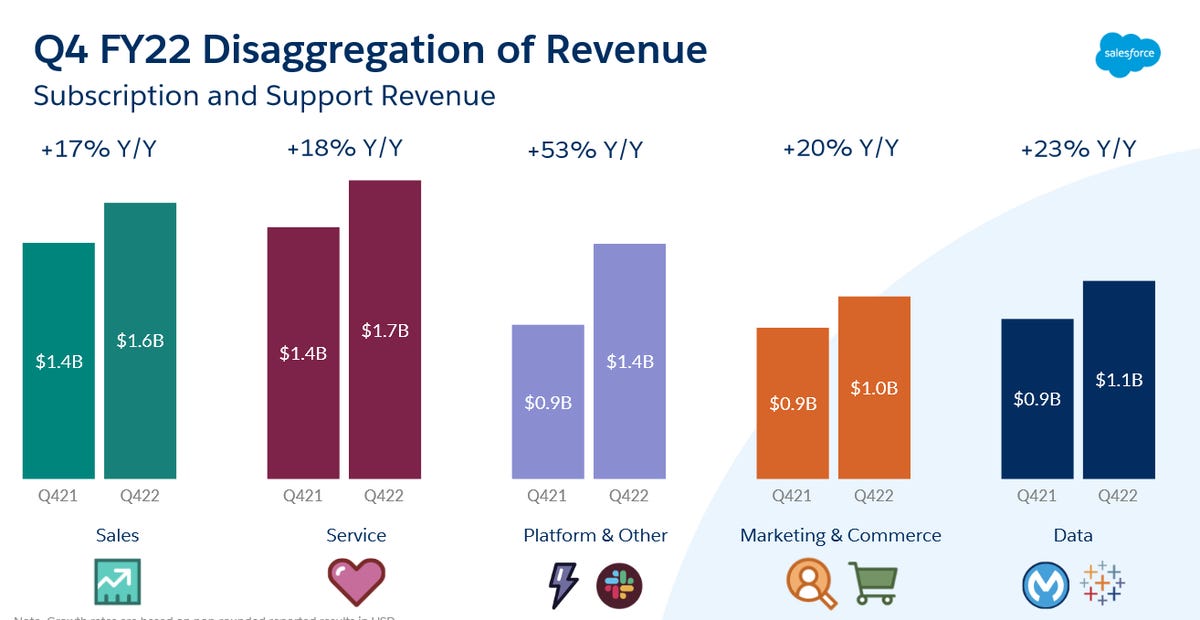

Within the Subscription and Support segment, the strongest category was Service, which delivered $1.7 billion in revenue, up 18%, followed by Sales with $1.6 billion, up 17%. The Platform & other segment added $1.4 billion, up 53%, while Data and Marketing & Commerce added $1.1 billion and $1 billion each.

In a conference call, Taylor said the Platform and Other segment benefited from $308 million in Slack subscription and support revenues. Slack is a business messaging and collaboration platform acquired by Salesforce for $27.7 billion in 2020.

Taylor told analysts Salesforce is focused on integrating many of its products with Slack and that it is unlikely to make any more big acquisitions soon. “We don’t have plans for any material M&A in the near term,” he said. “Slack is our focus.”

Chris Rothstein, founder and CEO of Groove Labs, Inc., told SiliconANGLE that Salesforce’s acquisition of Slack will enable it to evolve from a provider of department-level business applications to become a global provider of end-to-end cloud solutions.

“It’s no secret that Bret Taylor had a huge hand in making this happen, and I expect that we will continue to see Salesforce evolve in this direction under his leadership,” he said.

Taylor’s reward for engineering the Slack acquisition and Salesforce’s ongoing evolution was promotion. He was appointed as co-CEO alongside Benioff in November, having previously served as the company’s chief operating officer.

Rothstein said he expects Taylor to help the company grow substantially over the next year. He said the company will likely double-down on its industry-focused growth strategy to try and grow its customer base in lucrative segments such as financial services and healthcare.

“Salesforce has significantly diversified over the past few years,” Rothstein explained. “Sales Cloud only makes up 23% of Salesforce’s subscription and support revenue and is growing slower than other key areas of the business, including Platform, Marketing Cloud, Service Cloud, and Data.”

Salesforce seems confident its business will expand too. For the first quarter, it offered a revenue forecast of $7.37 billion to $7.38 billion, way ahead of Wall Street’s target of $7.26 billion.

For the full year, Salesforce said it sees revenue of $32 billion to $32.1 billion, versus the $31.78 billion consensus estimate.

Photo: Brian Solis/Wikimedia Commons

Show your support for our mission by joining our Cube Club and Cube Event Community of experts. Join the community that includes Amazon Web Services and Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger and many more luminaries and experts.

Source link